Nevada Sample Letter for Tax Deeds

Description

How to fill out Sample Letter For Tax Deeds?

It is feasible to spend numerous hours online trying to locate the sanctioned document template that meets the federal and state criteria you require. US Legal Forms provides an extensive array of legal forms that are reviewed by specialists.

You can conveniently obtain or print the Nevada Sample Letter for Tax Deeds from our platform.

If you already possess a US Legal Forms account, you can Log In and select the Acquire option. Subsequently, you can complete, modify, print, or sign the Nevada Sample Letter for Tax Deeds. Every legal document template you obtain is yours indefinitely. To retrieve another copy of a purchased form, navigate to the My documents tab and click the relevant option.

Select the format of your document and download it to your device. Make modifications to your document as needed. You can complete, edit, sign, and print the Nevada Sample Letter for Tax Deeds. Download and print a multitude of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

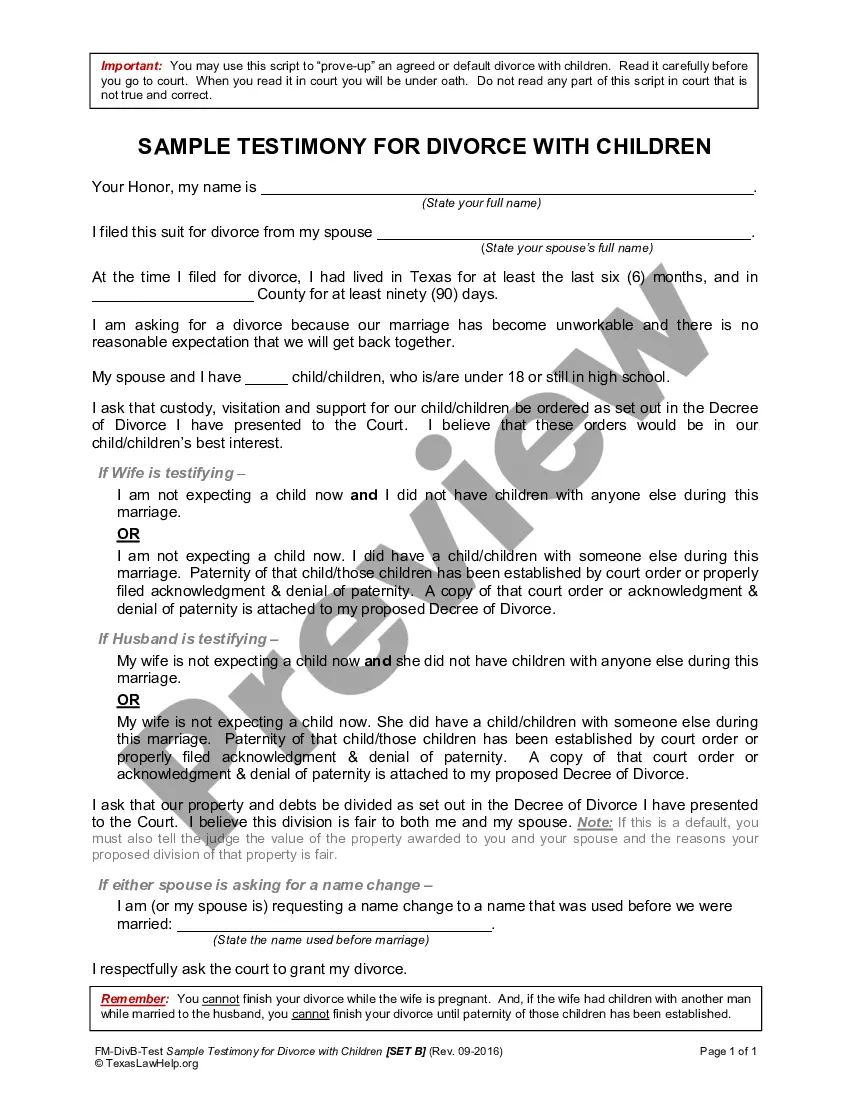

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice. Review the form outline to confirm you have chosen the right one.

- If available, utilize the Preview option to examine the document template as well.

- If you wish to find another version of your form, use the Search field to locate the template that suits your needs and requirements.

- Once you have located the template you desire, click on Buy now to proceed.

- Select the pricing plan you prefer, enter your information, and sign up for a free account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal form.

Form popularity

FAQ

If I pay the taxes will the property transfer to my name? No, if you are not the owner you must become the successful bidder at the county tax sale. Paying the taxes on such property will only cause a redemption or reconveyance to the current assessed owner.

Tax deed states with no redemption period are called ?redeemable deed? states. These states are Connecticut, Georgia, Rhode Island, Tennessee and Texas. Purchasing in a redeemable state can be very productive, and financial success is realistic if you follow the system Ted has outlined in his course material.

Failure to pay your property taxes on time could eventually lead to you losing your home. You have until the first Monday in June to clear your delinquent property tax bill. Otherwise, the County Treasurer can get a certificate that allows them to legally hold the property for two years.

If I pay the taxes will the property transfer to my name? No, if you are not the owner you must become the successful bidder at the county tax sale.

There is no redemption period on property acquired through the tax auction. Once you receive the recorded absolute deed the property is yours. There is a 2 year period where the previous owner may protest the sale and during which title companies do not issue title insurance.

We hope you enjoyed Ted's lesson, ?Is Nevada a Tax Lien or Tax Deed State?? The answer is that Nevada is both. You can purchase tax lien certificates in Nevada at oral bid auctions, and the interest rate paid on the certificates is up to 12%.

Property owners have 2 years from the date the Lien is filed to redeem the property by payment of all taxes, delinquencies and costs.

Redemption Period After the Certificate Is Issued. The redemption period before the county can sell your home at a tax sale is two years after the certificate is issued. (However, the redemption period for an abandoned property is one year.) (Nev.