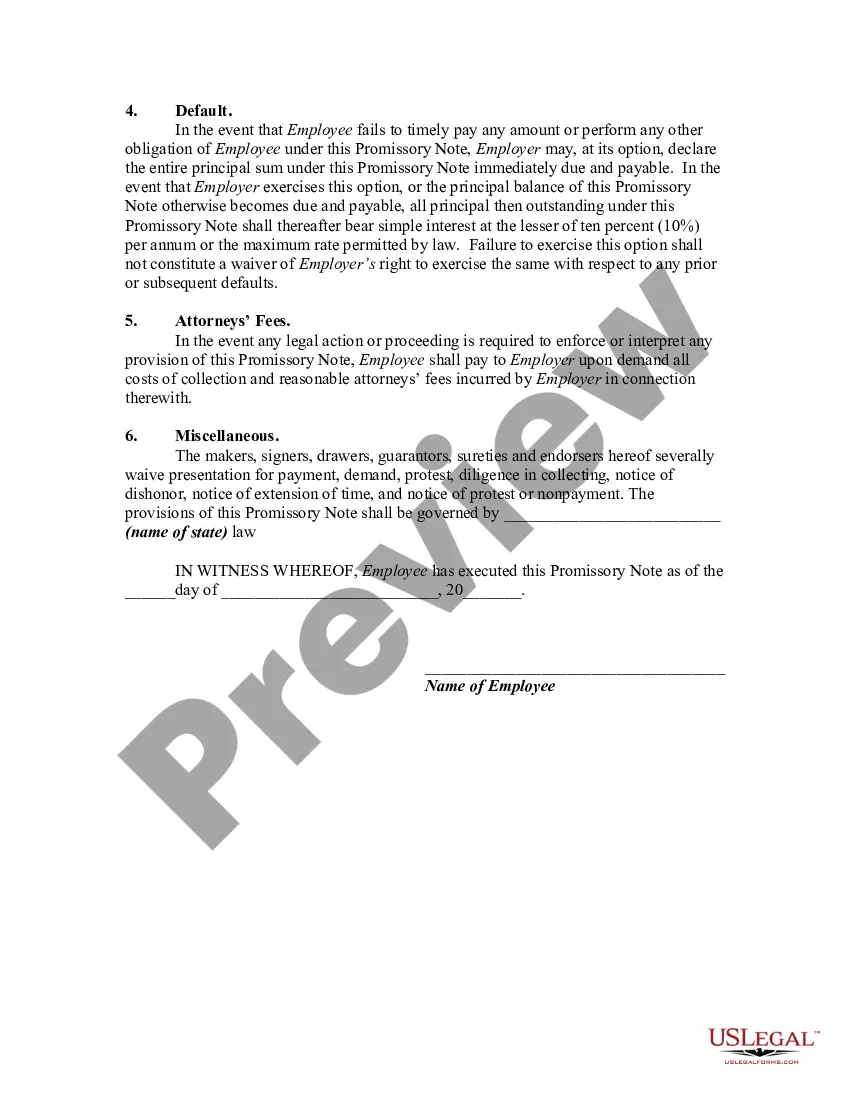

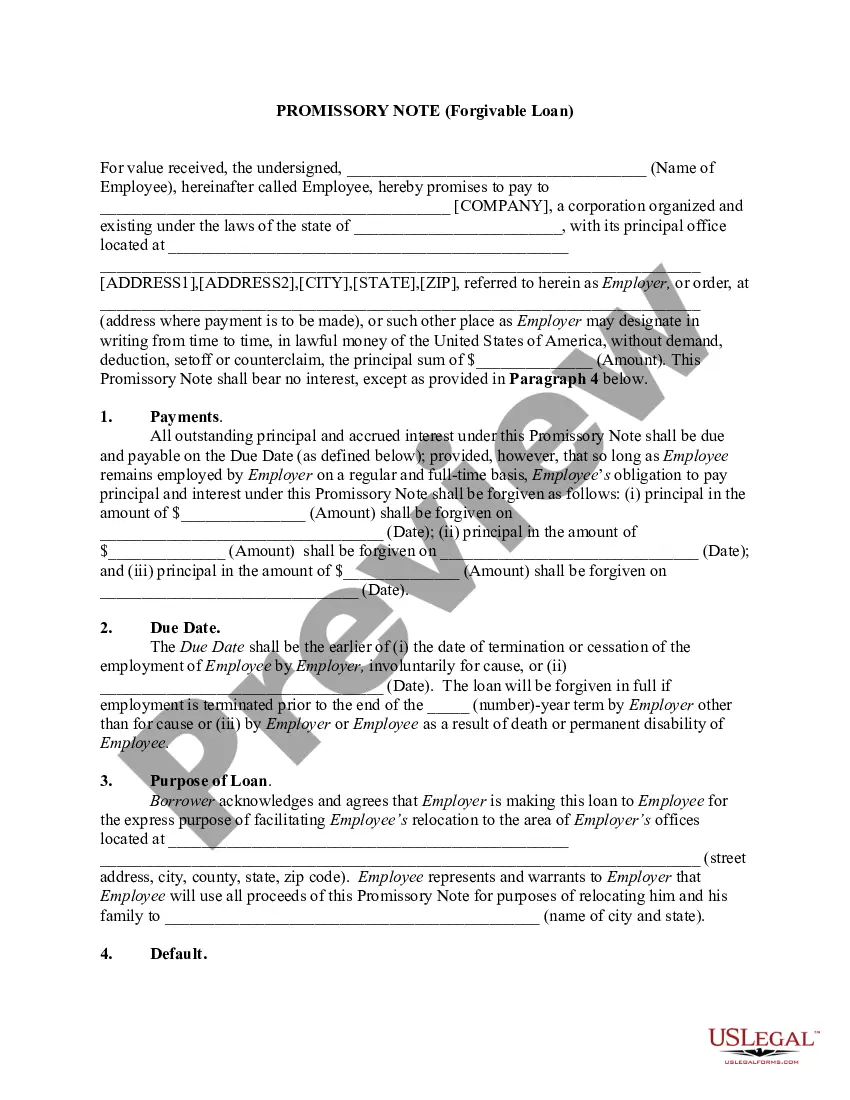

It is not uncommon for employers to make loans to their new executives. The purpose of such a loan may be to assist the executive in the purchase of a home or other relocation expenses. Frequently, the loan is forgivable over a period of time provided the executive remains employed. The loan also may be forgivable if the executive's employment terminates for specified reasons (e.g., death, disability or termination by the employer without cause).

Nevada Promissory Note - Forgivable Loan

Description

How to fill out Promissory Note - Forgivable Loan?

Have you found yourself in a situation where you frequently require documentation for potentially business or specific tasks.

There are numerous legal document templates accessible online, but identifying forms you can trust is challenging.

US Legal Forms offers thousands of form templates, such as the Nevada Promissory Note - Forgivable Loan, designed to meet state and federal standards.

Once you find the appropriate form, click Buy now.

Choose the pricing option you prefer, provide the necessary information to create your account, and complete the purchase with your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply sign in.

- Afterward, you can download the Nevada Promissory Note - Forgivable Loan template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

- Utilize the Preview button to examine the form.

- Review the description to confirm you have chosen the correct document.

- If the form does not meet your requirements, use the Search field to find the form that suits your needs.

Form popularity

FAQ

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

Promissory note are a valid instrument in the court of law to claim your amount. payable at a certain time after date. So if in your promissory note is it stated that your friend will pay you the amount after a certain date then the instruments date is not very essential.

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

There is no legal requirement to have a Nevada promissory note notarized. It must be dated and signed by the borrower and any co-signer who is a party to the agreement.

Promissory notes are legally binding contracts. That means when you don't pay back your loan, you could lose your collateral. If there's no collateral to secure the loan, the lender on the promissory note can take the borrower to court seeking repayment.

Whatever the scope of the promissory note, the basic tenet is that once it is signed by the involved parties, it becomes a legal instrument that can be enforced via legal remedy if one of the parties does not uphold their end of the bargain.

The lender can file a civil suit for recovering the money he owed through promissory note or loan agreement. He can do so under Order 37 of CPC which allows the lender to file a summary suit. He can file this suit in any high court, City Civil Court, Magistrate Court, Small Causes Court.

A Promissory Note will only be enforceable if it includes all the elements which are necessary to make it a legal document.