Nevada Hippa Release Form for Insurance

Description

How to fill out Hippa Release Form For Insurance?

It is feasible to spend multiple hours online attempting to locate the valid form template that meets the federal and state requirements you require.

US Legal Forms provides thousands of valid forms that have been evaluated by experts.

You can easily download or print the Nevada Hippa Release Form for Insurance from our service.

If available, use the Review button to look through the form template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Acquire button.

- Next, you can complete, modify, print, or sign the Nevada Hippa Release Form for Insurance.

- Every valid form template you obtain is yours permanently.

- To retrieve another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct form template for the region/city of your choice.

- Check the form description to confirm you have chosen the appropriate form.

Form popularity

FAQ

The decision to agree or decline HIPAA authorization requires reflection on your comfort with sharing your health information. If you trust the parties involved, agreeing may simplify processes related to your insurance. However, if you have reservations, you can choose to decline. Using the Nevada Hippa Release Form for Insurance optimally informs your choice, ensuring that your rights remain safeguarded.

There are both advantages and disadvantages to consider regarding HIPAA authorization. On the pro side, the Nevada Hippa Release Form for Insurance enables communication between your healthcare provider and insurance company, facilitating your care. Conversely, providing authorization may lead to discomfort about who accesses your private health information. Weigh these aspects carefully to determine what is best for you.

You are not legally required to agree to HIPAA authorization; it is your choice. However, if you decline, your healthcare provider may not share necessary information with your insurance company. This could result in delays or complications regarding your insurance claims. Understanding the Nevada Hippa Release Form for Insurance can help you make an informed decision.

Deciding to accept or decline HIPAA authorization can significantly impact your healthcare experience. The Nevada Hippa Release Form for Insurance allows you to control who accesses your medical information. If you trust the institution or individual requesting access, you may choose to accept. However, if you have concerns about privacy, you might consider declining the authorization.

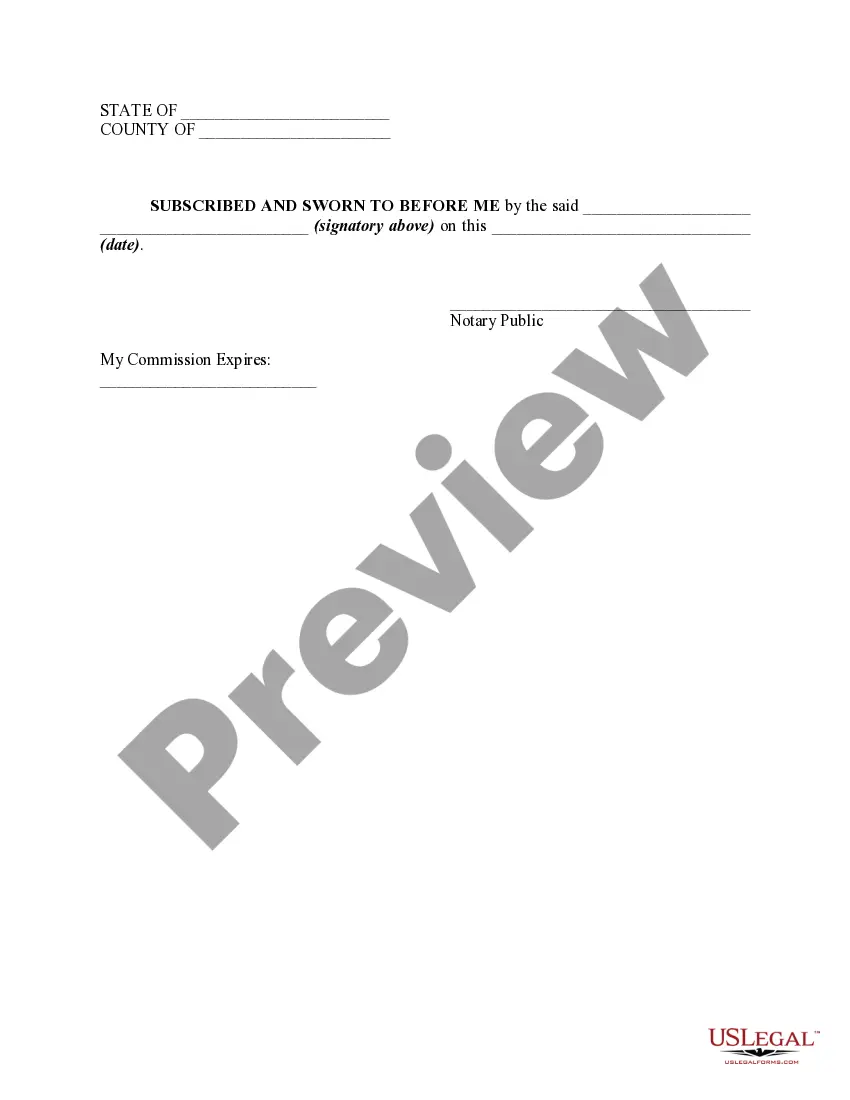

Notarization of HIPAA release forms is not always necessary, but it can add an extra layer of validity. In Nevada, a HIPAA release form for insurance may require notarization if specified by the insurer or involved parties. If you're unsure, check the specific requirements of your insurance provider and consult with a legal expert. This ensures that your release form remains compliant and effective.

No, there is no universal HIPAA release form that applies to every situation. Each Nevada HIPAA release form for insurance must be tailored to your specific needs and circumstances. It typically requires details about the patient, the information being shared, and the parties involved. Therefore, it's crucial to ensure your form complies with both state and federal regulations.

A HIPAA violation can occur when there is a failure to protect health information, either intentionally or due to negligence. Examples include unauthorized access to medical records or failure to provide adequate safeguards against data breaches. By using a Nevada Hippa Release Form for Insurance, you can clearly define who can access your health information, significantly reducing the risk of unintentional violations. This proactive approach helps you stay compliant while ensuring your information remains private.

The three main rules of HIPAA are the Privacy Rule, the Security Rule, and the Breach Notification Rule. The Privacy Rule safeguards individuals' medical information from unauthorized access. The Security Rule ensures that electronic health information is protected through appropriate security measures. Utilizing a Nevada Hippa Release Form for Insurance assists in complying with these rules, as it explicitly outlines who can access your information and under what circumstances.

A violation of patient confidentiality occurs when an individual's private health information is disclosed without their consent or knowledge. For example, sharing medical records or personal details with unauthorized parties is a breach. Using a Nevada Hippa Release Form for Insurance helps ensure that your information remains secure while allowing you to share essential details with designated individuals. This form protects your rights and maintains the integrity of your private information.

Certainly, forms can be signed electronically, making the process much more efficient in the digital age. Electronic signatures on documents like the Nevada Hippa Release Form for Insurance are not only convenient but also legally binding in many cases. Using services such as uslegalforms supports this modern approach to document management.