An irrevocable trust is one that generally cannot be changed or canceled once it is set up without the consent of the beneficiary. Contributions cannot be taken out of the trust by the trustor. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nevada General Form of Irrevocable Trust Agreement

Description

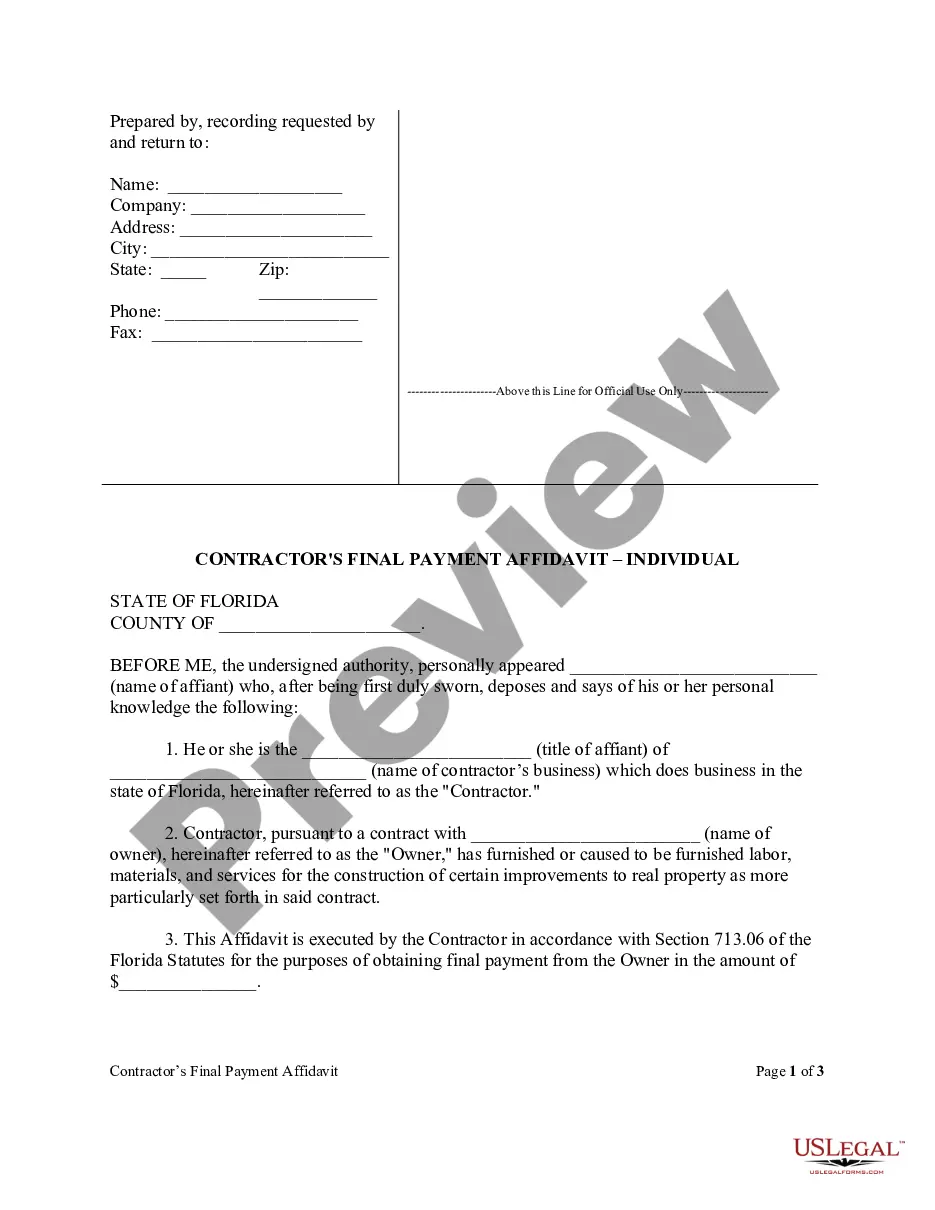

How to fill out General Form Of Irrevocable Trust Agreement?

Locating the appropriate legal document template can be quite challenging. Of course, there is a plethora of templates accessible online, but how can you discover the legal form you need? Utilize the US Legal Forms website. The platform offers thousands of templates, including the Nevada General Form of Irrevocable Trust Agreement, which you can employ for both business and personal purposes. All documents are reviewed by experts and adhere to federal and state requirements.

If you are already registered, sign in to your account and click on the Download button to retrieve the Nevada General Form of Irrevocable Trust Agreement. Use your account to search through the legal forms you have previously obtained. Visit the My documents tab of your account to obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward steps you can follow: First, ensure you have selected the correct form for your specific location. You can browse the form using the Preview button and review the form description to confirm it is suitable for you.

Finally, complete, edit, print, and sign the received Nevada General Form of Irrevocable Trust Agreement. US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Take advantage of the service to download professionally crafted papers that comply with state requirements.

- If the form does not satisfy your requirements, utilize the Search field to find the right form.

- Once you are certain that the form is appropriate, click the Buy now button to purchase the form.

- Choose the pricing plan you desire and provide the necessary information.

- Create your account and process the payment with your PayPal account or credit card.

- Select the document format and download the legal document template to your device.

Form popularity

FAQ

Yes, you can set up an irrevocable trust for yourself using the Nevada General Form of Irrevocable Trust Agreement. This type of trust helps in managing your assets while providing significant tax benefits. By establishing this trust, you relinquish control over the assets, thus protecting them from creditors or lawsuits. UsLegalForms offers easy-to-use templates and guidance that make the process straightforward and efficient.

For a trust to be valid in Nevada, it must meet specific legal requirements set by the state. The Nevada General Form of Irrevocable Trust Agreement must have a clearly defined grantor, trustee, and beneficiaries, along with a valid purpose. Additionally, the trust should be signed and notarized to ensure that it meets Nevada's legal standards and is enforceable.

Yes, you can put a trust in your own name. When using the Nevada General Form of Irrevocable Trust Agreement, you will typically be the grantor, which allows for personal control over the trust’s assets. However, it's important to remember that once you create an irrevocable trust, you relinquish control over the assets, which can have various legal and tax implications.

Filling out a trust agreement involves several key steps. Begin with the Nevada General Form of Irrevocable Trust Agreement, and clearly identify the grantor, trustee, and beneficiaries. Provide detailed instructions about asset distribution and management. It's crucial to ensure that all information is accurate and aligns with your wishes to prevent any future legal issues.

An irrevocable trust in Nevada offers numerous benefits, including asset protection, tax advantages, and clarity in the distribution of assets after your passing. Since the assets are removed from your estate, they may be protected from creditors and legal claims. Using a Nevada General Form of Irrevocable Trust Agreement can help you effectively secure these benefits and streamline the process.

Typically, assets that require direct access or have fluctuating values should not be placed in an irrevocable trust. This includes personal residences, retirement accounts, and items that may need to be liquidated quickly. When creating a Nevada General Form of Irrevocable Trust Agreement, it's important to carefully select which assets to include to ensure they align with your long-term goals.

The irrevocable trust law in Nevada provides specific guidelines and requirements for establishing such trusts. It ensures that once the trust is created, the assets within it cannot be removed or changed by the grantor. This law is crucial for anyone considering a Nevada General Form of Irrevocable Trust Agreement, as it defines the legal framework governing asset management and protection.

Yes, you can write your own trust in Nevada, as long as it complies with state laws. However, navigating the legal requirements can be complex and mistakes can lead to issues down the line. Consider utilizing a Nevada General Form of Irrevocable Trust Agreement from uslegalforms, which helps ensure your trust meets all legal requirements and functions correctly.

To write an irrevocable trust document, you first need to define the trust's purpose and identify the assets to be included. Then, outline the terms of the trust, including the trustee's responsibilities and the beneficiaries. Utilizing a Nevada General Form of Irrevocable Trust Agreement can simplify this process, providing a clear structure and essential clauses.

The primary disadvantage of an irrevocable trust is that once it is established, the grantor cannot alter or revoke it. This means you lose control over the assets placed within the trust, which can be a concern if your financial situation changes. However, despite this disadvantage, a Nevada General Form of Irrevocable Trust Agreement offers significant long-term benefits.