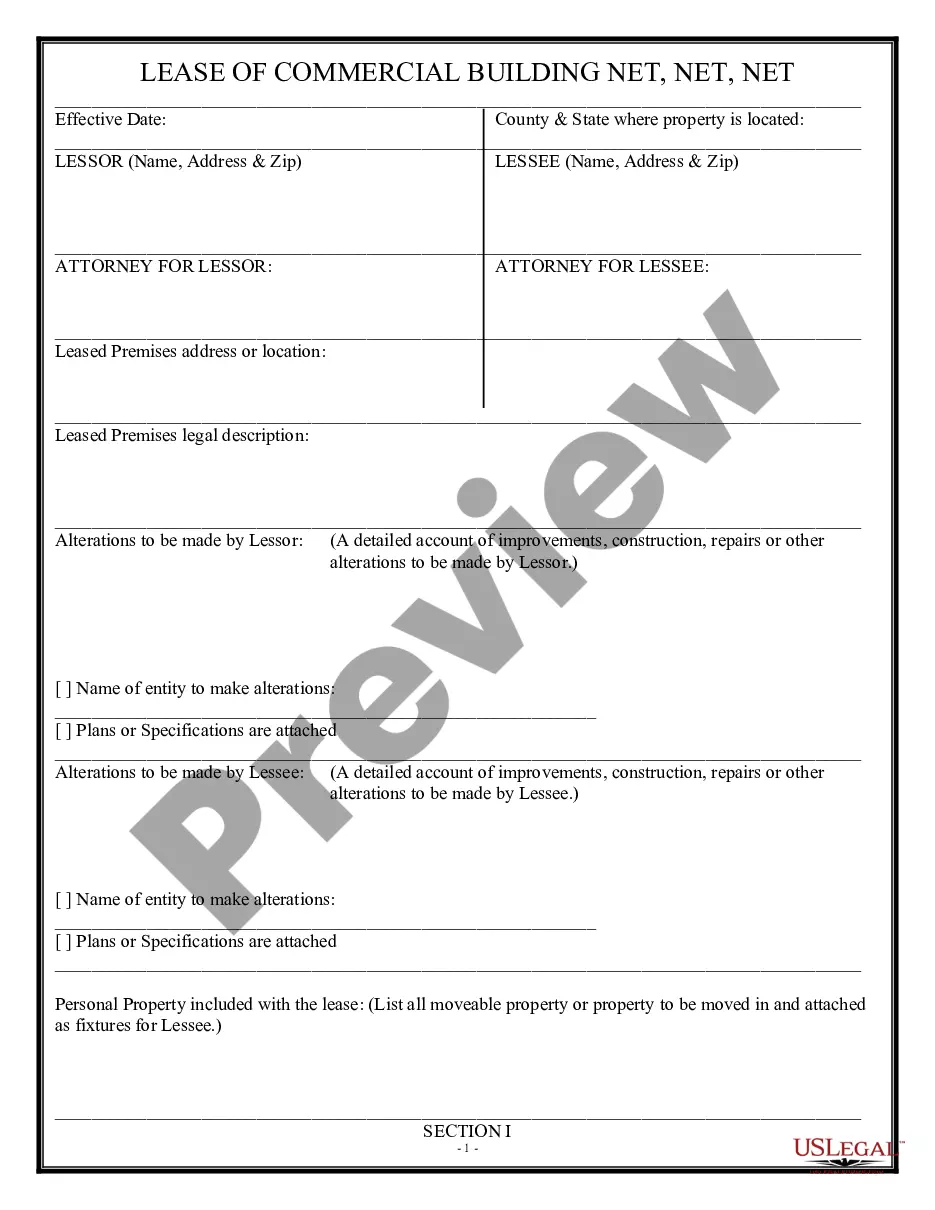

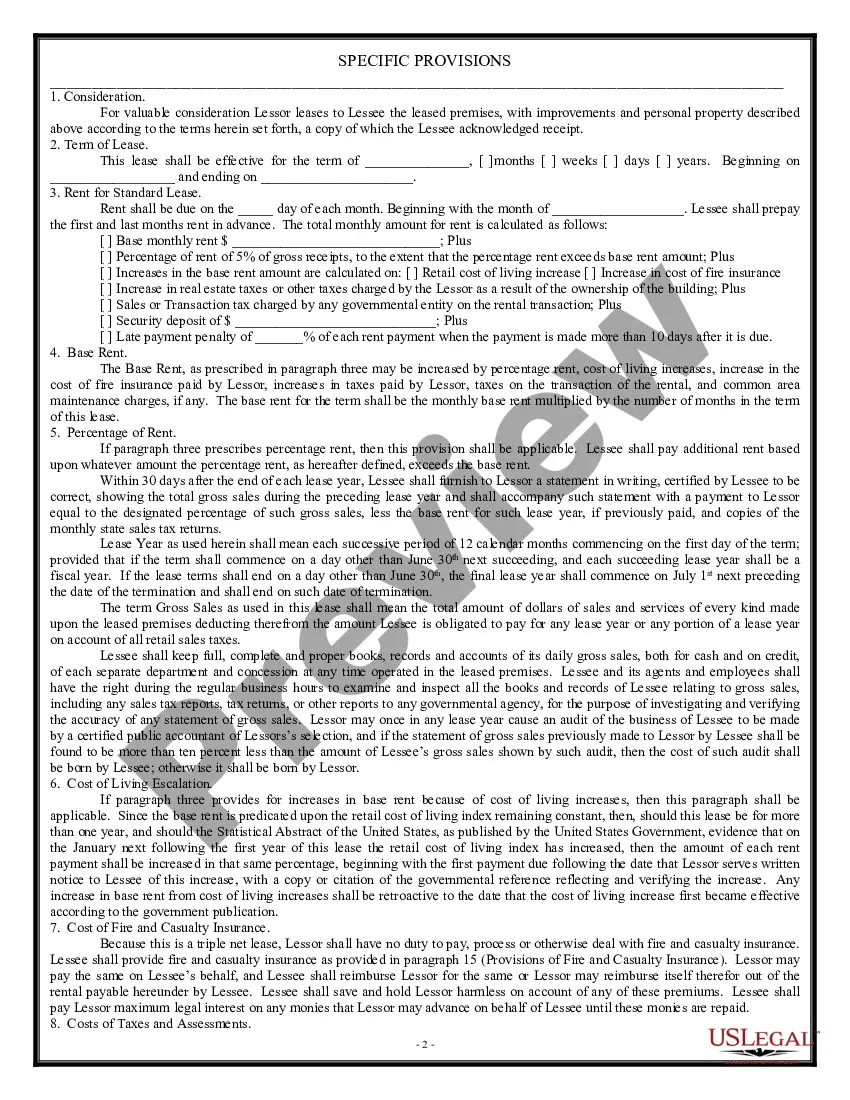

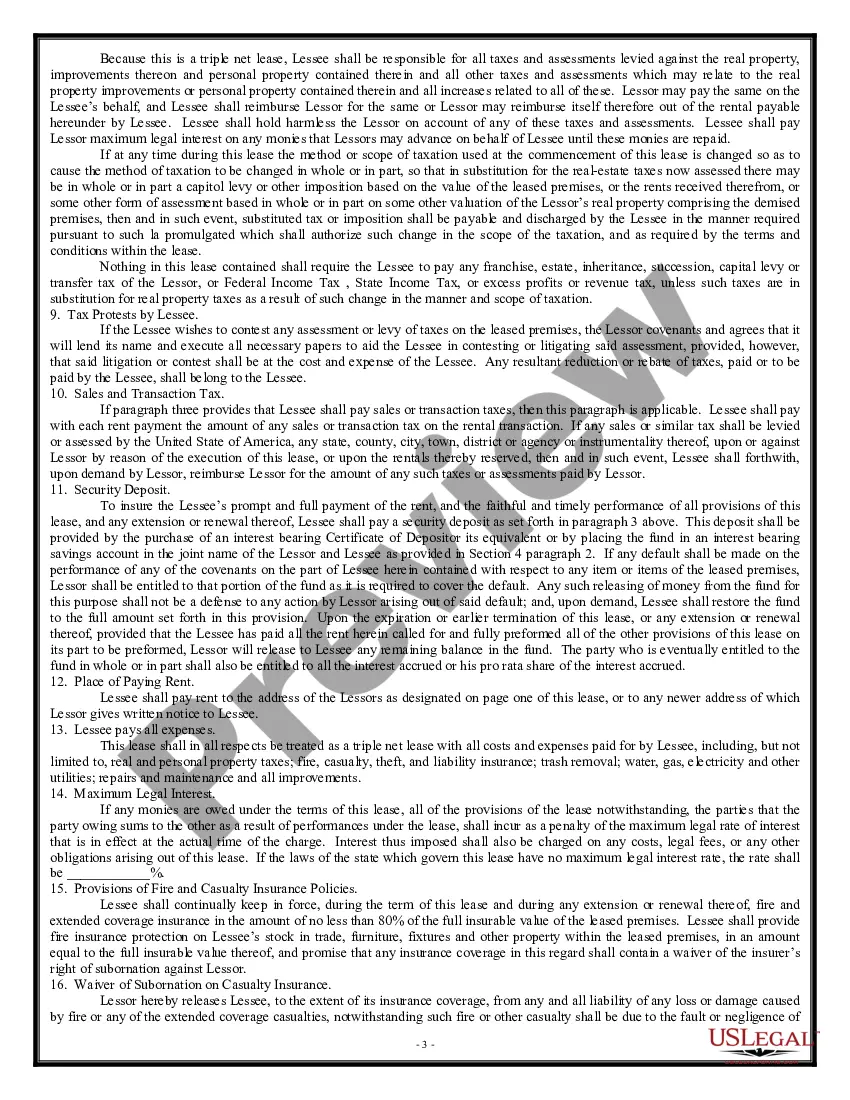

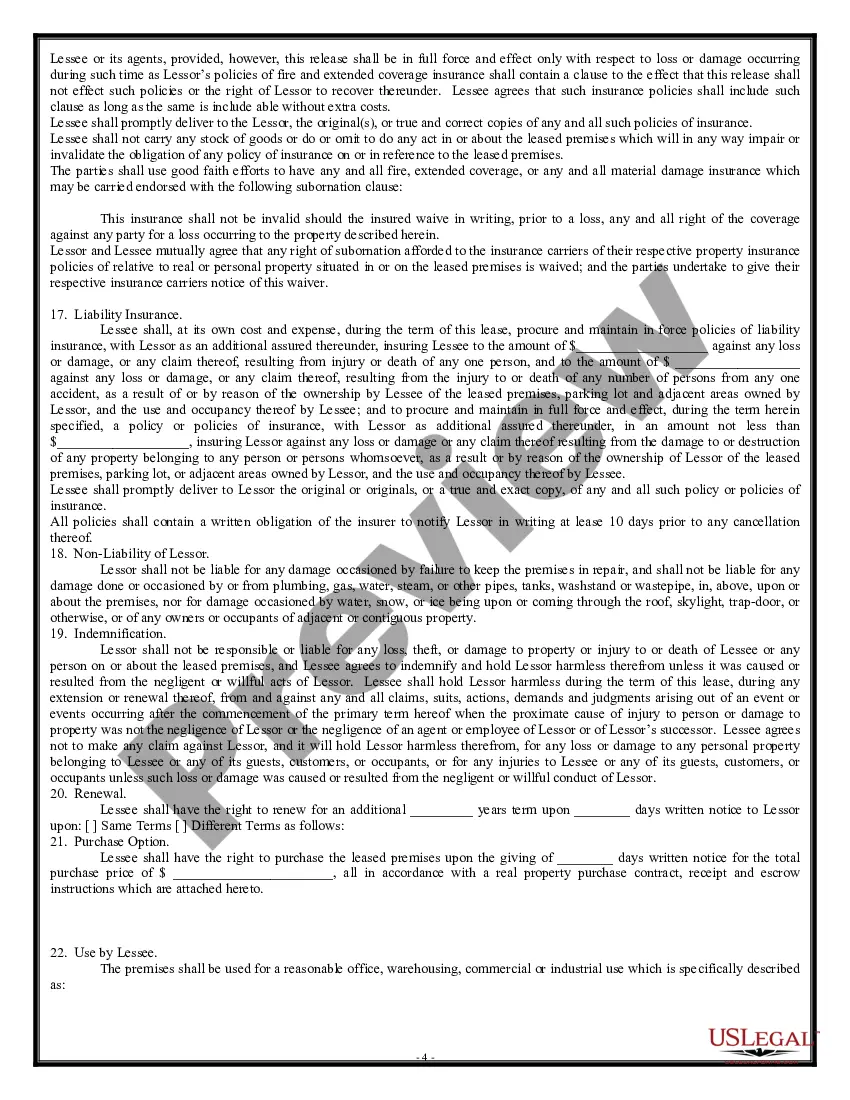

Nevada Space, Net, Net, Net — Triple Net Lease: A Comprehensive Overview In the realm of commercial real estate leasing, the Nevada Space, Net, Net, Net — Triple Net Lease offers a popular and profitable arrangement for both landlords and tenants. This leasing model refers to a specific type of lease agreement where the tenant is responsible for paying additional expenses on top of the base rent, including property taxes, insurance, and maintenance costs. In this detailed description, we will explore the various facets and types of Nevada Space, Net, Net, Net — Triple Net Lease. Key Aspects of Nevada Space, Net, Net, Net — Triple Net Lease: 1. Base Rent: The foundation of this lease structure is the base rent, which denotes the fixed amount paid by the tenant to the landlord. The base rent covers the use of the leased space and serves as a starting point for calculating additional expenses. 2. Property Taxes: One crucial element in a triple net lease is the responsibility of the tenant to pay property taxes. These taxes contribute to the local authority's revenue and are typically calculated based on the assessed value of the property. 3. Insurance: Another key aspect of a triple net lease is insurance. Tenants are required to obtain and maintain insurance coverage for the leased space, which typically includes general liability insurance as well as property insurance. This helps protect both the tenant and the landlord from potential risks and damages. 4. Maintenance Costs: The third additional expense in a triple net lease is maintenance costs. This includes general maintenance and repairs necessary to keep the leased space in good condition. It may cover both routine maintenance, such as cleaning and landscaping, as well as unexpected repairs such as HVAC maintenance or roof repairs. Types of Nevada Space, Net, Net, Net — Triple Net Lease: 1. Retail Space, Net, Net, Net — Triple Net Lease: This type of triple net lease is commonly used for retail properties, where the tenant occupies a commercial space within a shopping center, mall, or standalone retail building. 2. Office Space, Net, Net, Net — Triple Net Lease: This variation of triple net lease applies to office spaces, where the tenant utilizes the leased space for various professional activities. It is often seen in office buildings or business parks. 3. Industrial Space, Net, Net, Net — Triple Net Lease: Industrial properties such as warehouses, distribution centers, or manufacturing facilities also leverage the triple net lease structure. The tenant in this scenario bears the expenses related to the specific industrial space. Benefits of Nevada Space, Net, Net, Net — Triple Net Lease: 1. Predictable Expenses: For tenants, triple net leases provide predictability in budgeting, as they know upfront the additional expenses they will be responsible for throughout the lease term. 2. Greater Control: Tenants have more control over the property, including maintenance, insurance, and taxes, allowing them to ensure these aspects are managed in their best interest. 3. Passive Income Generation: For landlords, triple net leases offer an attractive investment opportunity, enabling them to generate passive income while shifting a significant burden of property-related expenses to the tenant. Conclusion: Nevada Space, Net, Net, Net — Triple Net Lease is a well-established commercial leasing model in Nevada, empowering both landlords and tenants with clear responsibilities and predictable expenses. With variations tailored to retail, office, and industrial spaces, this lease structure offers benefits for all parties involved and plays a vital role in the thriving Nevada commercial real estate market.

Nevada Space, Net, Net, Net — Triple Net Lease: A Comprehensive Overview In the realm of commercial real estate leasing, the Nevada Space, Net, Net, Net — Triple Net Lease offers a popular and profitable arrangement for both landlords and tenants. This leasing model refers to a specific type of lease agreement where the tenant is responsible for paying additional expenses on top of the base rent, including property taxes, insurance, and maintenance costs. In this detailed description, we will explore the various facets and types of Nevada Space, Net, Net, Net — Triple Net Lease. Key Aspects of Nevada Space, Net, Net, Net — Triple Net Lease: 1. Base Rent: The foundation of this lease structure is the base rent, which denotes the fixed amount paid by the tenant to the landlord. The base rent covers the use of the leased space and serves as a starting point for calculating additional expenses. 2. Property Taxes: One crucial element in a triple net lease is the responsibility of the tenant to pay property taxes. These taxes contribute to the local authority's revenue and are typically calculated based on the assessed value of the property. 3. Insurance: Another key aspect of a triple net lease is insurance. Tenants are required to obtain and maintain insurance coverage for the leased space, which typically includes general liability insurance as well as property insurance. This helps protect both the tenant and the landlord from potential risks and damages. 4. Maintenance Costs: The third additional expense in a triple net lease is maintenance costs. This includes general maintenance and repairs necessary to keep the leased space in good condition. It may cover both routine maintenance, such as cleaning and landscaping, as well as unexpected repairs such as HVAC maintenance or roof repairs. Types of Nevada Space, Net, Net, Net — Triple Net Lease: 1. Retail Space, Net, Net, Net — Triple Net Lease: This type of triple net lease is commonly used for retail properties, where the tenant occupies a commercial space within a shopping center, mall, or standalone retail building. 2. Office Space, Net, Net, Net — Triple Net Lease: This variation of triple net lease applies to office spaces, where the tenant utilizes the leased space for various professional activities. It is often seen in office buildings or business parks. 3. Industrial Space, Net, Net, Net — Triple Net Lease: Industrial properties such as warehouses, distribution centers, or manufacturing facilities also leverage the triple net lease structure. The tenant in this scenario bears the expenses related to the specific industrial space. Benefits of Nevada Space, Net, Net, Net — Triple Net Lease: 1. Predictable Expenses: For tenants, triple net leases provide predictability in budgeting, as they know upfront the additional expenses they will be responsible for throughout the lease term. 2. Greater Control: Tenants have more control over the property, including maintenance, insurance, and taxes, allowing them to ensure these aspects are managed in their best interest. 3. Passive Income Generation: For landlords, triple net leases offer an attractive investment opportunity, enabling them to generate passive income while shifting a significant burden of property-related expenses to the tenant. Conclusion: Nevada Space, Net, Net, Net — Triple Net Lease is a well-established commercial leasing model in Nevada, empowering both landlords and tenants with clear responsibilities and predictable expenses. With variations tailored to retail, office, and industrial spaces, this lease structure offers benefits for all parties involved and plays a vital role in the thriving Nevada commercial real estate market.