Nevada Revocable Trust for Child

Description

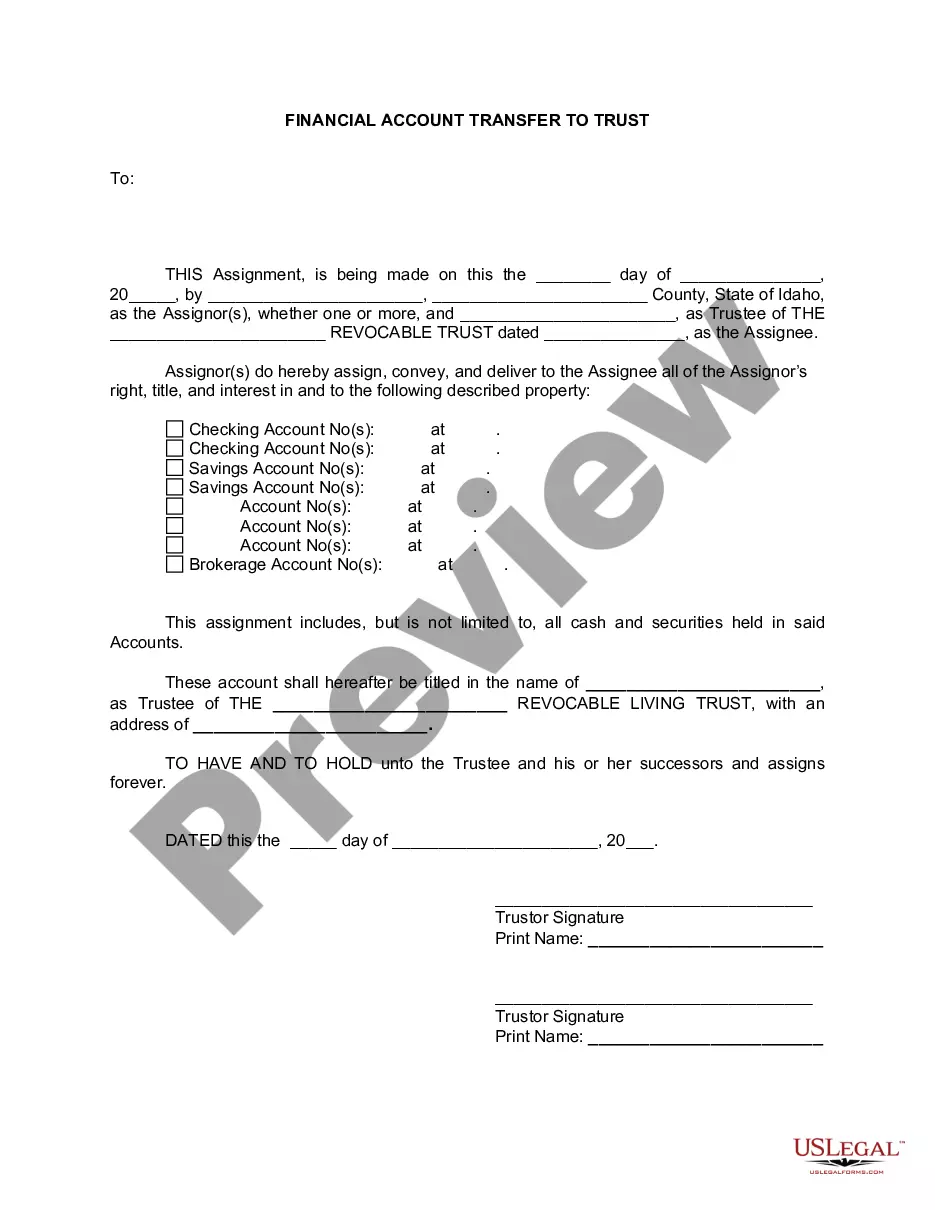

How to fill out Revocable Trust For Child?

It is feasible to spend time online searching for the legal document template that fulfills the federal and state requirements you seek.

US Legal Forms provides thousands of legal templates that are reviewed by professionals.

You can easily download or print the Nevada Revocable Trust for Child from the service.

If available, use the Review button to look through the document template as well.

- If you possess a US Legal Forms account, you can Log In and then click the Download button.

- Subsequently, you can complete, modify, print, or sign the Nevada Revocable Trust for Child.

- Each legal document template you obtain is yours forever.

- To obtain an additional copy of a purchased form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your county or town of choice.

- Review the form description to ensure you have chosen the appropriate form.

Form popularity

FAQ

A common mistake parents make in the UK while setting up a trust fund is failing to fund the trust properly. This oversight can lead to a situation where the intended benefits of the trust, much like those in a Nevada Revocable Trust for Child, are not realized. Always ensure that the trust contains the necessary assets to provide for your child's future, and consider seeking help from professionals for guidance.

In general, a Nevada Revocable Trust for Child does not need to be filed with the state, as it is a private document. However, specific documentation may be required for certain assets, such as real estate, to ensure proper title transfer. Consulting with a legal expert can clarify what is needed to set up your trust successfully and meet all requirements.

Setting up a trust, such as a Nevada Revocable Trust for Child, can involve several pitfalls. Common challenges include the potential for family conflicts over trust management and the complexities of ensuring that assets are correctly titled in the name of the trust. It's crucial to work with experts to navigate these issues and prevent costly mistakes.

One disadvantage of a family trust is the ongoing management it requires. As a parent considering a Nevada Revocable Trust for Child, you should be aware that maintaining the trust can demand time, effort, and sometimes, professional help. Additionally, if not properly funded, the trust may not effectively protect your assets or fulfill its intended purpose.

When considering a trust for children, a Nevada Revocable Trust for Child is often the best option. This type of trust provides you with the flexibility to make changes as your child's needs evolve over time. With this trust, you can designate specific uses for funds, ensuring they are used wisely and at the right time. Working with UsLegalForms can help simplify the process of establishing a trust that caters to your child's financial security.

The primary difference between a revocable and irrevocable trust in Nevada is control. A revocable trust, such as a Nevada Revocable Trust for Child, allows you to change or dissolve the trust at any time. On the other hand, an irrevocable trust generally cannot be altered or terminated without the consent of the beneficiaries. It's important to weigh the benefits and limitations of each type when planning for your child's future.

The best type of trust for a child often depends on your specific goals, but a Nevada Revocable Trust for Child is a popular choice. This trust allows for versatility and customization, enabling you to decide how and when your child will benefit from the trust assets. It can provide for education expenses, health care needs, or other responsibilities you deem important.

The best way to set up a trust for children is to create a Nevada Revocable Trust for Child. This type of trust allows parents to retain control over their assets while ensuring that the funds are used for their children’s benefit. You can define specific terms, such as when and how the children can access the funds. Consulting with professionals can also help streamline the process.

Yes, you can write your own trust in Nevada. However, you should ensure that your trust meets all legal requirements in the state. A Nevada Revocable Trust for Child can offer flexibility and control over your assets while allowing you to adjust the terms as needed. Consider using UsLegalForms to guide you through the process and create a legally sound document.

The primary downside of an irrevocable trust is the loss of control over the assets once they are transferred. You cannot easily change the terms or withdraw assets, which may limit your financial flexibility. However, this structure provides strong protections against creditors and potential estate taxes. If you prefer more control while still planning for your child, consider a Nevada Revocable Trust for Child as a suitable alternative.