Nevada Escrow Instructions for Residential Sale

Description

How to fill out Escrow Instructions For Residential Sale?

US Legal Forms - one of the premier collections of legal documents in the United States - offers a vast assortment of legal templates that you can download or print.

Utilizing the site, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Nevada Escrow Instructions for Residential Sale in moments.

If you already hold a subscription, Log In and retrieve the Nevada Escrow Instructions for Residential Sale from your US Legal Forms collection. The Download button will show up on every form you view. You can access all previously saved forms from the My documents section of your account.

Process the payment. Use a credit card or PayPal account to complete the payment.

Select the format and download the form onto your device. Make adjustments. Fill out, revise, print, and sign the saved Nevada Escrow Instructions for Residential Sale. Each template you added to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply return to the My documents section and click on the form you desire. Access the Nevada Escrow Instructions for Residential Sale with US Legal Forms, one of the largest collections of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

- If you plan to use US Legal Forms for the first time, here are simple instructions to assist you in getting started.

- Ensure that you have picked the correct form for your city/region.

- Click the Review button to examine the form's details.

- Read the form description to confirm you have selected the appropriate document.

- If the form does not meet your requirements, utilize the Search box at the top of the page to find a suitable one.

- If you are satisfied with the form, confirm your selection by clicking on the Purchase now button.

- Next, choose the payment plan you want and provide your information to register for an account.

Form popularity

FAQ

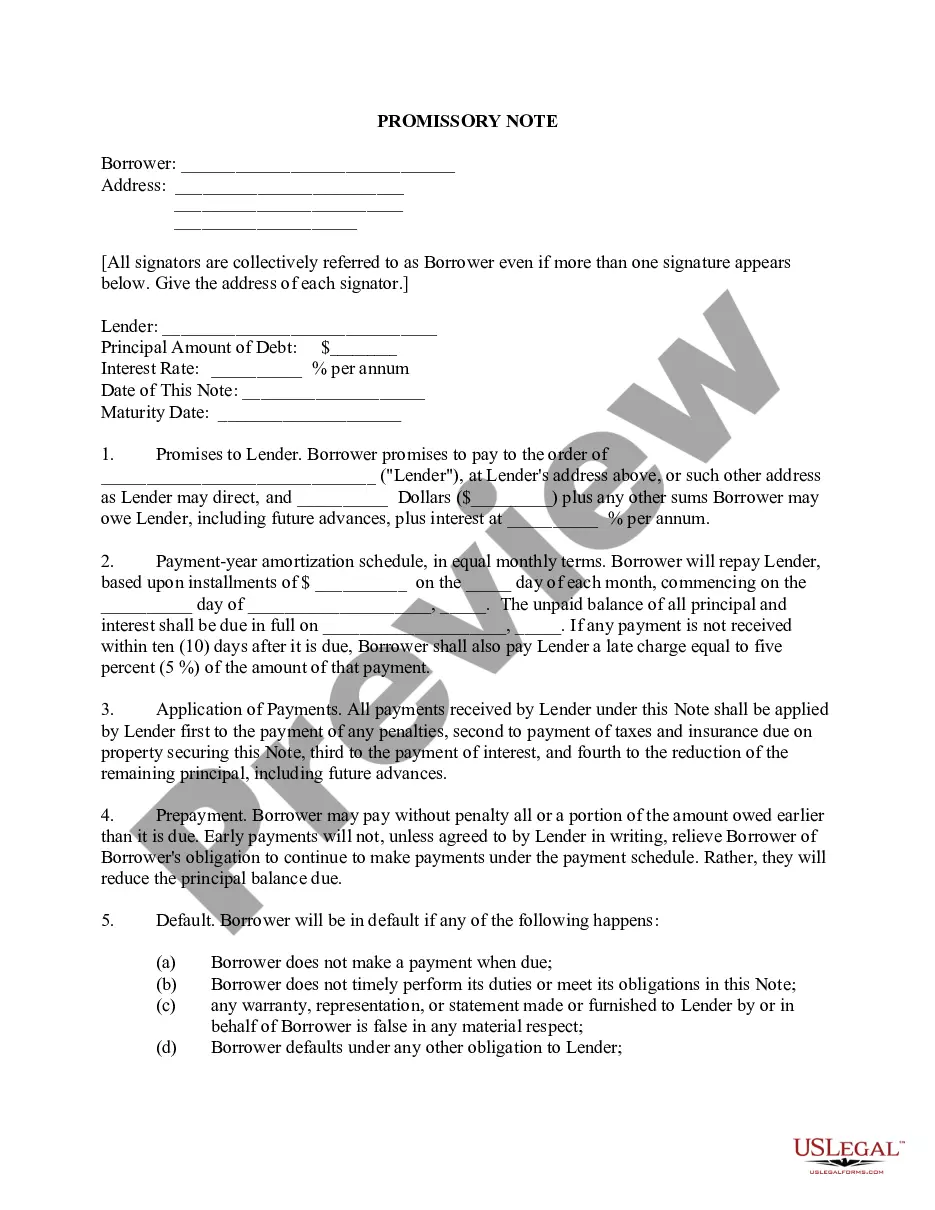

Escrow closing instructions detail the final steps required to close a real estate transaction. These instructions guide the escrow agent in disbursing funds, recording documents, and ensuring all conditions of sale are met. In Nevada, understanding the escrow closing instructions is vital for a smooth residential sale process. The Nevada Escrow Instructions for Residential Sale help clarify any uncertainties during closing.

An escrow agent typically uses the 'Escrow Agreement' as the primary document for escrow instructions. This agreement outlines the responsibilities of all parties involved in a residential sale in Nevada. It specifies how funds will be handled, how documents will be exchanged, and the conditions for closing. It is crucial to ensure that the Nevada Escrow Instructions for Residential Sale are clear and comprehensive.

Typically, the escrow instructions are laid out in the escrow agreement that is executed at the beginning of the transaction. This document describes how the escrow agent will manage the funds and property transfer under the conditions agreed upon by both the buyer and seller. Incorporating effective Nevada Escrow Instructions for Residential Sale helps create a transparent process and builds trust among all parties. As a reliable platform, uslegalforms provides templates to help you draft these essential documents seamlessly.

In Quizlet, the term 'escrow instructions' often refers to the same escrow agreement documented in a formal format. The purpose remains clear: it defines the responsibilities of the escrow agent during the residential sale. Utilizing Nevada Escrow Instructions for Residential Sale ensures that users understand their legal obligations, promoting a smoother sale process. This resource can be very helpful for students and professionals alike.

The primary document that serves as escrow instructions in a residential sale in Nevada is the escrow agreement. This contract outlines the terms and conditions that both parties agree to, ensuring that the escrow agent knows how to handle the funds and property. By using clear Nevada Escrow Instructions for Residential Sale, buyers and sellers can avoid misunderstandings during the transaction. Accurate escrow instructions protect the interests of both parties involved.

Escrow instructions are usually sent by the real estate agents representing the buyer and seller. These agents facilitate the communication, ensuring that both parties agree on the procedures that need to be followed. Utilizing the right resources, such as USLegalForms, can help you create accurate Nevada escrow instructions for residential sale that meet all legal requirements.

Sale escrow instructions are specific directives that outline how a property sale should be handled by the escrow agent. They cover key components such as payment details, title transfer, and other obligations that need to be fulfilled. Adequate sale escrow instructions, like those found in Nevada escrow instructions for residential sale, help mitigate disputes and streamline the transaction.

When you sell your house, the funds held in escrow are typically disbursed upon successful completion of the sale, according to the specified instructions. Any existing encumbrances or mortgages will be settled before you receive your net proceeds. Thus, ensuring you have appropriate Nevada escrow instructions for residential sale will guarantee you know what to expect.

Escrow instructions are legal documents that communicate the terms under which the escrow agent will hold and disburse funds. They specify details like payment amounts, closing dates, and conditions for releasing the property title. Clear and comprehensive Nevada escrow instructions for residential sale are vital to protect everyone’s interests.

Escrow instructions are typically provided by the parties involved in the transaction, such as the buyer and seller, often through their agents. This documentation guides the escrow agent on how to handle the funds and documents during the process. It's essential to follow Nevada escrow instructions for residential sale accurately to ensure a smooth transaction.