This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nevada Deed of Trust Securing Obligations Pursuant to Indemnification Agreement

Description

How to fill out Deed Of Trust Securing Obligations Pursuant To Indemnification Agreement?

Have you been within a position that you require paperwork for either company or personal purposes nearly every time? There are a variety of authorized document themes accessible on the Internet, but discovering kinds you can rely on isn`t simple. US Legal Forms gives a huge number of form themes, such as the Nevada Deed of Trust Securing Obligations Pursuant to Indemnification Agreement, that happen to be written in order to meet state and federal needs.

In case you are currently familiar with US Legal Forms internet site and have your account, simply log in. Following that, you can obtain the Nevada Deed of Trust Securing Obligations Pursuant to Indemnification Agreement template.

Should you not offer an bank account and wish to begin to use US Legal Forms, follow these steps:

- Find the form you want and make sure it is for the proper metropolis/county.

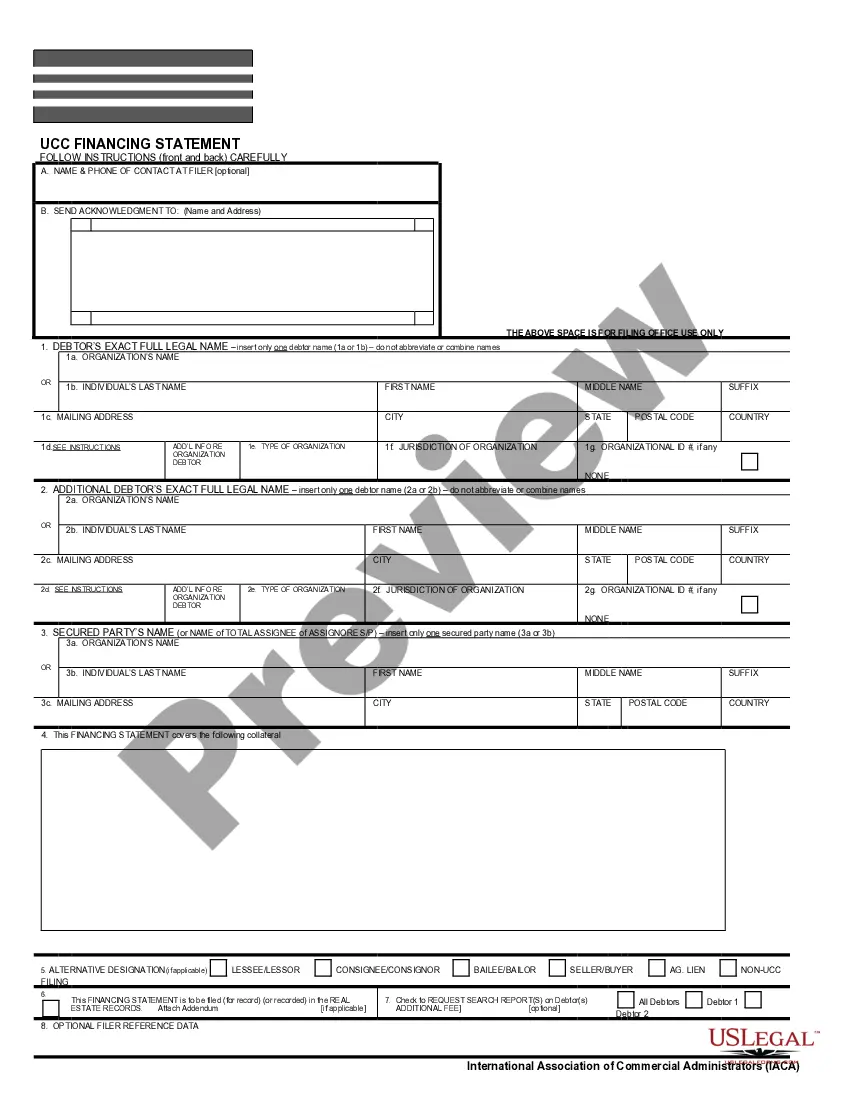

- Make use of the Review option to analyze the form.

- Browse the outline to ensure that you have chosen the right form.

- When the form isn`t what you are trying to find, utilize the Research area to find the form that meets your requirements and needs.

- When you obtain the proper form, click on Purchase now.

- Select the rates prepare you would like, complete the necessary details to produce your money, and buy the order with your PayPal or Visa or Mastercard.

- Select a hassle-free file structure and obtain your duplicate.

Find all the document themes you might have bought in the My Forms menu. You can aquire a additional duplicate of Nevada Deed of Trust Securing Obligations Pursuant to Indemnification Agreement anytime, if needed. Just click the needed form to obtain or produce the document template.

Use US Legal Forms, probably the most considerable selection of authorized varieties, to save lots of some time and prevent mistakes. The support gives expertly created authorized document themes that can be used for a range of purposes. Create your account on US Legal Forms and start producing your lifestyle a little easier.

Form popularity

FAQ

Also, the statute of limitations on a contract is 6 years on a ?contract, obligation or liability founded upon an instrument in writing: NRS 11.190(1)(b). However, the statute of limitations on a mortgage or deed of trust is 10 years. NRS 106.240.

An interest-only secured promissory note is a loan that is secured with property and requires interest-only payments through the life of the loan, with a large balloon payment for the principal at the end of the loan term.

Collateralization commonly occurs with the execution of a promissory note, along with a mortgage or deed of trust that is recorded with the county. This process places a lien against the property's title and must be satisfied, or paid, before the lien can be released.

The deed of trust is what secures the promissory note. The promissory note includes the interest rate, the payment amounts and terms, and the buyer's promise to pay the lender the amount borrowed plus interest.

This document may be called the Security Instrument, Deed of Trust, or Mortgage. When you sign this document, you are giving the lender the right to take your property by foreclosure if you fail to pay your mortgage ing to the terms you've agreed to.

A Deed of Trust is essentially an agreement between a lender and a borrower to give the property to a neutral third party who will serve as a trustee. The trustee holds the property until the borrower pays off the debt. The note lays out all the terms of the loan (repayment, interest, penalties, etc.).

The property owner signs the note, which is a written promise to repay the borrowed money. A trust deed gives the third-party ?trustee? (usually a title company or real estate broker) legal ownership of the property.

"Deed of trust" means an instrument, including, without limitation, a deed of trust, mortgage deed or other mortgage, that secures a mortgage loan and deed of trust note and creates a first lien on a fee interest in real property located within the State.