Title: Nevada Lease Purchase Agreement for Equipment: A Comprehensive Guide Introduction: In the state of Nevada, a Lease Purchase Agreement for Equipment serves as a legal contract wherein a lessee agrees to lease equipment from the lessor for a predetermined period, with an option to purchase the equipment at the end of the lease term. This article aims to provide a detailed description of the Nevada Lease Purchase Agreement for Equipment, covering its features, benefits, and different types available. Key Features of Nevada Lease Purchase Agreement for Equipment: 1. Lease Agreement: The Nevada Lease Purchase Agreement initiates as a standard lease agreement, designed to stipulate the terms and conditions for leasing equipment. 2. Purchase Option: This agreement offers the lessee an option to purchase the leased equipment within a specified period, usually at the end of the lease term. 3. Rent Payments: The lessee pays regular rental payments to the lessor throughout the lease term, typically based on the equipment's value, duration of the lease, and prevailing interest rates. 4. Depreciation: The equipment's depreciation is accounted for by reducing the purchase price based on the estimated value at the end of the lease term. 5. Security Deposit: Some agreements may require the lessee to provide a security deposit to protect the lessor against potential damages or non-payment. 6. Ownership Transfer: Upon exercising the purchase option, the equipment's ownership transfers to the lessee, converting the lease into an outright purchase. 7. Tax Benefits: Depending on the terms of the agreement, the lessee may be eligible for tax benefits, such as deducting lease payments as business expenses. Types of Nevada Lease Purchase Agreements for Equipment: 1. Capital Lease: This type of lease purchase agreement is suitable for lessees who intend to own the equipment eventually. The agreement transfers the equipment's risks and rewards to the lessee, providing them with the benefits of ownership. 2. Operating Lease: An operating lease allows the lessee to use the equipment for a specific period without the intention of ownership. It is commonly used for short-term equipment needs or when the lessee wants flexibility in equipment upgrades. 3. Conditional Sales Contract: This type of agreement functions similarly to a lease purchase agreement, but the seller retains legal ownership of the equipment until the lessee fully pays the purchase price agreed upon. Conclusion: The Nevada Lease Purchase Agreement for Equipment offers businesses and individuals a convenient and flexible way to acquire necessary equipment while minimizing upfront costs. It provides an option to lease equipment for a specific period, followed by the right to purchase it, allowing lessees to adapt to changing business requirements. By understanding the features and types of Nevada lease purchase agreements for equipment, businesses can make informed decisions that best suit their needs and financial goals.

Nevada Lease Purchase Agreement for Equipment

Description

How to fill out Lease Purchase Agreement For Equipment?

If you need to thorough, acquire, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms, available online.

Take advantage of the site's effortless and user-friendly search to find the documents you need.

A variety of templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and provide your credentials to register for the account.

Step 5. Complete the payment process. You can use your Visa, Mastercard, or PayPal account to finalize the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Nevada Lease Purchase Agreement for Equipment.

- Use US Legal Forms to obtain the Nevada Lease Purchase Agreement for Equipment in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Obtain button to access the Nevada Lease Purchase Agreement for Equipment.

- You can also access forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

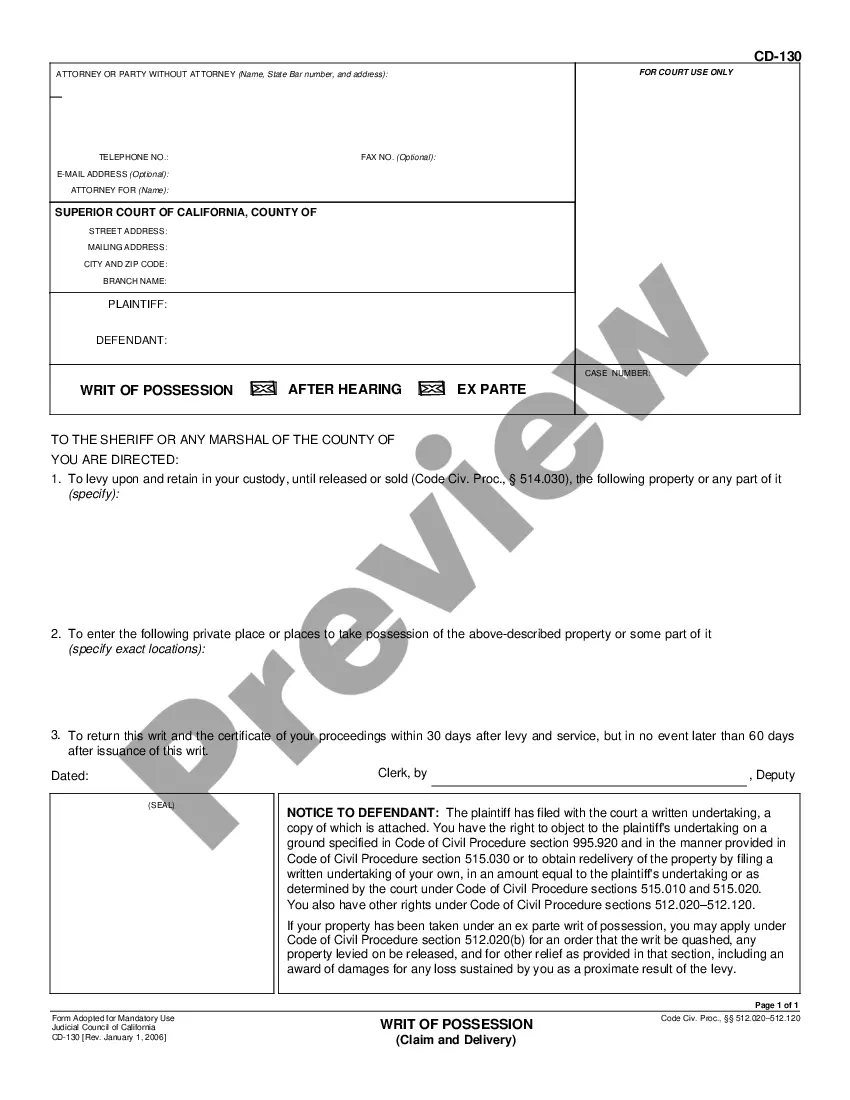

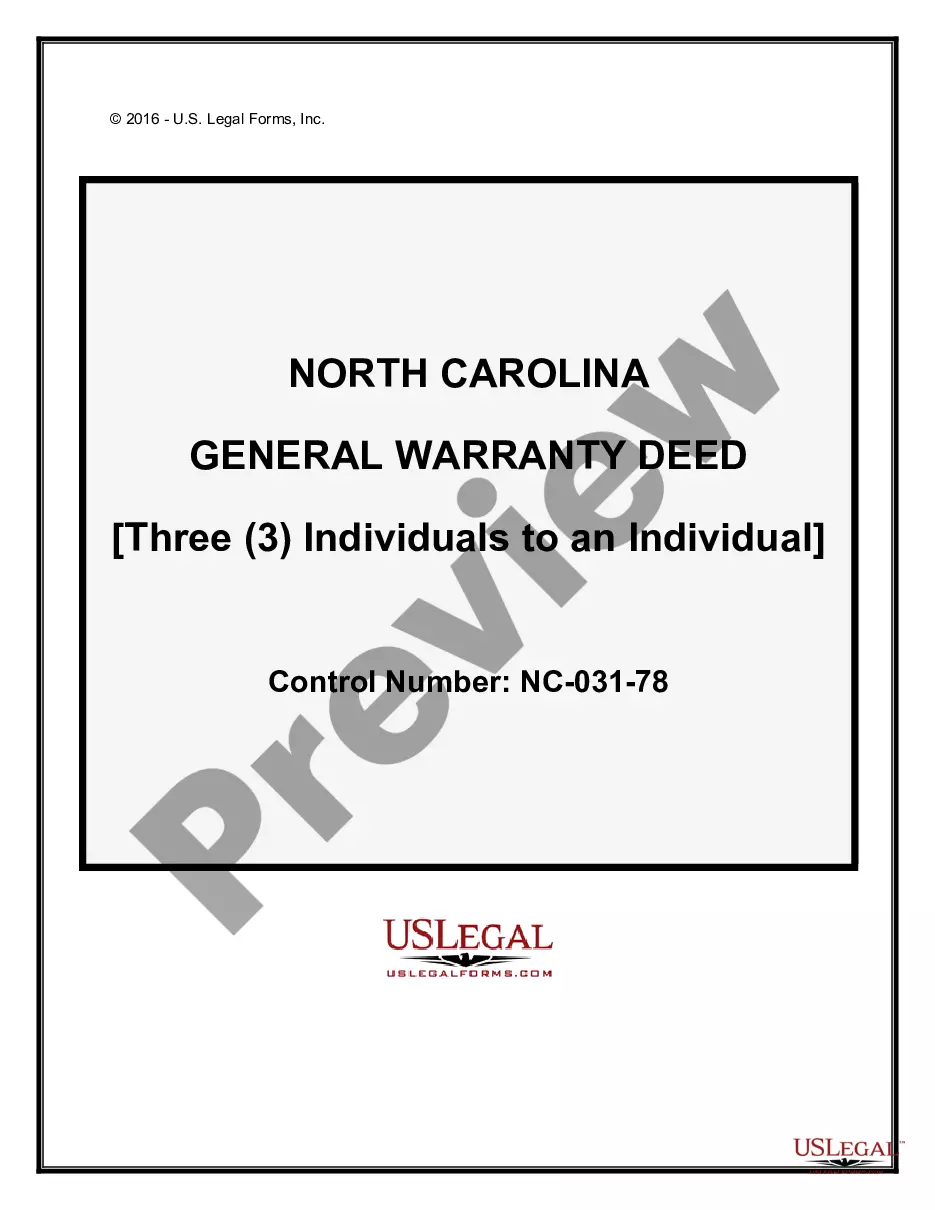

- Step 1. Ensure you have selected the form for the correct area/country.

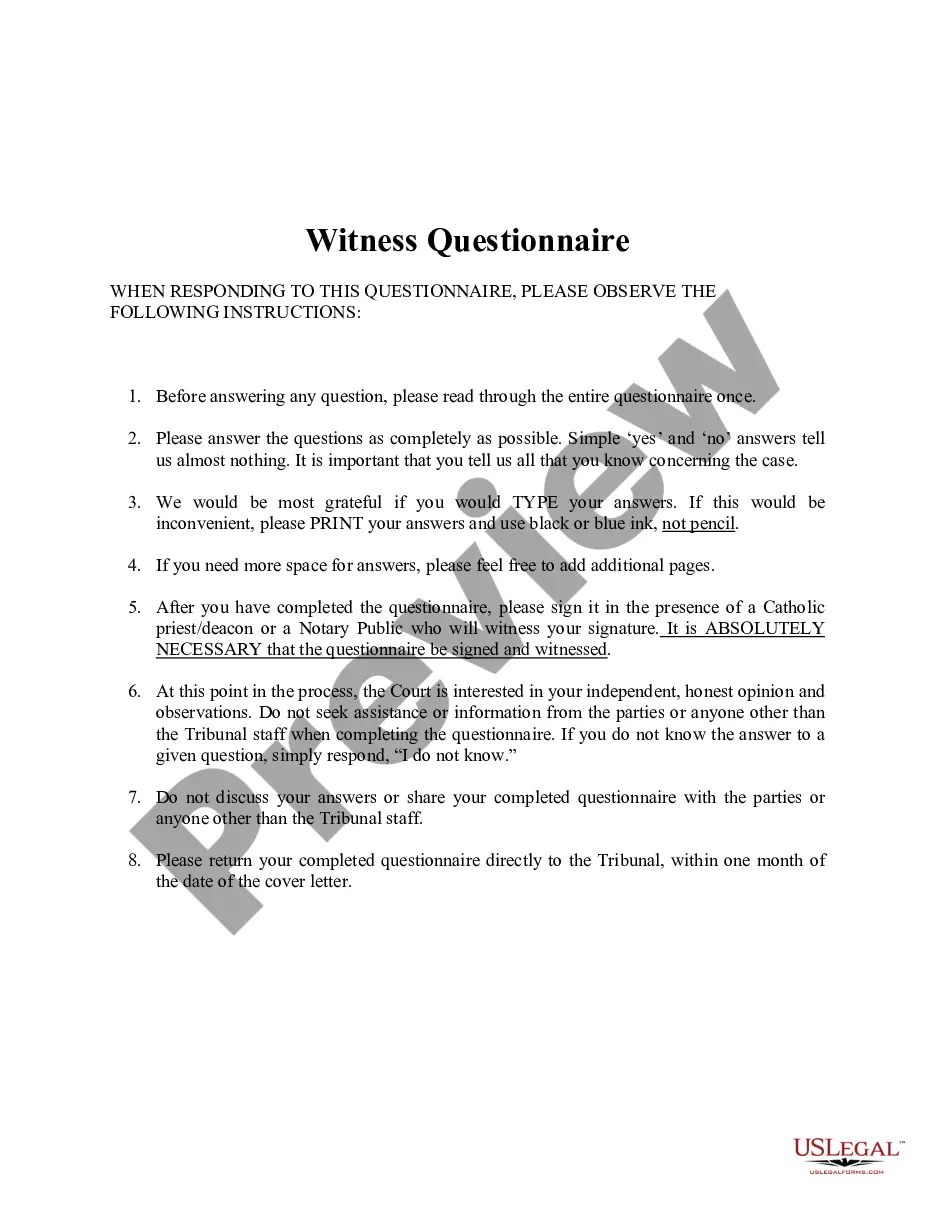

- Step 2. Use the Preview option to review the content of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Typically, equipment leasing companies look for a credit score that reflects your financial reliability. A score of 650 or higher can often facilitate approval, but some may consider applicants with lower scores depending on additional factors. Check specific requirements with your provider or review options through platforms like uslegalforms, which can help you navigate the leasing landscape.

The three main types of leasing are finance leasing, operating leasing and contract hire.

Originally meant to safeguard the interest of the parties, the rent agreement can also be used as an evidence in case of a dispute surfacing out of the property. Rent Agreement is basically a documentation of the terms mutually agreed between the owner and the tenant, to avoid potential disputes in the future.

If you default on the note, the lender can repossess the asset you purchased. Equipment loans do tend to be more difficult to qualify for. In most cases, you'll need a good credit score and a demonstrated ability to make the payments on your loan.

Learn more about Equipment Leasing!Sale/Leaseback: (allows you to use your equipment to get working capital)True Lease or Operating Equipment Leases: (Also known as fair market value leases)The P.U.T. Option Lease (Purchase upon Termination)TRAC Equipment Leases.More items...

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

Definition. An equipment rental agreement (also known as an equipment rental form or an equipment rental contract) is a legally binding document that is used to rent equipment from one party to another for a fixed period of time.

Equipment rental, also called plant hire in some countries (in the UK for instance), is a service industry providing machinery, equipment and tools of all kinds and sizes (from earthmoving to powered access, from power generation to hand-held tools, etc.)

An equipment lease agreement is a contractual agreement where the lessor, who is the owner of the equipment, allows the lessee to use the equipment for a specified period in exchange for periodic payments. The subject of the lease may be vehicles, factory machines, or any other equipment.

Interesting Questions

More info

Your equipment is yours and not for loan. The amount paid in equipment is only for you to keep while your equipment is in your residence. You are responsible for cleaning equipment at the end of its rental period. This will be discussed in more detail below. Equipment Rental Agreement Terms This includes the use of your equipment and will be discussed in more detail at the end of this section. Equipment rental is the only time any equipment in your home is not considered “personal”. Your equipment is yours and not for loan. The amount paid in equipment is only for you to keep while your equipment is in your residence. You are responsible for cleaning equipment at the end of its rental period. This will be discussed in more detail below.