When you cannot make your monthly credit card payment, the worst thing you can do is to simply let the bill go unpaid. Your creditor can charge you a late fee, raise your interest rate, and report the late payment to the credit bureaus. If you cannot pay the minimum, consider writing your credit card company and explaining your situation to them. Many creditors will extend your due date, waive the late fee, and continue reporting a "current" payment status to credit bureaus.

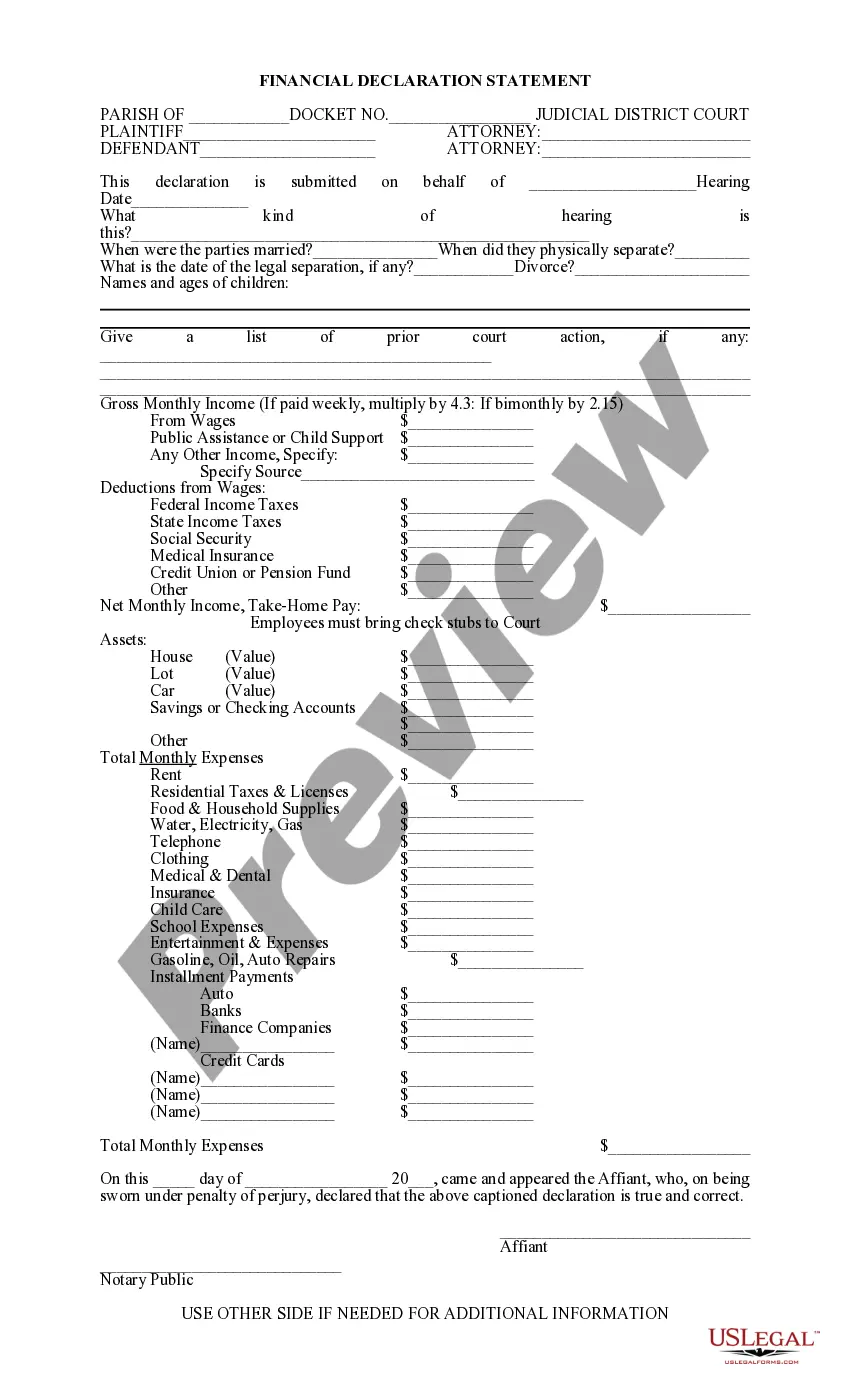

Title: Nevada Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties Keywords: Nevada, letter, credit card company, lower payments, financial difficulties Introduction: In the state of Nevada, individuals facing financial difficulties may find themselves seeking ways to lower credit card payments to alleviate their economic burden. Writing a well-crafted letter to a credit card company can be an effective method to initiate communication and request for payment adjustments. This article aims to provide a detailed description of what a Nevada Letter to a Credit Card Company Seeking to Lower Payments looks like, offering insights into its content and possible variations. Content: 1. Addressing the Credit Card Company: — Begin the letter with a concise and professional greeting, addressing the credit card company by name and specifying the department responsible for account services. 2. Providing Personal Details: — Introduce yourself by sharing your full name, address, and contact information. — Include your credit card account number, stating when the account was opened and any relevant details (such as the type of credit card and the credit limit). 3. Explain Financial Difficulties: — In a clear and honest manner, describe the circumstances that led to your financial difficulties. — Highlight any unexpected events or changes in your financial situation, such as job loss, medical emergencies, or increased expenses. — Emphasize how these challenges have made it difficult for you to meet your credit card payment obligations. 4. Request for Payment Adjustment: — Clearly express your intent to lower your monthly payments. Indicate the desired reduction amount or propose an affordable repayment plan. — Explain how this adjustment would help you meet your financial obligations, given your current circumstances. — Suggest a realistic timeline for the revised payment plan or request a temporary suspension of payments if necessary. 5. Supporting Documents: — Include any supporting documents that validate your financial situation, such as recent bank statements, medical bills, termination letters, or income statements. — Ensure that all attachments are clearly labeled and referenced in the letter. 6. Express Willingness to Cooperate: — Demonstrate your commitment to resolving the debt by reassuring the credit card company of your willingness to cooperate and find a fair solution. — Offer to provide additional information or answer any questions they may have regarding your financial situation. Variations of Nevada Letters to Credit Card Companies Seeking to Lower Payments: 1. Nevada Letter to Credit Card Company Requesting a Reduced Interest Rate: — This type of letter specifically focuses on requesting a reduction in the interest rate charged on the credit card balance, aiming to decrease overall debt over time. 2. Nevada Letter to Credit Card Company Requesting a Settlement: — In this variation, the objective is to negotiate a settlement agreement to pay off a portion of the outstanding balance in a lump sum, resulting in debt forgiveness for the remaining amount.Title: Nevada Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties Keywords: Nevada, letter, credit card company, lower payments, financial difficulties Introduction: In the state of Nevada, individuals facing financial difficulties may find themselves seeking ways to lower credit card payments to alleviate their economic burden. Writing a well-crafted letter to a credit card company can be an effective method to initiate communication and request for payment adjustments. This article aims to provide a detailed description of what a Nevada Letter to a Credit Card Company Seeking to Lower Payments looks like, offering insights into its content and possible variations. Content: 1. Addressing the Credit Card Company: — Begin the letter with a concise and professional greeting, addressing the credit card company by name and specifying the department responsible for account services. 2. Providing Personal Details: — Introduce yourself by sharing your full name, address, and contact information. — Include your credit card account number, stating when the account was opened and any relevant details (such as the type of credit card and the credit limit). 3. Explain Financial Difficulties: — In a clear and honest manner, describe the circumstances that led to your financial difficulties. — Highlight any unexpected events or changes in your financial situation, such as job loss, medical emergencies, or increased expenses. — Emphasize how these challenges have made it difficult for you to meet your credit card payment obligations. 4. Request for Payment Adjustment: — Clearly express your intent to lower your monthly payments. Indicate the desired reduction amount or propose an affordable repayment plan. — Explain how this adjustment would help you meet your financial obligations, given your current circumstances. — Suggest a realistic timeline for the revised payment plan or request a temporary suspension of payments if necessary. 5. Supporting Documents: — Include any supporting documents that validate your financial situation, such as recent bank statements, medical bills, termination letters, or income statements. — Ensure that all attachments are clearly labeled and referenced in the letter. 6. Express Willingness to Cooperate: — Demonstrate your commitment to resolving the debt by reassuring the credit card company of your willingness to cooperate and find a fair solution. — Offer to provide additional information or answer any questions they may have regarding your financial situation. Variations of Nevada Letters to Credit Card Companies Seeking to Lower Payments: 1. Nevada Letter to Credit Card Company Requesting a Reduced Interest Rate: — This type of letter specifically focuses on requesting a reduction in the interest rate charged on the credit card balance, aiming to decrease overall debt over time. 2. Nevada Letter to Credit Card Company Requesting a Settlement: — In this variation, the objective is to negotiate a settlement agreement to pay off a portion of the outstanding balance in a lump sum, resulting in debt forgiveness for the remaining amount.