A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept of an estate which has been conveyed to him. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nevada Disclaimer by Beneficiary of all Rights in Trust

Description

How to fill out Disclaimer By Beneficiary Of All Rights In Trust?

It is feasible to spend multiple hours online attempting to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal templates that are evaluated by professionals.

You can download or print the Nevada Disclaimer by Beneficiary of all Rights in Trust from their services.

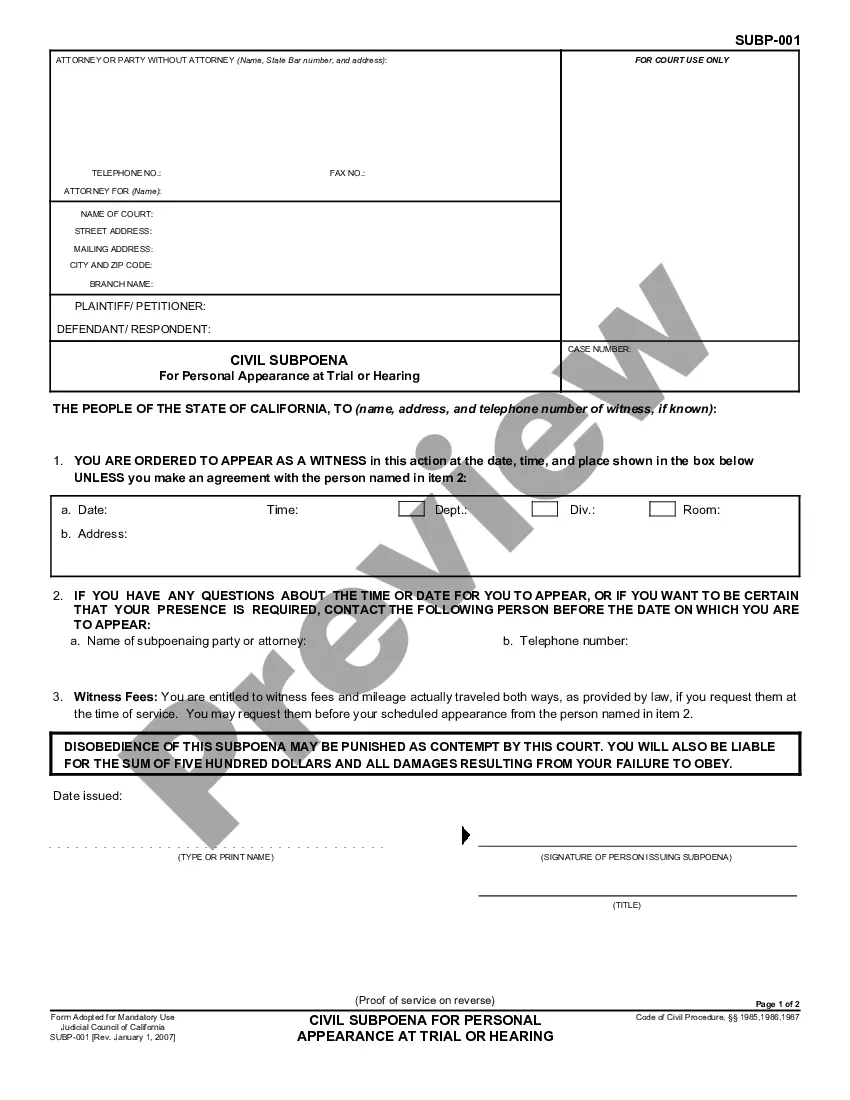

If available, utilize the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Acquire button.

- Afterward, you can fill out, modify, print, or sign the Nevada Disclaimer by Beneficiary of all Rights in Trust.

- Every legal document template you purchase is yours for an extended period.

- To obtain an additional copy of a purchased document, visit the My documents section and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, confirm that you have selected the correct document template for the state/city of your choice.

- Check the document description to ensure you have selected the appropriate template.

Form popularity

FAQ

Disclaimer trusts can introduce certain complexities, especially regarding tax implications and the distribution of assets. If a beneficiary disclaims their interest, it's crucial to ensure that the disclaiming process is executed correctly to avoid unintended consequences. Furthermore, a Nevada Disclaimer by Beneficiary of all Rights in Trust may not align with every individual's estate planning goals. Engaging with legal experts can help clarify the potential problems and ensure the use of disclaimer trusts aligns with your objectives.

A beneficiary can indeed disclaim their interests in a trust. By doing so, they effectively withdraw their right to receive any benefits from that trust. Utilizing a Nevada Disclaimer by Beneficiary of all Rights in Trust clarifies this intent and helps ensure that disclaiming parties are treated according to their wishes under the terms of the trust. It's advisable to seek guidance from a qualified attorney to navigate this process smoothly.

Yes, you can refuse to be a beneficiary of a trust. Renunciation often involves filing a Nevada Disclaimer by Beneficiary of all Rights in Trust, which formally communicates your decision to decline the benefits of the trust. This can be beneficial in situations where accepting the inheritance may lead to undesirable tax consequences or debt liabilities. Consulting with a legal professional can help you understand the implications of this decision.

Yes, a beneficiary can choose to renounce their interest in a trust. This process allows the beneficiary to formally refuse any rights or claims to the trust property. By executing a Nevada Disclaimer by Beneficiary of all Rights in Trust, they can effectively refuse inheritance and prevent any future tax liabilities. It's important to consult with a legal expert to ensure the disclaimer meets all legal requirements.

A Disclaimer by beneficiary of trust is a legal process where a beneficiary declines to accept property or benefits they would otherwise inherit. This decision removes the property from the beneficiary's estate, thus avoiding taxes or unwanted responsibilities. A Nevada Disclaimer by Beneficiary of all Rights in Trust is a well-defined mechanism for executing this intent, ensuring compliance with state laws.

A Disclaimer trust can provide benefits, but it also has some disadvantages to consider. For example, the beneficiary loses any claim to the disclaimed property, which could lead to potential disputes within the family. Additionally, if not structured correctly, it might not achieve the desired financial or estate planning goals. Understanding the implications of a Nevada Disclaimer by Beneficiary of all Rights in Trust is crucial in decision-making.

In Nevada, the right of survivorship means that when one joint owner passes away, their share of the property automatically transfers to the surviving owner(s). This arrangement helps streamline asset transfer without requiring probate. If you are considering how this may relate to a Nevada Disclaimer by Beneficiary of all Rights in Trust, it is essential to understand that disclaiming a property can affect these rights.

A beneficiary might choose to disclaim property for various reasons. For instance, they may wish to avoid potential tax liabilities associated with the inheritance. Additionally, disallowing acceptance can help manage personal finances or adhere to specific family arrangements. Ultimately, a Nevada Disclaimer by Beneficiary of all Rights in Trust can legally transfer the property to another party.

To write a beneficiary disclaimer letter, start with your personal information and the date. Clearly state your intention to disclaim your rights to the inheritance, refer to the relevant trust or estate, and sign the letter. It's vital for the letter to meet Nevada's legal standards for disclaimers. For helpful templates, check out UsLegalForms, which offers resources tailored to your needs.

Yes, a trust beneficiary can disclaim their interest in a trust in Nevada. This disclaimer must comply with specific legal requirements and deadlines set forth by state law. By disavowing your rights to the trust, you can avoid potential tax liabilities or disputes with heirs. Always seek legal guidance to ensure that your disclaimer is executed properly.