Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nevada Declaration of Gift Over Several Year Period

Description

How to fill out Declaration Of Gift Over Several Year Period?

US Legal Forms - one of the largest compilations of official templates in the United States - provides an extensive selection of official document formats that you can download or print.

By utilizing the website, you can access thousands of forms for commercial and personal uses, organized by categories, states, or keywords.

You can access the latest editions of forms like the Nevada Declaration of Gift Over Several Year Period in moments.

If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that suits you.

Once you are satisfied with the form, confirm your choice by clicking on the Buy now button. Then, select the pricing plan you prefer and provide your details to register for an account.

- If you already have a subscription, Log In and download the Nevada Declaration of Gift Over Several Year Period from your US Legal Forms account.

- The Download button will appear on every form you view.

- You gain access to all previously downloaded forms in the My documents section of your account.

- If you're looking to use US Legal Forms for the first time, here are some simple steps to get you started.

- Make sure to select the correct form for your location/region.

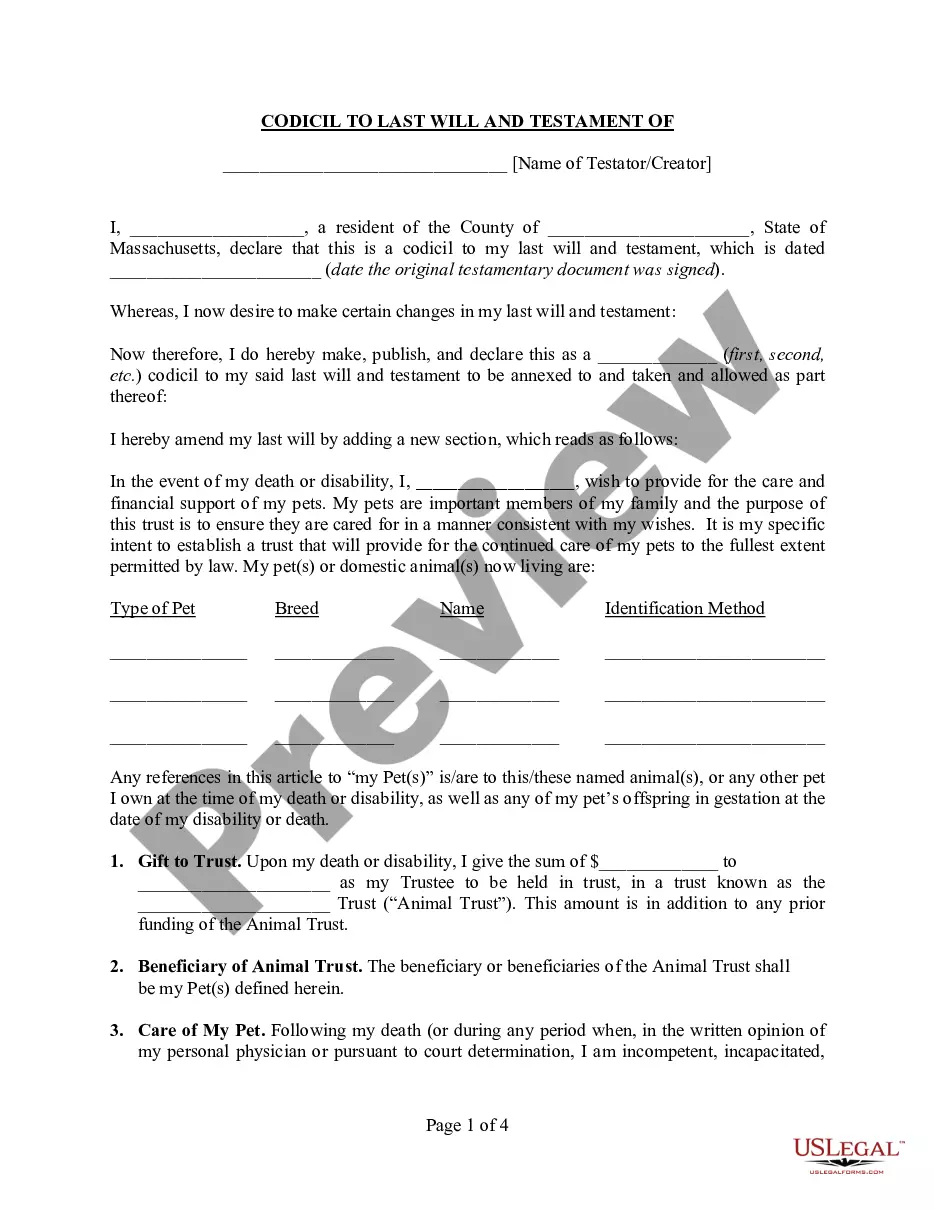

- Click the Review button to examine the form's content.

Form popularity

FAQ

You cannot file Form 709 directly through TurboTax, which may include matters related to the Nevada Declaration of Gift Over Several Year Period. TurboTax does not support this form, so you must prepare it through other means. After preparing the form, it should be printed and mailed. For assistance with the filing process, you can explore options on the US Legal Forms platform.

As of now, Form 709 cannot be filed electronically, including those related to the Nevada Declaration of Gift Over Several Year Period. You will need to print and mail the form. It's beneficial to ensure all parts are completed correctly to avoid delays in processing. For accurate filing guidelines, consider using resources from US Legal Forms to assist you.

Yes, you can request an extension for your gift tax return, including the one related to the Nevada Declaration of Gift Over Several Year Period. This extension can provide you additional time to gather necessary information or complete your filings. Just remember, an extension for filing does not extend your payment deadline. Tools from US Legal Forms can aid you in filing your extension accurately.

Form 709 does not need to be filed with your Form 1040. Instead, it should be submitted separately when dealing with the Nevada Declaration of Gift Over Several Year Period. However, if you have taxable gifts that impact your income, it's wise to report any relevant information on your 1040. For guidance on this, platforms like US Legal Forms can provide useful insights.

Currently, Form 709, often used for the Nevada Declaration of Gift Over Several Year Period, cannot be signed electronically. Signatures must adhere to specific regulations, which usually require a handwritten signature. Thus, it's essential to print the form and sign it appropriately before submission. To simplify this process, consider using platforms like US Legal Forms.

Yes, you can file a gift tax return late, including the Nevada Declaration of Gift Over Several Year Period. However, be aware that filing late can result in penalties and interest on unpaid taxes. It's advisable to file as soon as possible to minimize these consequences. Utilizing resources like the US Legal Forms can help you navigate late filings efficiently.

Certain forms related to the Nevada Declaration of Gift Over Several Year Period cannot be filed electronically. Typically, complex forms or those requiring additional signatures may need to be submitted via mail. It's important to check the specific guidelines for filing as this can vary by year. For detailed instructions, you can visit the US Legal Forms platform.

Several factors can trigger a gift tax audit, including large gifts that exceed annual exclusions and discrepancies in reported values. If you utilize a Nevada Declaration of Gift Over Several Year Period and have substantial gifts, be prepared for potential scrutiny from the IRS. Accurate record-keeping and compliance are critical in preventing audits and ensuring a smooth gifting process.

The statute of limitations for gift taxes typically spans three years from the date you file the tax return. However, if you do not file a return or if the IRS uncovers substantial underreporting, this period may extend indefinitely. Understanding this timeline is vital when considering the Nevada Declaration of Gift Over Several Year Period, as it impacts your ability to amend past filings and correct potential errors.

Failing to report gift tax can result in penalties and interest on unpaid taxes. When dealing with a Nevada Declaration of Gift Over Several Year Period, it's essential to report any gifts exceeding the annual exclusion to avoid complications with the IRS. Ignoring this responsibility may lead to audits and increased liabilities in the future, which can be frustrating and costly.