Nevada Miller Trust Forms for Medicaid

Description

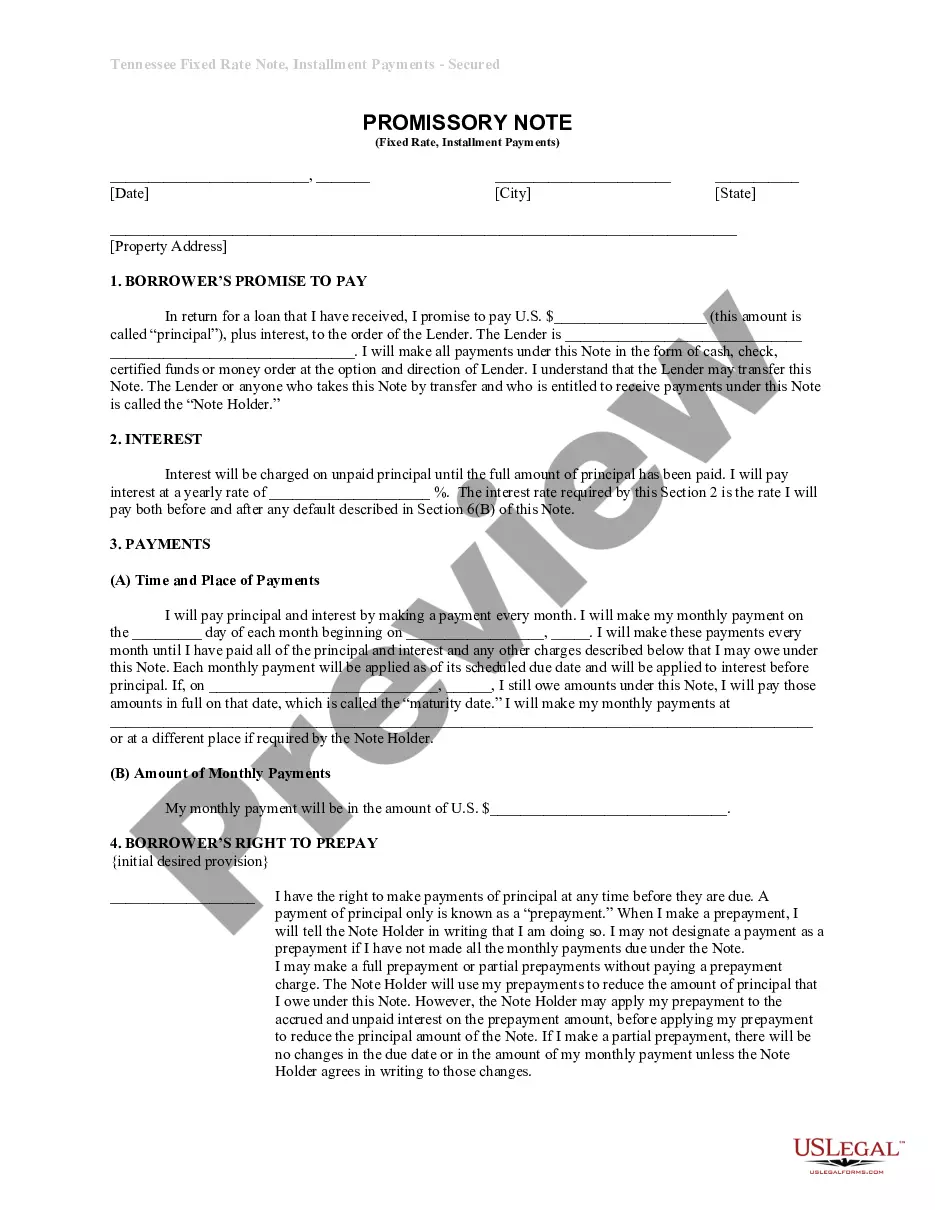

How to fill out Miller Trust Forms For Medicaid?

US Legal Forms - one of the largest collections of legal templates in the USA - offers a vast selection of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You will find the latest versions of forms such as the Nevada Miller Trust Forms for Medicaid within minutes.

If you already possess a subscription, Log In and download the Nevada Miller Trust Forms for Medicaid from the US Legal Forms library. The Download button will be visible on each form you view. You can access all previously downloaded forms from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Nevada Miller Trust Forms for Medicaid. Each template added to your account has no expiration date and is yours indefinitely. Therefore, to download or print another copy, simply go to the My documents section and click on the form you desire. Access the Nevada Miller Trust Forms for Medicaid with US Legal Forms, the largest collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to guide you:

- Ensure that you have selected the correct form for your region/state.

- Click on the Preview button to review the form's details.

- Read the form summary to confirm that you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking on the Buy now button.

- Then, choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Yes, Nevada Medicaid reviews financial records, including bank accounts, to assess eligibility. They evaluate both the account balances and transaction histories to ensure compliance with Medicaid regulations. By using Nevada Miller Trust Forms for Medicaid, you can strategically manage your financial assets. This legal tool helps you meet Medicaid guidelines while preserving your wealth.

Yes, Nevada Medicaid imposes asset limits to determine eligibility. As of 2023, individuals must meet specific asset criteria to qualify, which includes both countable and non-countable assets. However, by utilizing Nevada Miller Trust Forms for Medicaid, you can potentially exempt more of your assets from these limits, facilitating a smoother application process. Staying informed on these regulations is vital for maintaining financial security.

To avoid Medicaid estate recovery in Nevada, planning is essential. Utilizing Nevada Miller Trust Forms for Medicaid can help safeguard your assets and prevent recovery during the estate process. Properly structuring your estate and making timely amendments can ensure your loved ones receive their inheritance without involuntary claims. Partnering with a legal expert can provide personalized strategies tailored to your needs.

In Nevada, certain assets are exempt from Medicaid eligibility calculations. Personal property like your home, vehicle, and specific household goods often remain protected. Additionally, Nevada Miller Trust Forms for Medicaid can help protect excess income, allowing you to qualify for Medicaid without losing important assets. Understanding these exemptions is crucial for effective estate planning.

An income trust serves to manage and protect excess income, providing a structured way to deal with financial resources while qualifying for benefits like Medicaid. With a Nevada Miller Trust Forms for Medicaid, you can strategically place your income in a trust, thereby meeting Medicaid requirements without losing access to essential funds. This arrangement not only supports your current needs but also safeguards your future financial security.

The primary purpose of a Medicaid trust, particularly the Nevada Miller Trust Forms for Medicaid, is to help individuals qualify for Medicaid while preserving their assets. This trust effectively separates certain income from your personal resources, enabling you to meet eligibility requirements. By using this tool, you can ensure your assets remain intact while receiving crucial medical support.

A Medicaid income trust, such as a Nevada Miller Trust Forms for Medicaid, collects income that exceeds the Medicaid eligibility limit. This trust holds your excess income, allowing you to qualify for Medicaid while still having access to necessary funds for care. By structuring your income in this way, you can maintain your financial stability and secure the assistance you need.

Using a Nevada Miller Trust Forms for Medicaid allows you to protect your assets while qualifying for Medicaid. By placing income into this trust, you can meet Medicaid's income limits and maintain your eligibility for benefits. This strategy not only helps you manage your financial resources effectively, but it also ensures you receive the care you need without depleting your savings.

Certain types of trusts may be exempt from Medicaid, including revocable trusts and irrevocable trusts dedicated to specific purposes such as a special needs trust. However, not all trusts automatically qualify for exemption, so it's crucial to understand the details. For accurate information and assistance with the Nevada Miller Trust Forms for Medicaid, reaching out to legal experts can provide clarity on your specific situation.

Yes, you can use a Miller trust to qualify for Medicaid, as it helps manage income that exceeds eligibility limits. By depositing excess income into the trust, you may meet the financial criteria necessary for Medicaid coverage. Utilizing the Nevada Miller Trust Forms for Medicaid ensures that the trust is properly established to support your eligibility needs.