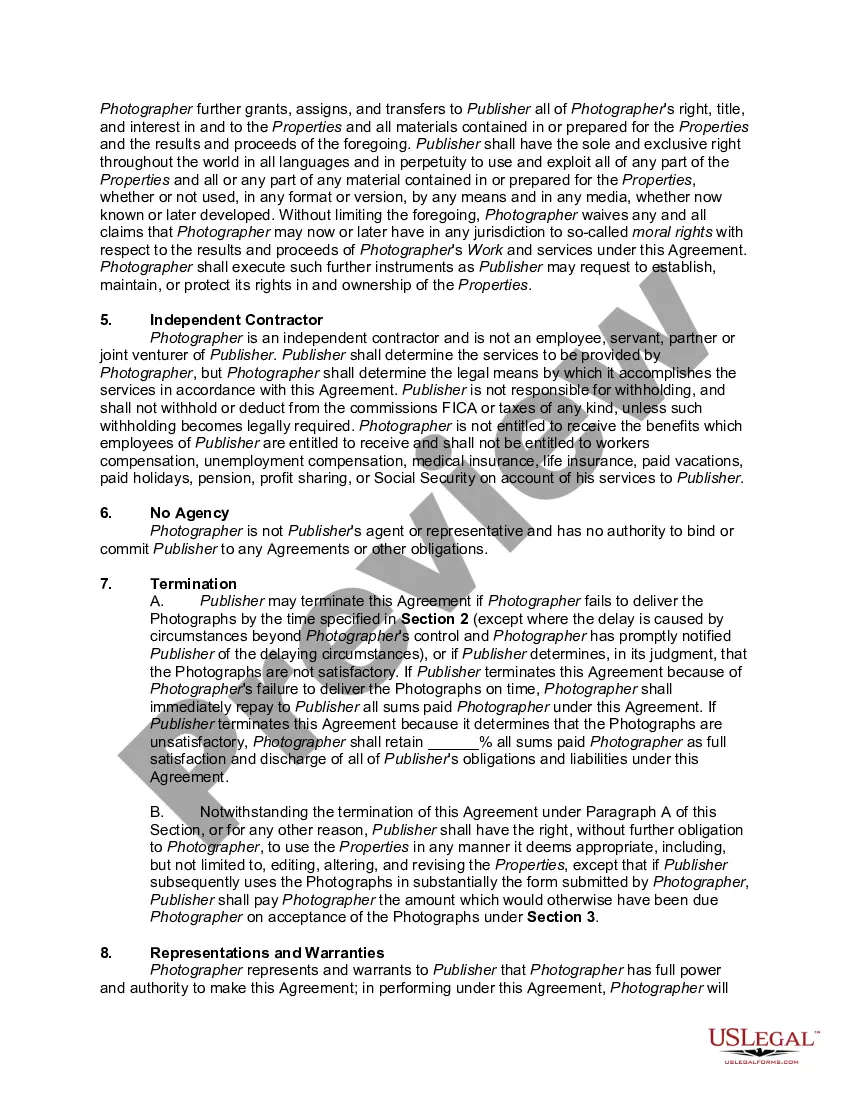

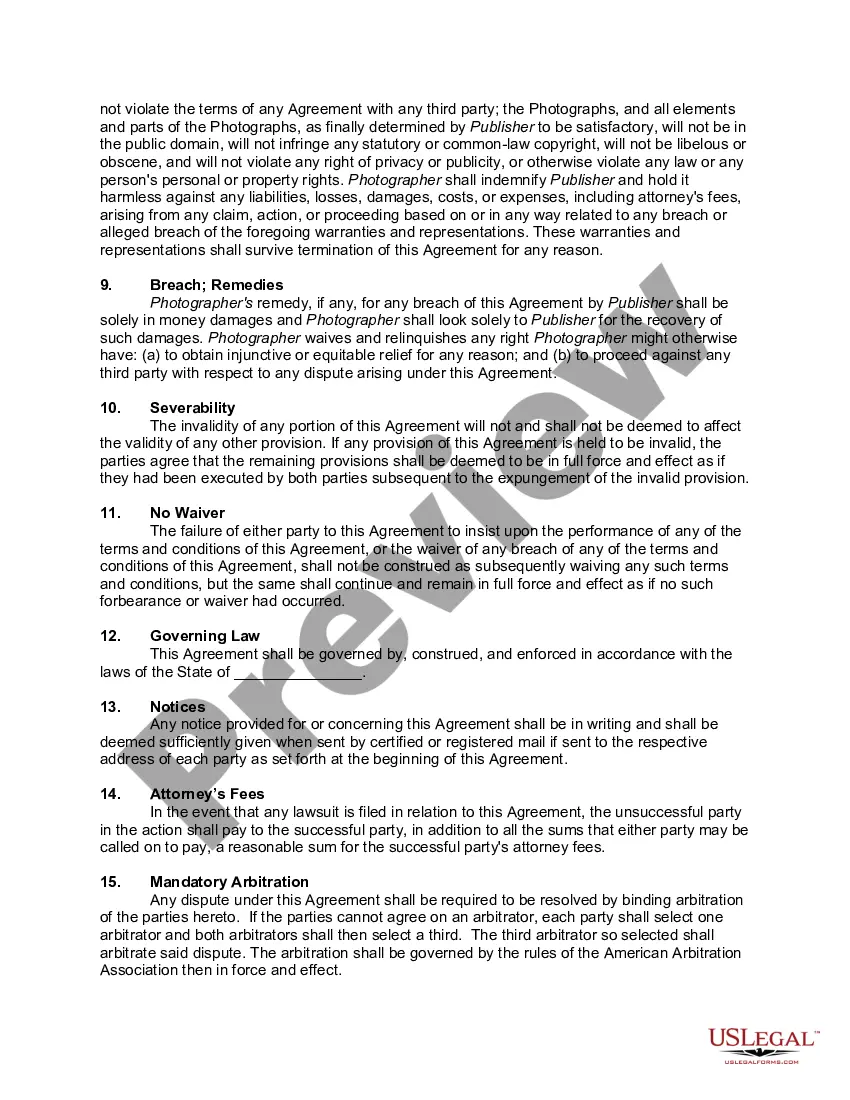

A Nevada Contract with Independent Contractor to Photograph Works of Art for a Book — Self-Employed is a legal agreement established between a photographer, acting as an independent contractor, and an individual or organization seeking photography services for their art book. This type of contract ensures that all parties involved understand their rights, obligations, and the scope of work to be performed. Below, we describe the key aspects that should be covered in this contract, while incorporating relevant keywords throughout: 1. Parties: The contract should clearly identify the contracting parties, including their legal names, addresses, and contact details. Keywords: Nevada, Contract, Independent Contractor, Photograph, Works of Art, Book, Self-Employed. 2. Scope of Work: The contract must outline the specific photography services to be provided by the independent contractor, including the number of artworks to be photographed, the format and resolution required, and the deadline for completion. Keywords: Photography Services, Artworks, Format, Resolution, Deadline. 3. Compensation and Expenses: This section should address the agreed-upon compensation for the contractor's services, whether it is a flat fee or an hourly rate, and when and how the payment will be made. It should also mention any additional expenses, such as travel or equipment costs, and how they will be reimbursed. Keywords: Compensation, Expenses, Flat Fee, Hourly Rate, Payment, Travel, Equipment, Reimbursement. 4. Ownership and Usage Rights: The contract should clarify the ownership of the photographs taken and specify if the contractor retains any copyright or intellectual property rights. It should also highlight how and where the photographs can be used, such as in the art book, promotional materials, or online platforms, while addressing any restrictions or limitations. Keywords: Ownership, Usage Rights, Copyright, Intellectual Property Rights, Art Book, Promotional Materials, Online Platforms, Restrictions. 5. Confidentiality: This clause emphasizes the contractor's responsibility to keep all information related to the project and the client's artworks confidential, to protect the client's interests. Keywords: Confidentiality, Information, Client's Artworks, Protect. 6. Indemnification: This section outlines the agreement of the independent contractor to indemnify and hold harmless the client from any claims, damages, or liabilities arising out of the contractor's negligence or violation of laws during the photography process. Keywords: Indemnification, Hold Harmless, Claims, Damages, Liabilities, Negligence, Violation. 7. Termination: The contract should define the conditions under which either party can terminate the contract, including the notice period required and any penalties or obligations upon termination. Keywords: Termination, Conditions, Notice Period, Penalties. Variations of this type of contract may exist depending on the specific needs and requirements of the project. For example, Nevada Contract with Independent Contractor to Photograph Works of Art for Book — Self-Employed could have specialized versions for photography of sculptures, paintings, or mixed media art. These variations would focus on the unique aspects and considerations relevant to each type of artwork. Keywords: Sculptures, Paintings, Mixed Media Art, Specialized Versions, Considerations.

Nevada Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed

Description

How to fill out Nevada Contract With Independent Contractor To Photograph Works Of Art For Book - Self-Employed?

If you want to total, down load, or produce legitimate record web templates, use US Legal Forms, the most important assortment of legitimate forms, that can be found online. Use the site`s simple and easy practical search to obtain the files you require. Different web templates for enterprise and personal purposes are sorted by categories and claims, or key phrases. Use US Legal Forms to obtain the Nevada Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed within a number of click throughs.

If you are previously a US Legal Forms consumer, log in for your accounts and then click the Obtain option to find the Nevada Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed. Also you can access forms you formerly saved in the My Forms tab of the accounts.

If you are using US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the shape to the correct metropolis/nation.

- Step 2. Use the Review choice to examine the form`s content. Do not forget about to read the information.

- Step 3. If you are unsatisfied with all the develop, use the Research industry at the top of the screen to locate other models from the legitimate develop web template.

- Step 4. Once you have found the shape you require, go through the Acquire now option. Choose the rates prepare you prefer and add your credentials to sign up for the accounts.

- Step 5. Procedure the purchase. You should use your Мisa or Ьastercard or PayPal accounts to perform the purchase.

- Step 6. Select the file format from the legitimate develop and down load it on your own product.

- Step 7. Total, edit and produce or indicator the Nevada Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed.

Each legitimate record web template you purchase is your own eternally. You may have acces to each and every develop you saved in your acccount. Select the My Forms segment and choose a develop to produce or down load again.

Remain competitive and down load, and produce the Nevada Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed with US Legal Forms. There are thousands of skilled and express-particular forms you may use for your enterprise or personal requirements.

Form popularity

FAQ

Independent contractor and self-employed are closely related but not identical. An independent contractor operates on a contract basis for specific clients, while self-employed individuals may oversee their own business. Understanding this difference is vital when working on a Nevada Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed to ensure you frame your work relationships correctly.

The 2 year contractor rule refers to a legal guideline where a contractor's status may be reclassified based on the duration of work relationships. If an independent contractor works continuously for the same client for two years or more, they may be entitled to benefits typically reserved for employees. This is relevant when drafting a Nevada Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed, as it can influence contract terms.

The IRS defines a self-employed person as someone who works for themselves rather than for an employer. This includes independent contractors, freelancers, and sole proprietors. When engaging in a Nevada Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed, it is essential to understand this definition as it affects your tax structure and deductions.

Yes, there is a subtle difference between being self-employed and an independent contractor. Self-employed individuals typically run their own business, while independent contractors provide services for a client under a contract. If you want to create a Nevada Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed, it's important to recognize this distinction, as it may impact your tax obligations and benefits.

The new independent contractor rules emphasize the importance of the relationship between the contractor and the employer. Specifically, they focus on the degree of control the employer has over the worker's tasks and how the work is done. For those creating a Nevada Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed, understanding these rules is crucial to ensure compliance and protect your rights.

In Nevada, a 1099 contractor, also known as an independent contractor, may require a business license depending on the services they provide. Specifically, if you are entering into a Nevada Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed, establishing a business license can enhance your credibility and compliance with local regulations. Additionally, having a license can help protect you legally and simplify tax processes. It is advisable to check county or city requirements to ensure you are operating within the law.

Yes, a photographer often operates as an independent contractor, especially in commercial settings. Additionally, engaging in a Nevada Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed can help streamline operations and define your rights and responsibilities. By formalizing your independent status, you position yourself for success in your photography career.

In Nevada, you can conduct work valued at a certain dollar limit without a contractor license. Beyond that limit, you must obtain the necessary licensing. For photographers, a Nevada Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed can serve as a great tool to manage jobs and maintain compliance with the state’s regulations.

Yes, a handyman in Nevada typically requires a business license if they operate as an independent contractor. This license helps maintain professional standards and protects clients. If your work involves photography projects, like creating a Nevada Contract with Independent Contractor to Photograph Works of Art for Book, having a proper business license ensures you are equipped to manage your artistry and legal responsibilities.

Hiring an unlicensed contractor in Nevada is not necessarily illegal, but it can lead to complications. If issues arise, such as unfinished work or poor quality, your options may be limited. To protect yourself, it’s wise to ensure that any independent contractor, including photographers, holds the necessary credentials for their work, such as a Nevada Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed.

More info

Independent Contractors can be found in many industries. Many independent contractors are working in businesses which are not fully legal and in other industries. In some industries a person does not need the legal status to contract out for services. This is why many people refer to this type of employment in business as self-employment. Legal status is necessary for an independent contractor to be a legally valid contracting or working relationship. Independent Contractors cannot contract out of an industry where they have legal status such as the employment of a medical doctor or a lawyer. However, it is possible for an independent contractor to contract out of a business where there is no legal status. In fact, there are cases of a person contracting out jobs that do not require a business license. However, a business license is required for a person to perform many things which could have been performed by an independent contractor without legal status.