A Nevada Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement is a legal document that outlines the terms and conditions under which an investor purchases stocks from two sellers in Nevada, and transfer of ownership/title is executed simultaneously with the execution of the agreement. This agreement serves as a safeguard for all parties involved, ensuring transparency and protection of their rights and interests. In this type of agreement, the two sellers are individuals or entities who own shares in a Nevada-based company, while the investor is an individual or entity interested in acquiring these shares for investment purposes. The agreement sets out the terms of the stock purchase, including the number of shares to be sold, the purchase price, and any conditions or restrictions on the transfer of ownership. It is important to note that there may be different variations or types of Nevada Stock Purchase Agreements between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement, depending on specific circumstances or preferences. These variations may include: 1. Cash Purchase Agreement: This type of agreement involves the investor purchasing the stocks for a predetermined cash amount. The transfer of ownership/title occurs immediately upon execution of the agreement, and the investor pays the agreed-upon price in full. 2. Installment Purchase Agreement: In certain cases, the parties may agree to a deferred payment method, where the investor pays the purchase price in installments over a specified period. The transfer of title occurs concurrently with the execution of the agreement, but the payment is spread out according to an agreed-upon schedule. 3. Escrow Purchase Agreement: Sometimes, the parties may choose to utilize an escrow service to facilitate the stock purchase and ensure a smooth transfer of title. In this scenario, the purchase price is held by a neutral third-party escrow agent, who releases the funds to the sellers upon successful completion of the transfer of ownership. 4. Stock Option Agreement: This type of agreement grants the investor the option to purchase the stocks at a pre-determined price within a specific timeframe. The transfer of title occurs concurrently with the execution of the agreement only if the investor exercises their option to buy the shares. Regardless of the specific type of Nevada Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement, it is crucial for all parties involved to consult with legal professionals to ensure compliance with applicable laws and to protect their respective interests.

Nevada Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement

Description

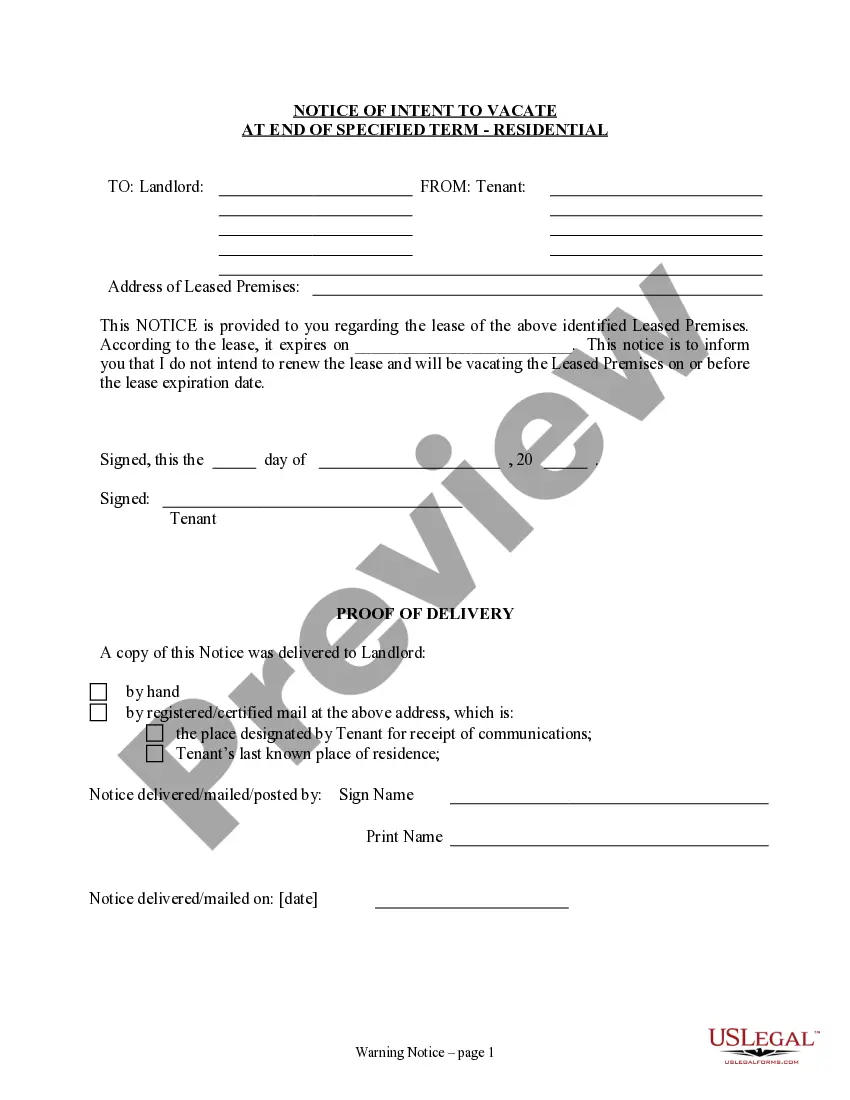

How to fill out Stock Purchase Agreement Between Two Sellers And One Investor With Transfer Of Title Concurrent With Execution Of Agreement?

If you want to complete, acquire, or print authentic document formats, utilize US Legal Forms, the largest repository of legal templates, available online.

Employ the site's straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have located the form you need, click the Buy Now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to conclude the transaction.

- Utilize US Legal Forms to obtain the Nevada Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to acquire the Nevada Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement.

- You can also access documents you previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the content of the form. Make sure to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

Shareholder's agreement is primarily entered to rectify the disputes that occurred between the company and the Shareholder. Meanwhile, the Share Purchase agreement is a document that legalizes the process of transaction of share held between the buyer and the seller.

Conditions precedent are all actions that are required to be carried out by both the parties before the actual transaction of sale of shares occurs. For the seller, these conditions culminate out of the due diligence carried out by the buyer.

In a share purchase, the purchaser buys the shares of the company that operates the business and that owns the assets of the business. Therefore, the purchaser would not own the business or the business assets directly but rather, through the company.

As share purchase agreements just lay down a lawful agreement between the parties about the transfer of shares, Shareholders agreement lays down the rights and other obligations of the parties. It defines the actual relationship of the parties in terms of rights generated by purchasing shares of the company.

Shareholder's agreement is primarily entered to rectify the disputes that occurred between the company and the Shareholder. Meanwhile, the Share Purchase agreement is a document that legalizes the process of transaction of share held between the buyer and the seller.

In the contract of sale, like we saw in the elements of a contract, an offer has to be made and then accepted. The offer is made by a seller and then accepted by the buyer. The contract of sale may be absolute or conditional.

A company executes a Share subscription agreement (SSA) in case of a fresh issue of shares. A shareholders' agreement (SHA) is a contract that contains the rights and obligations of the shareholders in a company.

A Sale and Purchase Agreement (SPA) is a legally binding contract outlining the agreed upon conditions of the buyer and seller of a property (e.g., a corporation). It is the main legal document in any sale process.

Shareholder's agreement is primarily entered to rectify the disputes that occurred between the company and the Shareholder. Meanwhile, the Share Purchase agreement is a document that legalizes the process of transaction of share held between the buyer and the seller.

A Share Purchase Agreement is a sales agreement used to transfer and assign ownership (shares of stock) in a corporation. The Seller is the current Shareholder of the Shares for sale.

More info

This agreement establishes the terms of two separate funds for management of and investment in Vila's assets, which together will form the Company Fund. In addition, this agreement provides that the Company will be organized into two separate corporations that have sole voting power with respect to Vila's assets. Each of the companies will have its own set of assets, corporate structure, employees and offices. The Company is a Delaware corporation, VILA is a Delaware limited liability company, VILA's controlling shareholder is The Company and VILA are related to each other by common ownership. This document is a “standard” set of documents, executed pursuant to an Order of the Delaware Court of Chancery. Standard Investment Contract (Investment) This standard, agreement will be used to govern, monitor and control the management of VILA entities by VILA and the Company, as appropriate.