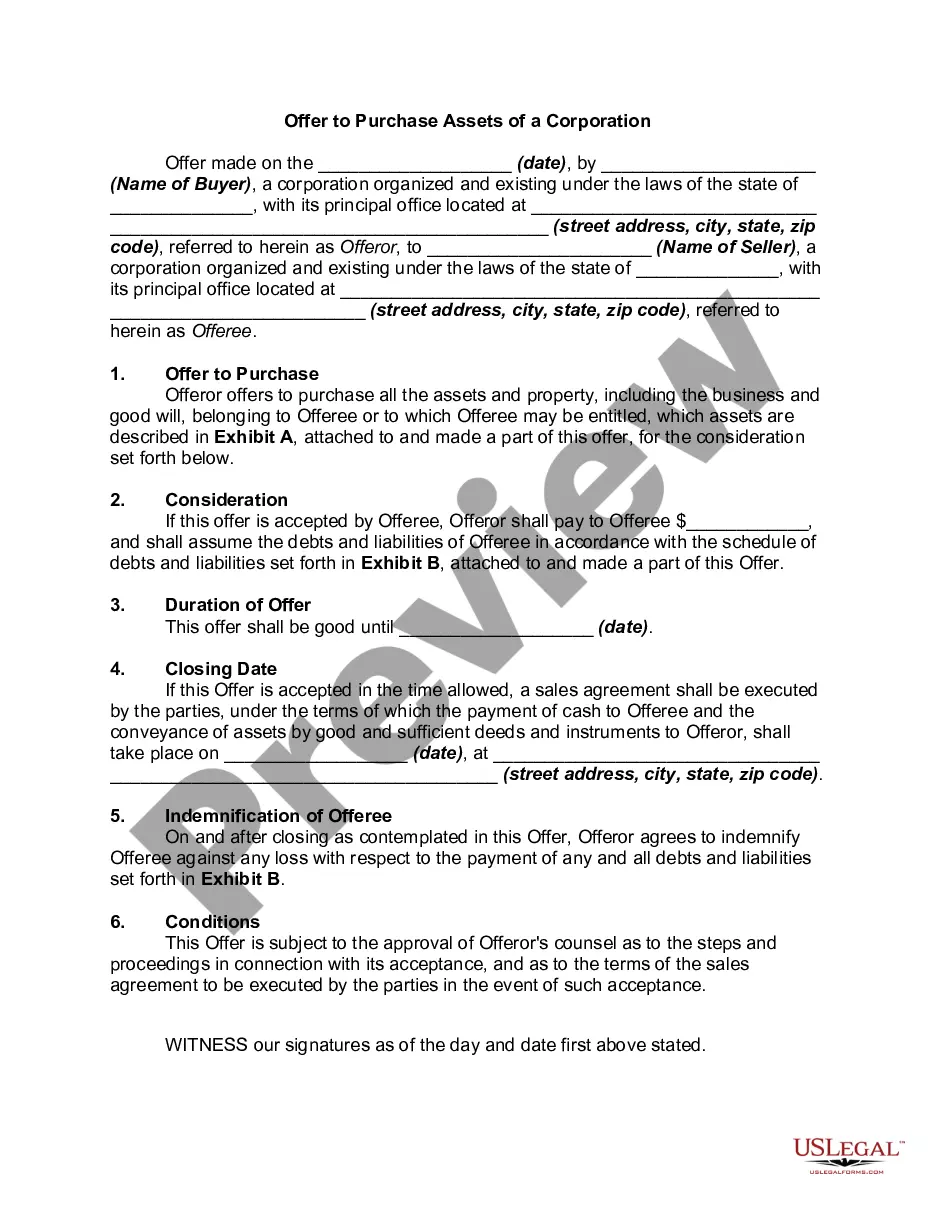

Nevada Offer to Purchase Assets of a Corporation

Description

Pursuant the Model Business Corporation Act, a sale of all of the assets of a corporation requires approval of the corporation's shareholders if the disposition would leave the corporation without a significant continuing business activity.

How to fill out Offer To Purchase Assets Of A Corporation?

It is possible to commit several hours on the web trying to find the lawful document design which fits the state and federal needs you need. US Legal Forms provides a huge number of lawful kinds which can be analyzed by specialists. You can easily acquire or printing the Nevada Offer to Purchase Assets of a Corporation from my services.

If you already have a US Legal Forms accounts, you are able to log in and click on the Acquire option. Next, you are able to comprehensive, edit, printing, or indication the Nevada Offer to Purchase Assets of a Corporation. Every lawful document design you get is your own property permanently. To obtain another copy of any acquired kind, visit the My Forms tab and click on the corresponding option.

If you work with the US Legal Forms web site the very first time, stick to the basic guidelines below:

- First, ensure that you have selected the right document design for the area/metropolis of your choosing. Browse the kind outline to make sure you have chosen the correct kind. If offered, utilize the Preview option to check through the document design at the same time.

- If you want to get another edition of your kind, utilize the Look for field to obtain the design that meets your needs and needs.

- When you have discovered the design you desire, click Purchase now to continue.

- Find the pricing plan you desire, type in your credentials, and sign up for an account on US Legal Forms.

- Total the financial transaction. You can use your credit card or PayPal accounts to cover the lawful kind.

- Find the file format of your document and acquire it to the product.

- Make modifications to the document if needed. It is possible to comprehensive, edit and indication and printing Nevada Offer to Purchase Assets of a Corporation.

Acquire and printing a huge number of document layouts utilizing the US Legal Forms site, that offers the biggest selection of lawful kinds. Use professional and status-distinct layouts to handle your business or specific needs.

Form popularity

FAQ

Nevada is another state that's friendly for corporations. There's no state or corporate income tax, and unlike Delaware, Nevada doesn't charge a franchise tax for corporations or LLCs. Through the state's online portal, it processes most transactions on the same day for no extra fee.

Nevada requires corporations to file an Initial List of Officers/Directors and Business License at the time of filing its Articles of Incorporation. The filing fee is $150 for the Initial List and $500 for the business license registration.

To start a corporation in Nevada, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Secretary of State. You can file this document online or by mail.

Delaware companies have a better reputation in the business community, as judged by the United States Chamber of Commerce. Neither Delaware nor Nevada requires a bank account to be opened or meetings to be held in state.

Initial Nevada Corporation Filing Fee This filing fee includes the filing fee of $75 as well as a fee of $150 for your initial annual list of officers and a fee of $500 for your state business license. All of these should be completed at the initial time of filing.

Nevada does not charge franchise tax, capital stock tax, stock transfer tax, estate taxes, corporate income taxes, nor does it tax corporate shares. Because there is no state income tax in Nevada, your corporation would only be subject to Federal taxation.