Nevada Buy-Sell Agreement between Two Shareholders of Closely Held Corporation

Description

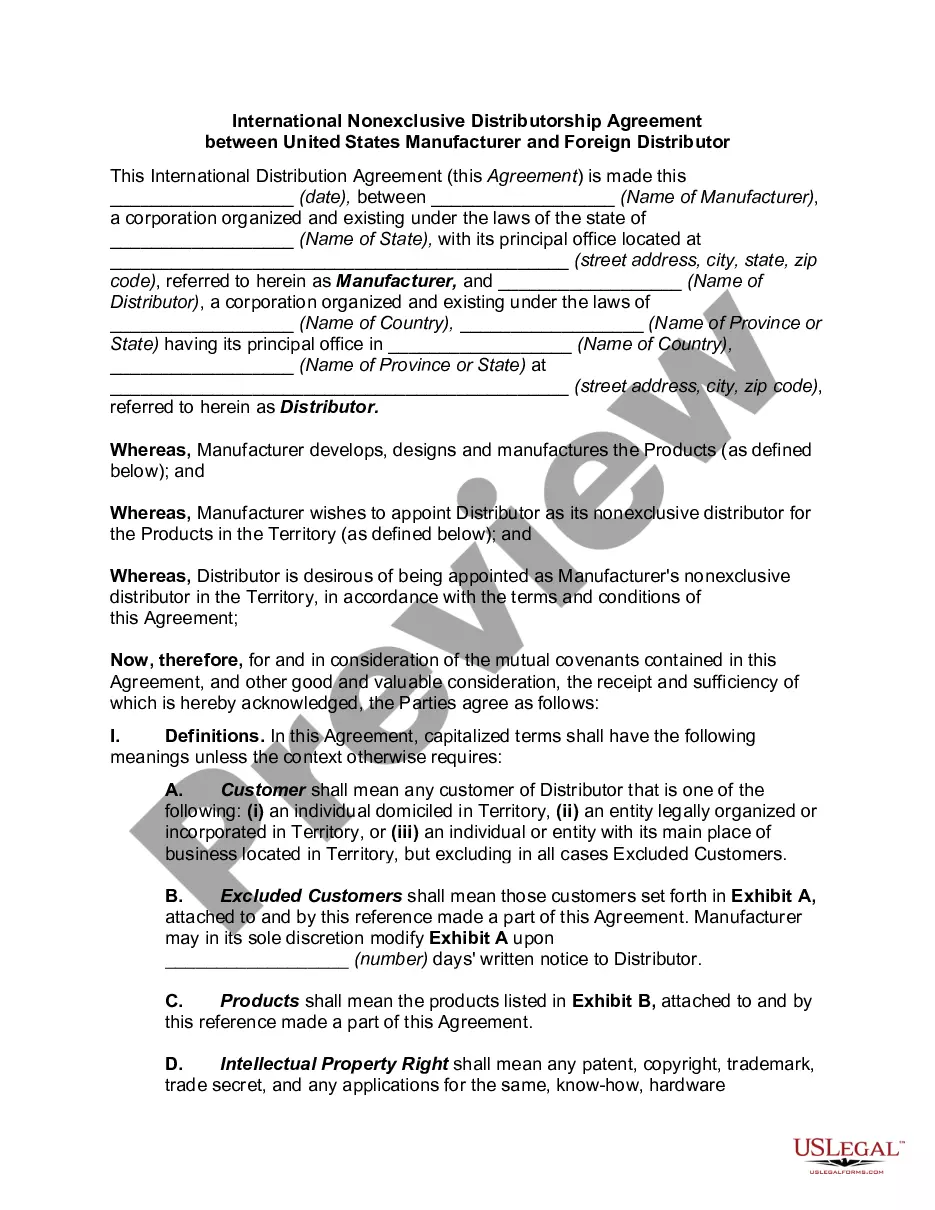

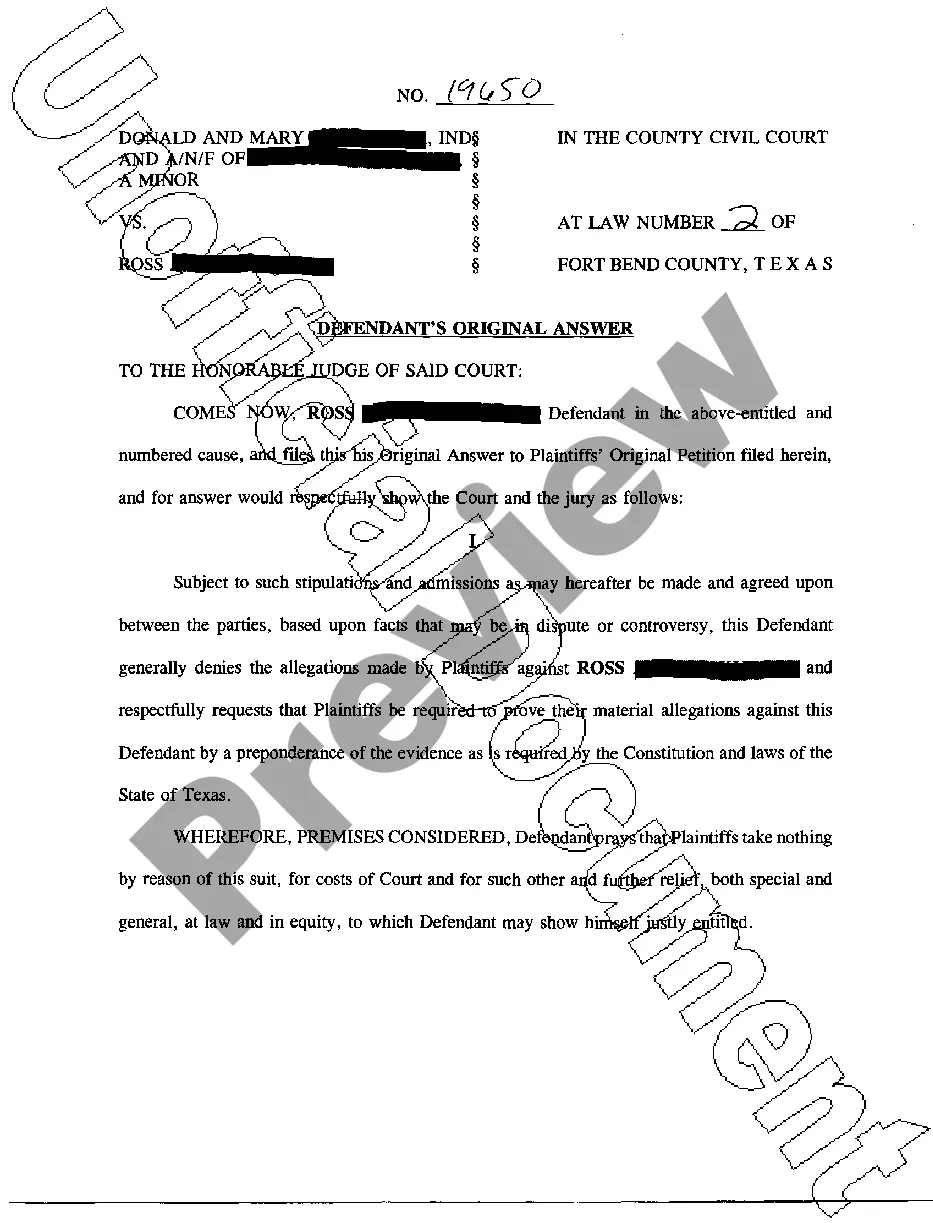

A buy-sell agreement is an agreement between the owners (shareholders) of a firm, defining their mutual obligations, privileges, protections, and rights.

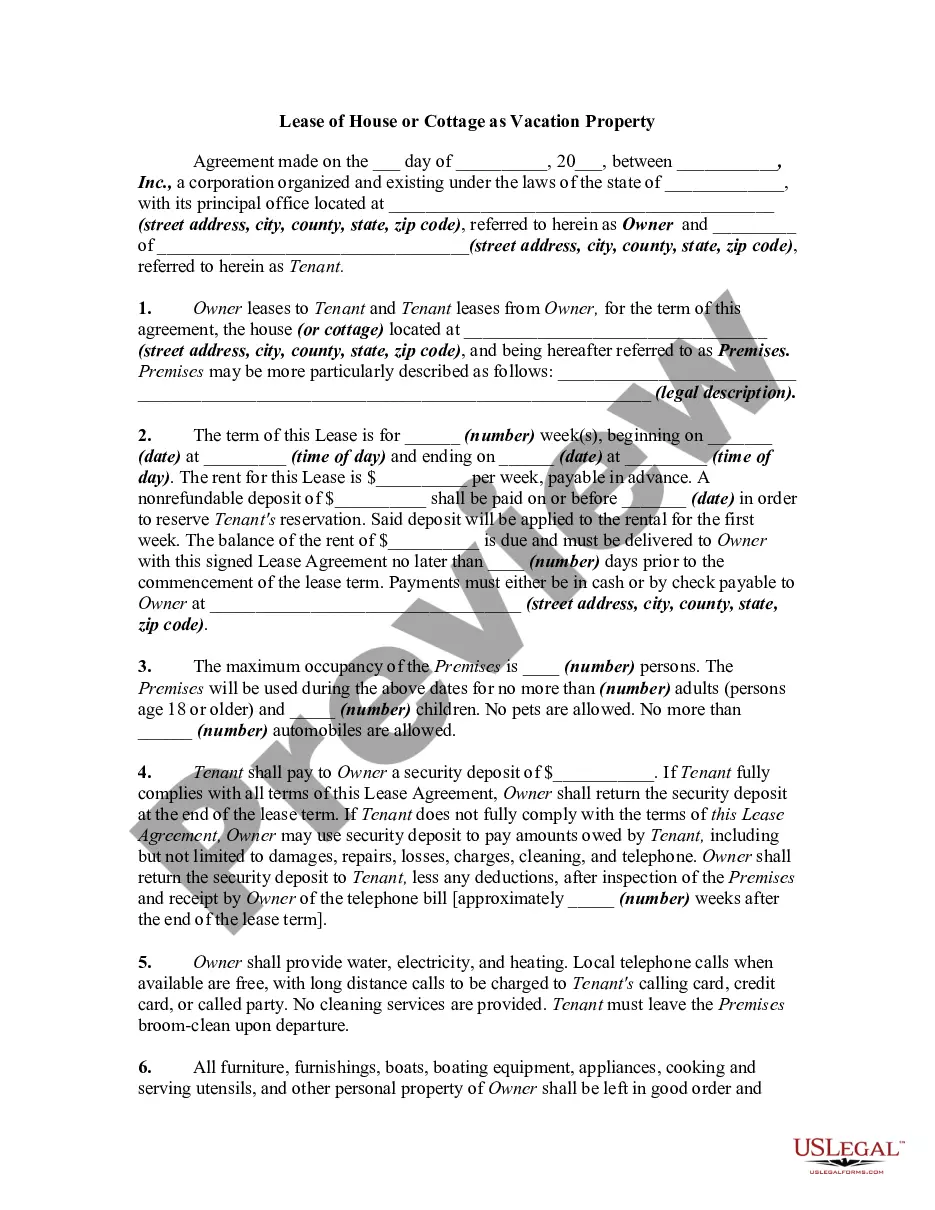

How to fill out Buy-Sell Agreement Between Two Shareholders Of Closely Held Corporation?

Selecting the appropriate legal document template can be a challenging task.

Clearly, there are numerous templates accessible online, but how can you find the legitimate form you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Nevada Buy-Sell Agreement between Two Shareholders of Closely Held Corporation, which can be used for business and personal purposes.

If the form does not meet your requirements, utilize the Search field to find the correct document. Once you are confident that the form is suitable, click the Buy Now button to acquire the document. Choose the pricing plan you wish and enter the necessary information. Create your account and complete your purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Fill out, modify, print, and sign the acquired Nevada Buy-Sell Agreement between Two Shareholders of Closely Held Corporation. US Legal Forms is the largest collection of legal forms where you can view a variety of document templates. Utilize the service to obtain professionally crafted documents that adhere to state requirements.

- All documents are reviewed by experts and comply with legal requirements at both federal and state levels.

- If you are already registered, Log In to your account and click the Download button to obtain the Nevada Buy-Sell Agreement between Two Shareholders of Closely Held Corporation.

- Use your account to search for the legal documents you have previously purchased.

- Visit the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

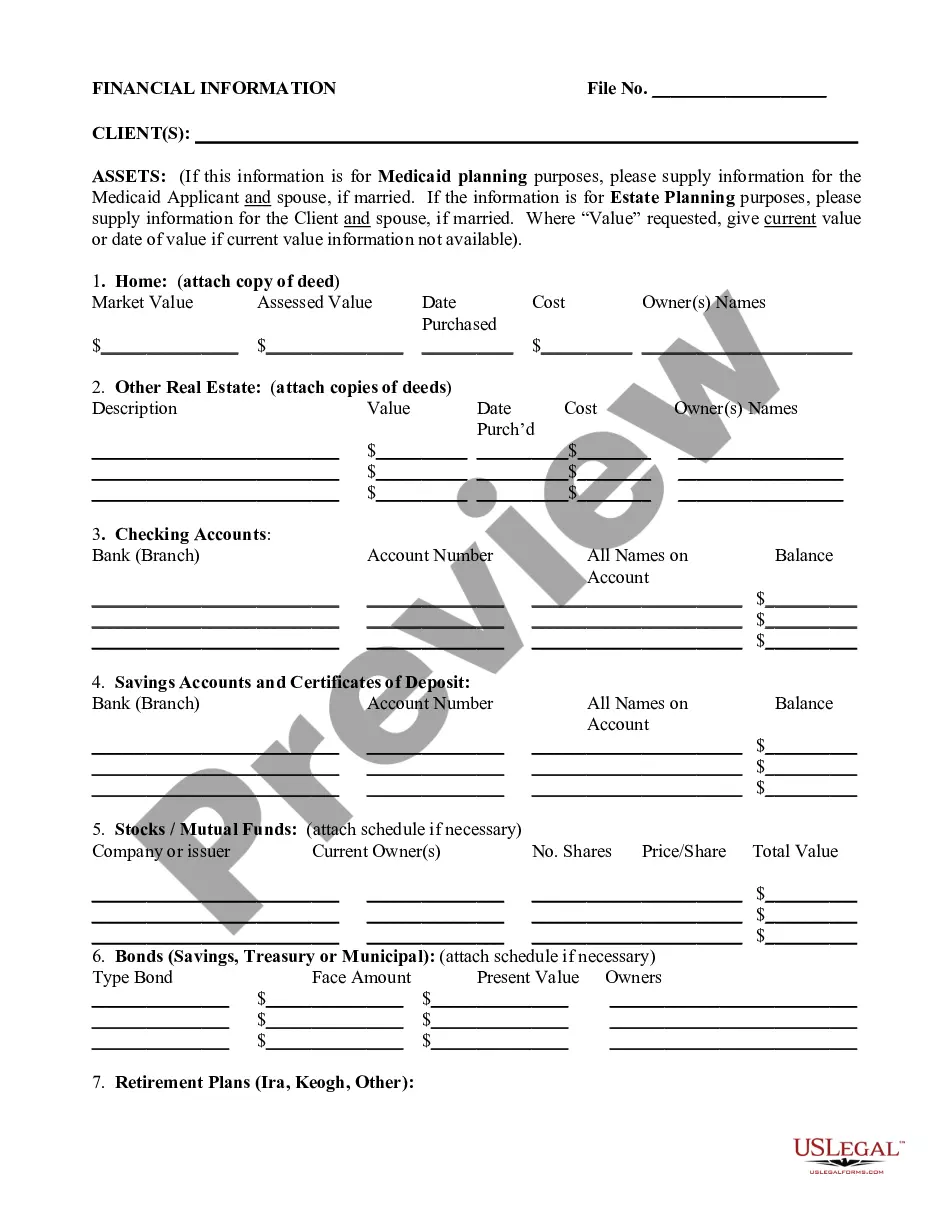

- First, ensure you have selected the correct form for your city/county. You can review the document by using the Preview button and examine the document summary to confirm it is the right one for you.

Form popularity

FAQ

A shareholder agreement is often referred to as a stockholders' agreement. This document serves the same purpose as a Nevada Buy-Sell Agreement between Two Shareholders of Closely Held Corporation, outlining the rights and obligations of the shareholders. Naming conventions may vary, but the intent remains the same: to govern the relationship among shareholders. Understanding these terms can help you navigate corporate structures more effectively.

Filling out a buy-sell agreement involves several key steps. First, you should identify the parties involved and specify the terms of the agreement, including valuation methods for shares. The Nevada Buy-Sell Agreement between Two Shareholders of Closely Held Corporation often includes provisions for triggering events, such as death or retirement. For accuracy, it is important to consult with legal experts or use reliable platforms like uslegalforms.

Yes, you can write your own shareholder agreement, but it is advisable to consult a legal professional to ensure that it meets legal requirements. A well-prepared Nevada Buy-Sell Agreement between Two Shareholders of Closely Held Corporation protects both parties' interests. By utilizing templates or legal services, you ensure clarity and effectiveness in your agreement. Remember, a properly structured agreement can prevent future conflicts.

To sell shares to another shareholder, you should consult your shareholder agreement to understand the existing rules and procedures. Typically, you will need to provide the other shareholder with a written offer detailing the sale terms. Utilizing a Nevada Buy-Sell Agreement between Two Shareholders of Closely Held Corporation can simplify this process, ensuring that all legal requirements are met and protecting the interests of both parties.

In general, the sale of shares is governed by the terms set in the shareholder agreement or the buy-sell agreement. A well-structured Nevada Buy-Sell Agreement between Two Shareholders of Closely Held Corporation often specifies conditions under which shares can be sold. This can include requirements such as unanimous consent or majority approval, depending on how the agreement is written.

A shareholder agreement serves to outline the relationship between shareholders in a corporation. It provides clarity on the rights and obligations of each shareholder. Additionally, it establishes procedures for decision-making and conflict resolution, ensuring smooth operations within the framework of a Nevada Buy-Sell Agreement between Two Shareholders of Closely Held Corporation.

An agreement for the sale of shares to another shareholder, often included in a Nevada Buy-Sell Agreement between Two Shareholders of Closely Held Corporation, outlines terms under which one shareholder can sell their shares to another. This ensures that shareholders can buy shares when someone decides to exit the business. It also helps maintain harmony by allowing remaining shareholders to retain control.

Not every corporation requires a buy-sell agreement. If the ownership structure is simple or if all shareholders are closely aligned and trust each other completely, you might forgo such an agreement. However, it's wise to consult a legal expert to discuss potential risks and ensure you understand the implications of proceeding without a Nevada Buy-Sell Agreement between Two Shareholders of Closely Held Corporation.

While a shareholder agreement and a Nevada Buy-Sell Agreement between Two Shareholders of Closely Held Corporation may seem similar, they serve different purposes. A shareholder agreement outlines the overall governance and operation of the corporation. In contrast, the buy-sell agreement specifically addresses the transfer of shares among shareholders, which is crucial for business continuity.

Backing out of a Nevada Buy-Sell Agreement between Two Shareholders of Closely Held Corporation can be complex. Generally, once both parties have signed the agreement, it becomes legally binding. However, you may review the terms and consult with a legal professional to explore options for termination or renegotiation if circumstances change.