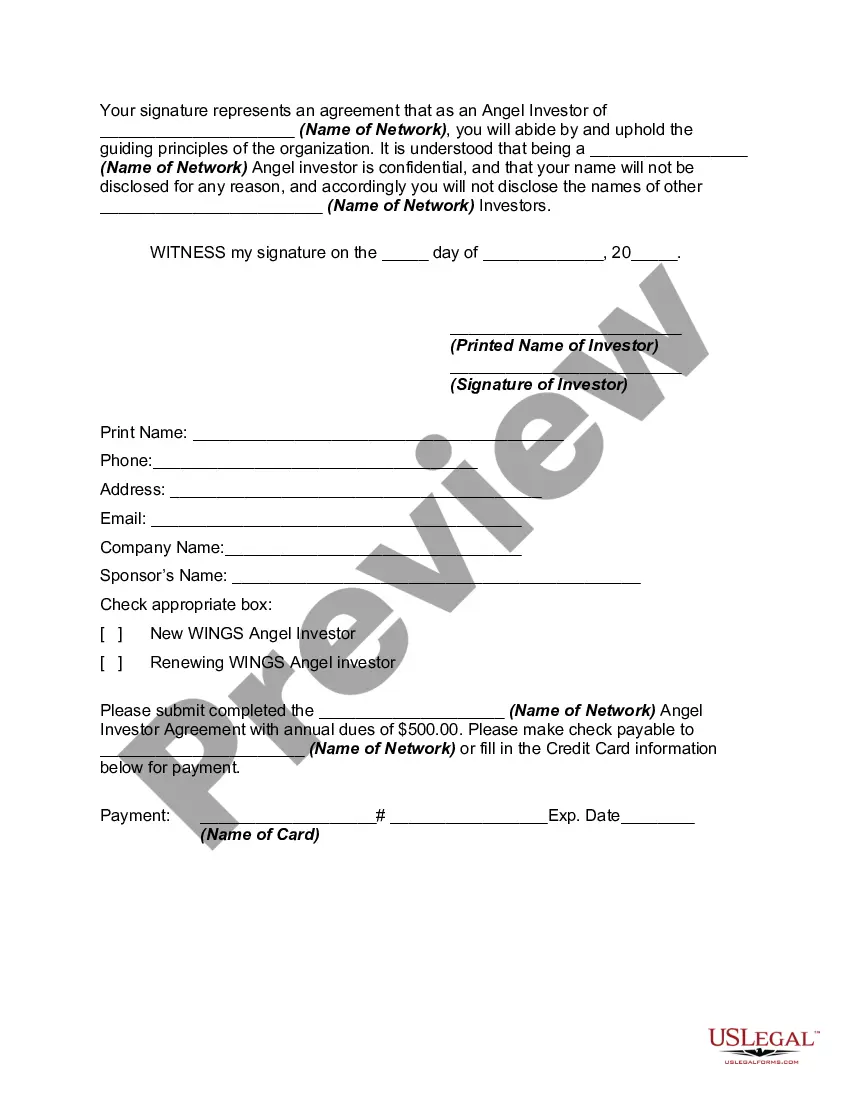

Nevada Angel Investor Agreement, also known as the Nevada Angel Investment Tax Credit Program, refers to a specific type of agreement that aims to encourage angel investment and startup growth in the state of Nevada. This agreement offers tax incentives to angel investors who provide financial backing to qualified Nevada-based startup companies. Under this program, a Nevada Angel Investor Agreement outlines the terms and conditions agreed upon between the angel investor and the startup seeking investment. It typically includes provisions regarding the amount of investment, ownership percentage, investment stage, risk allocation, exit strategies, and any other relevant terms. The goal of the Nevada Angel Investor Agreement is to foster economic development and stimulate innovation by providing financial support to early-stage companies that exhibit strong growth potential. The agreement is designed to bridge the funding gap that startups often face during their critical stages of growth and help them access the necessary capital to commercialize their innovative ideas. In Nevada, there are no specific types of Angel Investor Agreements categorized by the state. However, variations can occur based on the nature of the investment, level of risk, and investor preferences. Some common types of Angel Investor Agreements that can be seen in Nevada include: 1. Convertible Debt Agreement: This type of agreement allows the investor to provide a loan to the startup with an option to convert the debt into equity in the future, typically when the startup raises its next round of funding. 2. Equity Agreement: In this agreement, the angel investor acquires a predetermined percentage of equity ownership in the startup in exchange for their investment. The ownership percentage is usually determined based on the negotiated valuation of the company. 3. SAFE (Simple Agreement for Future Equity): A SAFE is a relatively new type of agreement that has gained popularity among angel investors. It allows investors to provide funds to startups in exchange for the right to convert their investment into equity at a future financing round or a liquidity event. 4. Royalty-based Agreement: This agreement entitles the angel investor to receive a percentage of the startup's future revenues or profits as a return on their investment. It is an alternative to traditional equity-based agreements and may be preferred by investors who seek regular cash flow without direct ownership. In conclusion, the Nevada Angel Investor Agreement is a pivotal framework facilitating angel investments in Nevada-based startups. By encouraging private investment, startups can access essential funding, fueling job creation, innovation, and economic growth in the state. Different types of Angel Investor Agreements, such as convertible debt, equity, SAFE, and royalty-based agreements, provide flexibility to investors and startups to structure their investment terms based on their preferences and risk appetite.

Nevada Angel Investor Agreement

Description

How to fill out Nevada Angel Investor Agreement?

Choosing the best lawful file web template can be quite a have difficulties. Naturally, there are a lot of web templates available on the net, but how do you get the lawful develop you will need? Utilize the US Legal Forms site. The services delivers 1000s of web templates, for example the Nevada Angel Investor Agreement, that can be used for enterprise and private needs. Each of the varieties are inspected by pros and meet state and federal needs.

If you are previously registered, log in to your accounts and click the Down load key to get the Nevada Angel Investor Agreement. Use your accounts to check with the lawful varieties you may have purchased in the past. Check out the My Forms tab of your respective accounts and get one more duplicate in the file you will need.

If you are a brand new consumer of US Legal Forms, here are straightforward directions so that you can adhere to:

- Very first, make certain you have chosen the correct develop for your personal metropolis/state. You may look over the form using the Review key and study the form outline to make sure this is the best for you.

- In case the develop will not meet your expectations, make use of the Seach discipline to discover the correct develop.

- When you are sure that the form is proper, click on the Buy now key to get the develop.

- Select the prices strategy you would like and enter the needed info. Make your accounts and pay money for the order with your PayPal accounts or bank card.

- Choose the data file structure and acquire the lawful file web template to your device.

- Complete, change and produce and indicator the attained Nevada Angel Investor Agreement.

US Legal Forms may be the largest local library of lawful varieties for which you will find a variety of file web templates. Utilize the service to acquire professionally-created papers that adhere to state needs.

Form popularity

FAQ

An angel investor agreement is a contract between an investor and a startup, outlining investment terms and expectations. This agreement typically covers the amount invested, equity stake, and other critical conditions. By using a Nevada Angel Investor Agreement, you can ensure your investment is safeguarded while supporting innovative startups.

As an aspiring angel investor, the income requirement often mandates at least $200,000 annually, or $300,000 with a spouse. Meeting these benchmarks helps protect both you and the companies you invest in. Utilizing a Nevada Angel Investor Agreement can clarify the terms of your investment, ensuring all parties are aligned.

To qualify as an angel investor, you usually need a net worth of at least $1 million or an annual income of $200,000 individually, or $300,000 with a spouse. This financial benchmark helps ensure you can afford the risks associated with startup investments. The Nevada Angel Investor Agreement helps protect your assets when entering these ventures.

Typically, individuals with a high net worth or income levels can qualify as angel investors. In general, you must meet the SEC requirements, which often involve having a net worth exceeding $1 million, excluding primary residence. A well-drafted Nevada Angel Investor Agreement can formalize your status and responsibilities.

The capital required varies widely, but many angel investors commit around $25,000 annually across multiple startups. This approach helps diversify your investment portfolio. Engaging in a Nevada Angel Investor Agreement enhances your understanding of the investment landscape, providing clear terms for your financial participation.

Generally, you do not need a specific license to become an angel investor. Instead, you simply need to meet certain accreditation criteria, which often include having a net worth above a specified threshold. Utilizing a Nevada Angel Investor Agreement can streamline your investments, ensuring compliance and minimizing risks.

The minimum amount to invest as an angel investor often starts around $5,000 to $10,000 for each investment. However, this varies based on the company and its requirements. To solidify your investment, consider using a Nevada Angel Investor Agreement to define your role and investment specifics.

To become an angel investor, you typically need to invest at least $10,000 per deal. However, many investors choose to invest significantly more, depending on the startup's valuation and potential. The Nevada Angel Investor Agreement guides your investment terms, ensuring clarity and protection for both the investor and entrepreneur.

To attract funding from angel investors, start by crafting a solid business plan that outlines your goals and vision. Networking with potential investors and presenting your idea clearly can make a significant impact. Formalizing the investment process with a Nevada Angel Investor Agreement can also help establish trust and clarity in your arrangements.

Someone qualifies as an angel investor based on their financial status and willingness to invest in early-stage companies. Generally, they should meet the accredited investor criteria and have a passion for nurturing new business ideas. A Nevada Angel Investor Agreement will help solidify their role and outline the specifics of their investment.