Nevada Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

How to fill out Private Annuity Agreement With Payments To Last For Life Of Annuitant?

US Legal Forms - one of the most extensive collections of legal documents in the United States - offers a range of legal document formats that can be downloaded or printed.

Through the website, you can discover thousands of forms for business and personal use, organized by categories, claims, or keywords. You can access the latest versions of forms such as the Nevada Private Annuity Agreement with Payments to Last for Life of the Annuitant in moments.

If you already have a membership, Log In and retrieve the Nevada Private Annuity Agreement with Payments to Last for Life of the Annuitant from your US Legal Forms database. The Download option will appear on each form you view. You can access all previously obtained forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the payment.

Select the format and download the form to your device. Make changes. Complete, modify, and print out and sign the acquired Nevada Private Annuity Agreement with Payments to Last for Life of the Annuitant. Each template you added to your account has no expiration date and is yours indefinitely. Therefore, to download or print another copy, simply go to the My documents section and click on the form you need. Access the Nevada Private Annuity Agreement with Payments to Last for Life of the Annuitant with US Legal Forms, the most extensive collection of legal document formats. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have chosen the correct form for your specific city/state.

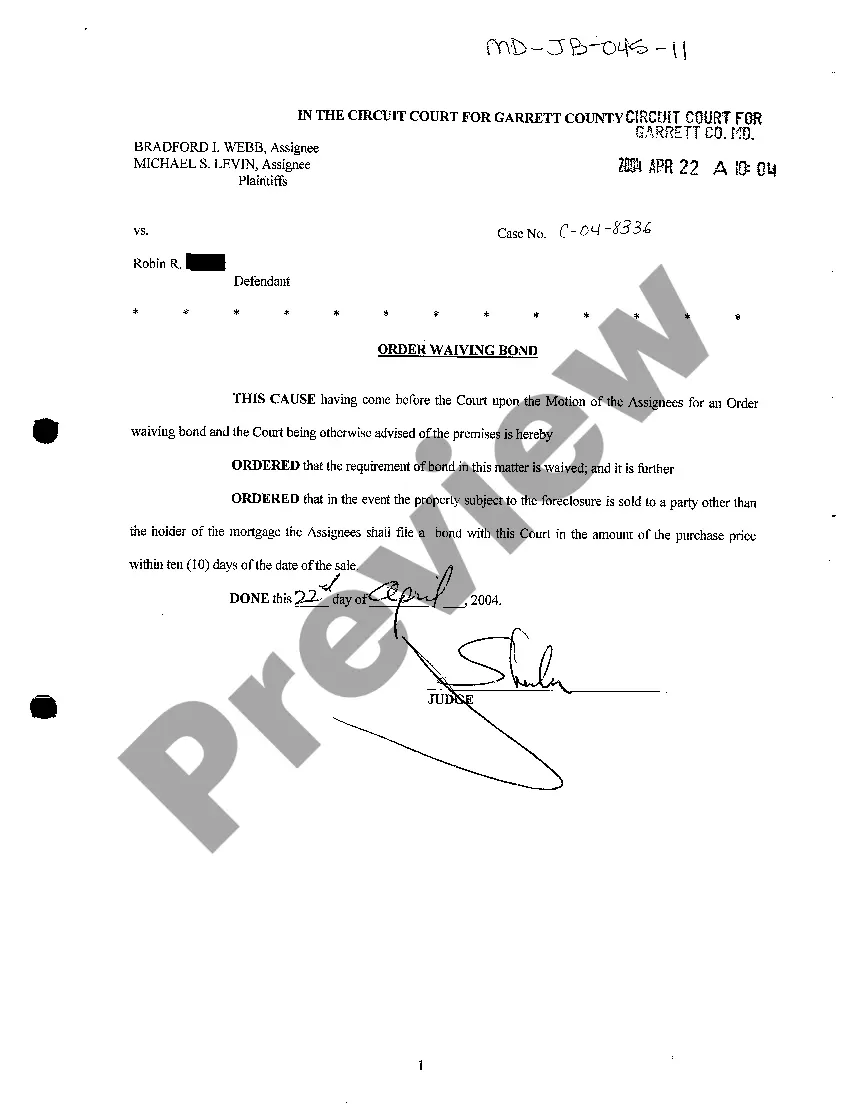

- Click on the Preview option to review the form’s content.

- Examine the form details to confirm you have selected the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose the pricing plan you prefer and provide your information to create an account.

Form popularity

FAQ

The annuity that stops payment when the annuitant dies is the life annuity. Specifically, the Nevada Private Annuity Agreement with Payments to Last for Life of Annuitant is designed to end payments upon the annuitant's passing. This feature is beneficial for individuals seeking to manage their financial portfolio effectively with limited obligations. Understanding this aspect can help you make informed decisions about your financial future and estate planning needs.

Payments stop at the annuitant's death in a standard life annuity settlement option. This is a crucial feature of a Nevada Private Annuity Agreement with Payments to Last for Life of Annuitant. The structure of this option secures the financial arrangement so that the payments are solely for the lifetime of the annuitant. It eliminates any ongoing financial obligations once the annuitant is deceased, providing clarity and peace of mind for both the annuitant and their beneficiaries.

When an annuitant passes away, the fate of the annuity depends on the type of agreement in place. In a Nevada Private Annuity Agreement with Payments to Last for Life of Annuitant, the payments stop at the annuitant's death, and no further distributions occur. This ensures that financial resources are not extended unnecessarily, aligning payment durations strictly with the life of the annuitant. Survivors may not receive any financial benefit from the annuity post-death under this specific arrangement.

The type of annuity settlement arrangement that ceases payments upon the annuitant's death is typically known as a life annuity. In a Nevada Private Annuity Agreement with Payments to Last for Life of Annuitant, the agreement specifically provides payments that continue only during the life of the annuitant. Once the annuitant passes away, the payments terminate, which is important for estate planning. This arrangement allows for predictable income during the annuitant's lifetime without extending the payment obligations beyond that time.

The immediate annuity is a popular choice that guarantees lifetime payments to the annuitant, starting almost immediately after a lump-sum investment. This option allows individuals to convert their savings into a steady income, which is especially beneficial for retirees. By choosing a Nevada Private Annuity Agreement with Payments to Last for Life of Annuitant, you can ensure that you receive reliable payments, making it easier to budget and enjoy your retirement without financial worries.

A lifetime payout annuity is a financial product designed to provide regular payments to the annuitant for the duration of their life. It helps to eliminate the worry of outliving one's savings, as payments continue as long as the individual is living. By utilizing a Nevada Private Annuity Agreement with Payments to Last for Life of Annuitant, individuals can secure their financial future and enjoy peace of mind knowing they have a reliable income stream.

The period certain annuity payout option combines lifetime payments with a guarantee that the annuitant will receive payments for a set number of years, even if they pass away earlier. This means that if the annuitant dies before this term ends, the remaining payments will go to their beneficiaries. Many people prefer this feature for its added security, ensuring that a Nevada Private Annuity Agreement with Payments to Last for Life of Annuitant can provide ongoing support for family members, even beyond the annuitant's lifetime.

The life only annuity payout option ensures that payments continue for the lifetime of the annuitant, without any future payouts to beneficiaries after their passing. This can be a suitable choice if the goal is to maximize monthly income during the annuitant’s life. Under a Nevada Private Annuity Agreement with Payments to Last for Life of Annuitant, this option offers a straightforward approach to financial planning, allowing individuals to enjoy predictable payments as long as they live.

An annuity agreement is a financial contract where one party pays another to receive periodic payments over time. This arrangement can involve various terms, including payment amounts, duration, and even conditions for beneficiaries. An annuity agreement is often used as a retirement strategy to provide a steady income flow. If you're interested, the Nevada Private Annuity Agreement with Payments to Last for Life of Annuitant can be a solid choice for those ready to secure their financial future.

Tax implications for private annuities can be complex after the death of the annuitant. Generally, the remaining annuity balance may pass to designated beneficiaries but can be subject to taxation. Understanding the tax responsibilities can save your beneficiaries from unexpected financial burdens. Utilizing the Nevada Private Annuity Agreement with Payments to Last for Life of Annuitant can help clarify these important tax considerations.