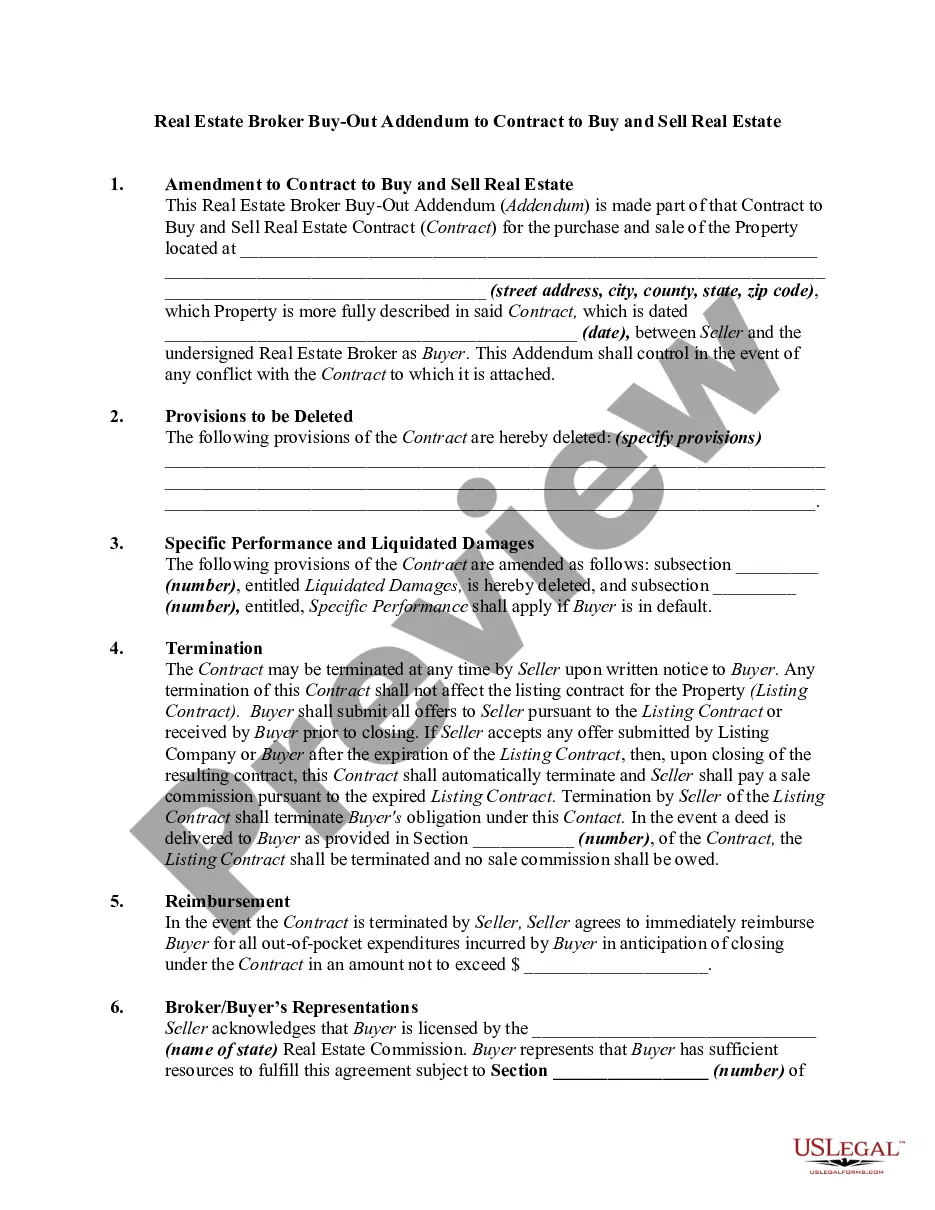

Nevada Disputed Accounted Settlement (NDAs) is a legal term referring to the resolution of a disputed account or debt in the state of Nevada. It is the process through which parties involved in a financial dispute come to a settlement or agreement, typically with the assistance of a mediator or through a court proceeding. NDAs are designed to provide a fair and impartial resolution for issues related to financial conflicts, such as outstanding debts, incorrect billing, or disputed transactions. It allows individuals, businesses, or organizations to seek a resolution while avoiding prolonged legal battles and high court fees. There are several types of Nevada Disputed Accounted Settlement depending on the specific nature of the dispute: 1. Debt Dispute Settlement: This type of NDAs focuses on resolving issues related to outstanding debts and payments. It involves negotiating terms, payment plans, or potentially reducing the amount owed to reach an amicable agreement between both parties. 2. Billing Dispute Settlement: In cases where there are disagreements over billing discrepancies, such as double charges, incorrect rates, or unauthorized charges, NDAs serves as a platform to find a mutually acceptable solution. Mediation or negotiation may be used to rectify the billing errors and determine fair compensation if necessary. 3. Transaction Dispute Settlement: NDAs can also be utilized to resolve disputes arising from erroneous or disputed transactions. This can involve instances such as unauthorized withdrawals, identity theft, fraudulent activities, or unresolved issues with merchants. 4. Collection Dispute Settlement: When individuals or businesses face collection agency-related disputes, NDAs provides a framework to negotiate terms, address violation claims under the Fair Debt Collection Practices Act (FD CPA), or settle account-related conflicts with the collectors. By engaging in a Nevada Disputed Accounted Settlement, parties involved can save time, money, and potential reputational damage resulting from protracted legal battles. It offers an opportunity for both parties to present their arguments, consider evidence, and reach a resolution that is satisfactory to all parties involved. If a settlement is reached, it is typically documented in a written agreement outlining the terms, conditions, and any financial obligations. This agreement serves as a legal contract and can be enforced if either party fails to comply with the agreed-upon terms. Overall, Nevada Disputed Accounted Settlement is a mechanism designed to promote fair resolution of financial disputes in Nevada, ensuring that both parties have the opportunity to be heard and that a mutually beneficial outcome is reached.

Nevada Disputed Accounted Settlement

Description

How to fill out Nevada Disputed Accounted Settlement?

Are you presently in a placement the place you require files for both business or personal functions nearly every day time? There are a variety of legal file templates available on the net, but getting kinds you can rely is not effortless. US Legal Forms delivers a large number of form templates, just like the Nevada Disputed Accounted Settlement, that are created to fulfill federal and state demands.

When you are currently acquainted with US Legal Forms website and get your account, basically log in. Next, you may down load the Nevada Disputed Accounted Settlement design.

Unless you come with an bank account and wish to start using US Legal Forms, abide by these steps:

- Obtain the form you want and make sure it is for the right metropolis/region.

- Use the Review key to analyze the form.

- Browse the information to ensure that you have selected the appropriate form.

- When the form is not what you`re trying to find, take advantage of the Lookup industry to get the form that meets your requirements and demands.

- If you obtain the right form, just click Buy now.

- Opt for the costs plan you want, fill out the necessary information to create your money, and purchase an order with your PayPal or charge card.

- Select a hassle-free file file format and down load your version.

Find each of the file templates you might have bought in the My Forms menus. You may get a further version of Nevada Disputed Accounted Settlement anytime, if possible. Just click on the required form to down load or produce the file design.

Use US Legal Forms, one of the most considerable variety of legal types, to save lots of efforts and stay away from errors. The support delivers skillfully produced legal file templates which can be used for an array of functions. Make your account on US Legal Forms and commence producing your daily life easier.