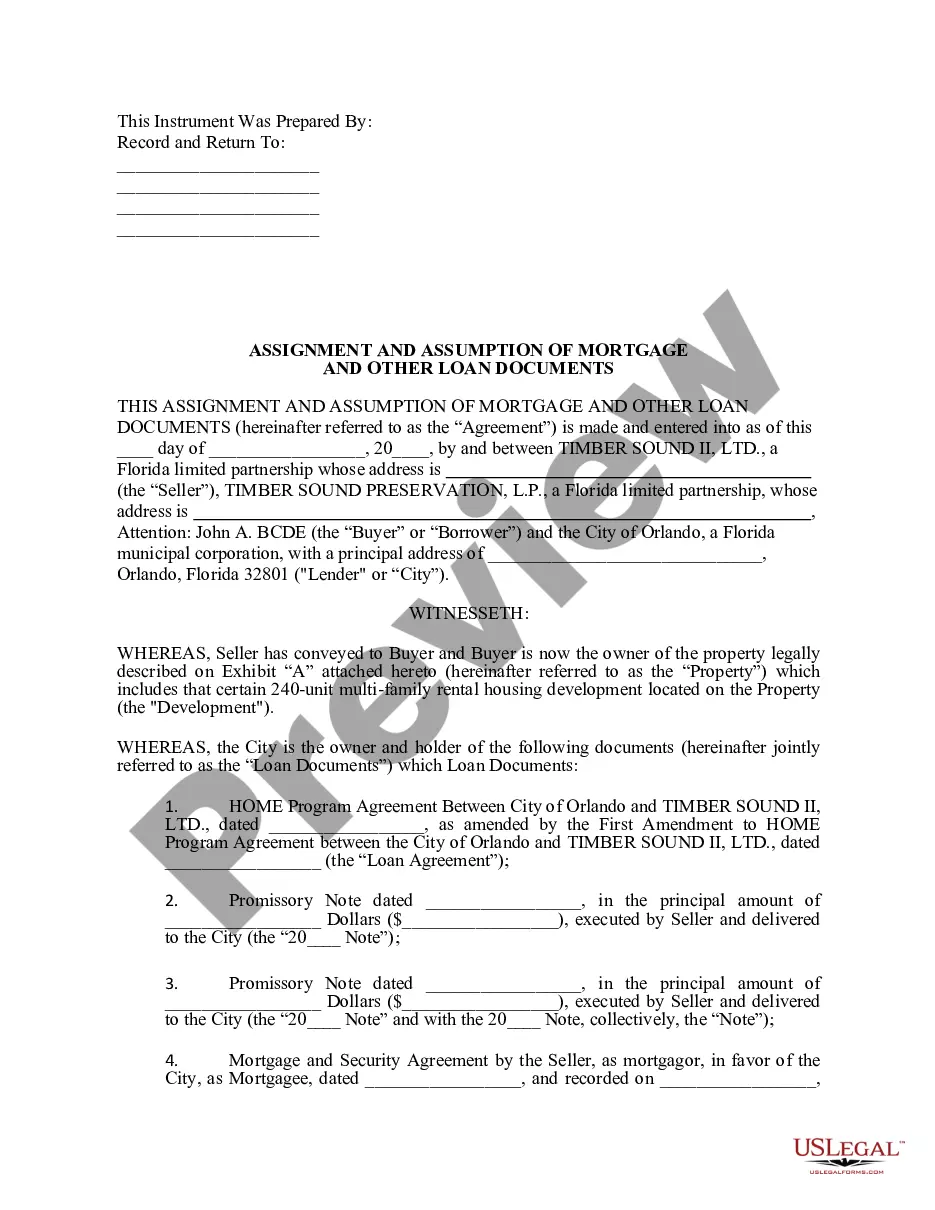

Nevada Assignment of Mortgage

Description

How to fill out Assignment Of Mortgage?

You may devote time online searching for the legal document web template that meets the state and federal requirements you require. US Legal Forms gives a large number of legal varieties that are analyzed by experts. You can actually down load or produce the Nevada Assignment of Mortgage from your service.

If you already possess a US Legal Forms profile, you can log in and then click the Acquire button. Afterward, you can total, change, produce, or indication the Nevada Assignment of Mortgage. Every single legal document web template you get is yours permanently. To have one more duplicate for any obtained type, check out the My Forms tab and then click the related button.

If you are using the US Legal Forms site the first time, follow the basic instructions below:

- Very first, ensure that you have chosen the correct document web template for your county/area of your choosing. See the type outline to ensure you have picked out the correct type. If accessible, take advantage of the Review button to appear through the document web template also.

- If you would like discover one more variation from the type, take advantage of the Search field to discover the web template that meets your needs and requirements.

- Once you have discovered the web template you need, simply click Acquire now to carry on.

- Find the prices program you need, type in your qualifications, and sign up for a merchant account on US Legal Forms.

- Complete the deal. You can utilize your Visa or Mastercard or PayPal profile to cover the legal type.

- Find the structure from the document and down load it in your system.

- Make modifications in your document if needed. You may total, change and indication and produce Nevada Assignment of Mortgage.

Acquire and produce a large number of document templates while using US Legal Forms Internet site, which offers the biggest selection of legal varieties. Use specialist and status-specific templates to take on your small business or individual requires.

Form popularity

FAQ

Civil Code section 2932.5, which mandates that an assignee of a mortgagee must record the assignment before exercising a power to sell the real property, only applies to mortgages and does not apply to deeds of trust. (Haynes v. EMC Mortgage Corporation (? Cal. Rptr.

In Nevada, lenders like a deed of trust (or ?trust deed?) to give them security in case the borrower defaults. Some states use a mortgage for security, which is a two-party transaction involving both the lender and the borrower.

A recorded mortgage must be discharged by a certificate signed by the mortgagee, his personal representatives or assigns, acknowledged or proved and certified as prescribed by the chapter on ?recording transfers,? stating that the mortgage has been paid, satisfied, or discharged.

The Court's holding requires that prior to the assignee of a mortgage loan filing suit on the note or mortgage, the assignee must have received both an allonge/assignment of the note and an assignment of the mortgage.

If it does not have an assignment or failed to record it as required by state law, this may result in the dismissal of the foreclosure action. Recording rules may require that the foreclosing party record the assignment before starting the foreclosure.

That a mortgage is not recorded does not prohibit the commencement of a mortgage foreclosure action. The mortgage contract between the borrower and the lender is no more binding when it is recorded and so legal action can be taken.

If an assignment is made with the fraudulent intent to delay, hinder, and defraud creditors, then it is void as fraudulent in fact.

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender's interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage's terms should remain the same.