The Nevada Cash Receipts Control Log serves as a crucial tool for monitoring and tracking all cash transactions within an organization. This log enables businesses and institutions in Nevada to maintain accurate records of their cash receipts, ensuring transparency, accountability, and compliance with financial regulations. By systematically recording each cash receipt, this control log contributes to maintaining accurate financial records, preventing cash leakages or discrepancies, and promoting an efficient cash management system. The log typically includes relevant details such as the date, time, source, purpose, and amount of each cash receipt. There are several types of Nevada Cash Receipts Control Logs, each tailored to specific industries or sectors within the state. Some common variations include: 1. Retail Cash Receipts Control Log: This type of log is utilized by businesses operating in the retail sector, such as supermarkets, clothing stores, and convenience stores. It focuses on tracking cash inflows from sales transactions, monitoring cash register activity, and ensuring the accuracy of cash deposits. 2. Government Agency Cash Receipts Control Log: Used by various government departments, agencies, and institutions in Nevada, this log is designed to maintain a record of cash receipts obtained through services offered to the public. It helps ensure efficient collection and reconciliation of cash revenues generated by governmental operations. 3. Non-Profit Organization Cash Receipts Control Log: Non-profit organizations often rely on donations, grants, and fundraising activities. This control log assists such organizations in managing and tracing cash receipts effectively. It ensures transparency in all financial transactions and facilitates compliance with reporting requirements for grants or donations received. 4. Hospitality Industry Cash Receipts Control Log: Hotels, restaurants, and other businesses in Nevada's hospitality industry use this type of control log to monitor cash inflows generated by hotel room bookings, dining services, and other ancillary revenue sources. It aids in managing cash collections from various outlets and provides a comprehensive record for auditing purposes. 5. Healthcare Facility Cash Receipts Control Log: Medical practices, hospitals, and clinics utilize this control log to accurately record patient payments, insurance reimbursements, and other cash receipts related to healthcare services. It helps maintain financial records required for insurance audits, patient billing, and internal financial management. In conclusion, the Nevada Cash Receipts Control Log acts as a vital instrument for organizations in Nevada to track and document cash receipts. By using these logs, businesses can ensure financial accuracy, prevent fraud, and comply with state regulations. The variations mentioned above cater to specific industries, assisting them in managing their unique cash flow requirements effectively.

Nevada Cash Receipts Control Log

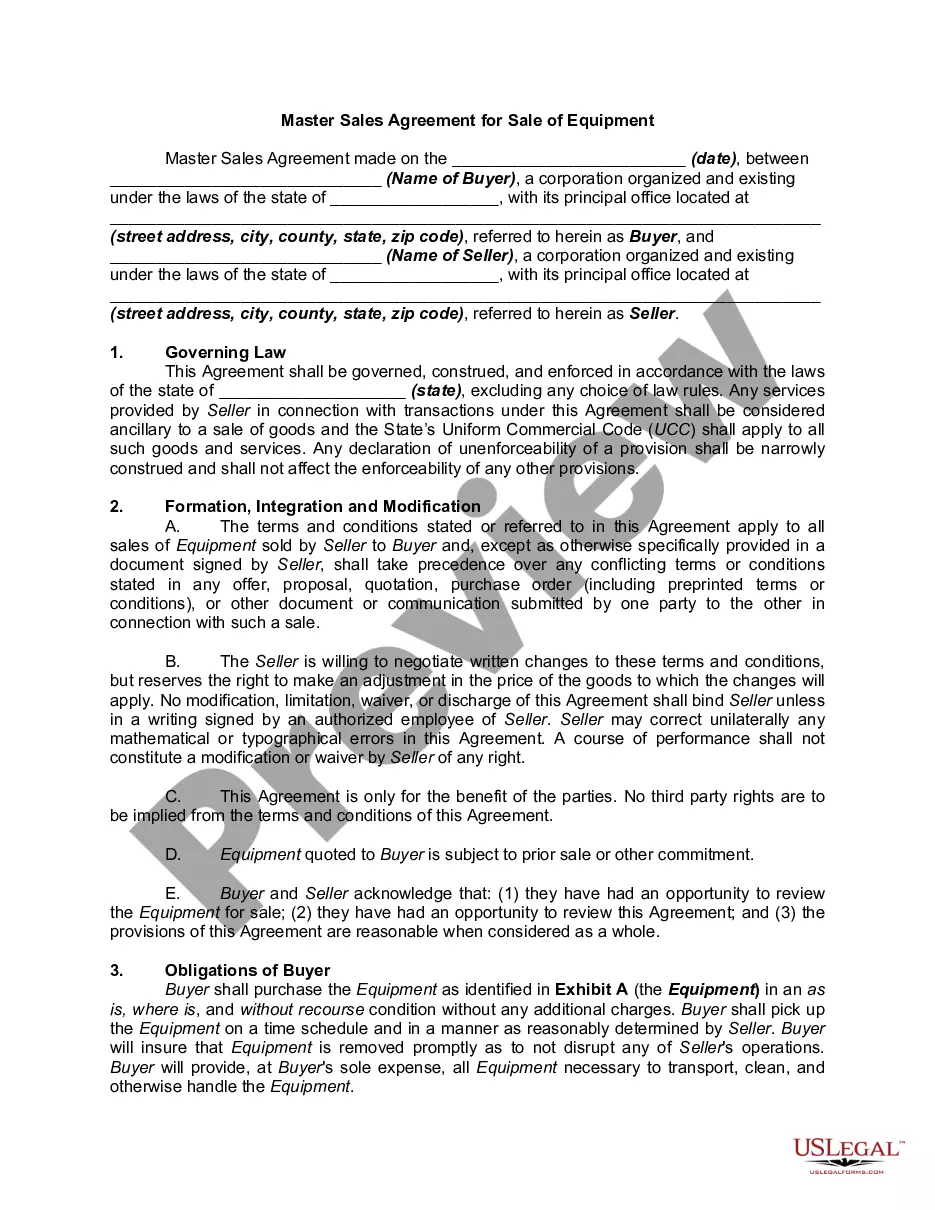

Description

How to fill out Nevada Cash Receipts Control Log?

Finding the right legal document template might be a have difficulties. Needless to say, there are tons of web templates available on the net, but how do you find the legal kind you want? Take advantage of the US Legal Forms website. The assistance offers 1000s of web templates, including the Nevada Cash Receipts Control Log, which you can use for organization and private requires. All the kinds are checked out by specialists and satisfy state and federal specifications.

In case you are previously signed up, log in in your account and click on the Down load key to find the Nevada Cash Receipts Control Log. Use your account to check from the legal kinds you may have bought in the past. Proceed to the My Forms tab of your account and acquire yet another duplicate of your document you want.

In case you are a whole new customer of US Legal Forms, listed below are easy guidelines that you should comply with:

- Initially, ensure you have selected the correct kind for your area/area. You may look over the form making use of the Review key and study the form information to make sure it will be the best for you.

- In the event the kind will not satisfy your needs, use the Seach field to obtain the appropriate kind.

- Once you are certain the form is acceptable, click the Get now key to find the kind.

- Choose the costs plan you would like and enter in the essential information. Build your account and purchase an order making use of your PayPal account or bank card.

- Choose the submit structure and download the legal document template in your device.

- Complete, edit and print and signal the attained Nevada Cash Receipts Control Log.

US Legal Forms will be the biggest library of legal kinds where you will find a variety of document web templates. Take advantage of the service to download appropriately-created files that comply with condition specifications.