Nevada Consultant Agreement with Sharing of Software Revenues

Description

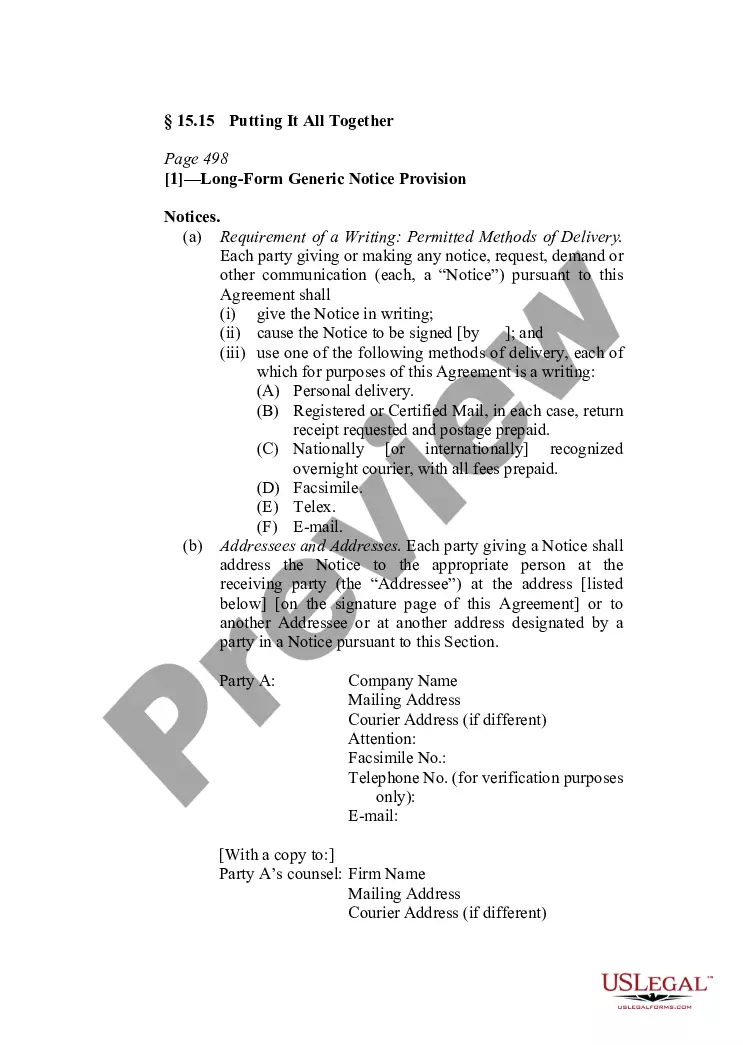

In this agreement, the consultant is not only paid an hourly rate, but is also paid a percentage of the net profits (as defined in the agreement) resulting from the software the consultant develops.

How to fill out Consultant Agreement With Sharing Of Software Revenues?

Selecting the finest authentic document template can be challenging.

Of course, there is a multitude of formats accessible on the web, but how do you locate the authentic form you require.

Utilize the US Legal Forms website.

First, ensure you have chosen the correct form for your specific city/region. You can review the document using the Preview button and read the document description to verify it is the correct one for you. If the document does not meet your needs, use the Search field to locate the appropriate form. Once you are certain the form is suitable, select the Buy now button to acquire the form. Choose the pricing plan you desire and enter the required information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, revise, print and sign the received Nevada Consultant Agreement with Sharing of Software Revenues. US Legal Forms is the largest library of legal forms where you can find numerous document formats. Utilize the service to download professionally crafted documents that adhere to state requirements.

- The service offers a vast array of formats, including the Nevada Consultant Agreement with Sharing of Software Revenues, suitable for business and personal uses.

- All the documents are reviewed by experts and comply with state and federal regulations.

- If you are currently registered, Log In to your account and hit the Acquire button to download the Nevada Consultant Agreement with Sharing of Software Revenues.

- Use your account to search for the legal forms you have purchased previously.

- Navigate to the My documents section of your account to retrieve an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps you can follow.

Form popularity

FAQ

The agreement you need is typically called an End User License Agreement (EULA). This document defines the rights of the individual purchaser regarding the software and outlines its permitted and restricted uses. In the context of a Nevada Consultant Agreement with Sharing of Software Revenues, the EULA can detail how both parties can benefit from the software while protecting their interests. To draft a solid EULA, consider using resources from platforms such as USLegalForms, designed to guide you through the process.

To write a profit sharing agreement, start by identifying the parties involved and clearly outline the revenue-sharing percentages. Next, specify how profits will be calculated and distributed, ensuring all terms are transparent and agreed upon. A well-drafted Nevada Consultant Agreement with Sharing of Software Revenues can serve as an excellent template, helping you cover all essential aspects like payment timelines, roles, and responsibilities. Utilizing platforms like USLegalForms can streamline this process, providing you with reliable templates tailored to your needs.

Structuring a revenue-sharing agreement involves defining key aspects such as percentage splits, payment timelines, and conditions in a Nevada Consultant Agreement with Sharing of Software Revenues. It's crucial to be thorough and specific to ensure all parties are on the same page. Utilizing platforms like uslegalforms can provide helpful templates to create a well-structured agreement that addresses all essential factors.

To determine revenue-sharing in a Nevada Consultant Agreement with Sharing of Software Revenues, assess each party's role, effort, and investment in the project. Clarity in your definitions can prevent misunderstandings down the road. Engaging in an open dialogue during initial discussions can help both parties arrive at a fair and satisfactory agreement.

Revenue sharing is calculated by assessing total income generated from a software project and then distributing this income according to the agreed-upon terms in a Nevada Consultant Agreement with Sharing of Software Revenues. Each party's contribution is evaluated, and shares are assigned based on their input. Regular audits can help ensure that the calculations remain accurate and fair.

Calculating the revenue share percentage in a Nevada Consultant Agreement with Sharing of Software Revenues generally requires you to determine total revenue and the roles of each party involved. You can express this as a percentage by dividing the revenue allocated to each party by the total revenue generated. This straightforward calculation allows for transparency and fairness in revenue distribution.

Setting up a consulting agreement involves drafting a clear document outlining the scope of work, payment terms, and expectations in a Nevada Consultant Agreement with Sharing of Software Revenues. You should include details such as deliverables, timelines, and responsibilities. Using a platform like uslegalforms can simplify this process by providing customizable templates that ensure you cover all necessary legal bases.

To negotiate revenue-sharing in a Nevada Consultant Agreement with Sharing of Software Revenues, both parties should start by clearly defining their goals and expectations. Open communication is essential, so be sure to listen actively and consider each party's contributions. Try to find a mutually beneficial arrangement that reflects the input and value each party brings to the software revenue stream.

The effective revenue share formula in a Nevada Consultant Agreement with Sharing of Software Revenues typically involves dividing total revenue by the contribution of each party. This formula ensures that all parties receive a fair share based on their inputs and responsibilities. Understanding this formula will help you compute equitable shares and avoid potential disputes.

An example of a revenue sharing agreement could involve a consultant who assists a software company in launching a new application. The agreement might state that the consultant will receive 20% of all revenue generated within the first year. Such arrangements can be beneficial for both parties, aligning incentives and fostering collaboration on shared goals.