A Nevada Notice of Default on Promissory Note Installment is a legal document served to inform borrowers of their default on the terms and conditions of a promissory note installment in the state of Nevada. It serves as a formal notification to borrowers that they have failed to make timely payments or violated other important provisions outlined in the promissory note. When a borrower fails to fulfill their obligations according to the terms of a promissory note installment, the lender has the right to begin the foreclosure process. However, before commencing foreclosure proceedings, the lender is required to serve a Nevada Notice of Default on Promissory Note Installment as a prerequisite. The notice typically contains essential information such as the borrower's name, contact details, and the date the promissory note installment was executed. It also outlines the specific default or breaches committed by the borrower, including missed payments, failure to pay interest, or any other defaults stated in the promissory note. Keywords: Nevada Notice of Default, Promissory Note Installment, legal document, borrowers, default, foreclosure process, missed payments, interest, breaches, terms and conditions, notification. In Nevada, there may be variations of a Notice of Default on Promissory Note Installment depending on the specific type of loan or the lending institution involved. These variations include: 1. Residential Mortgage Installment Notice of Default: This type of notice is specific to default on residential mortgage loans, including single-family homes, condominiums, or townhouses. 2. Commercial Property Installment Notice of Default: Commercial lenders use this notice to address default on promissory notes related to commercial property loans, such as office buildings, retail spaces, or industrial properties. 3. Personal Loan Installment Notice of Default: For personal loans obtained for various purposes, such as education, medical expenses, or debt consolidation, lenders can issue this notice when borrowers default on their repayment obligations. 4. Business Loan Installment Notice of Default: This notice is used when businesses default on loans acquired to support their operations, expansion, or investments. It is crucial for borrowers to address a Nevada Notice of Default on Promissory Note Installment promptly. Failure to respond or rectify the default within the specified period may lead to severe consequences, including foreclosure, negative impact on credit score, and legal action. Seeking legal advice or negotiating with the lender can help borrowers navigate the situation and explore potential options for resolving the default and maintaining their financial stability.

Nevada Notice of Default on Promissory Note Installment

Description

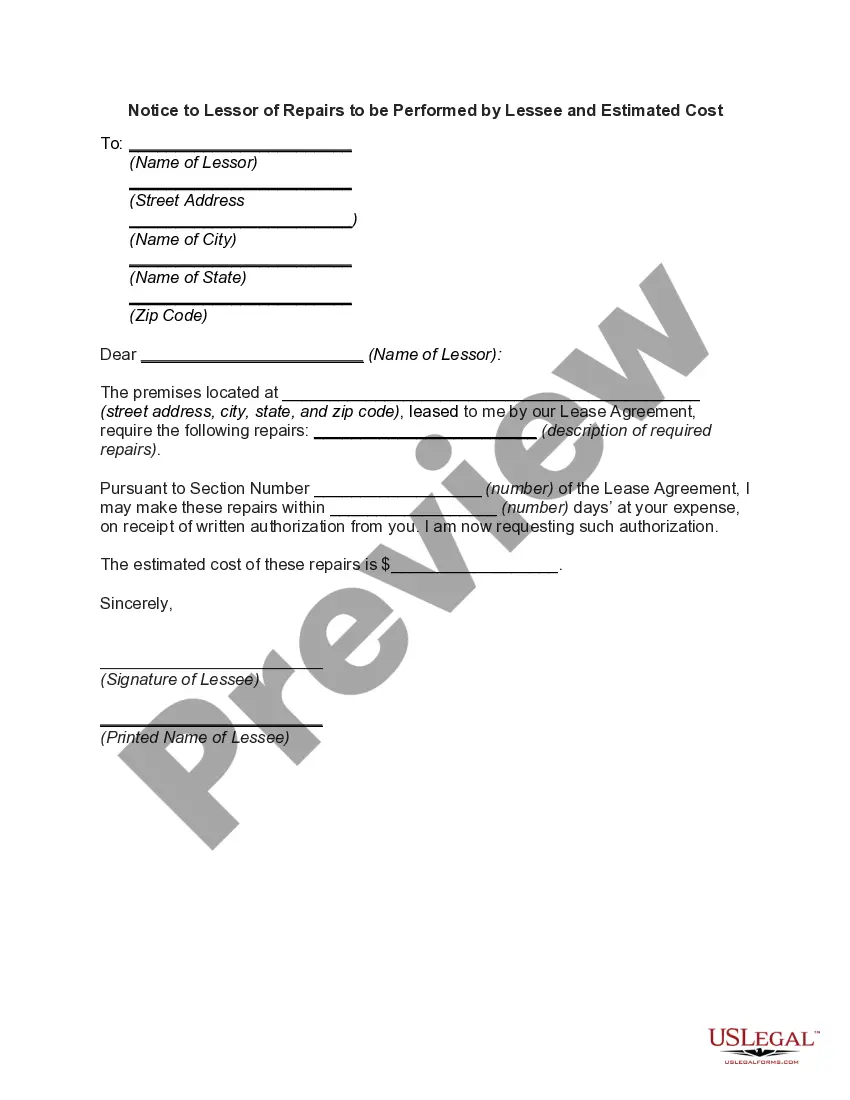

How to fill out Nevada Notice Of Default On Promissory Note Installment?

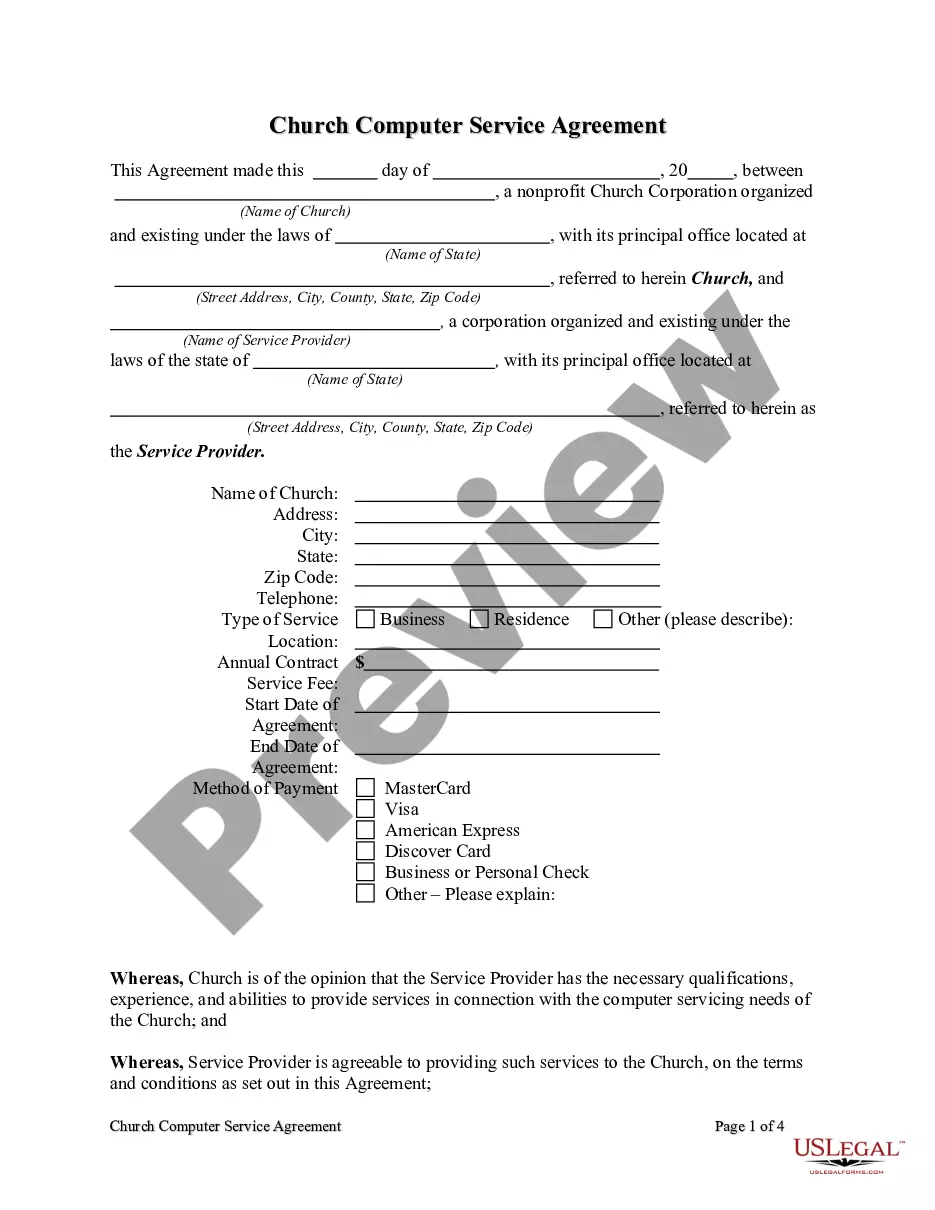

You are able to invest time on-line trying to find the legal document web template which fits the state and federal requirements you will need. US Legal Forms offers a huge number of legal forms which are reviewed by pros. You can actually obtain or printing the Nevada Notice of Default on Promissory Note Installment from the assistance.

If you currently have a US Legal Forms bank account, it is possible to log in and click on the Obtain key. Afterward, it is possible to full, change, printing, or signal the Nevada Notice of Default on Promissory Note Installment. Each and every legal document web template you acquire is your own for a long time. To have another duplicate for any obtained develop, visit the My Forms tab and click on the related key.

If you work with the US Legal Forms internet site the first time, keep to the straightforward instructions below:

- Initial, ensure that you have chosen the correct document web template to the area/metropolis that you pick. Look at the develop explanation to make sure you have selected the correct develop. If offered, make use of the Preview key to appear throughout the document web template as well.

- If you want to discover another variation of your develop, make use of the Research field to get the web template that meets your needs and requirements.

- When you have discovered the web template you would like, click Buy now to proceed.

- Select the pricing plan you would like, type in your references, and sign up for your account on US Legal Forms.

- Full the transaction. You may use your charge card or PayPal bank account to purchase the legal develop.

- Select the file format of your document and obtain it in your product.

- Make alterations in your document if necessary. You are able to full, change and signal and printing Nevada Notice of Default on Promissory Note Installment.

Obtain and printing a huge number of document web templates using the US Legal Forms web site, which offers the most important variety of legal forms. Use expert and status-specific web templates to deal with your business or specific requirements.

Form popularity

FAQ

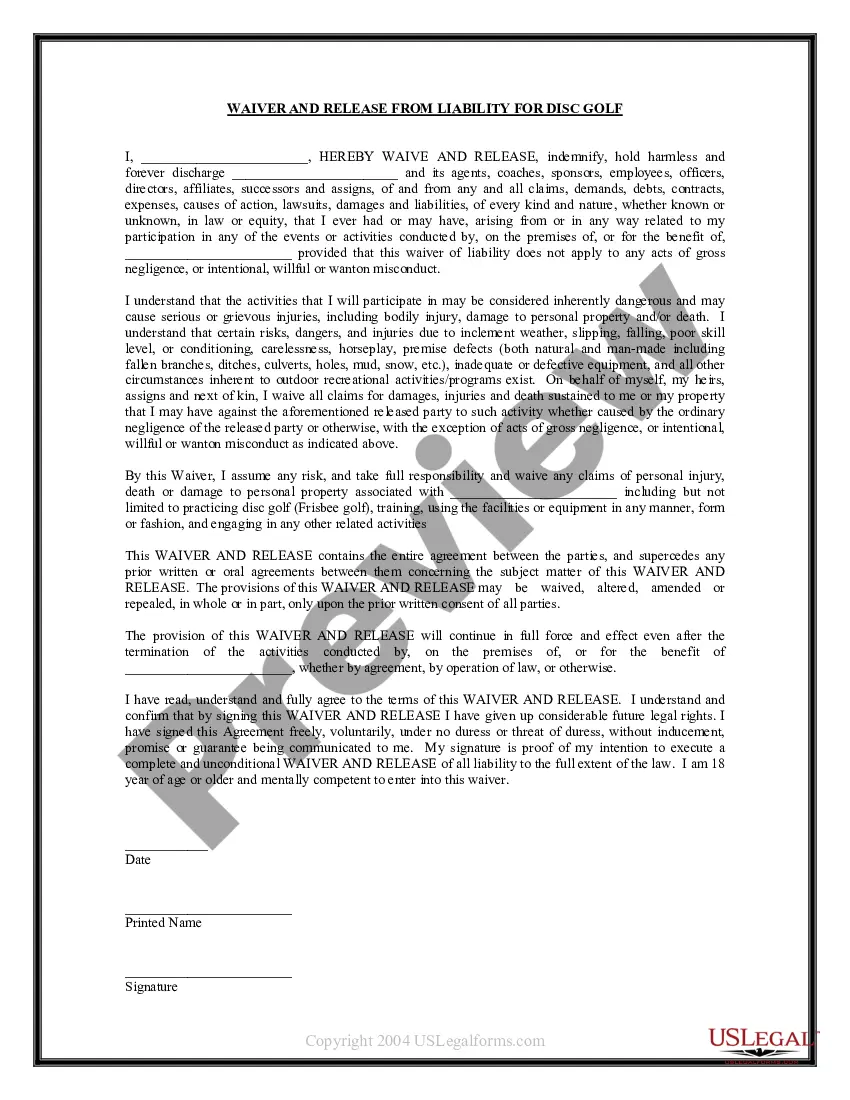

A promissory note may include a default on secured debt as part of the agreement. This means that if the borrower fails to pay under the agreed-upon terms of the promissory note, then the lender can take the secured debt as a form of payment.

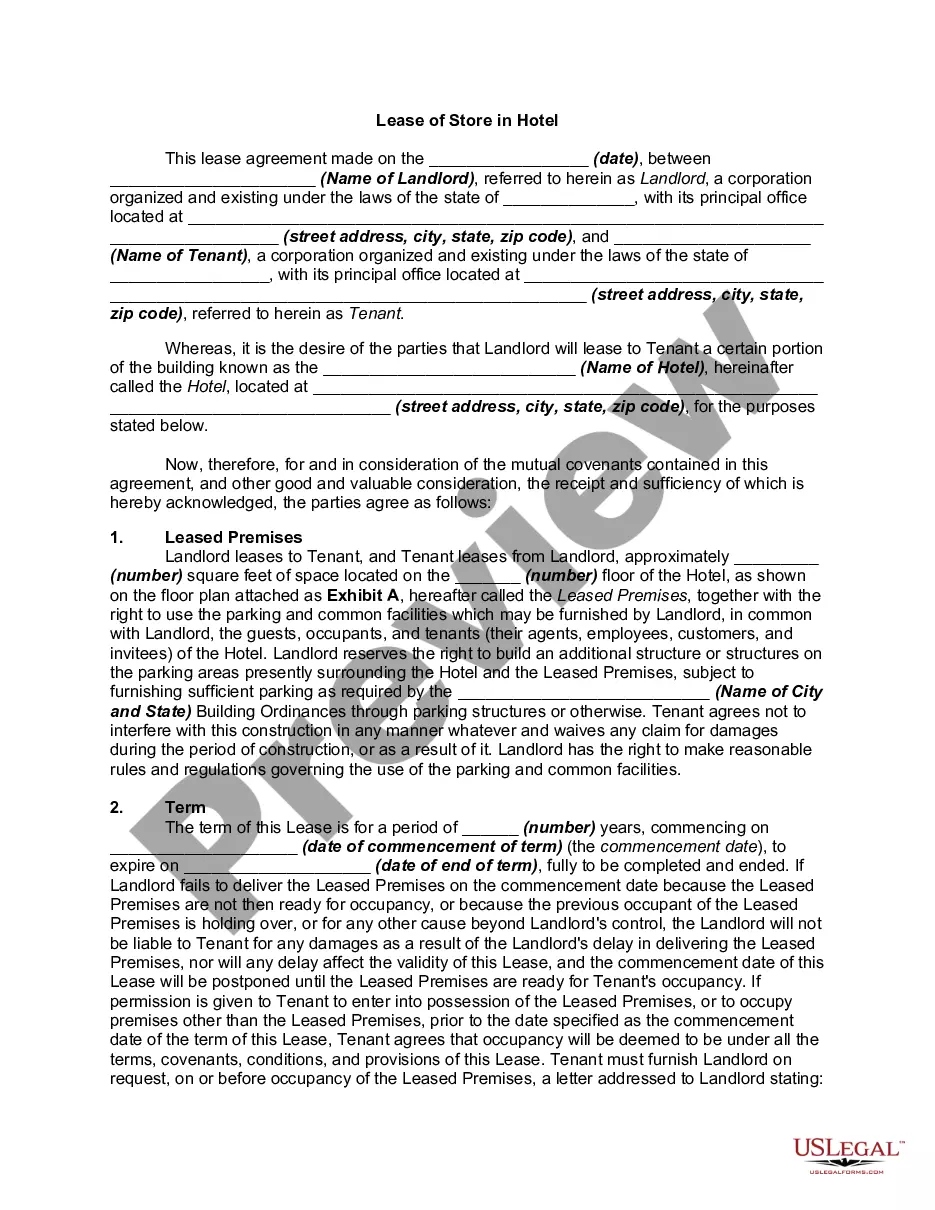

Information on notices of default normally includes the borrower and lender's name and address, the legal address of the property, the nature of the default, as well as other pertinent details. A notice of default is often considered the first step toward foreclosure.

Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions. You have a few options if someone who has borrowed money from you does not pay you back.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

A default notice is a formal letter sent to you by a lender or creditor when you're in arrears with your repayments to them.

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

How to Enforce a Promissory NoteTypes of Property that can be used as collateral.Speak to them in person.Draft a Demand / Notice Letter.Write and send a Follow Up Letter.Enlisting a Professional Collection Agency.Filing a petition or complaint in court.Selling the Promissory Note.Final Tips.More items...?

A default on a loan happens when the borrower fails to make the scheduled payments in full. Default could happen with one missed payment or might not occur until after several payments have been missed, depending on the terms of the note.

This is a legal document that states the following:The date of the notice.The names of the lender and borrower.The date of the promissory note itself.The full amount of the promissory note (that is, the total amount that was borrowed)The number of installment payments that have been missed.More items...

Only makers and acceptors (drawees that promise to pay when the instrument is presented) are subject to primary liability. The maker of a promissory note promises to pay the note. An acceptor is a drawee that promises to pay an instrument when it is presented later for payment.