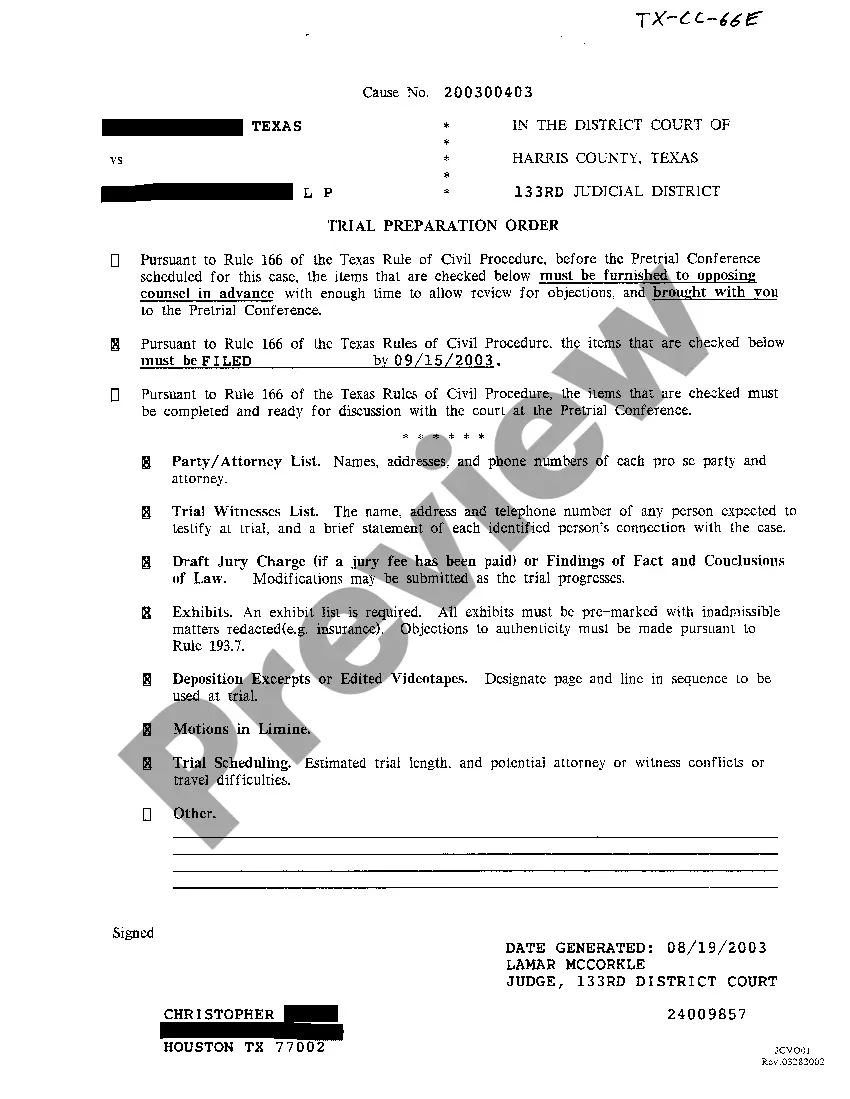

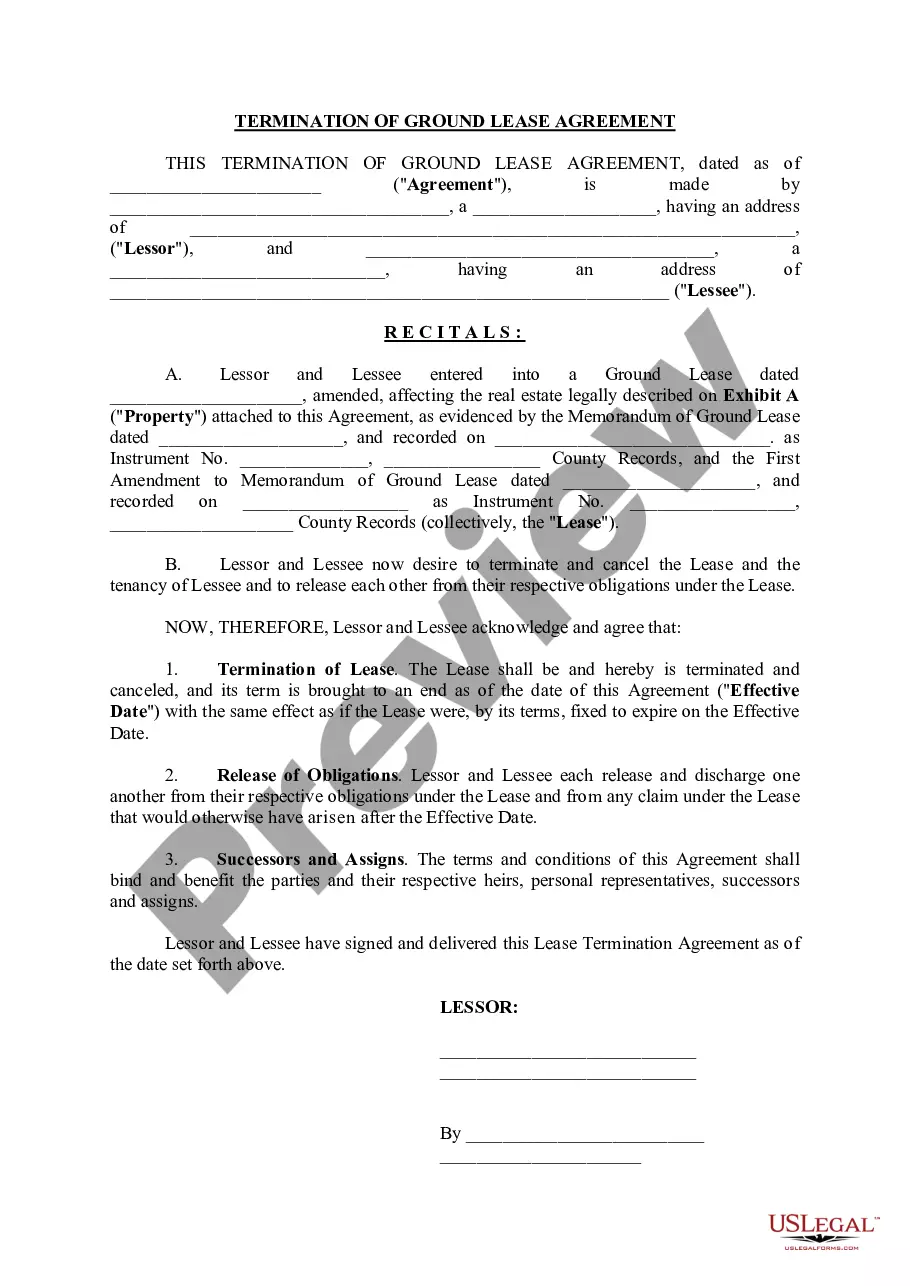

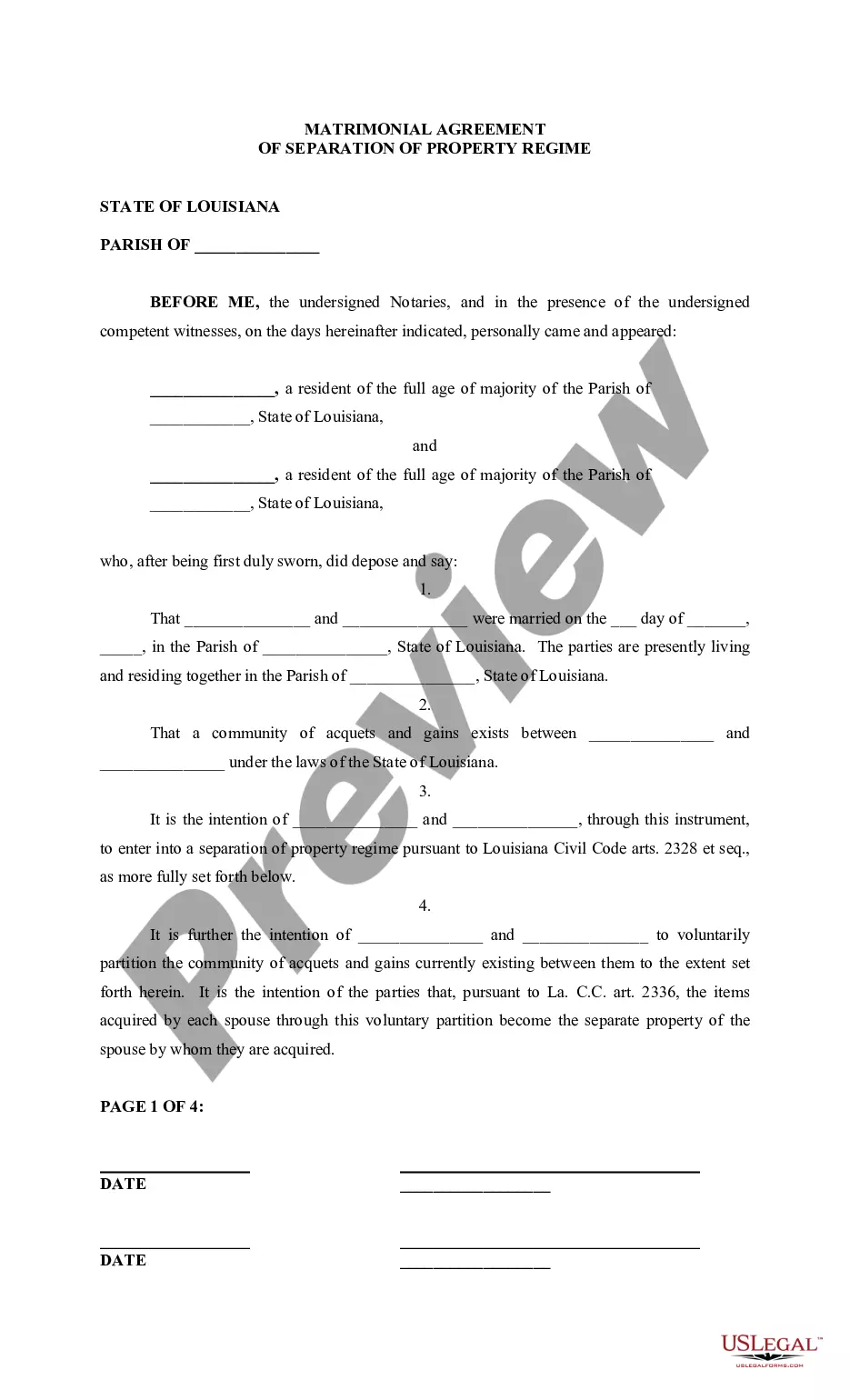

Nevada Invoice Template for Lecturer: A Comprehensive Overview An invoice is an essential document that helps lecturers efficiently track and receive payment for their services. A Nevada Invoice Template specifically caters to lecturers based in Nevada, ensuring it aligns with the state's specific invoicing requirements and nuances. 1. Nevada Invoice Template: Standard Version The standard Nevada Invoice Template for Lecturers acts as a foundational template catering to educators and lecturers across various subjects and disciplines. It includes essential components such as: — Header: Contains the lecturer's name, contact information (address, email, phone number), and business logo (if applicable). — Invoice Number: A unique identification number assigned to each invoice for better record-keeping and organization. — Date: The date on which the invoice is issued. — Lecturer's Client Details: Client name, billing address, and contact information. — Itemized Services: This section allows the lecturer to itemize the services provided, including lecture hours, consulting time, tutoring sessions, or any additional work completed. — Rate: The agreed-upon hourly rate or flat fee for each service rendered. — Total Amount: The sum total of all services provided, excluding taxes and deductions. — Tax Details: If applicable, this section includes the relevant tax information to comply with Nevada tax regulations. — Payment Terms: Clearly states the payment due date, accepted payment methods, and any late payment penalties or early payment discounts. — Terms & Conditions: Provides any additional payment terms or clauses to protect the lecturer's interests and clarify obligations, cancellations, or refunds. 2. Nevada Invoice Template: Tax-Compliant Version Nevada boasts specific tax regulations that may vary from other states. A tax-compliant Nevada Invoice Template for Lecturers ensures adherence to these rules for successful tax filings. It may include additional components such as: — State Sales Tax Calculation: Calculates applicable sales tax based on the services rendered and helps lecturers remain compliant with Nevada's sales tax requirements. — Tax Identification Number: Space to include a tax identification number or any necessary tax-related details. — Integrated Tax Formulas: Automatically computes and adds the appropriate tax amount to ensure accurate invoicing. — Tax Reporting Section: A dedicated section to summarize tax amounts and separate them from the total invoice amount. Nevada Invoice Templates for Lecturers provide a structured framework, saving lecturers time and effort in creating invoices from scratch. Using these templates ensures professionalism, accuracy, and compliance with Nevada-specific invoicing regulations. Efficient invoicing empowers lecturers to focus on their core responsibilities while maintaining a streamlined payment process.

Nevada Invoice Template for Lecturer

Description

How to fill out Nevada Invoice Template For Lecturer?

US Legal Forms - one of several biggest libraries of legitimate varieties in America - gives a wide array of legitimate record web templates you can download or printing. While using web site, you can find thousands of varieties for organization and specific uses, categorized by types, states, or key phrases.You will find the newest types of varieties much like the Nevada Invoice Template for Lecturer within minutes.

If you currently have a monthly subscription, log in and download Nevada Invoice Template for Lecturer from the US Legal Forms collection. The Down load switch will show up on each and every form you look at. You gain access to all formerly downloaded varieties within the My Forms tab of your respective account.

If you want to use US Legal Forms the very first time, listed below are simple guidelines to help you get started off:

- Be sure you have picked the proper form for your city/county. Click on the Preview switch to examine the form`s content material. Read the form explanation to ensure that you have chosen the correct form.

- In case the form does not match your demands, utilize the Research area near the top of the display to get the the one that does.

- Should you be satisfied with the form, affirm your choice by simply clicking the Buy now switch. Then, opt for the prices prepare you like and supply your references to register on an account.

- Procedure the purchase. Utilize your Visa or Mastercard or PayPal account to finish the purchase.

- Find the format and download the form on your own product.

- Make alterations. Load, edit and printing and indicator the downloaded Nevada Invoice Template for Lecturer.

Each and every design you added to your bank account lacks an expiration particular date and is also your own eternally. So, if you want to download or printing one more copy, just check out the My Forms section and click in the form you want.

Obtain access to the Nevada Invoice Template for Lecturer with US Legal Forms, the most extensive collection of legitimate record web templates. Use thousands of specialist and condition-particular web templates that meet up with your business or specific needs and demands.

Form popularity

FAQ

To use a Word template to create a new invoice, open Microsoft Word, click File and then navigate to New From Template in the menu. You should be presented with several options of downloadable invoice templates to choose from, depending on your industry, unique design style, and type of services rendered.

How to create an invoice: step-by-stepMake your invoice look professional. The first step is to put your invoice together.Clearly mark your invoice.Add company name and information.Write a description of the goods or services you're charging for.Don't forget the dates.Add up the money owed.Mention payment terms.

What should be included on an invoice for professional servicesThe name of your company.The name of your customer.The date the services were provided.Invoice number.A description of services rendered.Quantity of hours spent on services rendered.The price you're charging for the services or your hourly rate.More items...?

How to Create an Invoice in WordOpen a New Blank Document.Create an Invoice Header.Add the Invoice Date.Include a Unique Invoice Number.Include Your Client's Contact Details.Create an Itemized List of Services.Display the Total Amount Due.Add the Deadline for Payment.More items...?

Microsoft Word provides templates for invoice sheets that you customize to suit your business needs. Office features more than 100 online invoice templates that copy to a Word document. The Word command ribbon plus the Table Tools ribbon help update the style, color, alignment and other layout elements.

Quick invoicing tips for teachersAdd a timesheet. Many teachers bill by the hour, so keeping an up-to-date timesheet can help you accurately track your billable hours.Include an expense report.Be clear about the payment due date.Accept a variety of payment methods.Personalize your invoices.

Add the client's contact information, including the student's name, address, email address and phone number. Create a unique invoice number and include the invoice date and payment due date. Include an itemized list of the services provided with brief descriptions. Add the hourly or flat rate.

Here's a detailed step-by-step guide to making an invoice from a Word template:Open a New Word Document.Choose Your Invoice Template.Download the Invoice Template.Customize Your Invoice Template.Save Your Invoice.Send Your Invoice.Open a New Blank Document.Create an Invoice Header.More items...?

Microsoft Word provides templates for invoice sheets that you customize to suit your business needs. Office features more than 100 online invoice templates that copy to a Word document. The Word command ribbon plus the Table Tools ribbon help update the style, color, alignment and other layout elements.

Yes, there is no cost, they're 100% free. All invoices from the template gallery are free for download and use.