Nevada Guaranty of a Lease

Description

How to fill out Guaranty Of A Lease?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords. You can obtain the latest form types, including the Nevada Guaranty of a Lease, in just a few minutes.

If you have a subscription, Log In and download the Nevada Guaranty of a Lease from the US Legal Forms catalog. The Download button will be available for every document you view. You have access to all previously saved forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form onto your device. Make edits. Fill out, modify, and print and sign the saved Nevada Guaranty of a Lease.

Every template you add to your account does not expire and is yours permanently. Therefore, if you want to download or print another copy, simply visit the My documents section and click on the document you wish to access.

Gain access to the Nevada Guaranty of a Lease with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific forms that fulfill your business or personal requirements and needs.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/state.

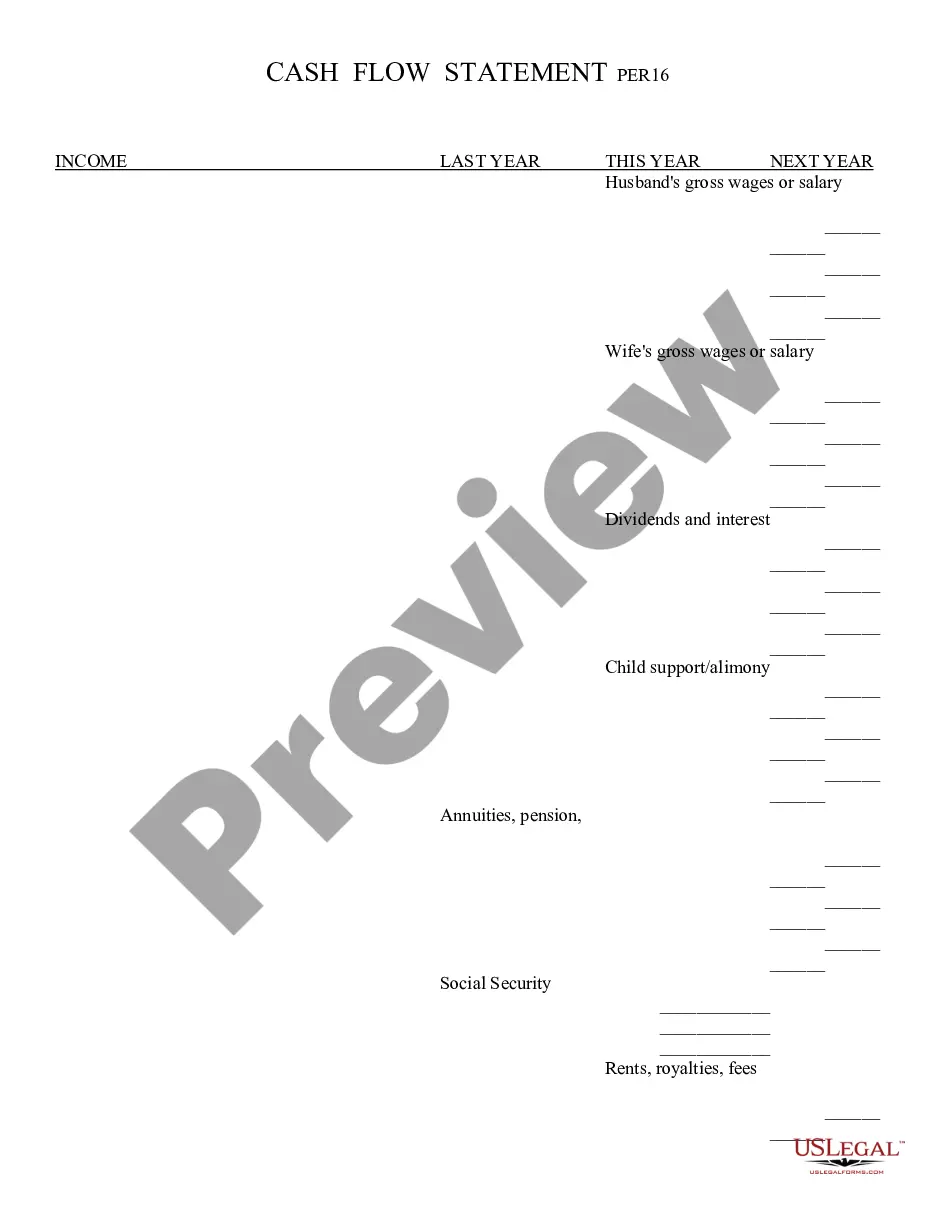

- Click the Preview button to review the content of the form.

- Read the form description to ensure you have chosen the right document.

- If the form does not meet your requirements, utilize the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking on the Get now button.

- Then, select your preferred pricing plan and provide your details to create an account.

Form popularity

FAQ

As a renter in Nevada, you have several rights, including the right to a safe and habitable living space, protection against discrimination, and a fair process in eviction. It's vital to familiarize yourself with local laws and the Nevada Guaranty of a Lease to protect your rights effectively. By being informed, you can advocate for yourself in any rental situation. If you need further clarification, consider utilizing legal resources to enhance your understanding.

Breaking up while sharing a signed lease can be challenging, but it's important to address it directly with your roommate or partner. Communication is key; discuss your feelings and consider how to part ways amicably. Understanding the Nevada Guaranty of a Lease can provide insights into your rights and obligations when one party wants to leave. You may also consult legal forms or advice to help manage the lease transition.

To terminate a lease early without penalty in Nevada, you must provide a legally valid reason, such as health issues, safety concerns, or other circumstances detailed in state law. Review your lease agreement for any clauses that may allow for early termination. Understanding the Nevada Guaranty of a Lease can help navigate this process effectively. If needed, legal resources like US Legal Forms can assist in formalizing your request.

After signing a lease in Nevada, the time frame to back out depends on the lease terms and applicable laws. Generally, if a tenant wishes to void the lease, they must act quickly and demonstrate a valid reason to avoid penalties. Being aware of the Nevada Guaranty of a Lease will help clarify your rights in this situation. It’s advisable to consult your lease and seek professional advice when considering this option.

The guaranty of a lease agreement is a provision that protects landlords by ensuring rental payments are covered even if the tenant defaults. This security mechanism often involves a third party, such as a guarantor, agreeing to take on financial responsibility. Understanding the Nevada Guaranty of a Lease is essential for both landlords and tenants when drafting their agreement. This helps establish clear expectations and enhances security for both parties.

Changing your mind after signing a rental lease is possible, but it requires following specific procedures. In Nevada, laws permit breaking a lease under certain conditions, such as being a victim of domestic violence or habitability issues. Familiarizing yourself with the Nevada Guaranty of a Lease can be valuable in understanding your position. Always communicate openly with your landlord to explore your options.

Yes, you can cancel a lease after signing, but the process can be complicated. In Nevada, you may need to provide a valid reason to break the lease, depending on the terms you agreed to. Consider consulting resources on the Nevada Guaranty of a Lease to understand your obligations and options. Additionally, negotiating with your landlord may provide a smoother exit.

To get approved for an apartment using a guarantor, provide your landlord with all required documents for both yourself and your guarantor. Communicate openly about your situation, particularly if you have limited credit history. The Nevada Guaranty of a Lease requires landlords to see financial security, so presenting clear documentation is crucial. Services like USLegalForms can aid you in ensuring that all forms and information are accurately completed for a smooth approval process.

A guarantor must often have a steady income, good credit history, and be legally able to enter into a contract. They typically should reside within the same state as the rental property to simplify legal processes. For a Nevada Guaranty of a Lease, understanding these requirements ensures you choose the right person to act as a guarantor. Resources such as those available on USLegalForms can help you identify suitable candidates based on these criteria.

To put a guarantor on a lease, first ensure the prospective guarantor meets the required financial criteria. Next, collect necessary documents and complete the lease guaranty form. Communicate clearly with the landlord about the intended guarantor's information, adhering to the guidelines of the Nevada Guaranty of a Lease. Using services like USLegalForms can provide templates and step-by-step guidance for this process.