This schedule is tailored for small businesses.

Nevada Balance Sheet Support Schedule - Inventory

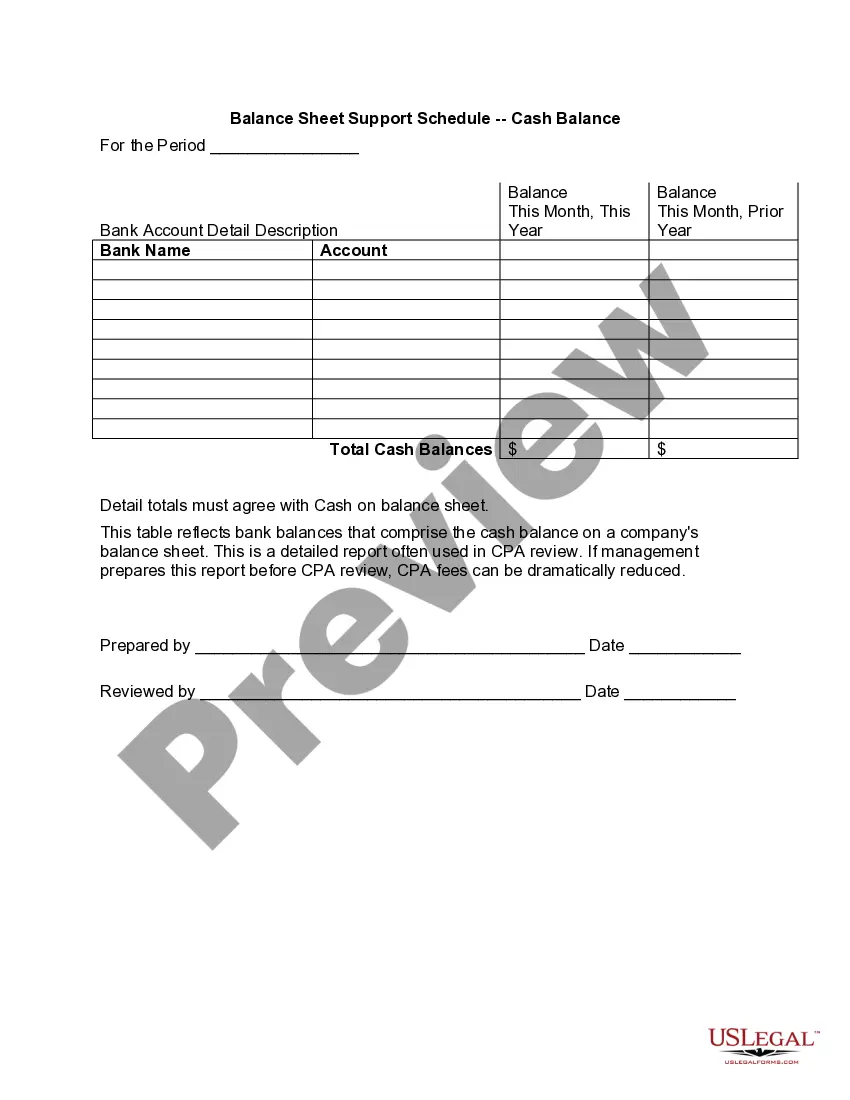

Description

How to fill out Balance Sheet Support Schedule - Inventory?

You can spend countless hours online trying to locate the legal document template that complies with the federal and state requirements you need.

US Legal Forms offers a vast array of legal templates that have been reviewed by experts.

You can download or print the Nevada Balance Sheet Support Schedule - Inventory from your support resources.

If available, utilize the Preview button to view the document template as well. If you would like to find another version of the form, use the Search field to locate the template that meets your needs and criteria.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the Nevada Balance Sheet Support Schedule - Inventory.

- Each legal document template you obtain is permanently yours.

- To get another copy of the acquired form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, verify that you have chosen the correct document template for your desired region/city.

- Review the form information to ensure you have selected the right one.

Form popularity

FAQ

Yes, renewal is required annually for your LLC in Nevada. This process involves filing your annual report, which may include details from the Nevada Balance Sheet Support Schedule - Inventory to ensure your financial standing is visible to the state. Staying on top of these renewals helps maintain your business in good standing.

To change the ownership of your LLC in Nevada, submit the appropriate forms to the Secretary of State. It may involve updating financial records related to ownership, such as the Nevada Balance Sheet Support Schedule - Inventory, to reflect the changes accurately. Keeping these documents current is vital for compliance.

Yes, Nevada has specific state tax forms that businesses must use for tax reporting purposes. Depending on your business structure, you might need to submit forms that relate to financial matters, including the Nevada Balance Sheet Support Schedule - Inventory. Check with the Nevada Department of Taxation for the latest forms.

Yes, you are required to file an annual report for your LLC in Nevada. This report is an important part of maintaining compliance and often includes the Nevada Balance Sheet Support Schedule - Inventory. Timely filing helps secure your LLC’s good standing with the state.

The fax number for the Secretary of State of Nevada is typically provided on their official website. Using this number can help you send essential documents related to your LLC, including forms associated with the Nevada Balance Sheet Support Schedule - Inventory. It’s best to verify the number before sending any documents.

You can contact the Nevada state business license office through their website or by calling their designated phone number. It’s advisable to have your business details handy, especially if you have questions relating to documents such as the Nevada Balance Sheet Support Schedule - Inventory. They are ready to assist you with your licensing needs.

To close your MBT account in Nevada, you must file the appropriate documentation with the Nevada Department of Taxation. Be sure to include any final filings, like the Nevada Balance Sheet Support Schedule - Inventory, to wrap up your business operations comprehensively. This ensures all obligations are settled before your account is closed.

The Nevada state number identifies your business entity within state records. This number is crucial for official documentation and matters such as the Nevada Balance Sheet Support Schedule - Inventory. You can find your state number on documents filed with the Secretary of State.

If you fail to file your annual report, the state may impose penalties or even revoke your LLC's status. This can lead to serious complications in managing your business, especially concerning financial documentation like the Nevada Balance Sheet Support Schedule - Inventory. Stay proactive to avoid these issues.

Yes, Nevada requires LLCs to file an annual report to maintain good standing. This report often includes a balance sheet and various financial details, which relate to the Nevada Balance Sheet Support Schedule - Inventory. Regular compliance helps ensure your business operates smoothly.