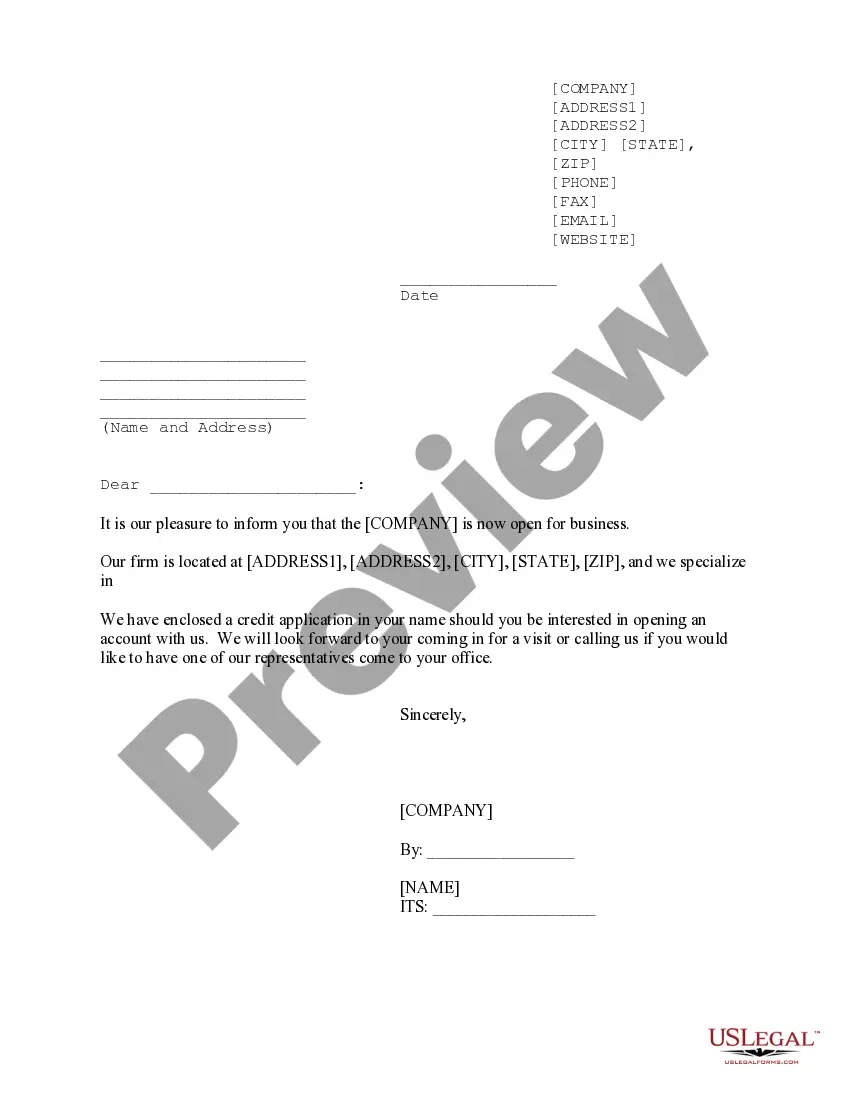

Nevada Sample Letter for New Business with Credit Application

Description

How to fill out Sample Letter For New Business With Credit Application?

Are you presently in a position where you need to have documents for potential corporate or personal activities almost every time.

There are numerous legitimate document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms provides a large selection of form templates, including the Nevada Sample Letter for New Business with Credit Application, which can be generated to satisfy state and federal regulations.

If you find the appropriate template, click Get now.

Select the pricing plan you want, complete the necessary details to create your account, and pay for your order using PayPal or a credit card. Choose a convenient document format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Nevada Sample Letter for New Business with Credit Application anytime if needed. Just select the necessary template to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and reduce errors. The service offers professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Nevada Sample Letter for New Business with Credit Application template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Obtain the template you require and ensure it is for the correct jurisdiction/area.

- Utilize the Review button to examine the document.

- Check the description to confirm that you have selected the correct template.

- If the template is not what you are searching for, use the Lookup field to find the template that meets your needs and specifications.

Form popularity

FAQ

Having a physical address is a requirement for forming an LLC in Nevada. However, this does not mean you must have an office in the state. Many entrepreneurs opt to use a registered agent with a local address, which meets legal requirements for service of process and mail handling. This solution provides a way to maintain compliance without incurring high overhead costs.

To file for an S Corp in Nevada, you must first establish your business as a corporation in the state. This includes registering your corporation and obtaining an Employer Identification Number (EIN). Additionally, you need to file Form 2553 with the IRS to elect S Corporation status. Utilizing resources like a Nevada Sample Letter for New Business with Credit Application can simplify your application process.

To start an LLC in a state where you do not live, begin by selecting a registered agent in that state. Next, research and comply with the state's formation requirements, which often involve filing articles of organization. You can also use our platform, US Legal Forms, to access a Nevada Sample Letter for New Business with Credit Application and streamline this process. This way, you can efficiently establish your LLC from a distance.

Opening an LLC in Nevada without residing there is entirely possible. Many business owners choose this route due to the advantages that Nevada offers, such as minimal taxes. By hiring a registered agent who has a physical address in the state, you can fulfill the legal requirements. This method allows you to take advantage of Nevada's business-friendly laws while managing your operations remotely.

Yes, you can form an LLC in Nevada even if you do not reside there. One of the appealing features of Nevada is its business-friendly environment, which includes options for non-residents. When setting up your LLC, you can utilize a registered agent based in Nevada to handle legal documents and notifications. This process supports entrepreneurs seeking to establish a presence in Nevada without relocating.

To write a credit letter step by step, start with a clear introduction stating the purpose of your letter. Follow with the necessary details, including the amount you seek and your business information. Ensure you conclude with a polite request for the credit amount and mention how your proposal can benefit the lender. For inspiration, you might consider a Nevada Sample Letter for New Business with Credit Application.

A credit application from a vendor is a request made by a business to establish a line of credit with a supplier. This document typically includes the business’s financial information, trade references, and credit terms. Understanding the details in a Nevada Sample Letter for New Business with Credit Application can help streamline your application process with vendors.

To write a credit letter explanation, start by addressing the specific issue and providing context. Clearly outline any discrepancies or reasons for missed payments, and be honest about your situation. Using a Nevada Sample Letter for New Business with Credit Application can aid in ensuring your explanation is clear and professionally presented.

A letter of credit for a new business is a guarantee from a bank that the business will fulfill its financial obligations. It assures suppliers of payment, reducing the risk in transactions. This document is vital for building credibility, and you can refer to a Nevada Sample Letter for New Business with Credit Application for guidance on how to structure such letters.

Writing a credit application involves providing comprehensive business information and financial details. Clearly express your business needs and why you seek credit. Organizing this information in a structured format, such as a Nevada Sample Letter for New Business with Credit Application, can enhance clarity and present your case effectively to creditors.