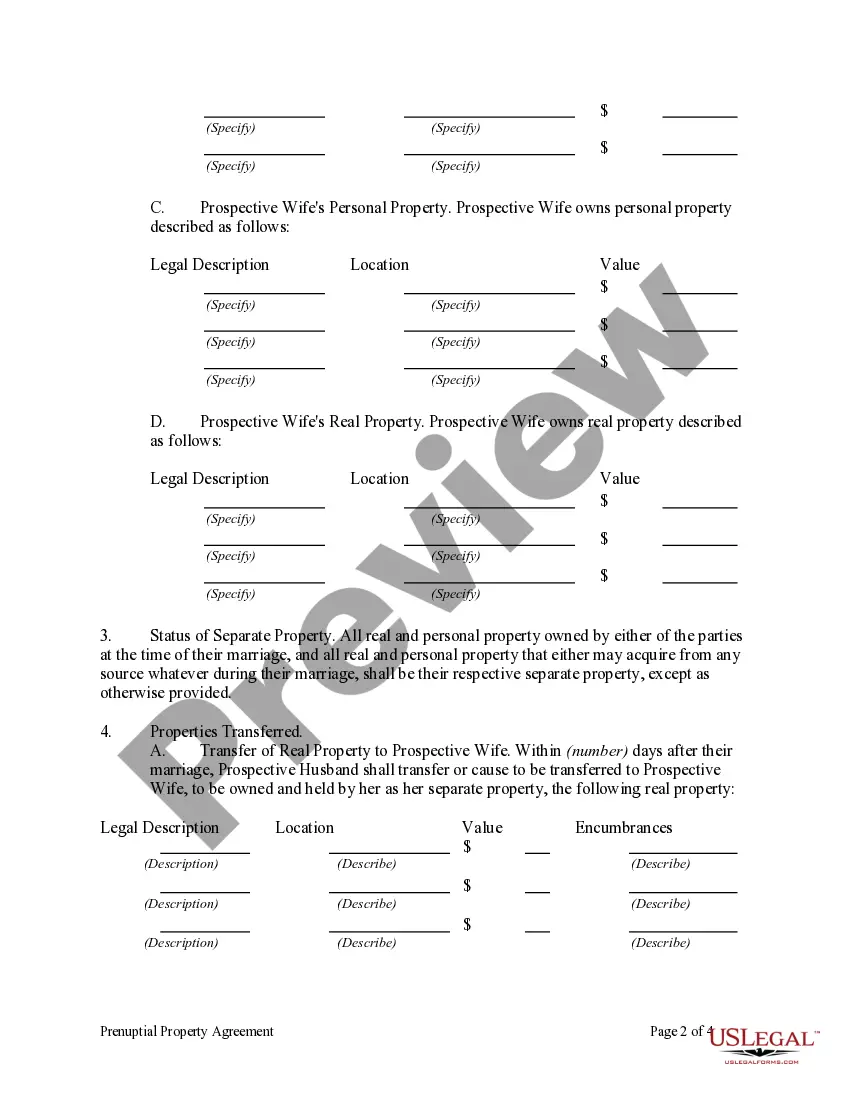

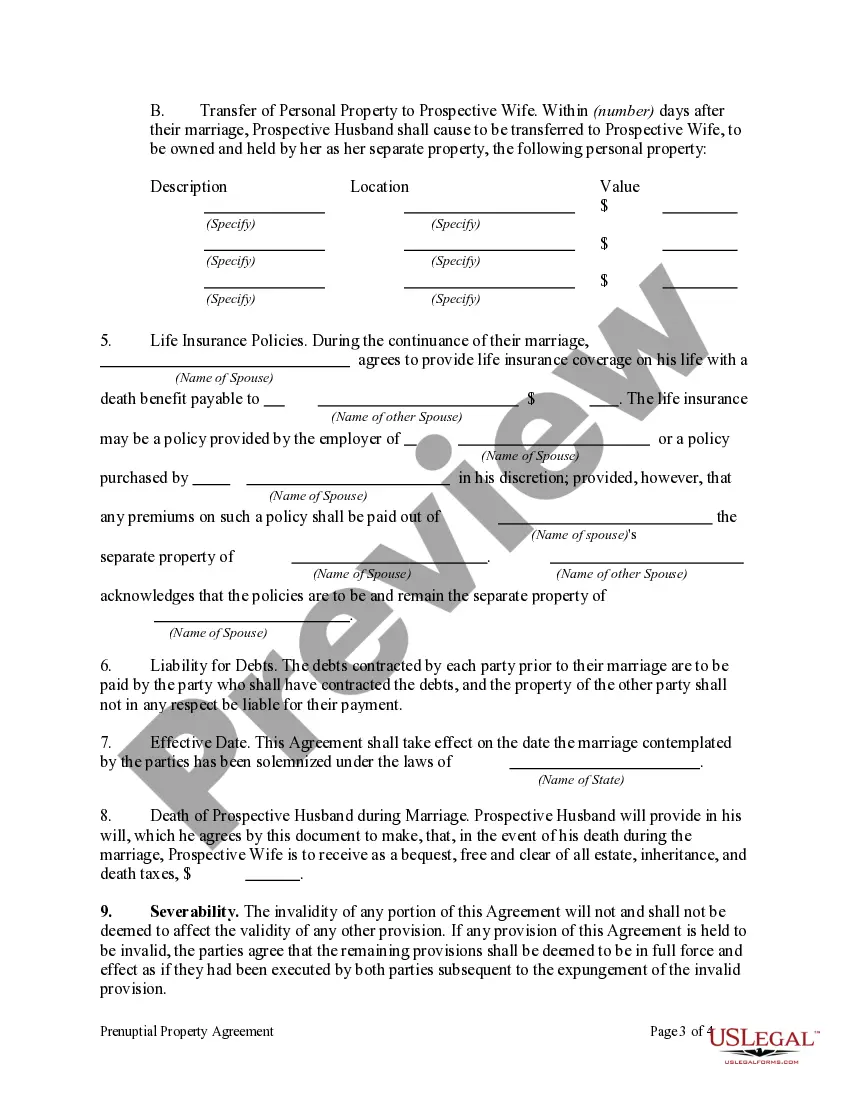

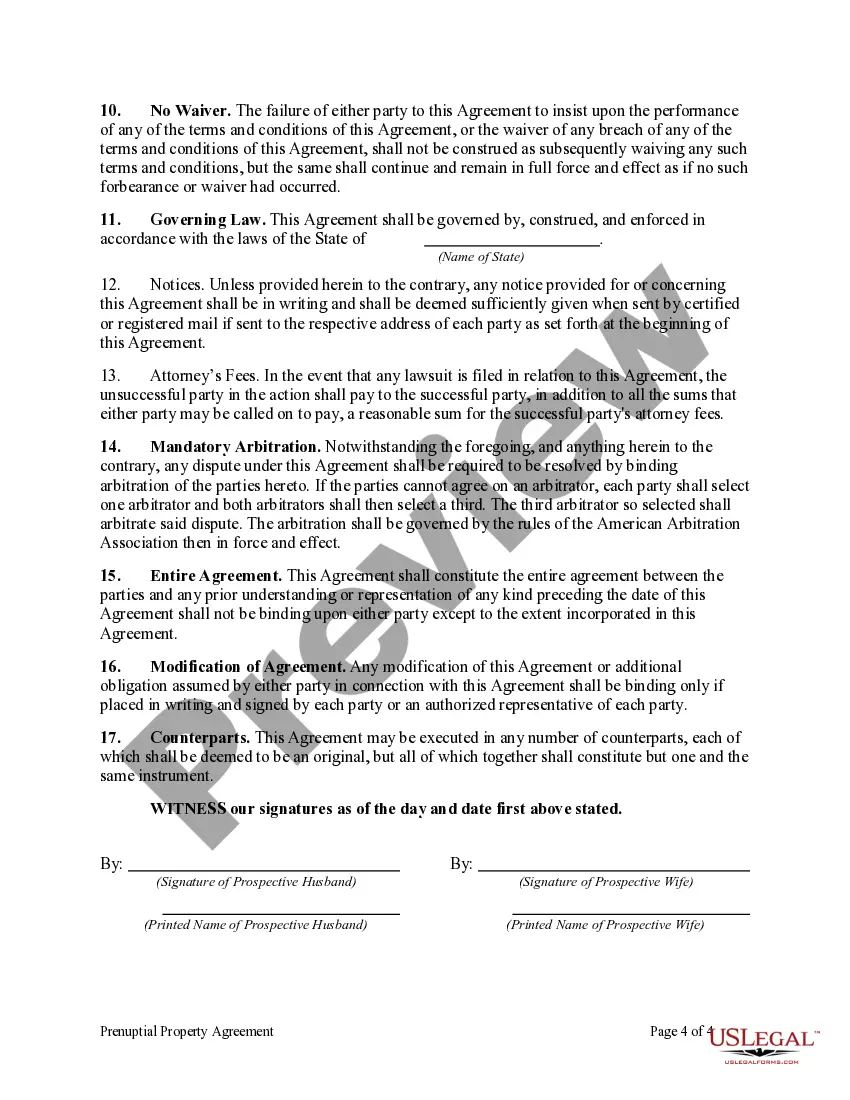

A Nevada Prenuptial Property Agreement, commonly known as a prenuptial agreement or "prenup," is a legally binding contract entered into by a couple before their marriage or civil union. This agreement outlines each spouse's rights and responsibilities regarding the division of assets, debts, and other financial matters in the event of a divorce, separation, or death. Nevada, like many other states, recognizes and enforces prenuptial agreements as long as they meet certain legal requirements. To ensure the validity of a Nevada Prenuptial Property Agreement, it must be in writing, signed by both parties, and agreed upon without coercion, fraud, or overreaching. It should also provide a full and fair disclosure of each party's assets, liabilities, and income. There are different types of Nevada Prenuptial Property Agreements that couples can consider based on their specific needs: 1. Traditional Prenuptial Property Agreement: This is the most common form of prenup, which establishes how the couple's assets, income, and debts will be divided in the event of divorce or separation. It often addresses issues related to spousal support, property division, and the distribution of assets acquired during the marriage. 2. Financial Protection Prenuptial Property Agreement: This type focuses on protecting one or both spouses' premarital assets, inheritances, or family businesses from being subject to division or distribution in the event of divorce. It helps safeguard individual financial interests and ensures that certain assets remain separate property. 3. Estate Planning Prenuptial Property Agreement: This variation of a prenup is designed to govern the distribution of property and assets upon the death of one spouse. It can address matters related to estate planning, including the distribution of assets, life insurance policies, and retirement benefits to protect both spouses' intended beneficiaries. 4. Postnuptial Property Agreement: Although not technically a prenuptial agreement since it is entered into after marriage, a postnuptial property agreement serves a similar purpose. It allows couples to establish rules for property division, financial obligations, and support in the case of a divorce or separation. Ultimately, a Nevada Prenuptial Property Agreement can offer peace of mind and provide a clear framework for handling financial matters in the future. Couples should consult with experienced family law attorneys to understand the legal implications, ensure compliance with Nevada state laws, and tailor the agreement to their unique circumstances.

Nevada Prenuptial Property Agreement

Description

How to fill out Nevada Prenuptial Property Agreement?

If you want to total, obtain, or print lawful record web templates, use US Legal Forms, the most important variety of lawful forms, that can be found on-line. Utilize the site`s basic and hassle-free lookup to find the paperwork you require. Various web templates for enterprise and personal purposes are sorted by groups and says, or keywords and phrases. Use US Legal Forms to find the Nevada Prenuptial Property Agreement in just a number of mouse clicks.

When you are presently a US Legal Forms consumer, log in to your profile and click on the Obtain button to have the Nevada Prenuptial Property Agreement. Also you can access forms you previously acquired within the My Forms tab of your respective profile.

Should you use US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape to the appropriate town/country.

- Step 2. Make use of the Review choice to look over the form`s articles. Don`t neglect to read through the explanation.

- Step 3. When you are not happy with all the kind, utilize the Look for industry towards the top of the screen to get other models of the lawful kind template.

- Step 4. When you have discovered the shape you require, go through the Get now button. Pick the pricing program you choose and include your credentials to register for an profile.

- Step 5. Procedure the purchase. You should use your credit card or PayPal profile to finish the purchase.

- Step 6. Pick the structure of the lawful kind and obtain it on your product.

- Step 7. Total, change and print or indicator the Nevada Prenuptial Property Agreement.

Each lawful record template you buy is your own forever. You might have acces to each kind you acquired with your acccount. Select the My Forms portion and select a kind to print or obtain yet again.

Compete and obtain, and print the Nevada Prenuptial Property Agreement with US Legal Forms. There are millions of professional and express-certain forms you can use for the enterprise or personal requirements.