Nevada Agreement for Consulting Services

Description

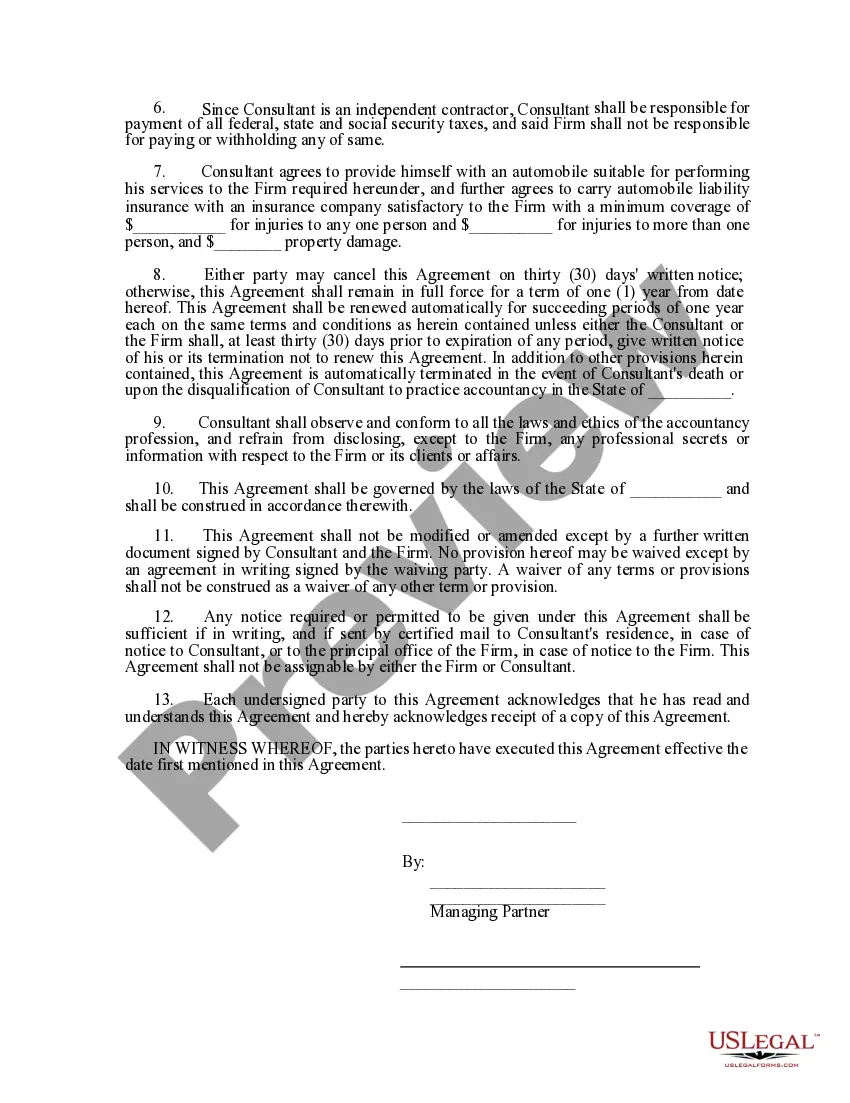

How to fill out Agreement For Consulting Services?

US Legal Forms - one of the largest collections of legal forms in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for both business and personal use, sorted by categories, states, or keywords. You can find the latest versions of forms such as the Nevada Agreement for Consulting Services within moments.

If you currently hold a monthly membership, Log In and download the Nevada Agreement for Consulting Services from your US Legal Forms library. The Download button will appear on each form you view. You have access to all previously downloaded forms in the My documents section of your account.

- Ensure you have chosen the correct form for your city/state.

- Click the Review button to examine the form's details.

- Read the form description to confirm you have selected the appropriate form.

- If the form does not meet your needs, utilize the Search box at the top of the screen to find the one that does.

- When satisfied with the form, confirm your choice by clicking the Purchase now button.

- Select your preferred pricing plan and provide your information to register for the account.

Form popularity

FAQ

To write a simple consulting agreement, begin by introducing the parties and outlining the services to be rendered. Clearly articulate the payment structure, deadlines, and any confidentiality requirements. This clarity protects both the consultant and the client. Leveraging a Nevada Agreement for Consulting Services can make this process more efficient and legally sound.

Writing a simple contract agreement starts with clear identification of the parties involved and the specific terms of agreement. Ensure you define the services provided, payment options, and timelines. Keeping it straightforward helps prevent misunderstandings. When drafting a Nevada Agreement for Consulting Services, clear terms can minimize potential disputes.

To write a simple consulting contract, begin by identifying the parties and providing a description of the consulting services. Outline payment terms and deadlines for deliverables. Be sure to include any necessary clauses regarding confidentiality and termination of the agreement. A Nevada Agreement for Consulting Services can serve as a great template, helping you cover all essential elements.

Filling out a contractor agreement involves providing detailed information about the contractor, the services they will deliver, and how they will be compensated. Make sure to include timelines, deliverables, and the legal rights of both parties. Reviewing the agreement ensures it reflects your intentions properly. You can create or utilize a Nevada Agreement for Consulting Services to streamline this process.

To write a simple service agreement, start with the title and date, followed by the identification of the parties involved. Clearly state the services to be provided, payment methods, and any timeframes associated with the services. Next, include clauses for confidentiality and termination. Using a Nevada Agreement for Consulting Services template can guide you in creating a professional document easily.

A consulting services agreement is a legal document that establishes the relationship between a consultant and a client. It outlines the specifics of the consulting services offered, payment terms, and other relevant conditions. This document protects both parties by clearly defining expectations. Utilizing a Nevada Agreement for Consulting Services ensures adherence to local regulations and legal standards.

To fill out a service agreement, first gather necessary details like the parties' names, services offered, and payment terms. You should then clearly define the scope of work, deadlines, and any special conditions. Make sure to review the document for accuracy before finalizing. A Nevada Agreement for Consulting Services can simplify this process and ensure compliance with state laws.

A consulting agreement and a contract serve similar purposes but differ in their structure. A consulting agreement specifically outlines the terms between a consultant and their client, focusing on the consulting services provided. In contrast, a contract can refer to a broader range of legal agreements. When working on a Nevada Agreement for Consulting Services, it is vital to ensure clarity in the scope and expectations.

To protect yourself as a consultant, always use a formal agreement, such as a Nevada Agreement for Consulting Services. This document should outline your responsibilities, payment structure, and dispute resolution procedures. It is also wise to maintain clear communication with your clients and keep records of all interactions.

Setting up a consulting agreement involves defining your services, payment terms, and project timelines. Use a Nevada Agreement for Consulting Services template to streamline the process, ensuring all critical components are covered. Remember to have both parties review and sign the agreement before starting any work.