Title: Nevada Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock: A Comprehensive Overview Keywords: Nevada Agreement to Incorporate, S Corp, Small Business Corporation, Section 1244 Stock, Qualification Introduction: In Nevada, entrepreneurs have the opportunity to establish their businesses as S Corporations (S Corps) and Small Business Corporations (SBS) with qualification for Section 1244 Stock. This article will provide a detailed description of the Nevada Agreement to Incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock, shedding light on the different types of agreements relevant to this topic. 1. Nevada Agreement to Incorporate as an S Corp: The Nevada Agreement to Incorporate as an S Corp involves forming a corporation that elects to be treated as an S Corporation for tax purposes. The S Corp status allows for pass-through taxation, eliminating the need for double taxation (once at the corporate level and once at the individual level). This type of agreement offers limited liability protection to its shareholders and restricts the corporation to complying with specific ownership and shareholder requirements. 2. Nevada Agreement to Incorporate as a Small Business Corporation: The Nevada Agreement to Incorporate as a Small Business Corporation enables entrepreneurs to establish SBS tailored to the needs of small businesses. These corporations provide legal and financial advantages, including the flexibility of ownership, simplified tax filing, and potential tax benefits. The SBC structure could be ideal for businesses that meet the eligibility criteria and can benefit from tax incentives without the limitations imposed on traditional S Corps. 3. Qualification for Section 1244 Stock: Section 1244 of the Internal Revenue Code (IRC) provides tax advantages to investors who acquire stock in small businesses that later suffer losses. The Qualification for Section 1244 Stock involves meeting specific requirements set forth by the regulations to take advantage of these tax benefits. By qualifying, shareholders are allowed to treat ordinary losses (up to the specified limit) resulting from the sale or liquidation of the Section 1244 stock as ordinary deductions on their income tax returns. Different Types of Agreements: a) Nevada Agreement to Incorporate as an S Corp with Section 1244 Stock Qualification: This agreement combines the benefits of incorporating as an S Corp with the additional advantage of potentially qualifying for Section 1244 Stock benefits. This type of incorporation allows shareholders to have greater flexibility and potentially mitigate tax liabilities in the event of losses. b) Nevada Agreement to Incorporate as a Small Business Corporation with Section 1244 Stock Qualification: This agreement caters specifically to small businesses seeking the advantages of a Small Business Corporation structure, while also aiming to qualify for Section 1244 Stock tax benefits. By incorporating as an SBC and meeting the Section 1244 requirements, entrepreneurs can potentially enhance their ability to offset losses against ordinary income. Conclusion: When starting a business in Nevada, entrepreneurs have the option to incorporate as an S Corp, Small Business Corporation, or both, while qualifying for Section 1244 Stock benefits. Each type of agreement offers unique advantages and considerations. It is crucial to seek professional advice and carefully assess the eligibility criteria and ongoing obligations to determine the most suitable incorporation structure for your small business.

Nevada Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock

Description

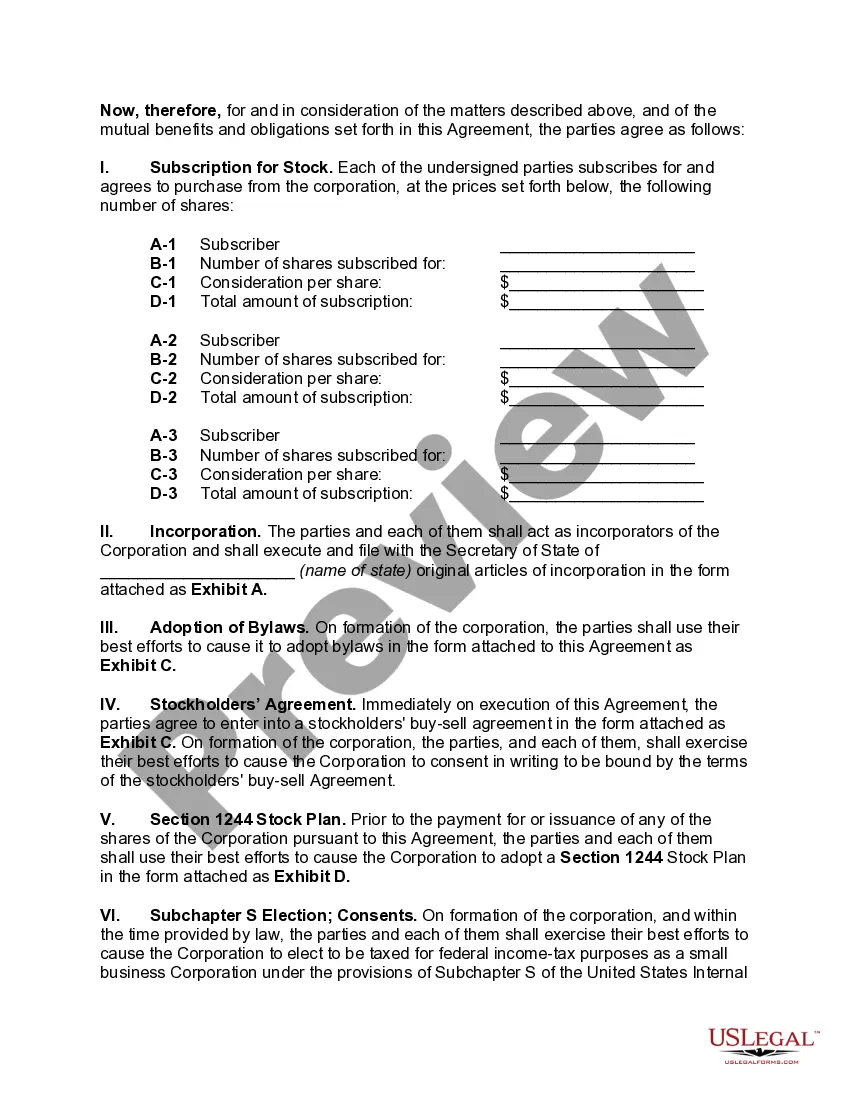

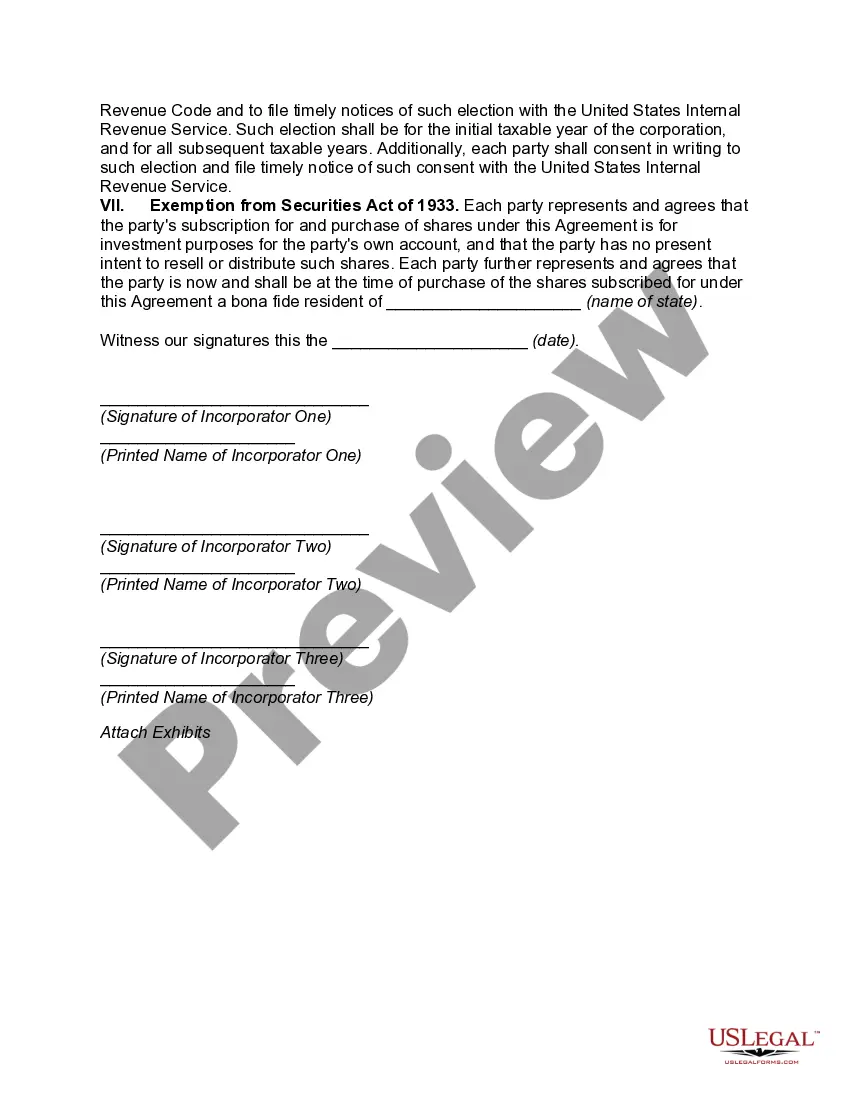

How to fill out Nevada Agreement To Incorporate As An S Corp And As Small Business Corporation With Qualification For Section 1244 Stock?

Are you presently within a situation that you need papers for either business or specific reasons nearly every day? There are a variety of legitimate file themes available online, but finding ones you can depend on isn`t easy. US Legal Forms gives thousands of type themes, just like the Nevada Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock, which can be published to fulfill state and federal demands.

When you are presently acquainted with US Legal Forms web site and also have your account, merely log in. After that, it is possible to obtain the Nevada Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock web template.

Should you not provide an accounts and want to begin using US Legal Forms, follow these steps:

- Discover the type you require and ensure it is for that appropriate area/region.

- Make use of the Preview option to check the form.

- Read the outline to actually have selected the correct type.

- When the type isn`t what you`re trying to find, use the Research area to obtain the type that fits your needs and demands.

- Once you find the appropriate type, just click Purchase now.

- Pick the costs prepare you desire, fill out the desired details to make your bank account, and pay money for an order making use of your PayPal or credit card.

- Decide on a practical data file formatting and obtain your version.

Discover every one of the file themes you have purchased in the My Forms food list. You can aquire a further version of Nevada Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock at any time, if needed. Just select the required type to obtain or produce the file web template.

Use US Legal Forms, the most considerable variety of legitimate varieties, in order to save time and steer clear of mistakes. The service gives appropriately created legitimate file themes that you can use for an array of reasons. Make your account on US Legal Forms and initiate creating your lifestyle easier.

Form popularity

FAQ

S corporations as small business corporations. S corporations can issue Section 1244 stock.

Qualifying for Section 1244 StockThe shareholder must have purchased the stock and not received it as compensation. Only individual shareholders who purchase the stock directly from the company qualify for the special tax treatment. A majority of the corporation's revenues must come directly from operations.

1244 stock is available only to individuals and partners in partnerships. The ruling held that if IRC Sec. 1244 stock is issued to S corporations, such corporations and their shareholders may not treat losses on such stock as ordinary losses. This is so notwithstanding IRC Sec.

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of

1244(b)). Any loss in excess of the limit is a capital loss, subject to the capital loss rules. Thus, if the potential loss exceeds the $50,000 (or $100,000) limit, the stock should be disposed of in more than one year to maximize the ordinary loss treatment.

Section 1244 of the Internal Revenue Code allows eligible shareholders of domestic small business corporations to deduct a loss on the disposal of such stock as an ordinary loss rather than a capital loss. Eligible investors include individuals, partnerships and LLCs taxed as partnerships.

Qualifying for Section 1244 StockThe stock must be issued by U.S. corporations and can be either a common or preferred stock.The corporation's aggregate capital must not have exceeded $1 million when the stock was issued and the corporation cannot derive more than 50% of its income from passive investments.More items...

1244 stock is issued to S corporations, such corporations and their shareholders may not treat losses on such stock as ordinary losses. This is so notwithstanding IRC Sec. 1363, which provides that the taxable income of an S corporation must be computed in the same manner as that of an individual.