Nevada Self-Assessment Worksheet

Category:

State:

Multi-State

Control #:

US-04029BG

Format:

Word;

Rich Text

Instant download

Description

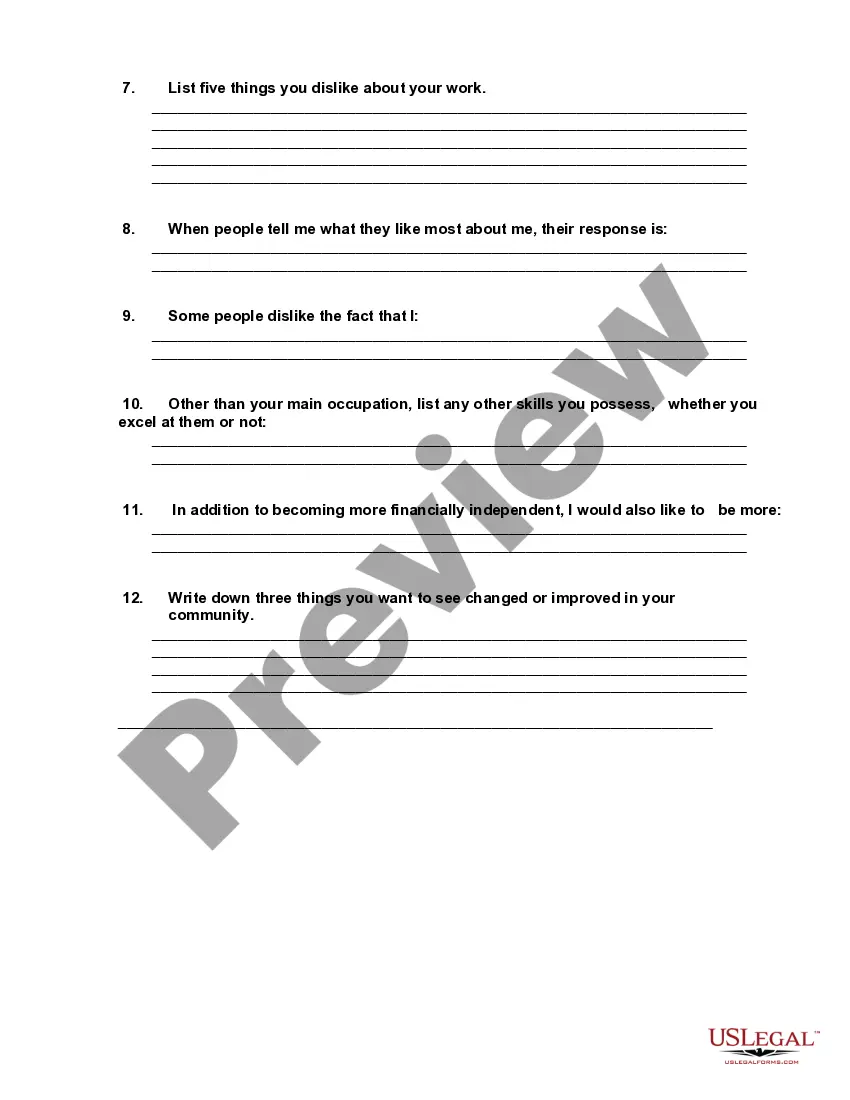

Complete the following self-assessment work sheet as honestly as you can. Just write down whatever comes to mind; don't over-think the exercise. Most likely, your first response will be your best. Once you've finished the exercises, look for patterns (i.e., is there a need for a business doing one of the things you like or are good at?)

Free preview

How to fill out Self-Assessment Worksheet?

You can invest hours online trying to locate the appropriate legal document template that meets the state and federal regulations you require.

US Legal Forms offers thousands of legal templates that are reviewed by experts.

You can download or print the Nevada Self-Assessment Worksheet from my services.

If available, take advantage of the Preview button to view the document template as well. If you want to find another version of the form, utilize the Search section to find the template that suits your needs and requirements.

- If you already have a US Legal Forms account, you may Log In and then click the Download button.

- Next, you can fill out, modify, print, or sign the Nevada Self-Assessment Worksheet.

- Every legal document template you purchase becomes yours permanently.

- To obtain an additional copy of the acquired form, visit the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Review the form description to confirm that you have chosen the appropriate form.