A buy-sell agreement is an agreement between the owners of the business for purchase of each others interest in the business. Such an agreement will spell out the terms governing sale of company stock to an outsider and thus protect control of the company. It can be triggered in the event of the owner's death, disability, retirement, withdrawal from the business or other events. Life insurance owned by the corporation is often used to provide the funds to purchase the shares of a closely held company if one of the owners dies.

The time to prevent disputes is before they occur. Experience proves that owners anxieties created in dealing with one another are inversely proportional to the effort they spend addressing business problems in the event that they should happen. Dealing with these contingencies before they manifest themselves is the secret to a harmonious business relationship with other owners, Use the checklist below to determine areas where you may need assistance.

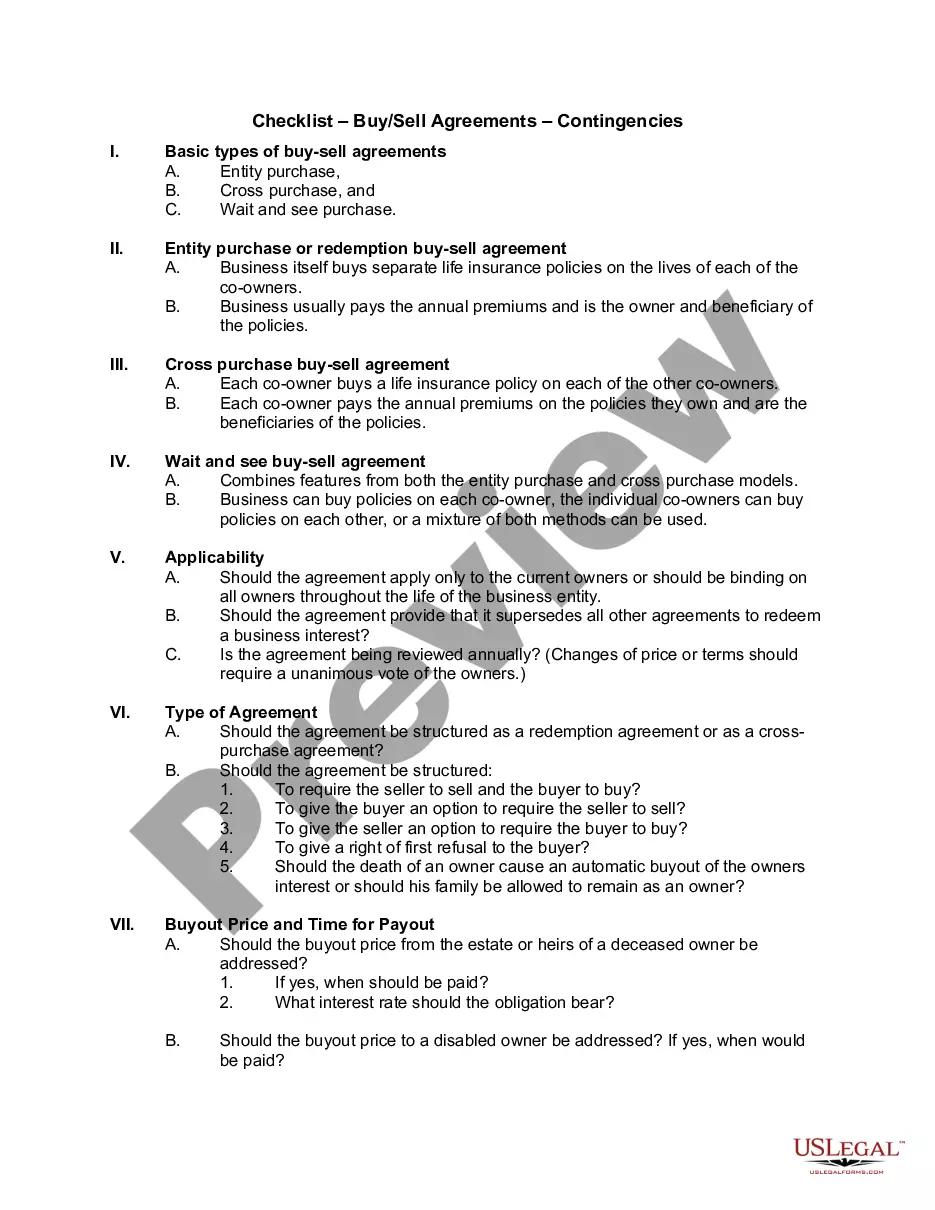

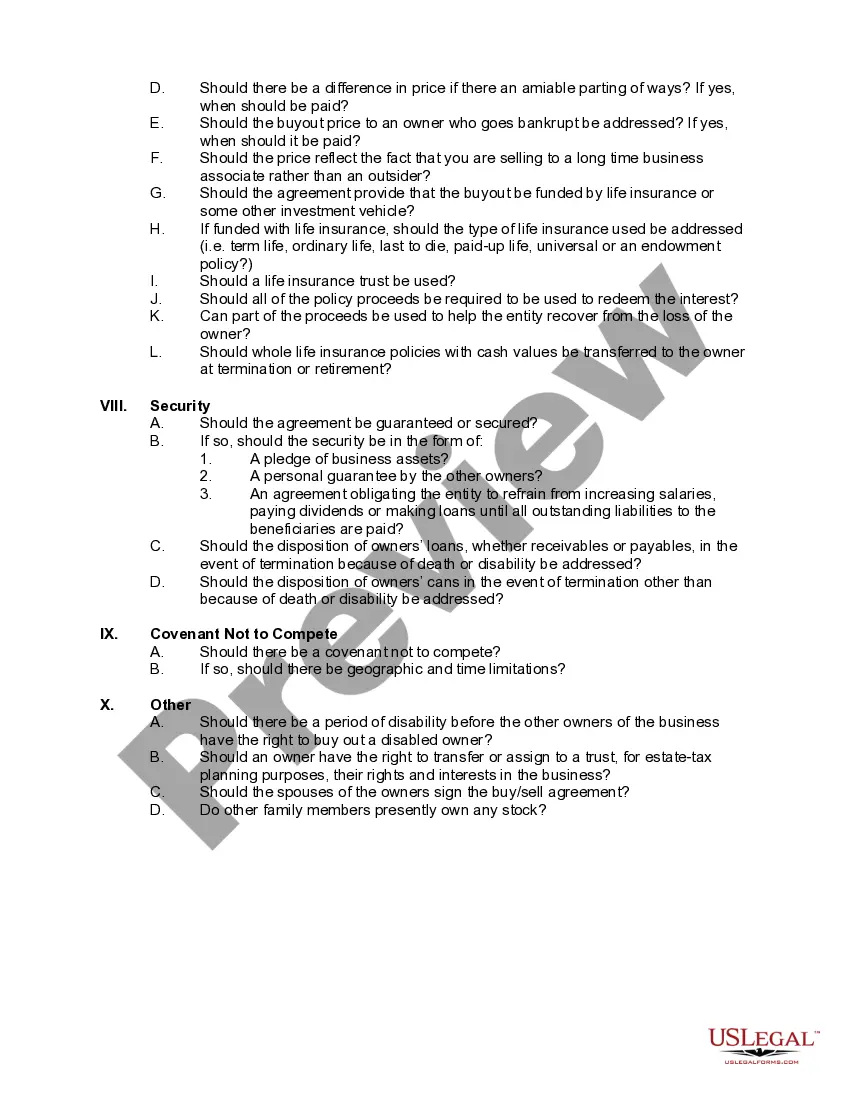

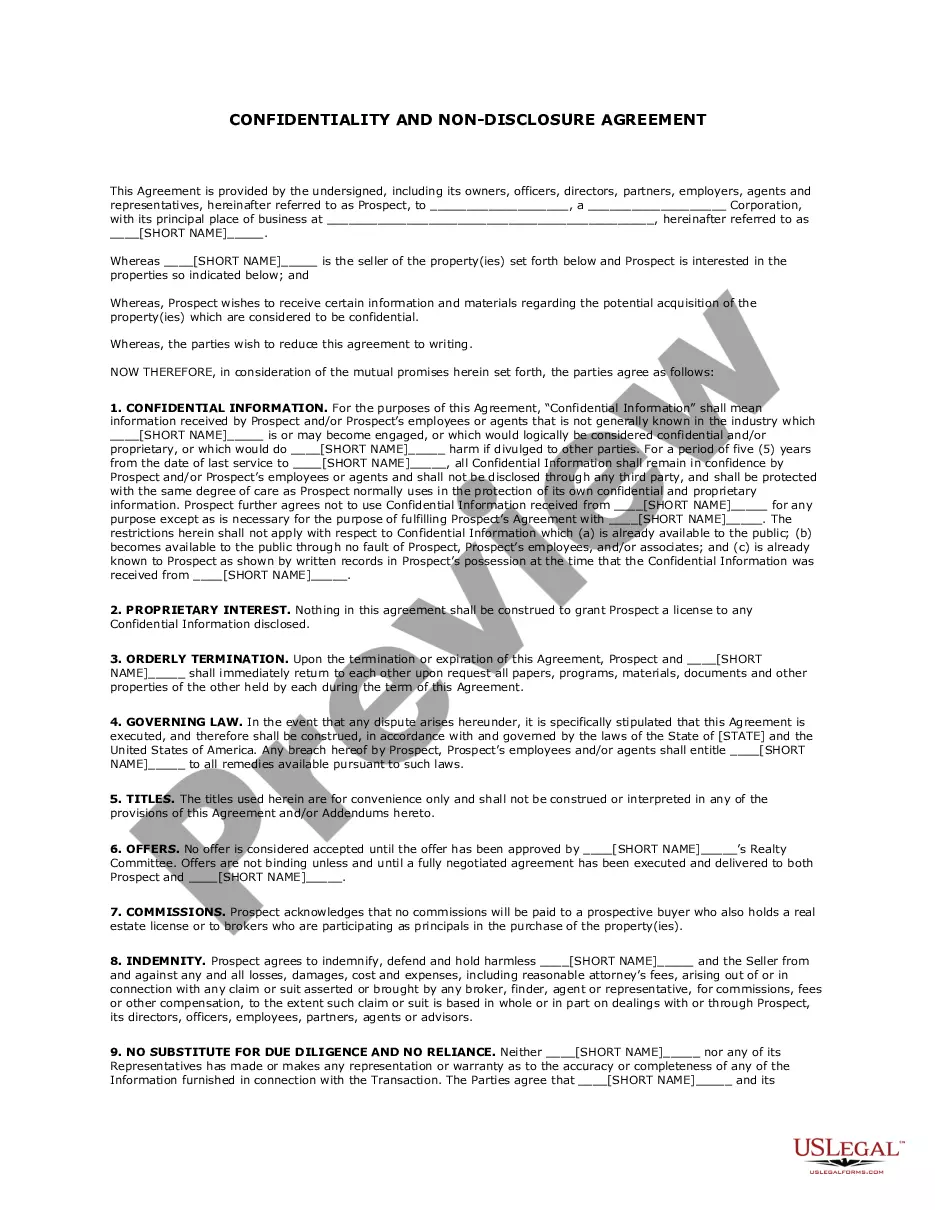

Nevada Checklist — Buy/Sell Agreement— - Contingencies: A Comprehensive Guide for Buyers or Sellers When engaging in a buy/sell agreement in Nevada, it is crucial to understand the importance of including contingencies, which are provisions established to address potential unforeseen circumstances that may arise during the transaction process. Contingencies play a significant role in protecting both buyers and sellers, ensuring that their interests are safeguarded throughout the agreement. This detailed description will explore the key components of a Nevada Checklist for Buy/Sell Agreements with a focus on contingencies. Types of Contingencies: 1. Financing Contingency: One of the most common contingencies in a buy/sell agreement, the financing contingency provides protection for the buyer. It ensures that the buyer has the necessary time to secure adequate funding to complete the purchase successfully. If the buyer fails to obtain financing within the specified timeframe, this contingency allows them to back out of the agreement without any financial consequences. 2. Appraisal Contingency: This contingency is designed to protect both the buyer and the seller. It provides a safeguard in case the appraised value of the property is significantly different from the agreed-upon purchase price. If the appraisal comes in lower than expected, the buyer may choose to renegotiate the price or terminate the agreement. 3. Inspection Contingency: Aimed at protecting the buyer's interests, the inspection contingency provides an opportunity for the buyer to conduct a thorough examination of the property. Inspections may include a general inspection, termite inspection, or any other necessary assessments. If issues are identified that the buyer finds unacceptable, they can request repairs or potentially terminate the agreement. 4. Title Contingency: The title contingency ensures the buyer receives clear and marketable title to the property. This contingency allows the buyer to investigate any potential title issues, such as liens, easements, or encroachments, and request corrections or terminate the agreement if any unresolved issues arise. 5. Home Sale Contingency: In situations where a buyer needs to sell their current residence to finance the purchase, a home sale contingency becomes pivotal. This contingency makes the final agreement conditional upon the successful sale of the buyer's existing property within a specific timeframe. Steps for Including Contingencies in a Nevada Buy/Sell Agreement: 1. Consult with an Attorney or Realtor: Seeking expert advice from a real estate attorney or a skilled realtor familiar with Nevada laws is crucial to ensure that your buy/sell agreement is comprehensive and legally binding. 2. Identify Appropriate Contingencies: Tailor the contingencies according to your specific needs. Consider the type of property, financing options, and personal circumstances to determine which contingencies are relevant in your situation. 3. Specify Timeframes: Clearly define the timeframe for fulfillment of each contingency. This allows enough time for the necessary inspections, financing approvals, and other assessments to be conducted. 4. Include Contingency Release Clauses: To ensure transparency and avoid disputes, include contingency release clauses that outline the conditions for releasing contingencies. This allows all parties involved to be aware of the progress and obligations throughout the transaction. 5. Review and Negotiate: Thoroughly review the buy/sell agreement with all contingencies included and negotiate any necessary modifications or changes to protect your interests effectively. In summary, when embarking on a buy/sell agreement in Nevada, incorporating appropriate contingencies is essential to mitigate risks for both buyers and sellers. By including contingencies such as financing, appraisal, inspection, title, and home sale contingencies, individuals can ensure a smooth and secure transaction process. Consulting with professionals and following a comprehensive Nevada Checklist for Buy/Sell Agreements enables buyers and sellers to navigate the complex real estate market with confidence.Nevada Checklist — Buy/Sell Agreement— - Contingencies: A Comprehensive Guide for Buyers or Sellers When engaging in a buy/sell agreement in Nevada, it is crucial to understand the importance of including contingencies, which are provisions established to address potential unforeseen circumstances that may arise during the transaction process. Contingencies play a significant role in protecting both buyers and sellers, ensuring that their interests are safeguarded throughout the agreement. This detailed description will explore the key components of a Nevada Checklist for Buy/Sell Agreements with a focus on contingencies. Types of Contingencies: 1. Financing Contingency: One of the most common contingencies in a buy/sell agreement, the financing contingency provides protection for the buyer. It ensures that the buyer has the necessary time to secure adequate funding to complete the purchase successfully. If the buyer fails to obtain financing within the specified timeframe, this contingency allows them to back out of the agreement without any financial consequences. 2. Appraisal Contingency: This contingency is designed to protect both the buyer and the seller. It provides a safeguard in case the appraised value of the property is significantly different from the agreed-upon purchase price. If the appraisal comes in lower than expected, the buyer may choose to renegotiate the price or terminate the agreement. 3. Inspection Contingency: Aimed at protecting the buyer's interests, the inspection contingency provides an opportunity for the buyer to conduct a thorough examination of the property. Inspections may include a general inspection, termite inspection, or any other necessary assessments. If issues are identified that the buyer finds unacceptable, they can request repairs or potentially terminate the agreement. 4. Title Contingency: The title contingency ensures the buyer receives clear and marketable title to the property. This contingency allows the buyer to investigate any potential title issues, such as liens, easements, or encroachments, and request corrections or terminate the agreement if any unresolved issues arise. 5. Home Sale Contingency: In situations where a buyer needs to sell their current residence to finance the purchase, a home sale contingency becomes pivotal. This contingency makes the final agreement conditional upon the successful sale of the buyer's existing property within a specific timeframe. Steps for Including Contingencies in a Nevada Buy/Sell Agreement: 1. Consult with an Attorney or Realtor: Seeking expert advice from a real estate attorney or a skilled realtor familiar with Nevada laws is crucial to ensure that your buy/sell agreement is comprehensive and legally binding. 2. Identify Appropriate Contingencies: Tailor the contingencies according to your specific needs. Consider the type of property, financing options, and personal circumstances to determine which contingencies are relevant in your situation. 3. Specify Timeframes: Clearly define the timeframe for fulfillment of each contingency. This allows enough time for the necessary inspections, financing approvals, and other assessments to be conducted. 4. Include Contingency Release Clauses: To ensure transparency and avoid disputes, include contingency release clauses that outline the conditions for releasing contingencies. This allows all parties involved to be aware of the progress and obligations throughout the transaction. 5. Review and Negotiate: Thoroughly review the buy/sell agreement with all contingencies included and negotiate any necessary modifications or changes to protect your interests effectively. In summary, when embarking on a buy/sell agreement in Nevada, incorporating appropriate contingencies is essential to mitigate risks for both buyers and sellers. By including contingencies such as financing, appraisal, inspection, title, and home sale contingencies, individuals can ensure a smooth and secure transaction process. Consulting with professionals and following a comprehensive Nevada Checklist for Buy/Sell Agreements enables buyers and sellers to navigate the complex real estate market with confidence.