The Limited Liability Partnership (LLP) is an alternative to the limited liability company (LLC). As with the limited liability company, the limited liability partnership provides a method of insulating partners from personal liability for acts of other partners.

A limited liability partnership is a general partnership that elects to be treated as an LLP by registering with the Secretary of State. Many attorneys and accountants choose the LLP structure since it shields the partners from vicarious liability, can operate more informally and flexibly than a corporation, and is accorded full partnership tax treatment. In a general partnership, individual partners are liable for the partnership's debts and obligations whereas the partners in a limited liability partnership are statutorily provided full-shield protection from partnership liabilities, debts and obligations. It allows the members of the LLP to take an active role in the business of the partnership, without exposing them to personal liability for others' acts except to the extent of their investment in the LLP. Many law and accounting firms now operate as LLPs. In some states, with certain exceptions, the LLP is only available to attorneys and accountants.

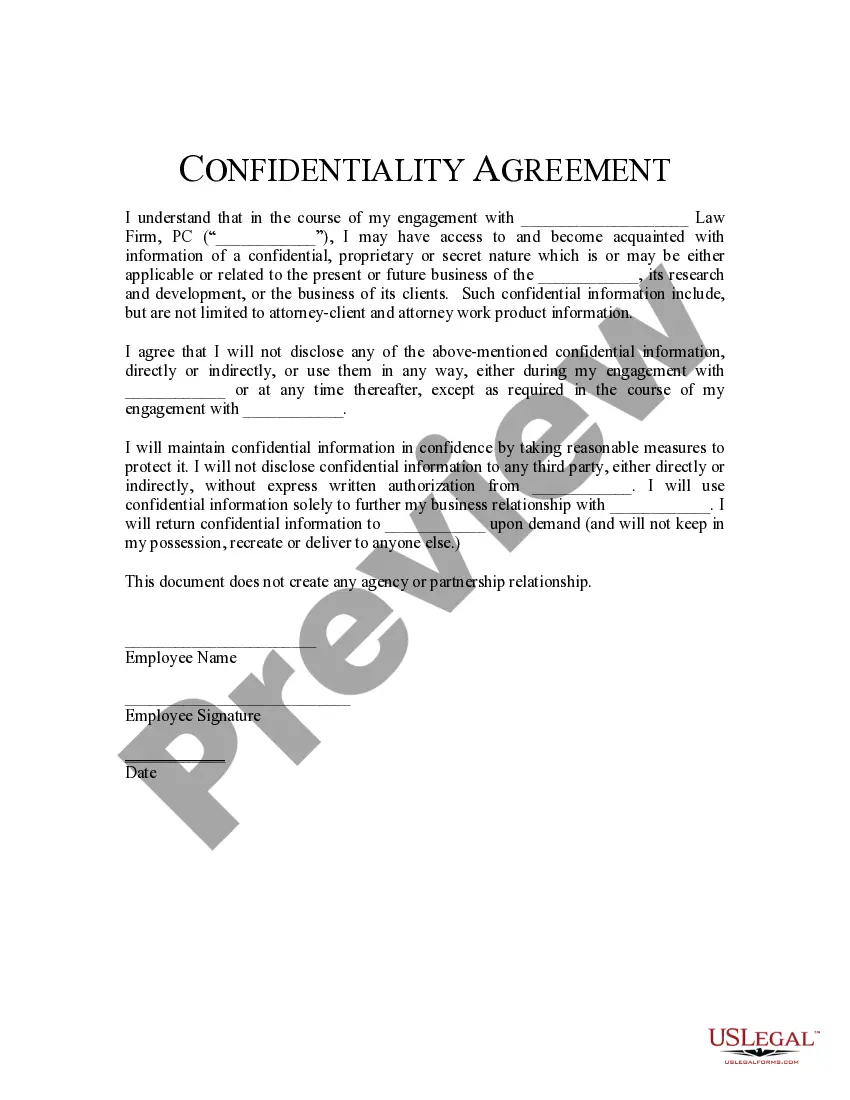

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nevada Employment Agreement and Non-Competition Agreement between Physician and Medical Practice Providing Services as a Limited Liability Partnership Introduction: In Nevada, employment agreements and non-competition agreements between physicians and medical practices operating as limited liability partnerships (Laps) hold significant importance. These legally binding arrangements outline the terms and conditions for employment and establish restrictions on the physician's ability to compete with the medical practice after termination of employment. A Nevada employment agreement and non-competition agreement aim to protect the interests of both the physician and the medical practice, ensuring a fair and mutually beneficial working relationship. Basic Components of Nevada Employment Agreement: 1. Job Description and Duties: The agreement will clearly define the physician's role, responsibilities, and obligations within the medical practice, including patient care, research, administrative tasks, and any specific specialization required. 2. Compensation and Benefits: The agreement should outline the physician's salary, bonuses, incentives, and any benefits provided, such as healthcare or retirement plans, vacation time, and insurance coverage. 3. Term and Termination: This section specifies the duration of the employment relationship, whether it is indefinite or for a fixed term, as well as the provisions and conditions for termination, including notice periods and grounds for termination. 4. Non-Disclosure and Confidentiality: The agreement may include provisions to safeguard the practice's confidential information, trade secrets, patient records, and proprietary knowledge, ensuring the physician's adherence to confidentiality policies. 5. Intellectual Property: If the physician produces intellectual property during their employment, such as research findings or innovative medical procedures, the agreement should define who holds ownership rights and potential financial provisions related to such intellectual property. 6. Restrictive Covenants: A crucial aspect of the agreement, this section addresses non-competition, non-solicitation, and non-interference clauses. It outlines the physician's post-employment obligations, restricting their ability to work for competitors or solicit patients or employees from the medical practice. Different Types of Nevada Employment Agreement and Non-Competition Agreement: While the core elements mentioned above remain similar, the specific terms and clauses can vary depending on the particular agreement type. Some common variations include: 1. Full-Time Employment Agreement: This agreement outlines the terms and conditions when a physician is employed on a full-time basis, usually working a set number of hours per week and receiving full benefits and compensation. 2. Part-Time Employment Agreement: Part-time agreements apply when a physician works a reduced number of hours or days per week, providing flexibility for both the physician and the medical practice. 3. Associate Agreement: An associate agreement is typically utilized when a physician is joining an existing medical practice as an entry-level or junior partner, outlining the path towards potential partnership and highlighting defined career progression opportunities. 4. Buy-In/Buy-Out Agreement: These agreements govern the process by which a physician purchases an ownership interest (buy-in) or sells their stake (buy-out) in the medical practice, usually in the context of transitioning from an associate to a full partner or when a partner decides to leave the practice. Conclusion: Nevada Employment Agreement and Non-Competition Agreement between Physician and Medical Practice Providing Services as a Limited Liability Partnership are crucial legal documents that establish the foundation for a physician's employment within a medical practice. By clearly defining the terms, obligations, and restrictions, these agreements protect the interests of both parties and contribute to a fair and harmonious working relationship. It is essential for physicians and medical practices alike to understand the nuances of these agreements and seek legal advice to ensure their compliance and enforceability.