Subject: Detailed Description of Nevada Sample Letter for Mobile Home Insurance Policy Keywords: Nevada, sample letter, mobile home insurance policy, types Dear [Policyholder's Name], We understand the importance of protecting your valuable investment in your mobile home, which is why we are pleased to provide you with a detailed description of our Nevada Sample Letter for Mobile Home Insurance Policy. This comprehensive policy is designed to cover various risks and protect you against potential financial losses resulting from unforeseen events. Our Nevada Sample Letter for Mobile Home Insurance Policy offers several types of coverage options tailored to your specific needs. Let's delve into each category: 1. Dwelling Coverage: This component provides protection for the structure of your mobile home, including the walls, roof, foundation, and any attached structures, such as porches or decks. It ensures reimbursement for repair or replacement costs resulting from covered perils like fire, lightning, hailstorms, theft, vandalism, and more. 2. Personal Property Coverage: Our policy extends coverage to your personal belongings inside the mobile home. This includes furniture, appliances, electronics, clothing, and other valuable possessions. In case of damage or loss due to covered incidents, you will be eligible for reimbursement or replacements, up to the specified policy limits. 3. Liability Coverage: As a responsible homeowner, it is essential to be protected against potential liabilities. Our Nevada Sample Letter for Mobile Home Insurance Policy includes liability coverage, which safeguards you against legal obligations arising from injuries or property damage incurred by others on your property. This includes medical expenses, legal fees, and settlements, up to the coverage limits specified in your policy. 4. Additional Living Expenses: In the event that your mobile home becomes uninhabitable due to a covered loss, our policy offers coverage for additional living expenses. This feature helps cover the costs associated with temporary housing, food, and any other necessary expenses until your home becomes habitable again. 5. Named Perils and All-Risk Coverage: Our Nevada Sample Letter for Mobile Home Insurance Policy provides flexibility when it comes to coverage options. You can choose between named perils coverage, which protects you against specific risks explicitly mentioned in the policy, or all-risk coverage, which provides broader protection against a wide range of perils, excluding any explicitly excluded incidents. Please note that the above description outlines the general features of our Nevada Sample Letter for Mobile Home Insurance Policy. For specific terms, conditions, exclusions, and limits of coverage, we recommend carefully reviewing your individual policy documents. At [Insurance Company Name], we strive to offer our policyholders comprehensive protection, prompt claims processing, and exceptional customer service. Should you have any questions or require further clarification regarding our mobile home insurance policy, please do not hesitate to contact our dedicated team of professionals. Safeguard your mobile home and peace of mind with our Nevada Sample Letter for Mobile Home Insurance Policy today! Warm regards, [Your Name] [Your Title/Position] [Insurance Company Name] [Contact Information]

Nevada Sample Letter for Mobile Home Insurance Policy

Description

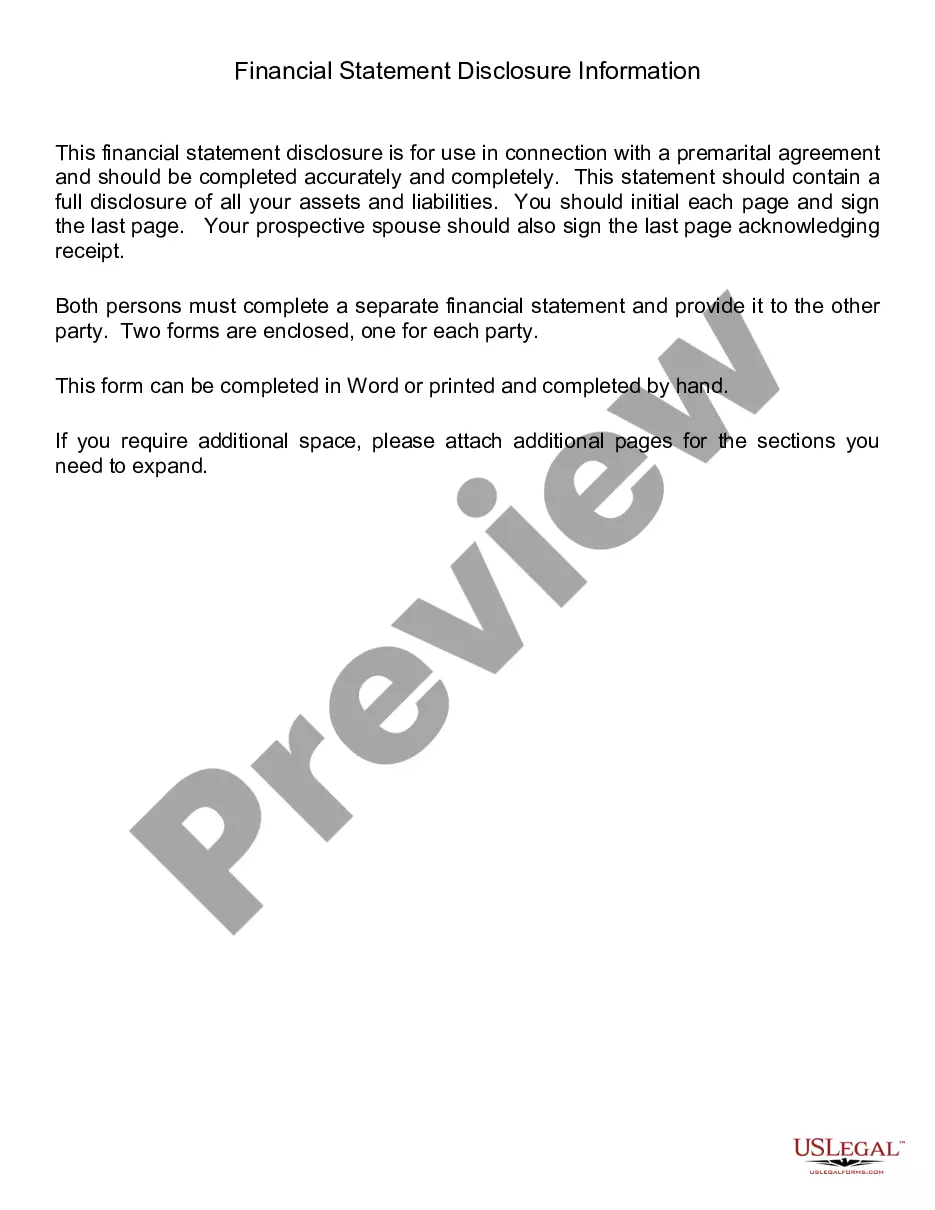

How to fill out Nevada Sample Letter For Mobile Home Insurance Policy?

It is possible to commit hours online attempting to find the legal papers web template that suits the state and federal requirements you want. US Legal Forms gives 1000s of legal types that happen to be analyzed by experts. It is simple to download or produce the Nevada Sample Letter for Mobile Home Insurance Policy from our service.

If you already possess a US Legal Forms profile, you may log in and click on the Down load switch. After that, you may complete, edit, produce, or signal the Nevada Sample Letter for Mobile Home Insurance Policy. Every single legal papers web template you get is yours forever. To get one more backup associated with a acquired form, visit the My Forms tab and click on the related switch.

Should you use the US Legal Forms web site the very first time, follow the straightforward instructions listed below:

- First, ensure that you have selected the best papers web template for that state/city of your choice. See the form description to ensure you have selected the correct form. If offered, make use of the Review switch to check from the papers web template too.

- If you would like get one more version of the form, make use of the Search field to obtain the web template that meets your requirements and requirements.

- After you have located the web template you want, simply click Acquire now to proceed.

- Pick the prices prepare you want, type your references, and register for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You may use your bank card or PayPal profile to pay for the legal form.

- Pick the format of the papers and download it to the product.

- Make changes to the papers if required. It is possible to complete, edit and signal and produce Nevada Sample Letter for Mobile Home Insurance Policy.

Down load and produce 1000s of papers web templates using the US Legal Forms web site, which provides the biggest collection of legal types. Use specialist and express-particular web templates to handle your organization or specific requirements.

Form popularity

FAQ

Policy form - The definitions, insuring agreement, exclusions, and conditions are typically combined into a single integrated document called a policy form. Some insurers call it a coverage form or coverage part.

Standard form or policy describes an insurance policy form that is designed to be used by many different insurers and has exactly the same provisions regardless of the insurer issuing the policy.

Insurance is a contract (policy) in which an insurer indemnifies another against losses from specific contingencies or perils. There are many types of insurance policies. Life, health, homeowners, and auto are among the most common forms of insurance.

Dear [INSURANCE COMPANY], Please send me a complete and certified copy of my homeowner's insurance policy, including all declarations, endorsements, riders and/or changes to the policy, which would affect coverage at the time of the above-noted loss.

1- Declaration: This has the details of the insured individual or company, the type of insurance being provided, the limit of coverage as well as the premium. The declaration is the summary of the policy. This part may have some variables that need to be filled.

In order to write a successful insurance claim letter, start with an introduction who you are, why you are writing, contact information and the details on your property. This will help the insurance adjuster understand the most important details and how to get in touch with you when there are questions.

The most common types of insurance coverage include auto insurance, life insurance and homeowners insurance. Insurance coverage helps consumers recover financially from unexpected events, such as car accidents or the loss of an income-producing adult supporting a family.