Nevada Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife

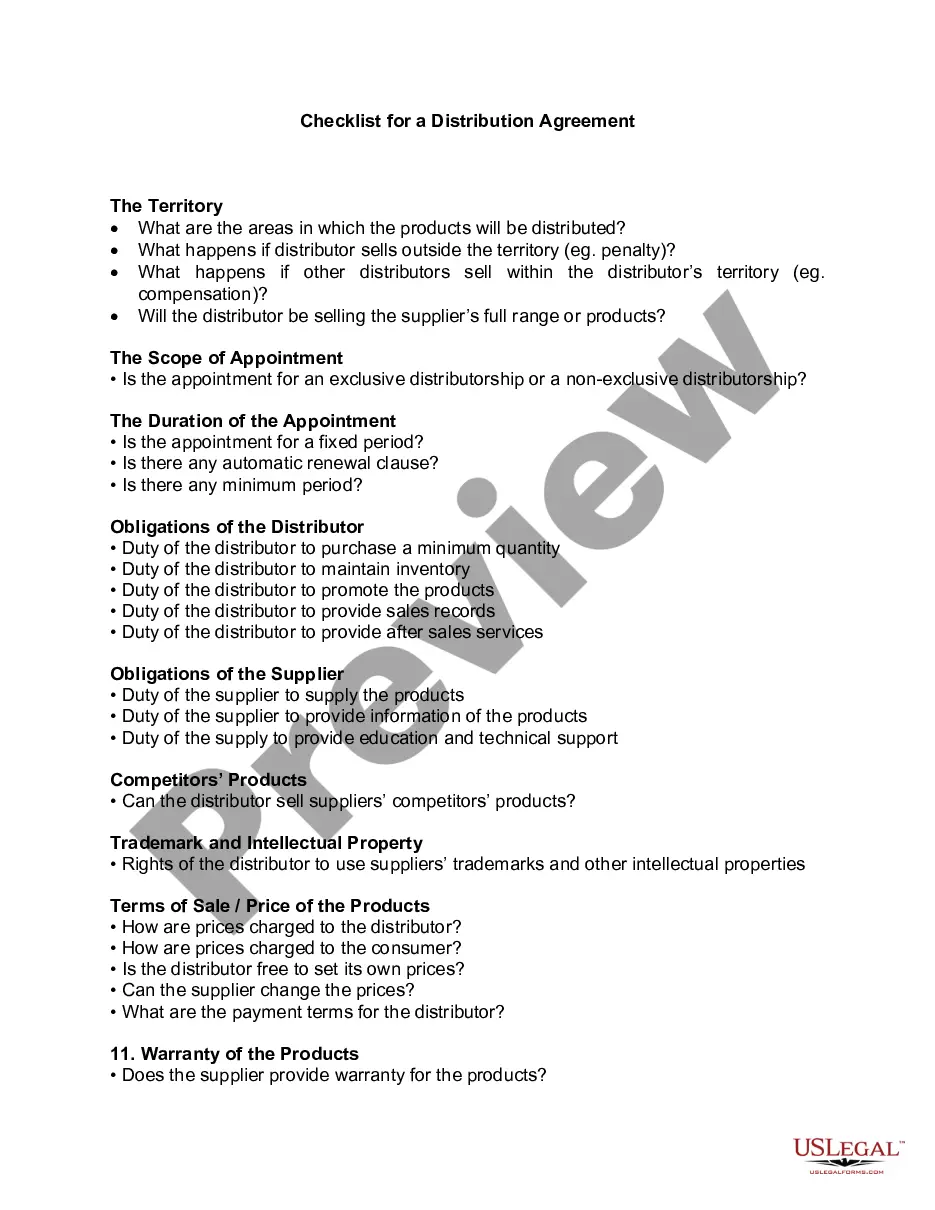

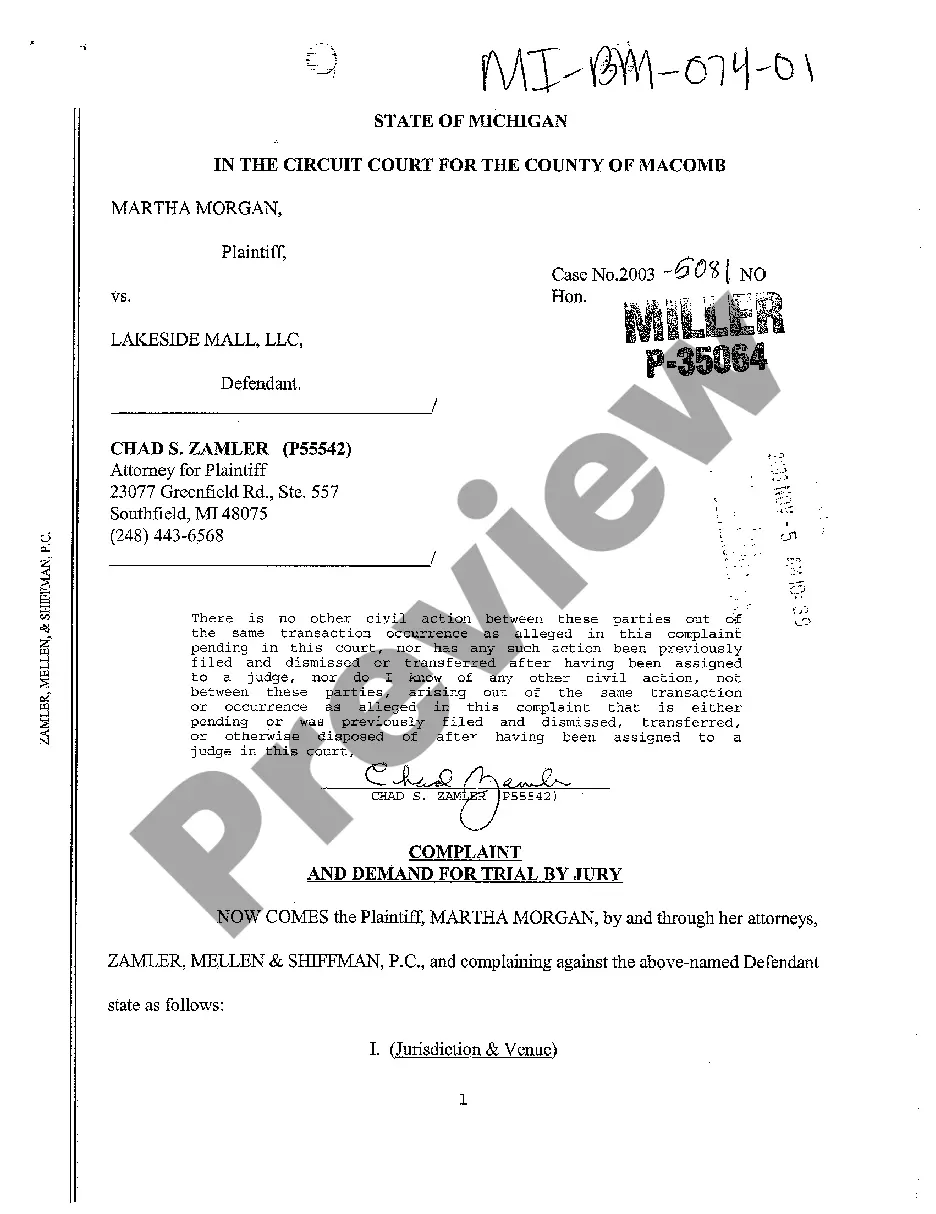

Description

How to fill out Testamentary Trust Of The Residue Of An Estate For The Benefit Of A Wife With The Trust To Continue For Benefit Of Children After The Death Of The Wife?

It is feasible to spend hours online attempting to locate the legal document template that meets the state and national requirements you need.

US Legal Forms provides thousands of legal forms that can be reviewed by experts.

You can effortlessly acquire or create the Nevada Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife through my assistance.

If available, utilize the Review option to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download option.

- Afterward, you can complete, modify, print, or sign the Nevada Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife.

- Each legal document template you purchase is yours indefinitely.

- To obtain another copy of the acquired form, visit the My documents tab and click on the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the basic guidelines below.

- First, ensure that you have selected the correct document template for the area/city of your preference.

- Review the form description to confirm that you have chosen the right form.

Form popularity

FAQ

A testamentary trust allows the person who controls it to split the income generated by the trust between family members. Importantly, children who receive income from a testamentary trust are taxed at adult tax rates, instead of penalty rates (up to 66%) which apply to other types of trusts.

The major benefit of a trust is that it gives the settlor control over when and how his or her assets are disbursed. This is especially important for settlors who have young children or grandchildren. With a testamentary trust, assets can remain protected until the child is old enough to be financially responsible.

The trust can also be used to reduce estate tax liabilities and ensure professional management of the assets. A disadvantage of a testamentary trust is that it does not avoid probatethe legal process of distributing assets through the court.

How does it save tax? A testamentary trust allows the person who controls it to split the income generated by the trust between family members. Importantly, children who receive income from a testamentary trust are taxed at adult tax rates, instead of penalty rates (up to 66%) which apply to other types of trusts.

Currently, taxable income earned in a testamentary trust is subject to the same graduated tax rates as an individual taxpayer (this is subject to change after December 31, 2015).

The adult pays the top marginal tax rate on their non-inheritance income. the beneficiaries of the testamentary trust include three. the low income rebate applies to the distributions to minors and. the inheritance earns income of $60,000 per annum.

Unlike a living trust, a testamentary trust comes into existence only after the settlor dies. Because a testamentary trust doesn't take effect until after the settlor dies, he or she can make changes up until that point, when the trust becomes irrevocable.