Nevada Credit support agreement

Description

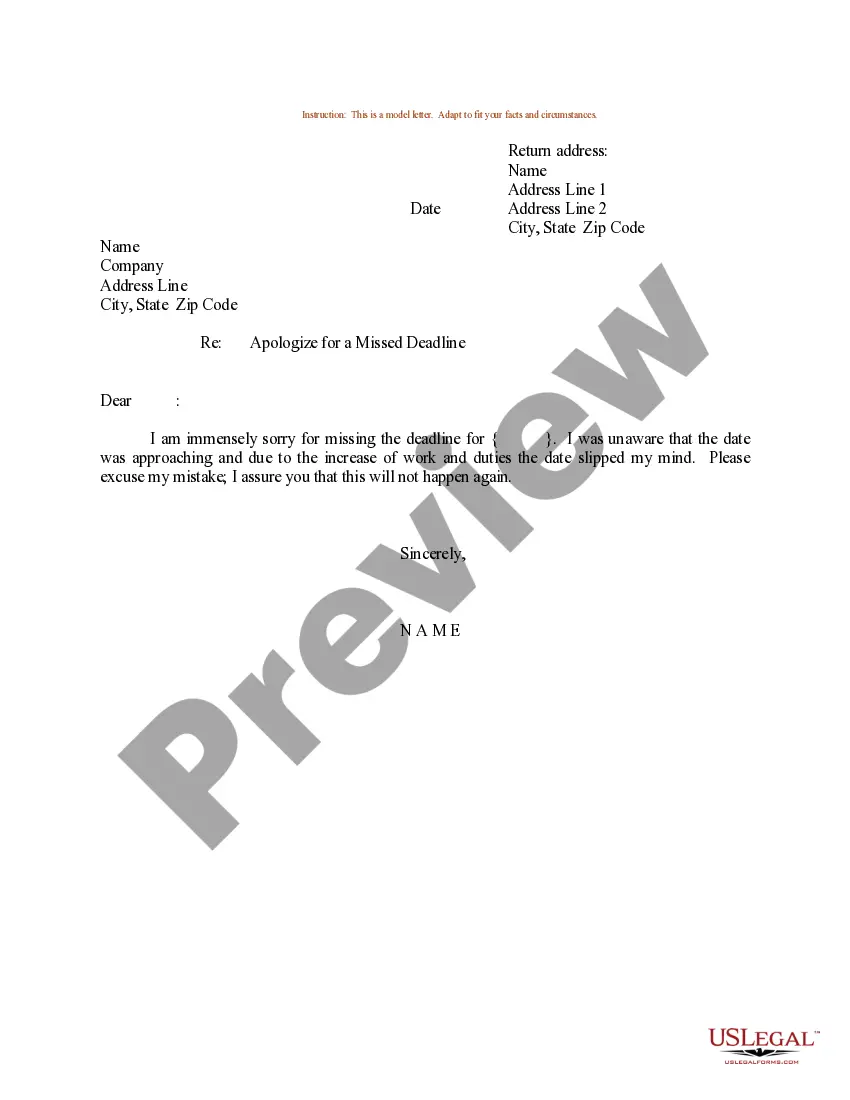

How to fill out Credit Support Agreement?

US Legal Forms - one of the greatest libraries of legal forms in the USA - gives a variety of legal papers web templates you are able to down load or print. Utilizing the internet site, you will get a huge number of forms for enterprise and specific functions, sorted by categories, suggests, or search phrases.You can get the most recent models of forms just like the Nevada Credit support agreement in seconds.

If you already have a registration, log in and down load Nevada Credit support agreement from your US Legal Forms collection. The Acquire key will appear on every single kind you look at. You have access to all formerly delivered electronically forms from the My Forms tab of your own profile.

If you wish to use US Legal Forms the first time, listed below are simple instructions to get you started:

- Be sure you have picked the proper kind for your personal metropolis/county. Click on the Review key to review the form`s content material. Browse the kind explanation to ensure that you have selected the correct kind.

- If the kind doesn`t fit your requirements, use the Search field near the top of the display to find the one which does.

- In case you are pleased with the form, affirm your selection by clicking on the Purchase now key. Then, pick the rates plan you like and supply your qualifications to sign up on an profile.

- Method the transaction. Make use of bank card or PayPal profile to finish the transaction.

- Choose the structure and down load the form in your system.

- Make modifications. Complete, change and print and sign the delivered electronically Nevada Credit support agreement.

Each template you added to your bank account lacks an expiry day and is yours permanently. So, if you want to down load or print another duplicate, just go to the My Forms portion and click on the kind you require.

Obtain access to the Nevada Credit support agreement with US Legal Forms, one of the most substantial collection of legal papers web templates. Use a huge number of expert and express-certain web templates that meet your company or specific needs and requirements.

Form popularity

FAQ

If a child support order is for one child only, the ongoing child support obligation shall terminate when the child turns 18, or, if the child is still in high school, until graduation or age 19, whichever comes first, unless there exists a statutory basis to terminate the obligation to provide ongoing support sooner ...

(b) ?Obligation for support? means the sum certain dollar amount determined ing to the following schedule: (1) For one child, 18 percent; (2) For two children, 25 percent; (3) For three children, 29 percent; (4) For four children, 31 percent; and (5) For each additional child, an additional 2 percent, of a ...

In Nevada, you can modify your child support when there is a minimum 20% change in income. Child support is reviewable every three years.

In the new Nevada child support laws, there is no presumptive maximum of support. Instead, whatever the amount is, based on the parent's total income, is presumed to meet the needs of the child. The parents can rebut that presumption by presenting evidence and asking the court to order a different amount.

The Child Support Division has a voice response unit ( vru ) telephone number for information on child support payments, office locations, and general child support information. Each client must call (775) 684-0500 or 800-992-0900 ext. 6840500 for their own Personal Identification Number (PIN) to use this system.

If a parent refuses to make his court-ordered child support payments, the State of Nevada may force the parent to make payments by garnishing his or her wages. A parent who refuses to pay court-ordered child support can also face a range of penalties, including fines and jail time.

The Nevada Child Support Debit Card is a fast and convenient way to receive your child support payments. No credit check or bank account is required. fees can be avoided by using your card to make purchases and get cash back at merchants, and by using Bank of America and Allpoint AtMs.

If the most recent child support order is for more than one child, and allocates a specific amount of the total support obligation to each child, the ongoing child support amount allocated for the subject child shall terminate the month following the date that child turns 18, or, if the child is still in high school, ...