Title: Understanding Nevada Sample Letters for Revolving Note and Loan Agreement Introduction: In the state of Nevada, individuals and businesses often engage in various financial transactions, including revolving notes and loan agreements. To ensure transparency and legal compliance, it is essential to have a well-drafted and detailed Nevada Sample Letter regarding Revolving Note and Loan Agreement. This article will delve into the intricacies of such letters, highlighting their importance, structure, and different types available. Key Points: 1. Overview of a Nevada Sample Letter regarding Revolving Note and Loan Agreement: — Definition and purpose of the letter— - Importance of legal documentation in financial transactions. — Protecting the interests of both the lender and borrower. — Complying with Nevada state laws and regulations. 2. Structure and Key Components of the Letter: — Introduction: Clearly stating the purpose and intent of the letter. — Parties involved: Identifying the lender and borrower. — Loan details: Outlining the loan amount, interest rate, repayment terms, and any additional fees. — Collateral: Specifying any assets pledged as security for the loan. — Conditions and covenants: Detailing the obligations and responsibilities of both parties. — Default and remedies: Explaining the consequences of non-payment or breach of terms. — Governing law: Specifying that Nevada laws govern the agreement. — Signatures: Obtaining signatures of all involved parties to validate the agreement. 3. Types of Nevada Sample Letters regarding Revolving Note and Loan Agreement: — Promissory Note: Outlines the borrower's promise to repay the loan with specific terms and conditions. — Loan Agreement: A comprehensive document that establishes the terms, legal rights, and obligations of both parties. — Revolving Credit Agreement: A loan arrangement that allows the borrower to access funds up to a specified limit for a defined period. 4. Importance of Consulting an Attorney: — Nevada state laws are nuanced, and legal guidance ensures compliant agreements. — Customizing agreements to meet specific needs while adhering to legal obligations. — Avoiding potential disputes and legal issues in the future. Conclusion: Nevada Sample Letters regarding Revolving Note and Loan Agreement play a vital role in documenting and formalizing financial transactions. These letters safeguard the interests of both parties, setting clear terms and conditions for the loan. Understanding the structure and content of these letters, as well as seeking legal advice when necessary, will help ensure compliance with Nevada laws and promote a smooth borrowing experience.

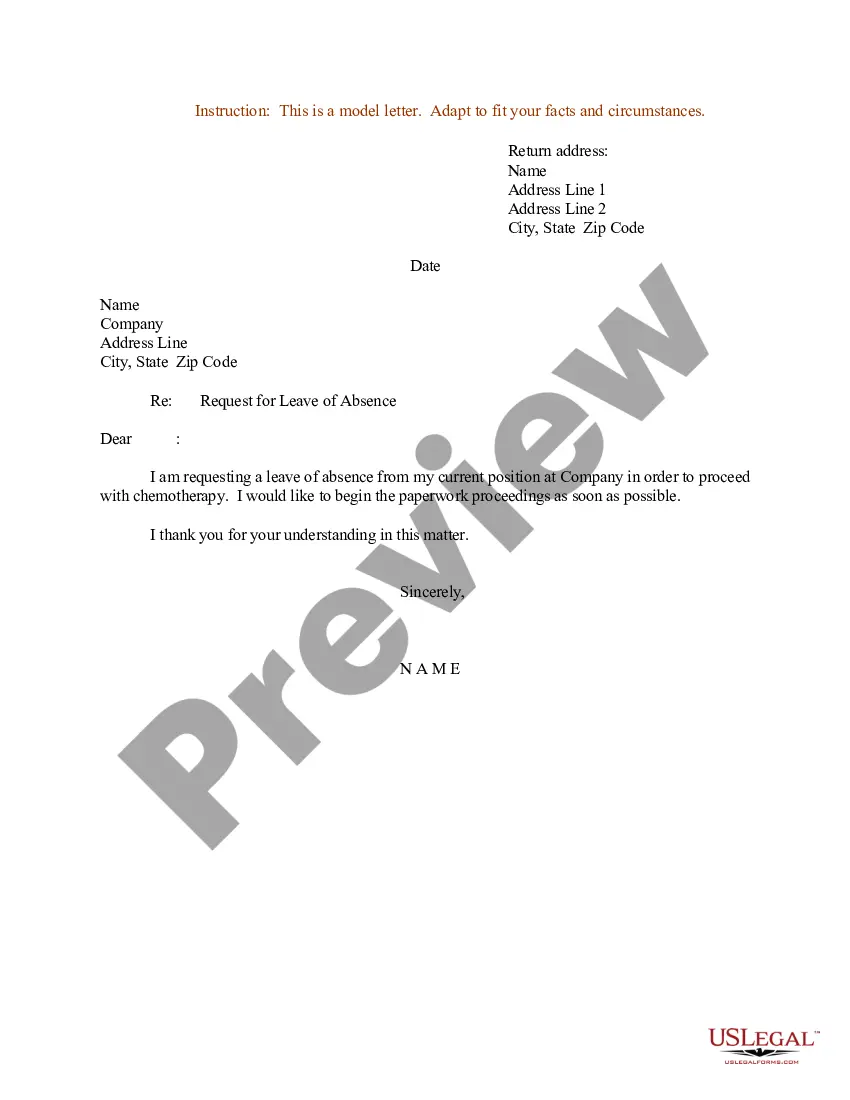

Nevada Sample Letter regarding Revolving Note and Loan Agreement

Description

How to fill out Nevada Sample Letter Regarding Revolving Note And Loan Agreement?

Choosing the best authorized document web template can be quite a struggle. Needless to say, there are tons of web templates available on the Internet, but how do you get the authorized type you will need? Take advantage of the US Legal Forms website. The support provides a huge number of web templates, for example the Nevada Sample Letter regarding Revolving Note and Loan Agreement, which you can use for enterprise and private requires. All of the kinds are checked out by experts and meet federal and state requirements.

If you are currently signed up, log in for your account and click on the Acquire key to obtain the Nevada Sample Letter regarding Revolving Note and Loan Agreement. Use your account to look throughout the authorized kinds you possess acquired previously. Proceed to the My Forms tab of your account and get another duplicate from the document you will need.

If you are a new consumer of US Legal Forms, allow me to share simple recommendations that you should stick to:

- First, be sure you have chosen the right type to your metropolis/county. You may look through the shape making use of the Review key and read the shape outline to make sure it will be the best for you.

- If the type fails to meet your requirements, use the Seach field to obtain the correct type.

- When you are certain the shape is proper, select the Buy now key to obtain the type.

- Choose the prices prepare you need and enter the necessary information. Design your account and purchase the transaction utilizing your PayPal account or bank card.

- Select the file formatting and download the authorized document web template for your device.

- Complete, edit and produce and signal the received Nevada Sample Letter regarding Revolving Note and Loan Agreement.

US Legal Forms is the largest library of authorized kinds for which you will find a variety of document web templates. Take advantage of the company to download expertly-made files that stick to state requirements.