The Nevada Contractor's Performance Bond with Limitation of Right of Action is a crucial legal instrument that provides protection for both the project owner and subcontractors involved in construction projects within the state of Nevada. This bond establishes a guarantee that the contractor will fulfill their contractual obligations satisfactorily and meet all requirements specified in the agreement. The primary purpose of this bond is to ensure that the contractor completes the project as per the agreed-upon terms, within the specified timeframe, and adhering to all applicable laws and regulations. It serves as a safeguard for the project owner, providing financial compensation if the contractor fails to deliver on their obligations. Simultaneously, it also safeguards the rights of subcontractors, ensuring they are rightfully compensated for their services and materials provided. It is essential to understand that there are different types of Nevada Contractor's Performance Bonds with Limitation of Right of Action, each serving a specific purpose: 1. Bid Bond: This bond is submitted with a contractor's bid to demonstrate their financial capability and sincerity to accept the project if awarded. In the event that the contractor withdraws their bid before the project is officially awarded, the obliged (project owner) may claim a percentage of the bid amount from the bond. 2. Payment Bond: This bond assures subcontractors and suppliers that they will receive payment for their labor and materials used in the construction project. In case the contractor fails to compensate the subcontractors or suppliers, they can make claims against this bond to secure their due payments. 3. Performance Bond: This bond guarantees the contractor's performance and completion of the project according to the agreed-upon terms. If the contractor fails to deliver the project as specified, the bond ensures financial compensation to the project owner, allowing them to hire another contractor to complete the work. Now, let's explore the concept of "Limitation of Right of Action" in relation to the Nevada Contractor's Performance Bond. This limitation places specific restrictions on the parties that can bring forth claims against the bond. Typically, the bond outlines that only the project owner (obliged) has the right to bring legal action against the surety company providing the bond. This means that subcontractors or suppliers who may have direct financial claims against the contractor cannot pursue legal action against the surety company directly but can only claim against the contractor themselves. The purpose of the "Limitation of Right of Action" clause is to streamline the claims process and ensure that the project owner remains the primary party responsible for seeking compensation from the surety company. Nevertheless, subcontractors and suppliers maintain their right to pursue claims against the contractor for unpaid amounts through other legal means allowed under the construction contract or applicable laws. In summary, the Nevada Contractor's Performance Bond with Limitation of Right of Action is a crucial tool that offers protection to both project owners and subcontractors involved in construction projects. It guarantees that the contractor fulfills their obligations, and in case of failure, ensures financial compensation to the project owner. This bond comes in different forms like Bid Bond, Payment Bond, and Performance Bond. The limitation of right of action clause restricts the parties who can directly file claims against the surety company, with the project owner being the primary party allowed to do so.

Nevada Contractor's Performance Bond with Limitation of Right of Action

Description

How to fill out Nevada Contractor's Performance Bond With Limitation Of Right Of Action?

Choosing the right legal file format might be a struggle. Obviously, there are tons of templates available on the net, but how do you obtain the legal kind you need? Utilize the US Legal Forms website. The service provides a large number of templates, like the Nevada Contractor's Performance Bond with Limitation of Right of Action, that can be used for business and personal needs. Each of the forms are inspected by professionals and fulfill state and federal demands.

When you are already authorized, log in for your accounts and click on the Down load key to have the Nevada Contractor's Performance Bond with Limitation of Right of Action. Utilize your accounts to look from the legal forms you possess ordered earlier. Go to the My Forms tab of your respective accounts and get one more copy from the file you need.

When you are a whole new user of US Legal Forms, here are simple guidelines for you to adhere to:

- Very first, make certain you have chosen the correct kind for your personal area/state. It is possible to check out the form utilizing the Review key and read the form outline to make sure this is the best for you.

- In the event the kind fails to fulfill your preferences, take advantage of the Seach field to obtain the appropriate kind.

- Once you are certain the form would work, select the Purchase now key to have the kind.

- Choose the pricing program you need and enter in the necessary info. Make your accounts and purchase an order with your PayPal accounts or credit card.

- Choose the data file file format and download the legal file format for your system.

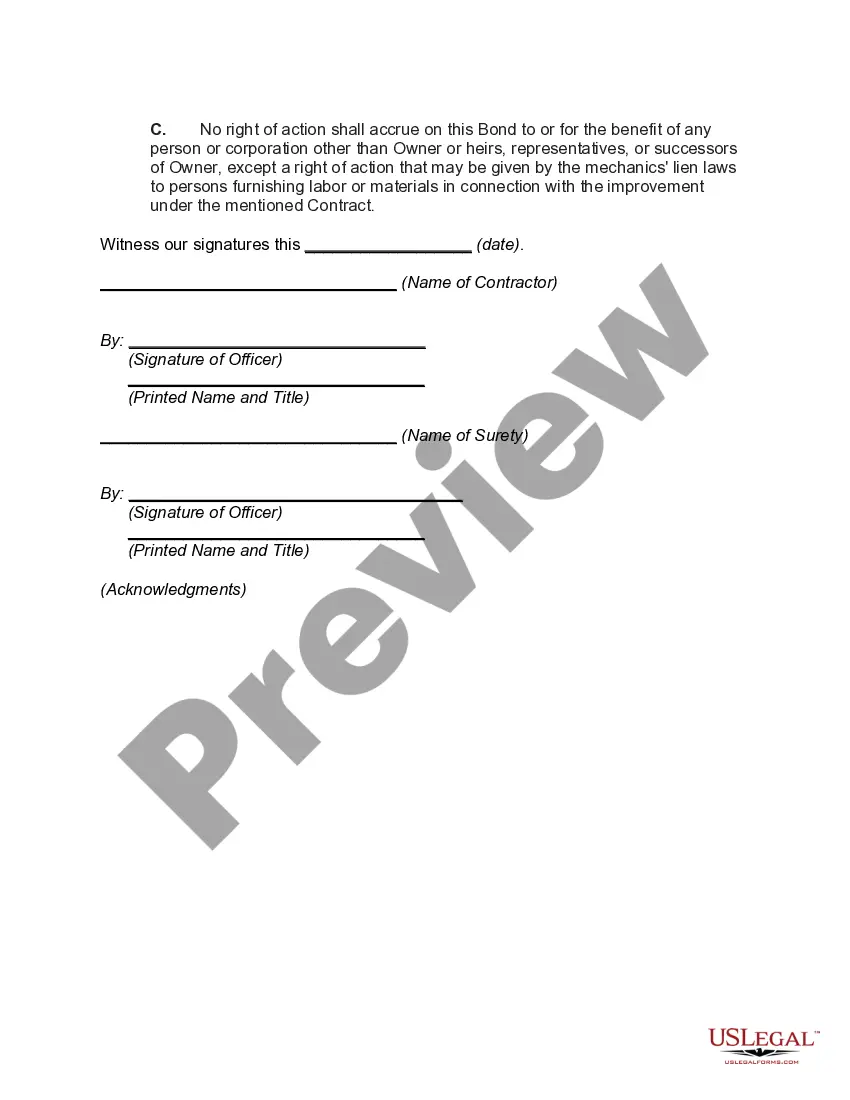

- Comprehensive, revise and printing and sign the attained Nevada Contractor's Performance Bond with Limitation of Right of Action.

US Legal Forms is definitely the most significant library of legal forms for which you can see a variety of file templates. Utilize the company to download expertly-made papers that adhere to state demands.

Form popularity

FAQ

Performance bonds, which are secured by a contractor before the beginning of a project, provide a guarantee to the project owner that contract obligations will be fulfilled. If the contractor fails to complete work ing to the contract terms, the property owner may be financially compensated.

For example, a construction payment bond may need to cover the entire construction contract amount for a $5 million project, but a $50 million project only requires a bond of 50% of the total contract value. The required bond amounts are set out in the specific statutes of the state in which the project takes place.

A payment bond is a type of surety bond issued to contractors which guarantee that all entities involved with the project will be paid. A payment surety bond is a legal contract, a type of bond, that guarantees certain employees, subcontractors, and suppliers are protected against non-payment.

If a claim against a bond is filed pursuant to NRS 240A. 120, the claimant must notify the Secretary of State in writing upon filing the action. A claim against a bond filed pursuant to NRS 240A. 120 may be filed in a court of competent jurisdiction for damages to the extent covered by the bond.

NRS 624.700 Engaging in business or submitting bid without license unlawful; prosecution; damages; bid submitted in violation of section void.

Bonds are issued by governments and corporations when they want to raise money. By buying a bond, you're giving the issuer a loan, and they agree to pay you back the face value of the loan on a specific date, and to pay you periodic interest payments along the way, usually twice a year.

If the surety does not voluntarily pay the claim, a lawsuit must be filed against the payment bond surety as follows: (a) if the public entity files a notice of completion or cessation notice, thirty (30) days six plus (6) months after the notice is filed or (b) if neither a notice of completion or cessation is filed, ...

How Long Does a Performance Bond Last? The time limit for claiming a performance bond will be spelled out in the bond contract. However, most performance bonds have a duration of twelve months, with some lasting for 36 months. In addition, your bond may be renewable or non-renewable.