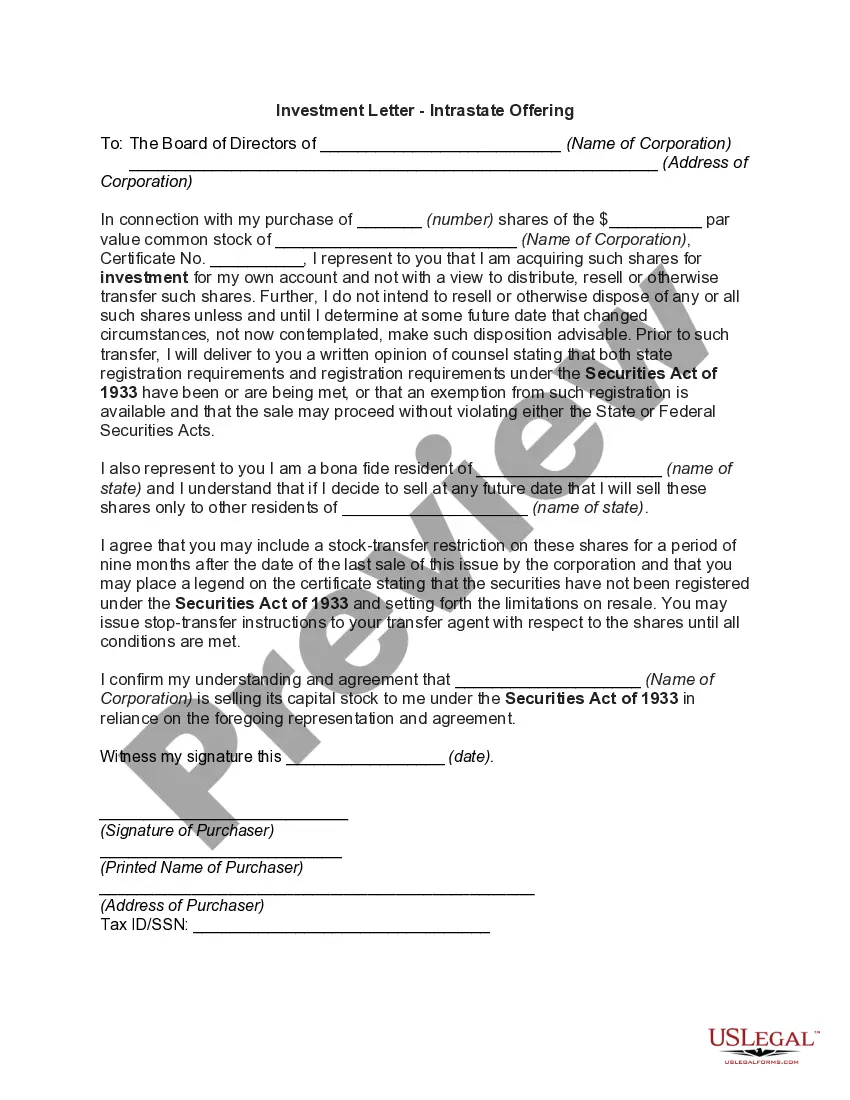

Nevada Investment Letter - Intrastate Offering

Description

How to fill out Investment Letter - Intrastate Offering?

US Legal Forms - among the biggest libraries of legal kinds in America - provides a wide array of legal file themes you are able to download or produce. Making use of the website, you will get a large number of kinds for company and specific reasons, sorted by categories, says, or keywords.You will discover the most recent versions of kinds just like the Nevada Investment Letter - Intrastate Offering within minutes.

If you already possess a registration, log in and download Nevada Investment Letter - Intrastate Offering from the US Legal Forms local library. The Down load switch will show up on every type you see. You have accessibility to all formerly delivered electronically kinds within the My Forms tab of the account.

If you want to use US Legal Forms for the first time, allow me to share straightforward instructions to help you get started:

- Ensure you have chosen the right type for your personal metropolis/state. Click the Preview switch to review the form`s information. Browse the type information to ensure that you have selected the appropriate type.

- In case the type doesn`t match your requirements, make use of the Search industry on top of the display screen to find the one that does.

- Should you be pleased with the shape, verify your selection by visiting the Get now switch. Then, select the prices prepare you prefer and offer your qualifications to sign up to have an account.

- Approach the financial transaction. Make use of your bank card or PayPal account to complete the financial transaction.

- Pick the structure and download the shape in your gadget.

- Make modifications. Fill up, edit and produce and sign the delivered electronically Nevada Investment Letter - Intrastate Offering.

Every design you added to your account does not have an expiry particular date and is also your own permanently. So, if you want to download or produce one more duplicate, just visit the My Forms section and then click around the type you will need.

Obtain access to the Nevada Investment Letter - Intrastate Offering with US Legal Forms, one of the most comprehensive local library of legal file themes. Use a large number of specialist and condition-particular themes that meet up with your company or specific requires and requirements.

Form popularity

FAQ

The federal Intrastate Exemption exempts any security which is a part of an issue offered and sold only to persons resident within a single State or Territory, where the issuer of such security is a person resident and doing business within or, if a corporation, incorporated by and doing business within, such State or

An exempt transaction is a type of securities transaction where a business does not need to file registrations with any regulatory bodies, provided the number of securities involved is relatively minor compared to the scope of the issuer's operations and that no new securities are being issued.

A Regulation D offering is intended to make access to the capital markets possible for small companies that could not otherwise bear the costs of a normal SEC registration. Reg D may also refer to an investment strategy, mostly associated with hedge funds, based upon the same regulation.

In the United States, an intrastate offering is a securities offering that can only be purchased in the state in which it is being issued. Because the offering only includes one state, it does not fall under the jurisdiction of the Securities and Exchange Commission (SEC).

Section 4(a)(2) is also known as the private placement exemption and is the most widely used exemption for securities offerings in the U.S. The exemption allows an issuer to raise an unlimited amount of capital in private transactions from sophisticated investors who are able to fend for themselves.

The federal Intrastate Exemption exempts any security which is a part of an issue offered and sold only to persons resident within a single State or Territory, where the issuer of such security is a person resident and doing business within or, if a corporation, incorporated by and doing business within, such State or

The federal Intrastate Exemption exempts any security which is a part of an issue offered and sold only to persons resident within a single State or Territory, where the issuer of such security is a person resident and doing business within or, if a corporation, incorporated by and doing business within, such State or

Rule 504 of Regulation D exempts from registration the offer and sale of up to $10 million of securities in a 12-month period. A company is required to file a notice with the Commission on Form D within 15 days after the first sale of securities in the offering.

Rule 147, as amended, has the following requirements: the company must be organized in the state where it offers and sells securities. the company must have its principal place of business in-state and satisfy at least one doing business requirement that demonstrates the in-state nature of the company's business.