Nevada Notice of Special Stockholders' Meeting to Consider Recapitalization is a legal document issued by a corporation registered in the state of Nevada to inform stockholders of an upcoming meeting that will discuss and vote on a proposed recapitalization plan. Recapitalization refers to restructuring a company's capital structure, including changes to its stock ownership, debt levels, and other financial aspects. Keywords: Nevada, Notice, Special Stockholders' Meeting, Consider, Recapitalization. Types of Nevada Notice of Special Stockholders' Meeting to Consider Recapitalization: 1. Full Recapitalization Plan: This type of meeting notice is issued when the corporation intends to make significant changes to its financial structure, such as altering the stock class, issuing additional stock, or redeeming existing shares. 2. Debt Recapitalization Meeting: In this case, the focus of the meeting is on the reallocation of debt within the corporation. The notice will inform stockholders about plans to retire existing debt, issue new debt, or modify terms and conditions of existing debt. 3. Equity Recapitalization Meeting: This type of notice is for a meeting that primarily revolves around the modification of equity ownership. It may include discussions on stock splits, reverse stock splits, stock buybacks, or any other transaction impacting the company's equity structure. 4. Voting for Recapitalization Alternatives: This meeting notice pertains to situations where stockholders will be presented with alternative recapitalization plans, and their votes will determine the plan to be implemented. It provides details about the different proposals and how stockholders can participate in the decision-making process. 5. Special Meeting for Recapitalization Announcement: Occasionally, a corporation may already have a recapitalization plan in place and wants to inform stockholders about the outcome or progress. This type of notice will highlight the details of the existing recapitalization plan, including any current developments or achievements. Nevada Notice of Special Stockholders' Meeting to Consider Recapitalization is a crucial document for maintaining transparency and ensuring that all stockholders can participate in the decision-making process. It informs them about the proposed changes, provides relevant details, and gives instructions for attending and voting at the meeting. As regulations may vary, it is advisable to consult legal counsel or refer to specific Nevada corporate laws when drafting or reviewing such notices.

Nevada Notice of Special Stockholders' Meeting to Consider Recapitalization

Description

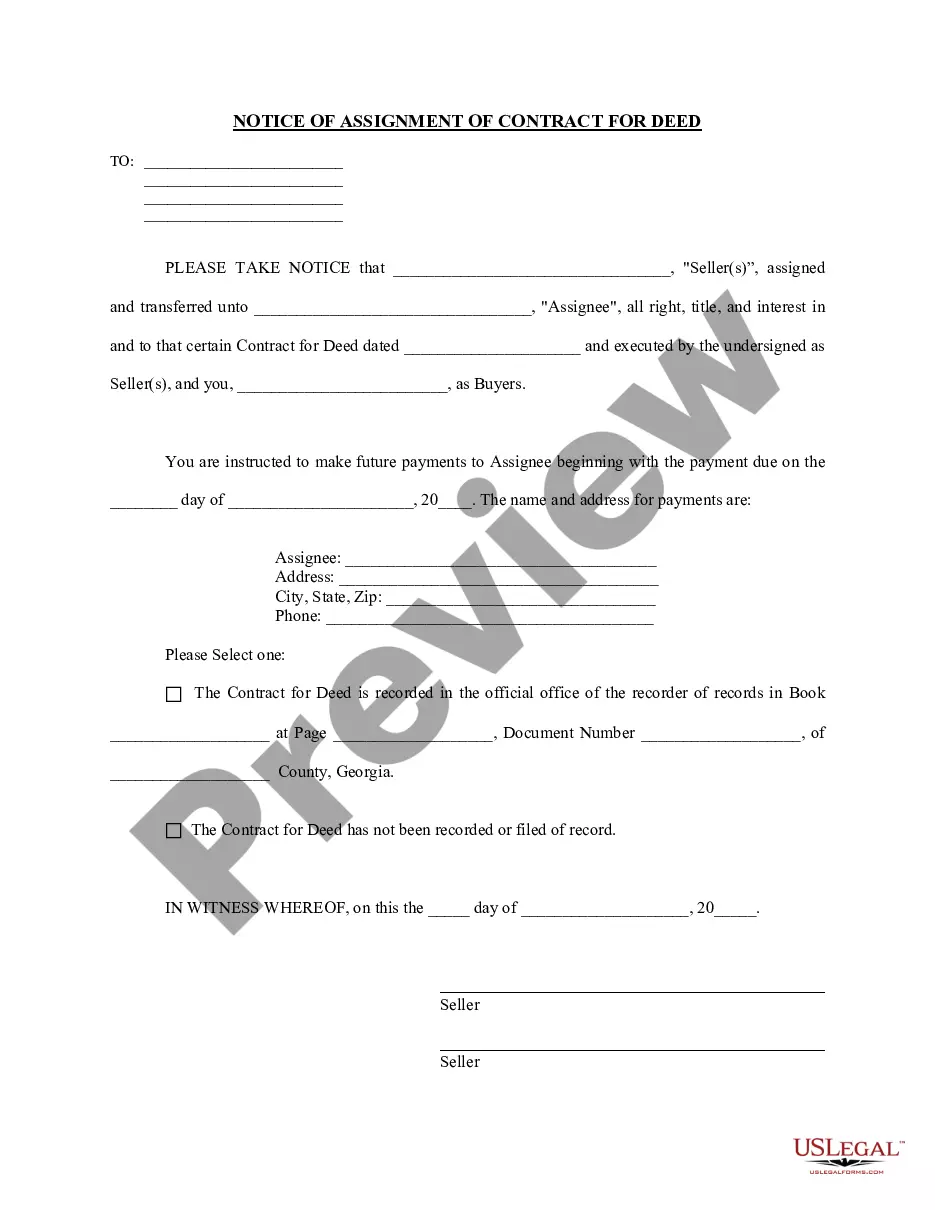

How to fill out Nevada Notice Of Special Stockholders' Meeting To Consider Recapitalization?

Discovering the right legitimate document template might be a struggle. Needless to say, there are tons of layouts available on the Internet, but how can you get the legitimate form you want? Take advantage of the US Legal Forms site. The assistance provides thousands of layouts, like the Nevada Notice of Special Stockholders' Meeting to Consider Recapitalization, which can be used for business and private requires. All of the types are examined by experts and fulfill federal and state demands.

Should you be currently authorized, log in for your profile and click on the Acquire key to obtain the Nevada Notice of Special Stockholders' Meeting to Consider Recapitalization. Make use of profile to search with the legitimate types you may have bought previously. Check out the My Forms tab of your profile and have one more backup of your document you want.

Should you be a brand new consumer of US Legal Forms, listed below are easy guidelines that you should comply with:

- Initially, be sure you have selected the right form for the area/county. You may check out the shape utilizing the Review key and browse the shape description to guarantee this is basically the best for you.

- When the form does not fulfill your preferences, use the Seach industry to get the proper form.

- When you are certain that the shape is suitable, go through the Acquire now key to obtain the form.

- Opt for the prices program you need and type in the required information. Create your profile and pay for an order using your PayPal profile or charge card.

- Opt for the data file formatting and acquire the legitimate document template for your system.

- Full, revise and print and signal the acquired Nevada Notice of Special Stockholders' Meeting to Consider Recapitalization.

US Legal Forms may be the most significant collection of legitimate types where you can find various document layouts. Take advantage of the service to acquire appropriately-produced paperwork that comply with condition demands.

Form popularity

FAQ

Most special meetings involve director elections, which typically work pursuant to a less-restrictive plurality standard, rather than a majority standard.

Special stockholder meetings can be called by the board of directors or any person that is authorized in the certificate of incorporation or in the bylaws of the company.

NRS 78.028 Filing of records written in language other than English. NRS 78.0285 Secretary of State authorized to adopt certain regulations to allow corporation to carry out powers and duties through most recent technology.

Special meeting is a meeting called by shareholders to discuss specific matters stated in the notice of the meeting. It is a meeting of shareholders outside the usual annual general meeting.

In operation, a close corporation is a corporation whose shareholders and directors are entitled to operate much like a partnership. Typically, shareholders must agree unanimously to close corporation status, and a written shareholders' agreement governing the affairs of the corporation must be drafted.

NRS means the Nevada Revised Statutes.

Bylaws set out the internal governance rules of a corporation. Under Chapter 78 of the Nevada Revised Statutes (Nevada Corporations Act) (NRS 78.010 et seq.), a corporation may, but need not, adopt bylaws consistent with federal and Nevada law for: The management, regulation, and government of its affairs and property.

The corporation can allow others to call a special meeting, such as the BoD Chair, CEO, or yes, shareholders.

Nevada does have a general law providing for the organization of corporations, but it does not carry the name "Nevada General Corporation Law". It is simply Chapter 78 of Nevada Revised Statutes.