Nevada Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed

Description

How to fill out Letter To Creditor Confirming Agreement That Monthly Payments Be Temporarily Postponed?

You may spend hours on the web looking for the authorized file web template which fits the federal and state requirements you will need. US Legal Forms provides a huge number of authorized types which are analyzed by pros. You can actually download or printing the Nevada Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed from our service.

If you have a US Legal Forms bank account, you may log in and click the Download option. Next, you may comprehensive, modify, printing, or signal the Nevada Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed. Every single authorized file web template you purchase is yours forever. To acquire yet another version for any obtained form, check out the My Forms tab and click the related option.

If you use the US Legal Forms site the first time, follow the basic guidelines beneath:

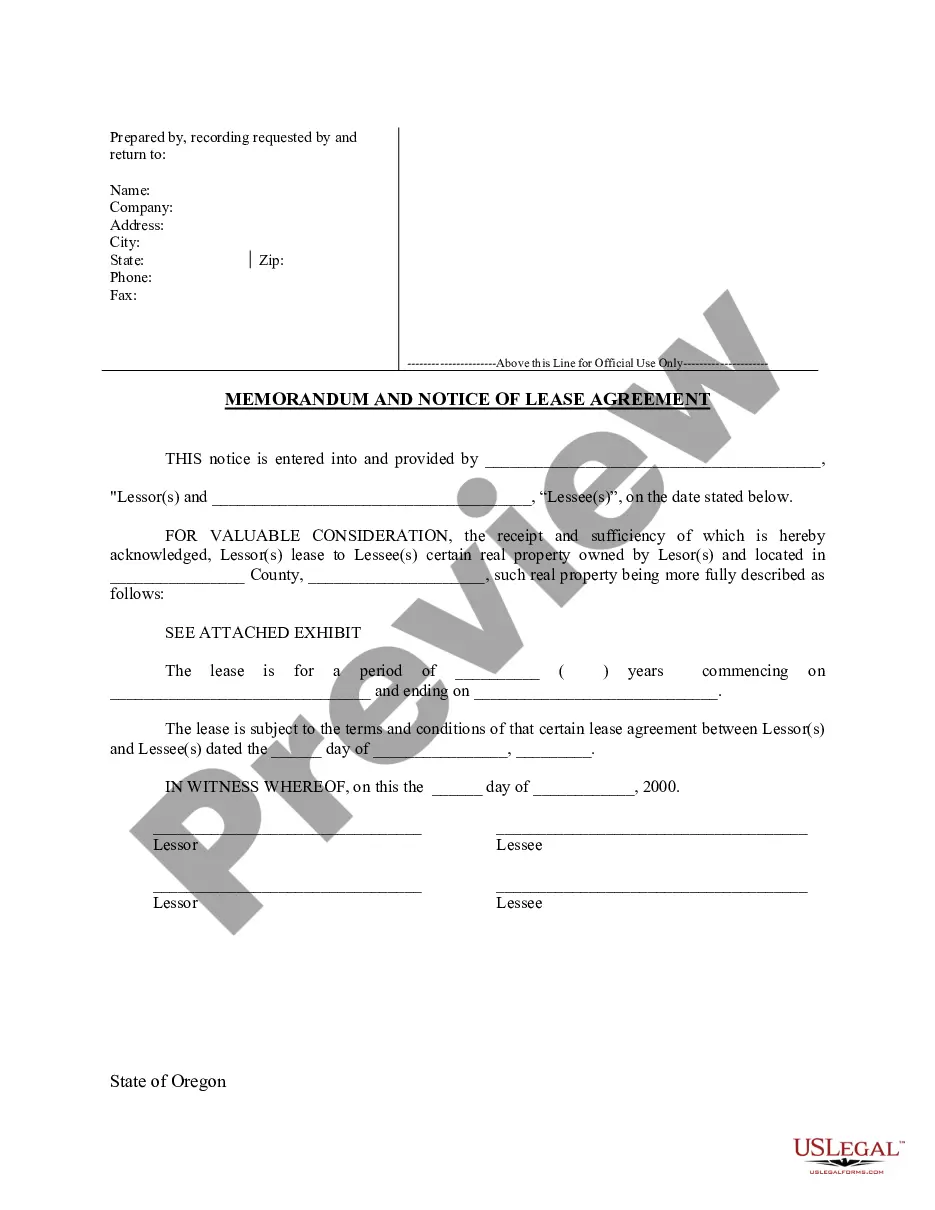

- Very first, ensure that you have chosen the best file web template for the area/metropolis of your choice. Browse the form explanation to make sure you have picked out the proper form. If readily available, make use of the Review option to appear from the file web template too.

- If you wish to discover yet another model from the form, make use of the Lookup industry to discover the web template that meets your requirements and requirements.

- Upon having discovered the web template you want, click Acquire now to proceed.

- Select the costs prepare you want, type in your qualifications, and sign up for an account on US Legal Forms.

- Comprehensive the deal. You may use your charge card or PayPal bank account to pay for the authorized form.

- Select the file format from the file and download it for your gadget.

- Make changes for your file if necessary. You may comprehensive, modify and signal and printing Nevada Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed.

Download and printing a huge number of file layouts making use of the US Legal Forms web site, which provides the greatest collection of authorized types. Use specialist and express-particular layouts to handle your business or specific needs.