A Nevada Security Agreement in Personal Property Fixtures is a legal document that is used to secure a commercial loan by offering personal property fixtures as collateral. It is considered an important aspect of the lending process, ensuring that the lender has a claim to the borrower's assets in the event of default. In Nevada, there are different types of Security Agreements in Personal Property Fixtures used to secure a commercial loan: 1. Nevada Security Agreement — Basic: A standard agreement that outlines the lender's rights to the borrower's personal property fixtures, including equipment, machinery, furniture, and any other tangible assets. 2. Nevada Purchase Money Security Agreement: This type of security agreement is used when the loan is obtained to finance the purchase of specific personal property fixtures. It ensures that the lender has a first lien on the assets, offering additional protection to the lender. 3. Nevada Fixture Filing: A Fixture Filing is an attachment to the Security Agreement that is filed with the Nevada Secretary of State. It provides public notice to other potential creditors that the lender has a security interest in the personal property fixtures. 4. Nevada Continuation Statement: This document is used to extend the validity of the Security Agreement beyond its original term. It is typically filed before the initial agreement expires to maintain the lender's priority over other creditors. The Nevada Security Agreement in Personal Property Fixtures serves as a safeguard for lenders, giving them legal recourse in case the borrower defaults on the loan. It allows them to seize and sell the secured personal property fixtures to recover their losses. In turn, borrowers benefit from access to commercial loans with more favorable terms, as lenders have the assurance that their investment is protected. Understanding the intricacies and nuances of these agreements is crucial for both borrowers and lenders. Legal advice from a qualified attorney should be sought to draft and review these agreements accurately, ensuring they meet Nevada's legal requirements and adequately protect the interests of both parties involved in securing a commercial loan.

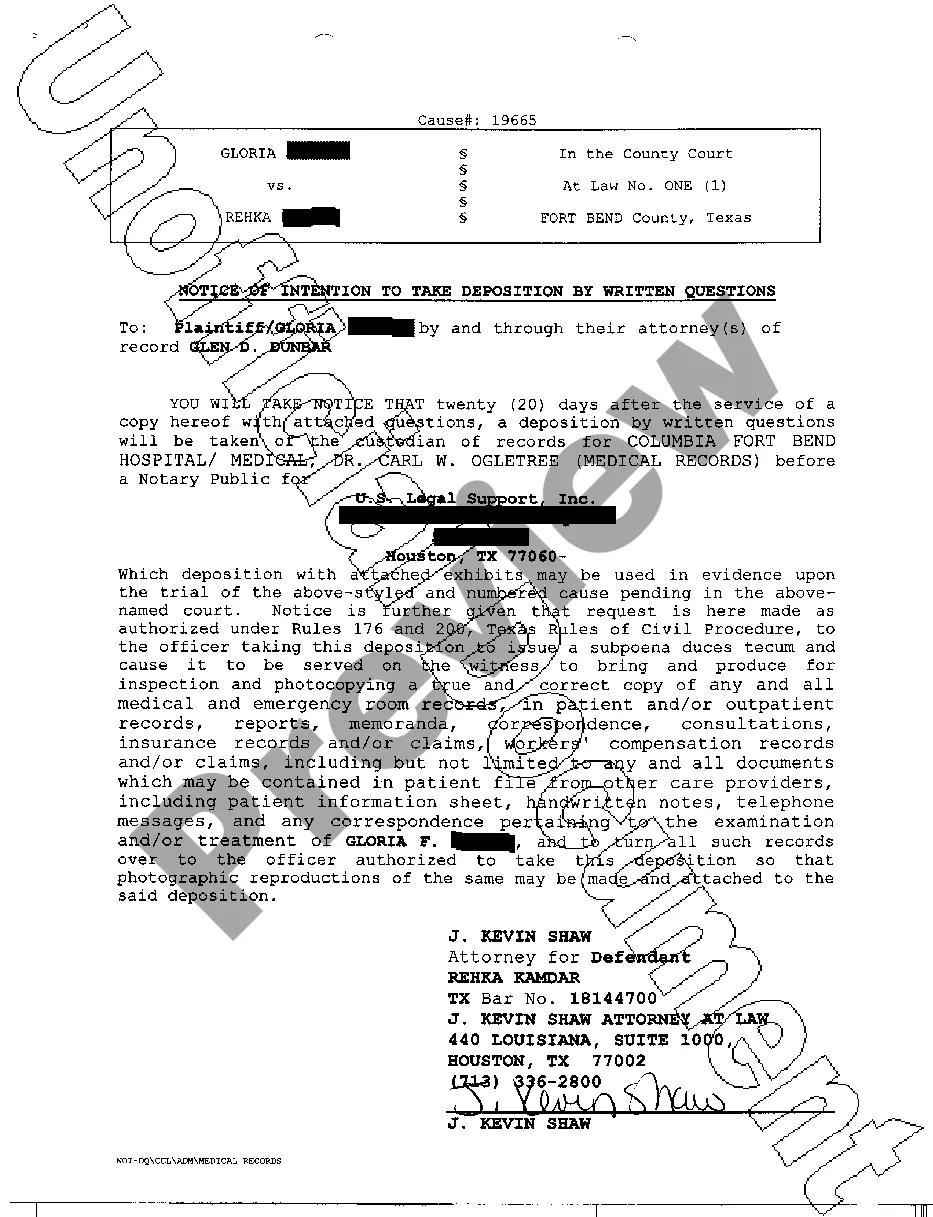

Nevada Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan

Description

How to fill out Nevada Security Agreement In Personal Property Fixtures Regarding Securing A Commercial Loan?

Choosing the best authorized papers template can be a have a problem. Needless to say, there are tons of layouts available on the Internet, but how would you find the authorized develop you need? Utilize the US Legal Forms site. The services delivers 1000s of layouts, such as the Nevada Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan, that can be used for business and personal needs. All the types are examined by experts and meet federal and state needs.

In case you are already authorized, log in in your profile and click the Acquire switch to get the Nevada Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan. Make use of your profile to check through the authorized types you might have purchased formerly. Check out the My Forms tab of the profile and acquire another version in the papers you need.

In case you are a brand new user of US Legal Forms, here are straightforward instructions for you to comply with:

- Initially, ensure you have selected the appropriate develop to your town/area. It is possible to look over the form utilizing the Review switch and study the form explanation to make certain this is basically the best for you.

- When the develop will not meet your expectations, take advantage of the Seach discipline to obtain the appropriate develop.

- When you are positive that the form would work, click on the Purchase now switch to get the develop.

- Choose the prices program you need and type in the essential information and facts. Design your profile and purchase the order with your PayPal profile or bank card.

- Choose the file structure and obtain the authorized papers template in your device.

- Total, modify and printing and signal the attained Nevada Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan.

US Legal Forms will be the most significant collection of authorized types that you can discover a variety of papers layouts. Utilize the company to obtain skillfully-made papers that comply with condition needs.

Form popularity

FAQ

Below are the primary methods for perfecting a security interest: Filing a financing statement in the appropriate public office; Take or retain possession of the collateral; Obtain or retain control of the collateral over the collateral; or.

At a minimum, a valid security agreement consists of a description of the collateral, a statement of the intention of providing security interest, and signatures from all parties involved. Most security agreements, however, go beyond these basic requirements.

A security interest is not enforceable unless it has attached. Attachment of a security interest generally requires a written security agreement, description of collateral, secured party's giving value, and the debtor having rights in collateral.

As discussed above, all the requirements for a security interest must be met: a valid security agreement, rights in the collateral, and value given. Here, as set out above, there is a valid security agreement between bank and the man covering the man's equipment, and including an after-acquired property clause.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Below are common types of security interests that apply to land. Mortgage. This is a loan instrument where an individual acquires a loan to buy a house. ... Deed of Trust. In the US, a deed of trust is a legal instrument used to create security interests. ... A contract for the sale of land.

The security interest attaches when the following elements exist simultaneously: (1) the secured party gives value; (2) the debtor has rights in the collateral or the power to transfer rights in the collateral to a secured party; and (3) the debtor has authenticated a security agreement that sufficiently describes the ...

Under the UCC, a pledge agreement is a security agreement. The nature of the pledged assets means that a pledge agreement may contain different representations and warranties and covenants than a security agreement over business assets (for example, voting rights).