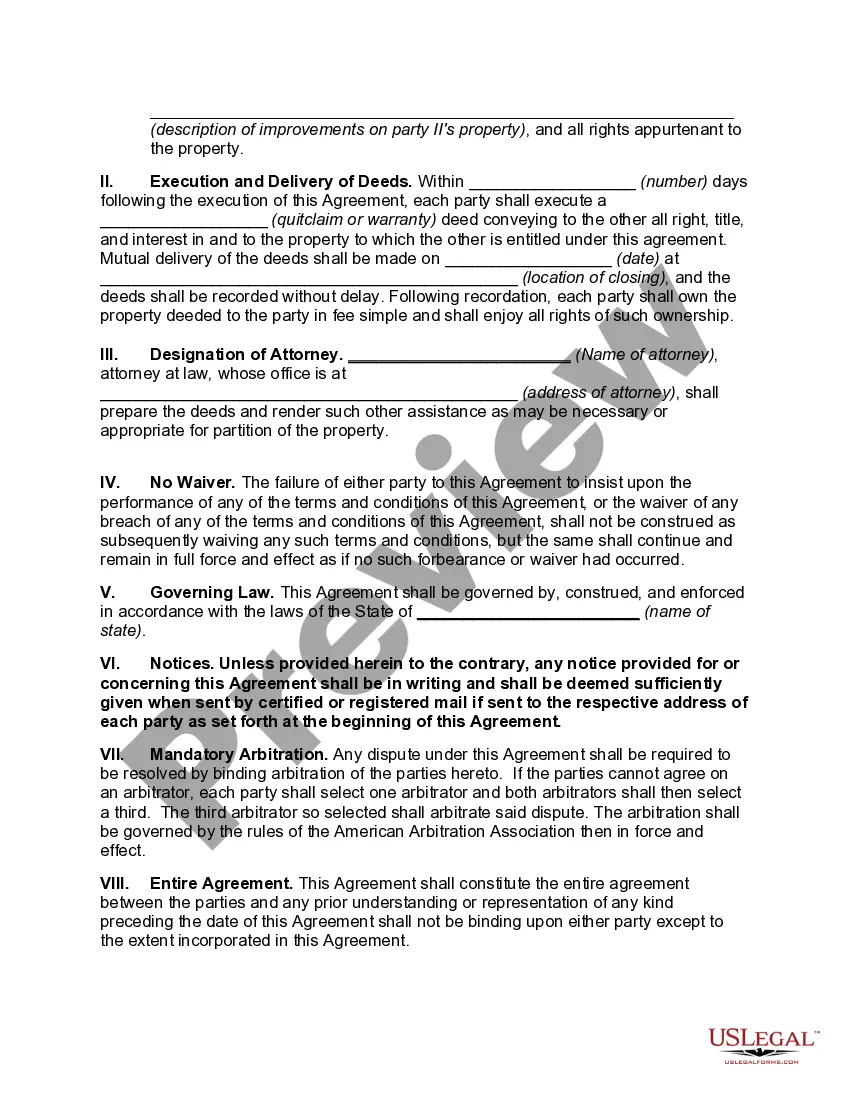

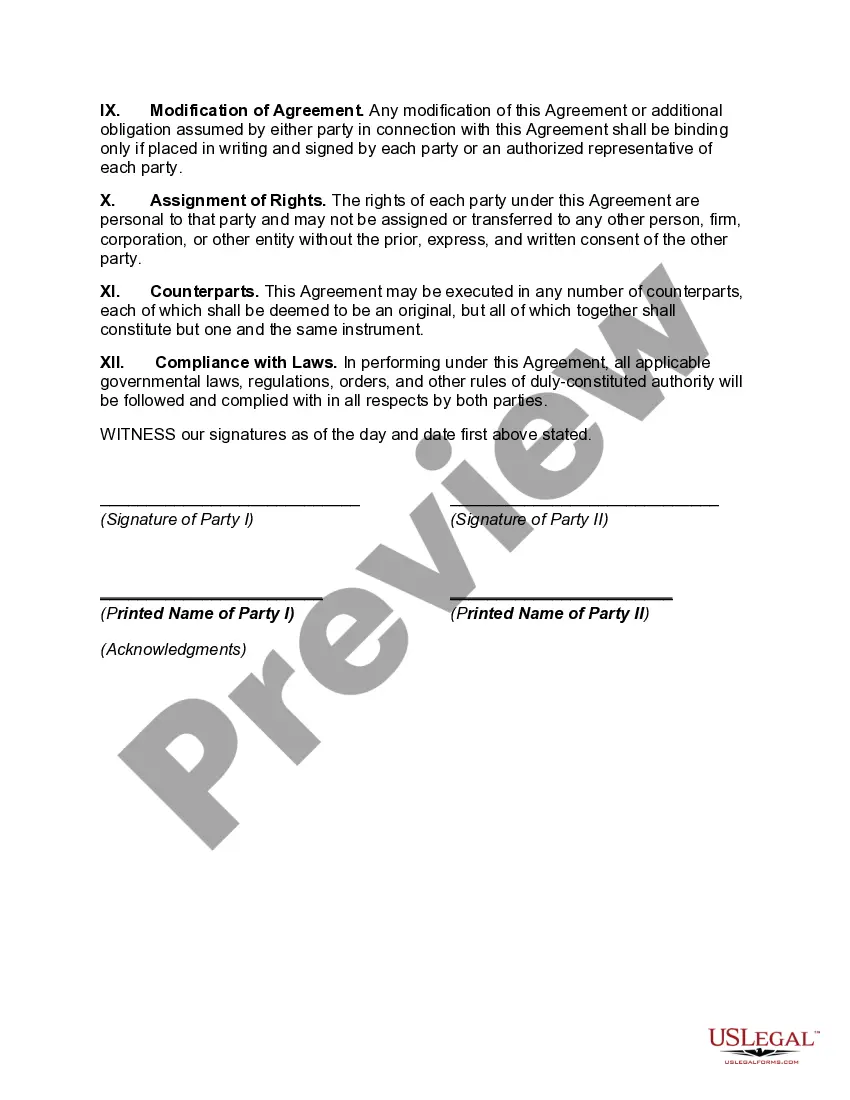

Nevada Agreement to Partition Real Property Between Children of Decedent refers to a legal contract that outlines the division or distribution of real estate property among the children of a deceased individual in the state of Nevada. This agreement is crucial when multiple heirs or beneficiaries become joint owners of real property, typically inherited after the death of their parent or relative. The Nevada Agreement to Partition Real Property serves as a comprehensive document that sets forth the terms, conditions, and processes through which the real estate will be divided. It aims to establish a fair and mutually acceptable arrangement, preventing potential conflicts and facilitating a smooth transfer of ownership. This agreement may vary based on the specific circumstances and requirements of the involved parties. Different types of Nevada Agreements to Partition Real Property Between Children of Decedent may include: 1. Simple Partition Agreement: This type of agreement details a straightforward division of the property, where each heir receives a specific portion or share, typically based on equal percentages or as defined in the decedent's will. 2. Complex Partition Agreement: In cases where it is difficult to distribute the property equally or when there are disputes among the heirs, a complex partition agreement may be necessary. This type of agreement provides a detailed framework for resolving conflicts and ensuring a fair and just distribution, considering factors such as property values, market conditions, and the preferences of the involved parties. 3. Sale and Partition Agreement: When the children of the decedent choose not to retain the real estate jointly, a sale and partition agreement becomes relevant. This agreement outlines the process of selling the property and dividing the proceeds among the heirs based on their respective ownership shares. 4. Buyout Provision Agreement: In some situations, one or more heirs may wish to buy out the ownership interest of other co-owners. A buyout provision agreement specifies the terms and conditions under which such a buyout can occur, ensuring transparency, fairness, and proper valuation of the property. Regardless of the specific type, a Nevada Agreement to Partition Real Property Between Children of Decedent typically addresses essential aspects such as the identification and description of the property, the heirs involved, their respective ownership shares, the method of division, any financial considerations, agreements on maintenance, taxation, and any other relevant terms and conditions. Having an attorney review and assist in drafting the Nevada Agreement to Partition Real Property is highly recommended. This ensures that all legal requirements are fulfilled, and the agreement reflects the intention of the decedent and the best interests of the involved parties.

Nevada Agreement to Partition Real Property Between Children of Decedent

Description

How to fill out Agreement To Partition Real Property Between Children Of Decedent?

If you wish to comprehensive, obtain, or print legal document layouts, use US Legal Forms, the largest selection of legal forms, that can be found on the Internet. Make use of the site`s basic and convenient search to discover the files you want. Different layouts for company and specific uses are categorized by classes and claims, or keywords and phrases. Use US Legal Forms to discover the Nevada Agreement to Partition Real Property Between Children of Decedent with a number of mouse clicks.

If you are presently a US Legal Forms buyer, log in in your bank account and click the Obtain button to find the Nevada Agreement to Partition Real Property Between Children of Decedent. You may also gain access to forms you in the past acquired inside the My Forms tab of the bank account.

Should you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Make sure you have selected the shape for your right city/land.

- Step 2. Take advantage of the Preview option to look through the form`s information. Do not neglect to learn the information.

- Step 3. If you are unsatisfied together with the type, use the Look for discipline towards the top of the monitor to discover other types of your legal type web template.

- Step 4. When you have identified the shape you want, select the Buy now button. Select the costs program you favor and add your references to sign up for the bank account.

- Step 5. Procedure the deal. You may use your bank card or PayPal bank account to accomplish the deal.

- Step 6. Pick the file format of your legal type and obtain it in your product.

- Step 7. Comprehensive, change and print or sign the Nevada Agreement to Partition Real Property Between Children of Decedent.

Every single legal document web template you purchase is the one you have permanently. You might have acces to every type you acquired within your acccount. Select the My Forms section and pick a type to print or obtain again.

Remain competitive and obtain, and print the Nevada Agreement to Partition Real Property Between Children of Decedent with US Legal Forms. There are many expert and status-particular forms you can utilize for your company or specific requires.

Form popularity

FAQ

In contrast to joint tenancy, if you own property with another person but you don't own it 50-50 or if you don't want that person to get your share of the property when you die, you might consider ownership as ?tenants in common.? Tenants in common don't necessarily have equal interests.

Community Property with Right of Survivorship: On the death of an owner, the decedent's interest ends and the survivor owns the property.

The biggest issue with tenants in common is that they have complete freedom over how they use their fractional ownership interest in the property. One of the joint owners may borrow money against their share of the property. The interest held by one owner is also subject to the creditors of that owner.

How to Force the Sale of Jointly Owned Property (step-by-step) Step 1: Confirm title to the jointly owned property. ... Step 2: Identify the benefits and burdens of ownership. ... Step 3: Attempt a voluntary sale, buyout, or alternate solution. ... Step 3: File and serve a partition lawsuit.

Because joint tenancy provides the right of survivorship, you may sometimes see it as ?joint tenancy with right of survivorship? and abbreviated JTWROS. In a tenancy in common, there is no right of survivorship. This means that property ownership does not automatically pass to the surviving owners.

Disadvantages of joint tenants with right of survivorship JTWROS accounts involving real estate may require all owners to consent to selling the property. Frozen bank accounts. In some cases, the probate court can freeze bank accounts until the estate is settled.

It is worth noting that there are always exceptions. It is entirely possible for complex cases to be resolved faster than those with more simple terms. While the process will vary from case to case, it is reasonable to expect a partition action to take anywhere from 18 months to 24 months.

In contrast to joint tenancy, if you own property with another person but you don't own it 50-50 or if you don't want that person to get your share of the property when you die, you might consider ownership as ?tenants in common.? Tenants in common don't necessarily have equal interests.