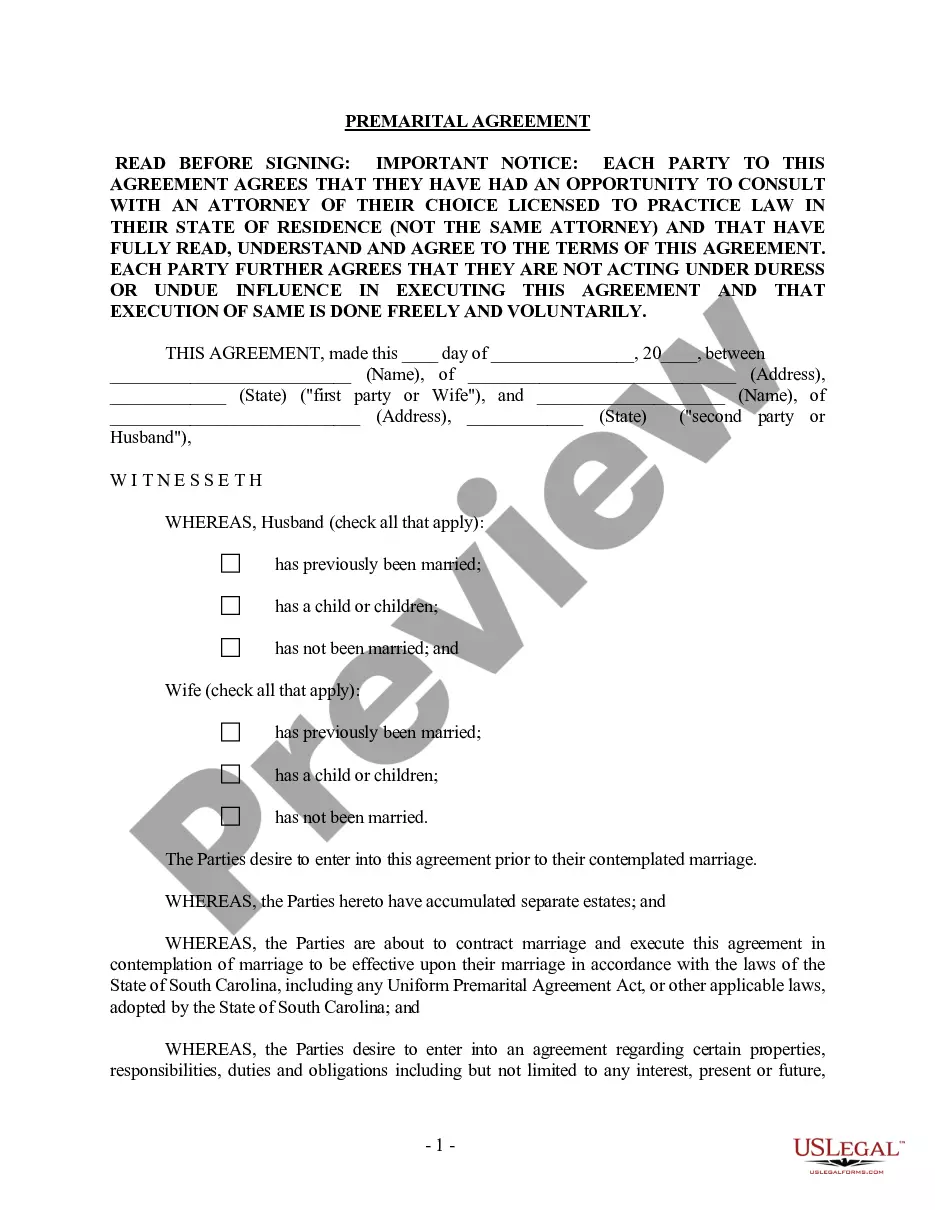

The Nevada Independent Contractor Services Agreement with Accountant is a comprehensive contract that outlines the professional relationship and responsibilities between an independent accountant and their client in the state of Nevada. This agreement is vital for individuals or businesses seeking accounting services in Nevada, as it ensures clarity and protection for both parties involved. Keywords: Nevada, Independent Contractor, Services Agreement, Accountant While there may not be specific subcategories of this agreement, variations can arise based on the specific services being offered or the terms negotiated between the accountant and client. However, it is essential to include certain key elements in any Nevada Independent Contractor Services Agreement with Accountant: 1. Scope of Services: Clearly define the accounting services to be provided by the accountant. This should include details such as bookkeeping, tax preparation, financial analysis, or any other specific tasks agreed upon. 2. Compensation: Outline the payment structure and terms, including the rate, frequency of payment, and any additional expenses that the accountant may incur. This section may also address reimbursement for specific costs related to the services. 3. Term and Termination: Specify the duration of the agreement and the conditions under which either party may terminate the contract. This section should also address any notice period required for termination. 4. Independent Contractor Relationship: State that the accountant is an independent contractor and not an employee of the client. Clarify that the accountant is responsible for their own taxes, licenses, and any liabilities arising from their work. 5. Confidentiality and Non-Disclosure: Include provisions to protect sensitive information shared during the engagement. This ensures that the accountant maintains confidentiality and refrains from sharing or using the client's proprietary information without consent. 6. Intellectual Property: Address ownership rights of any intellectual property created or developed during the provision of the accounting services. Specify whether the accountant transfers these rights to the client or retains them. 7. Indemnification: Define the responsibilities of each party regarding liability and claims arising from the services. This section may outline instances where the accountant is required to indemnify the client for any errors, omissions, or negligence in their work. 8. Governing Law and Dispute Resolution: Determine the jurisdiction and laws under which any disputes will be resolved. Include provisions for mediation, arbitration, or litigation in case of disagreements. Remember, the specific terms and conditions within the Nevada Independent Contractor Services Agreement with Accountant can vary based on the nature of the services and the negotiations between the parties involved. It is recommended to have this agreement reviewed by legal professionals familiar with Nevada state laws to ensure compliance and protect the interests of both parties.

Nevada Independent Contractor Services Agreement with Accountant

Description

How to fill out Nevada Independent Contractor Services Agreement With Accountant?

Finding the right authorized papers web template can be a struggle. Of course, there are a lot of templates available on the net, but how can you get the authorized kind you will need? Use the US Legal Forms site. The service offers a huge number of templates, such as the Nevada Independent Contractor Services Agreement with Accountant, that can be used for enterprise and personal requires. All the forms are checked out by pros and satisfy state and federal needs.

Should you be currently listed, log in for your account and click on the Down load key to have the Nevada Independent Contractor Services Agreement with Accountant. Make use of account to appear through the authorized forms you might have purchased formerly. Proceed to the My Forms tab of your own account and acquire yet another backup of your papers you will need.

Should you be a whole new user of US Legal Forms, here are straightforward guidelines so that you can comply with:

- Initially, be sure you have selected the correct kind for your personal metropolis/area. It is possible to look through the form using the Review key and read the form outline to ensure this is basically the best for you.

- If the kind fails to satisfy your needs, make use of the Seach discipline to obtain the right kind.

- When you are sure that the form is proper, click on the Get now key to have the kind.

- Pick the costs strategy you would like and type in the needed info. Make your account and pay for an order utilizing your PayPal account or charge card.

- Select the data file formatting and download the authorized papers web template for your system.

- Total, revise and print and sign the attained Nevada Independent Contractor Services Agreement with Accountant.

US Legal Forms will be the most significant library of authorized forms for which you can see different papers templates. Use the service to download professionally-created paperwork that comply with status needs.

Form popularity

FAQ

Am I required to have a State Business License? Yes. Unless statutorily exempted, sole proprietors doing business in Nevada must maintain a State Business License. Sole proprietors may submit their State Business License application online at , by mail, or in-person.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

All businesses or individuals who construct or alter any building, highway, road, parking facility, railroad, excavation, or other structure in Nevada must be licensed by the Nevada State Contractors Board. Contractors, including subcontractors and specialty contractors must be licensed before submitting bids.

Do I need a business license? Yes, if you are not paid as an employee, you are considered independent or self-employed and are required to obtain a business license.

Nevada nonprofit entities formed pursuant to NRS Chapter 82 and corporations sole formed pursuant to NRS Chapter 84 are specifically exempted from the requirements of the State Business License and are not required to maintain a state business license nor are they required to claim an exemption.

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.

What to Include in a ContractThe date the contract begins and when it expires.The names of all parties involved in the transaction.Any key terms and definitions.The products and services included in the transaction.Any payment amounts, project schedules, terms, and billing dates.More items...?

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

How Do I Become An Independent Contractor In Nevada? According to a 2015 state law, workers are presumed to be independent contractors instead of employees if they have insurance or an occupational license, are bonded, have a Social Security number, or have filed self-employment taxes.