Nevada Cash Disbursements and Receipts

Description

How to fill out Cash Disbursements And Receipts?

Are you currently in a role that necessitates paperwork for either an organization or particular functions almost every moment.

There are numerous authentic document templates accessible online, but finding forms you can trust is not easy.

US Legal Forms offers a wide array of form templates, similar to the Nevada Cash Disbursements and Receipts, which are designed to comply with federal and state requirements.

Once you find the appropriate form, click Get now.

Select the pricing plan you prefer, enter the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can obtain the Nevada Cash Disbursements and Receipts template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

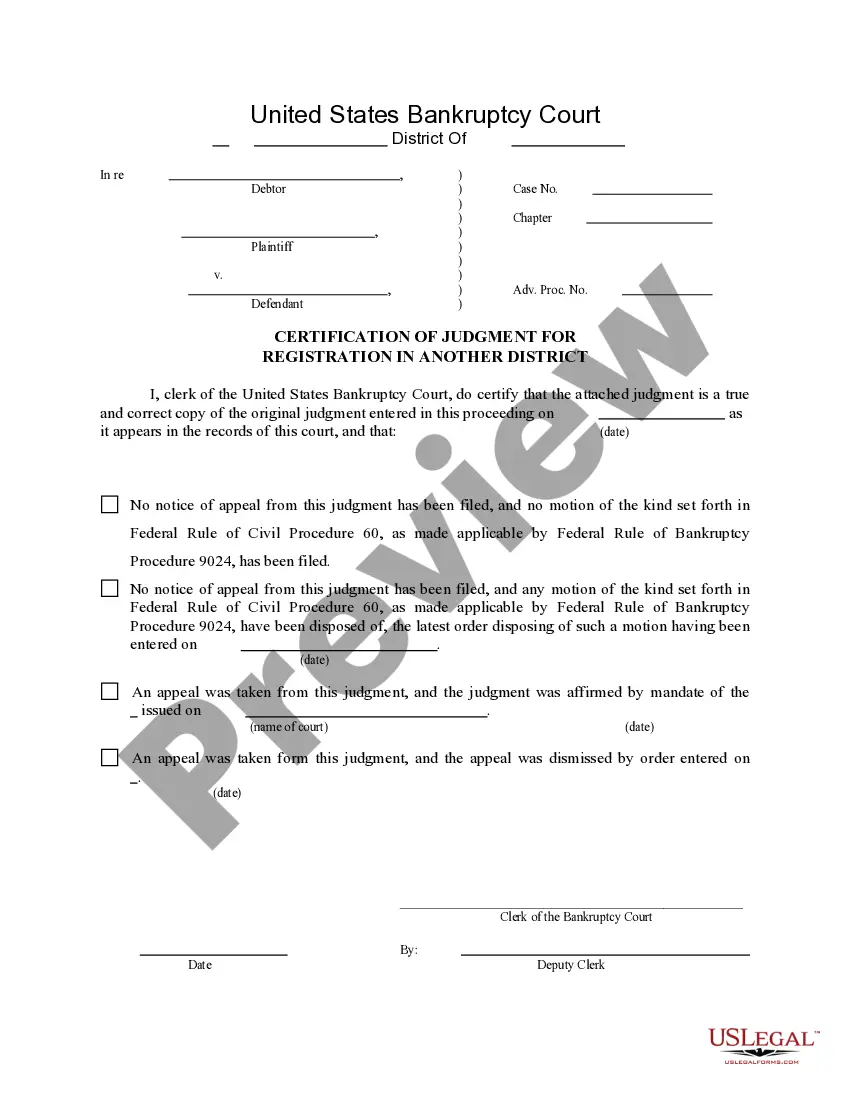

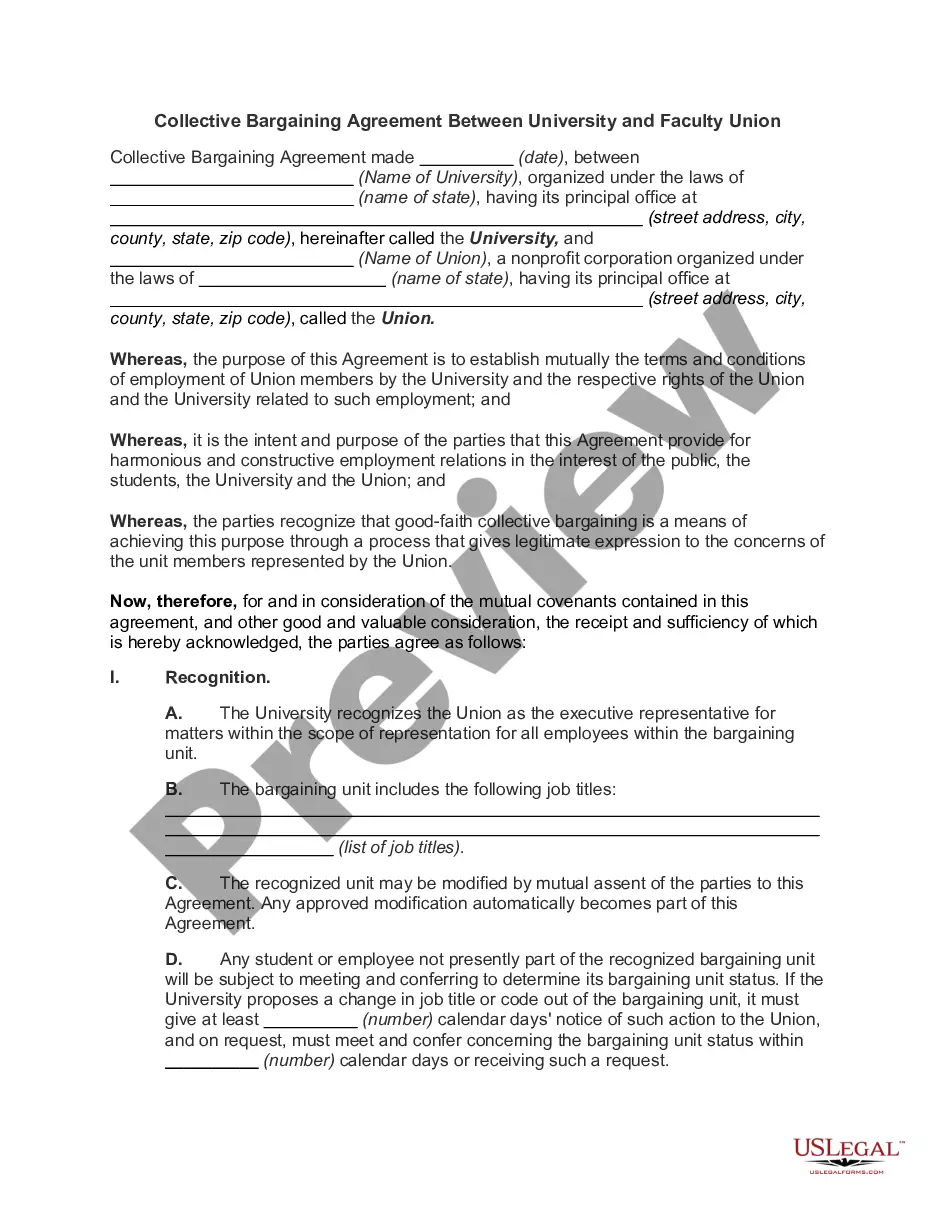

- Use the Preview button to review the form.

- Read the description to confirm that you have selected the correct form.

- If the form does not meet your criteria, utilize the Search field to find the form that fulfills your requirements.

Form popularity

FAQ

The MBT, or modified business tax, is a payroll tax based on the total wages your business pays to employees in Nevada. This tax is calculated on the amount exceeding a specific threshold, making it crucial for businesses to keep accurate records of their payroll. Understanding how this relates to your Nevada Cash Disbursements and Receipts can help in effective tax planning and compliance.

TurboTax does not support Nevada’s specific tax structures due to the state's unique tax laws. Nevada has a commerce tax based on gross receipts, which differs from standard income taxes. When dealing with Nevada Cash Disbursements and Receipts, using other platforms or services like US Legal Forms can provide the tailored guidance necessary for your business needs.

In Nevada, the gross receipts threshold for filing the commerce tax is currently set at $4,000,000. If your business generates revenue below this amount, you do not need to file the tax. Make sure to keep track of your Nevada Cash Disbursements and Receipts to assess whether your business needs to comply with this tax requirement.

You can file the Nevada commerce tax online through the Nevada Department of Taxation's website. It's essential to ensure that you submit the tax form during the designated filing period to avoid penalties. For further assistance with Nevada Cash Disbursements and Receipts, consider utilizing resources from US Legal Forms, which can help you navigate through the filing process effectively.

Yes, Nevada requires a seller's permit for individuals or businesses selling goods or services. This permit is essential for legally conducting business and collecting sales tax. Obtaining a seller's permit is a step that will support your efforts in managing Nevada Cash Disbursements and Receipts effectively.

A legacy taxpayer ID is an older identification number assigned to businesses in Nevada. Some businesses may still possess this ID for tax filings and other legal requirements. If you're navigating through Nevada Cash Disbursements and Receipts, being aware of your legacy taxpayer ID can help ensure that all your tax documents are in order.

The entry for cash receipts typically involves debiting the cash account and crediting the sales or revenue account. This double-entry approach maintains financial balance in your records, particularly regarding Nevada Cash Disbursements and Receipts. Using software like USLegalForms can simplify this process, ensuring your entries are accurate and compliant.

To enter cash receipts, create a record that includes the receipt date, payer's name, amount, and purpose of the transaction. You should regularly update your cash receipts journal to capture all Nevada Cash Disbursements and Receipts accurately. Consistent entry helps track your business's cash inflow and ensures better financial planning.

Completing a Cash Receipts Journal (CRJ) involves entering all cash received in a systematic manner. Start by documenting the date, payer details, and amounts while ensuring totals are calculated accurately. This practice is essential for organizing Nevada Cash Disbursements and Receipts effectively and contributes to better financial management.

An example of a cash receipt entry is when a business receives $500 from a customer for services rendered. You would enter this amount in the cash receipts journal, noting the date and transaction details. This entry is crucial for tracking Nevada Cash Disbursements and Receipts accurately and ensuring your financial records are up to date.