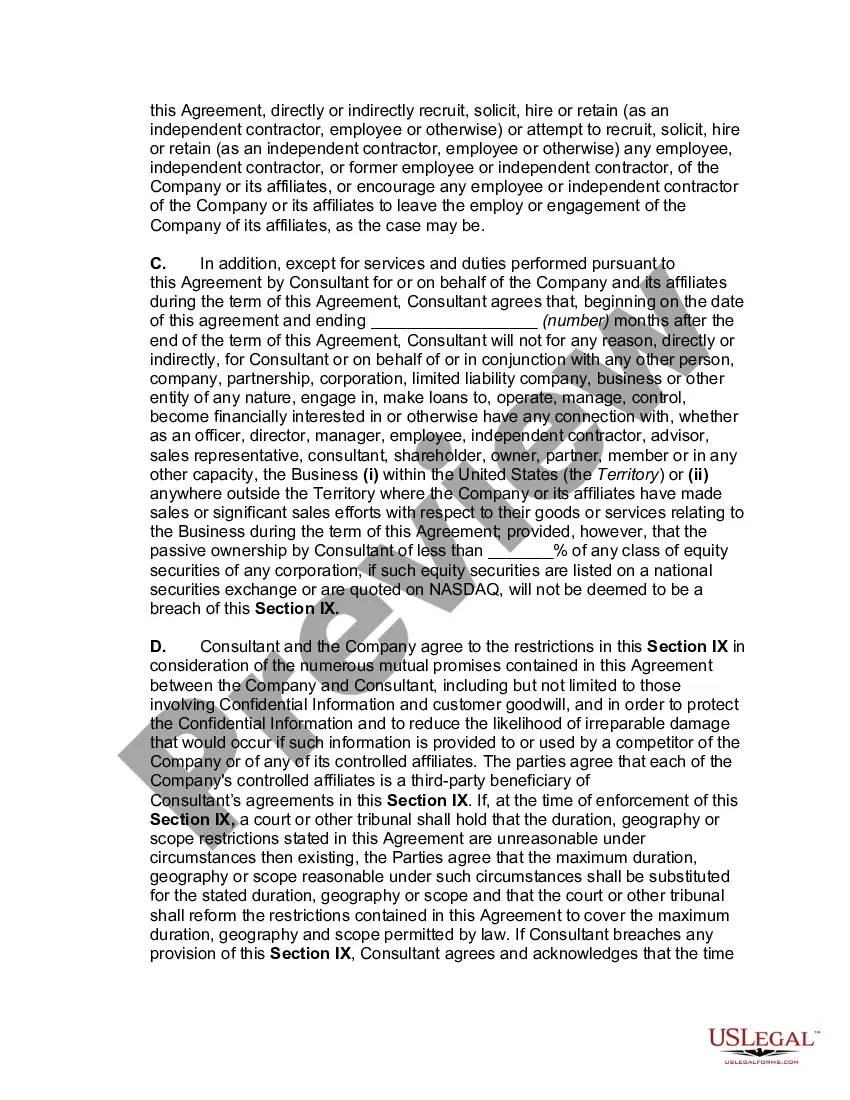

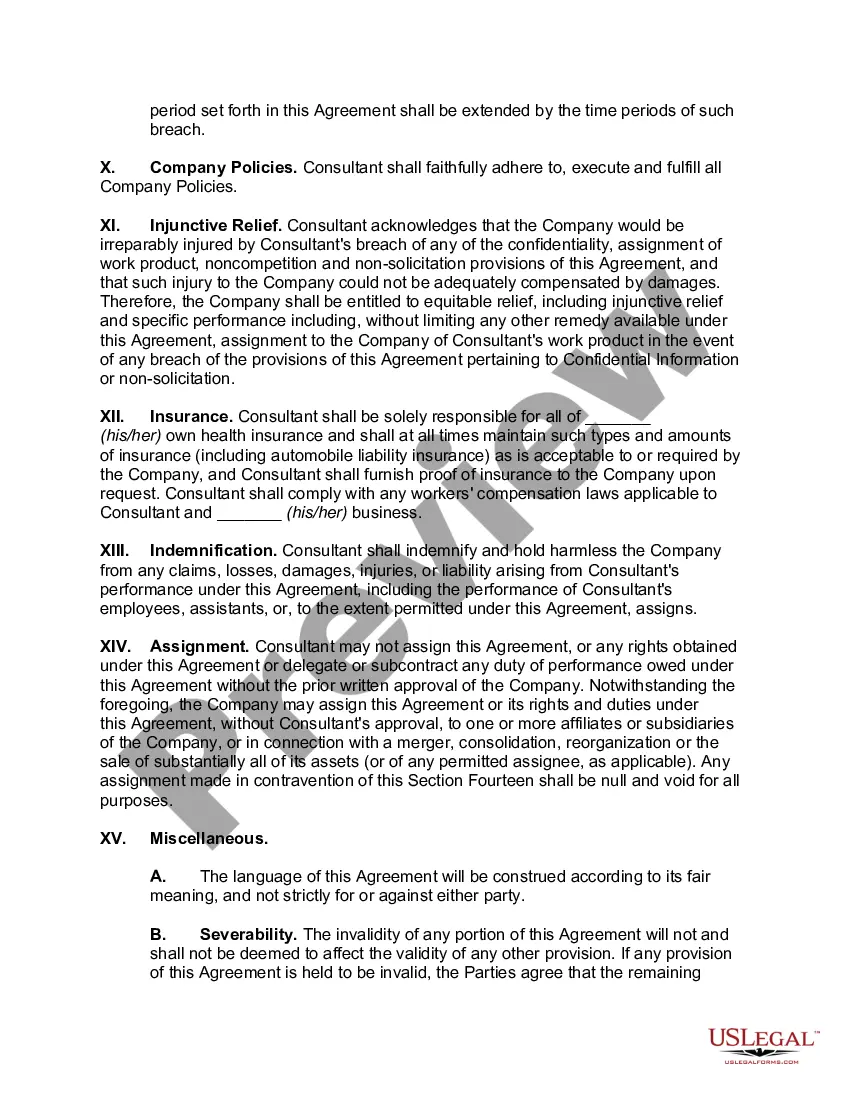

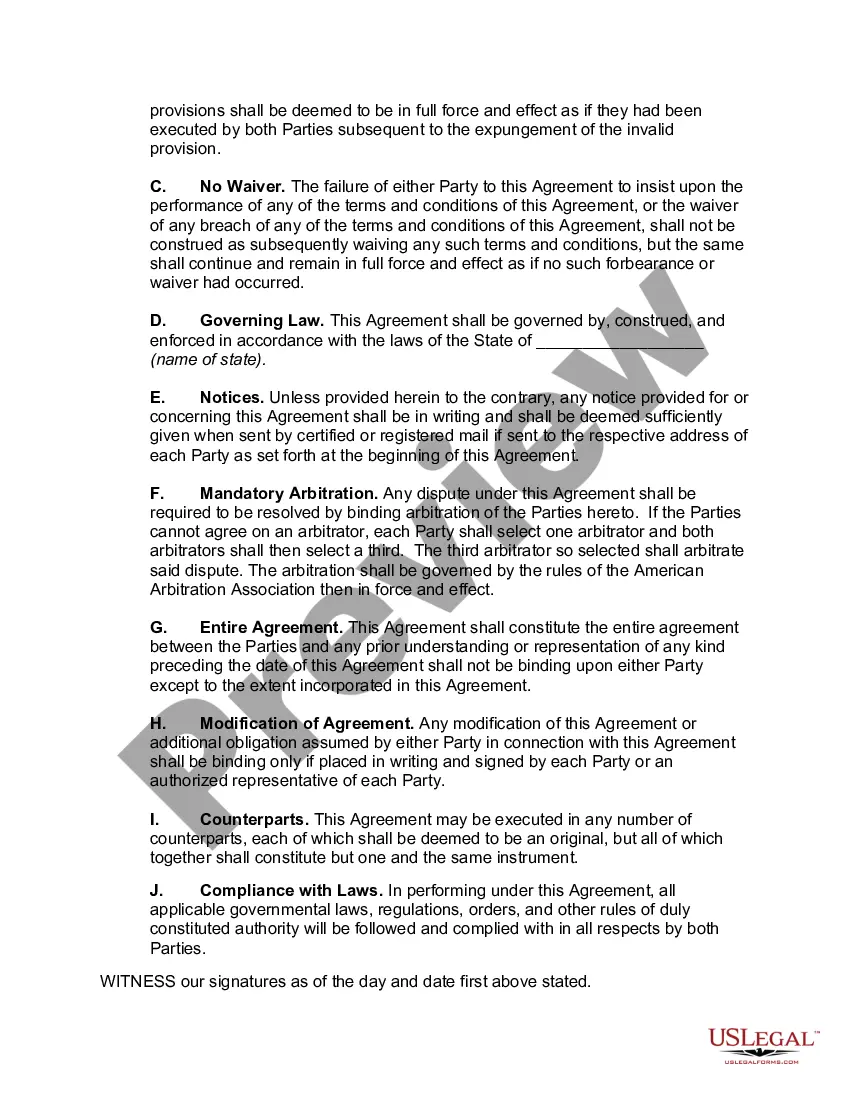

Nevada Consulting Agreement with Independent Contractor-- Company Entitiled to Work Product, Developments, Improvements and Inventions of Consultant

Description

How to fill out Consulting Agreement With Independent Contractor-- Company Entitiled To Work Product, Developments, Improvements And Inventions Of Consultant?

Are you in the place in which you need to have files for either enterprise or personal purposes virtually every day time? There are tons of legitimate record themes accessible on the Internet, but getting versions you can rely is not straightforward. US Legal Forms gives a large number of form themes, such as the Nevada Consulting Agreement with Independent Contractor-- Company Entitiled to Work Product, Developments, Improvements and Inventions of Consultant, that are published to fulfill federal and state requirements.

If you are already acquainted with US Legal Forms web site and have a merchant account, simply log in. Afterward, you may down load the Nevada Consulting Agreement with Independent Contractor-- Company Entitiled to Work Product, Developments, Improvements and Inventions of Consultant web template.

If you do not come with an account and need to begin using US Legal Forms, follow these steps:

- Obtain the form you will need and make sure it is for the proper town/area.

- Use the Preview option to review the form.

- Browse the explanation to ensure that you have chosen the proper form.

- If the form is not what you are trying to find, utilize the Search field to obtain the form that meets your requirements and requirements.

- When you obtain the proper form, click on Get now.

- Select the rates program you need, submit the necessary information and facts to make your account, and pay money for an order using your PayPal or bank card.

- Select a convenient paper file format and down load your version.

Discover all of the record themes you possess bought in the My Forms menus. You can aquire a additional version of Nevada Consulting Agreement with Independent Contractor-- Company Entitiled to Work Product, Developments, Improvements and Inventions of Consultant anytime, if necessary. Just select the necessary form to down load or print out the record web template.

Use US Legal Forms, one of the most extensive variety of legitimate varieties, to save lots of time and avoid errors. The assistance gives professionally manufactured legitimate record themes which can be used for a selection of purposes. Generate a merchant account on US Legal Forms and commence generating your lifestyle a little easier.

Form popularity

FAQ

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

Securing your company's intellectual property rights can be as simple as including an additional form in the employee manual or implementing a written policy to have all employees and independent contractors sign a one page document, either acknowledging a "work made for hire" arrangement or an "assignment" of all

The consulting agreement is an agreement between a consultant and a client who wishes to retain certain specified services of the consultant for a specified time at a specified rate of compensation.

Under the U.S. Copyright Act, a consultant who produces a creative work is the author and owner of the copyright -- unless the work is a work made for hire. Thus, some consulting agreements include clauses that classify such works as works for hire and transfer copyright ownership to the company.

A consulting contract should offer a detailed description of the duties you will perform and the deliverables you promise the client. The agreement may also explain how much work you will perform at the client's office and how often you will work remotely.

Here are five tips for accurately reviewing, understanding, and negotiating your next independent contractor agreement.Define Details, Deliverables, and Deadlines.Know Your Bill Rate and Stick to it.Beware of Confidentiality or Non-compete Clauses.Recognize When to Walk Away.Involve a Professional.

Here's a short list of what should be included in every consulting contract:Full names and titles of the people with whom you're doing business. Be sure they're all spelled correctly.Project objectives.Detailed description of the project.List of responsibilities.Fees.Timeline.Page numbers.

How to Package Consulting Services:Outline all of your consulting services.Evaluate your audience and the market.Determine the consulting service to package.Map out your process.Evaluate your costs and time.Determine pricing for your consulting package.Write your sales copy.Design your package landing page.

Starting a Consulting Business in CaliforniaChoosing the Business Entity. Depending on the details of your particular consulting business, you might well be able to operate as a sole proprietorship or partnership.Licenses and Permits.Health and Safety.Tax Matters.Insurance.Policy Statements and Contracts.Employees.

Register copyrights, trademarks, and patents Copyright, trademark, and patent are three of the most common types of IP protection. These grant you the exclusive rights to your creations, especially when it comes to the commercial gains of its use.