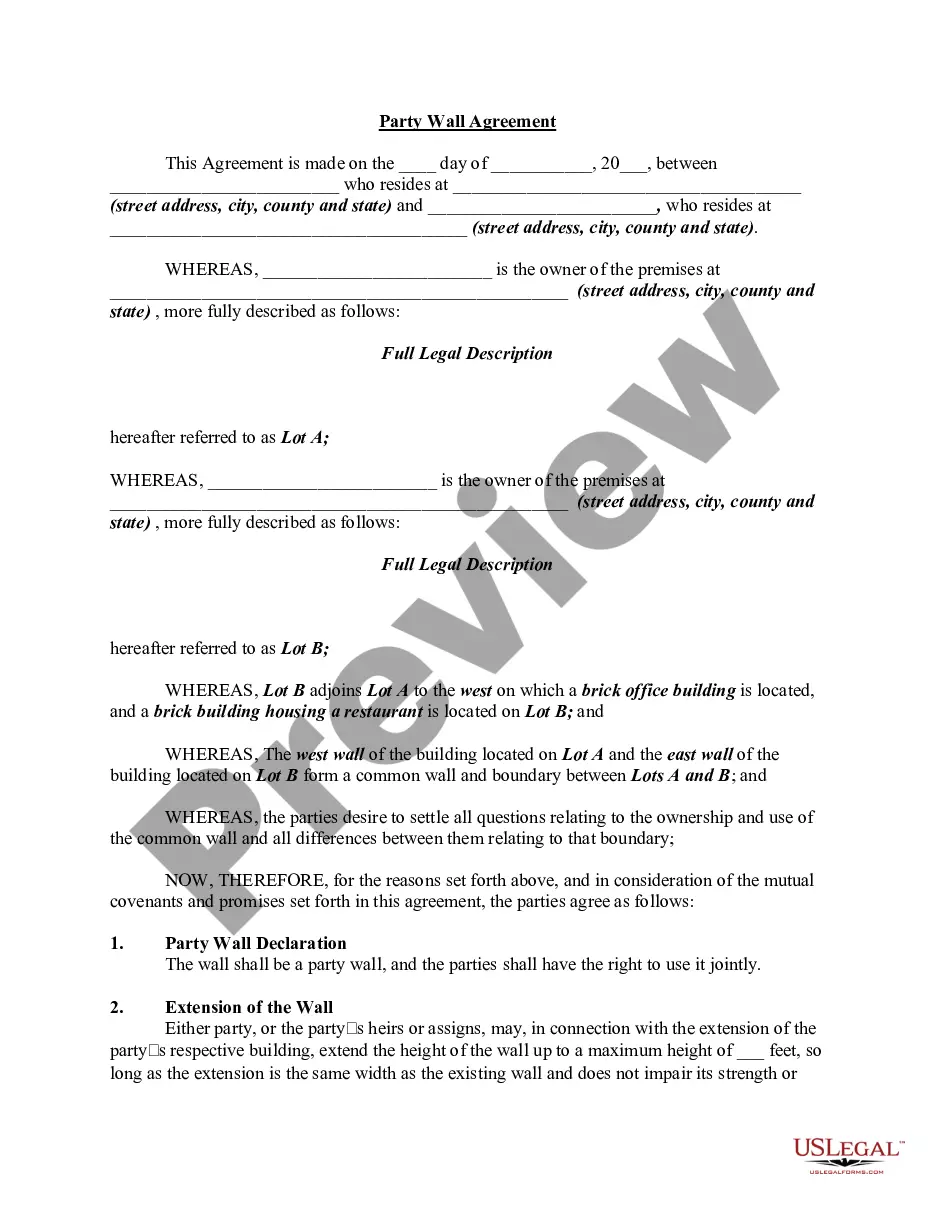

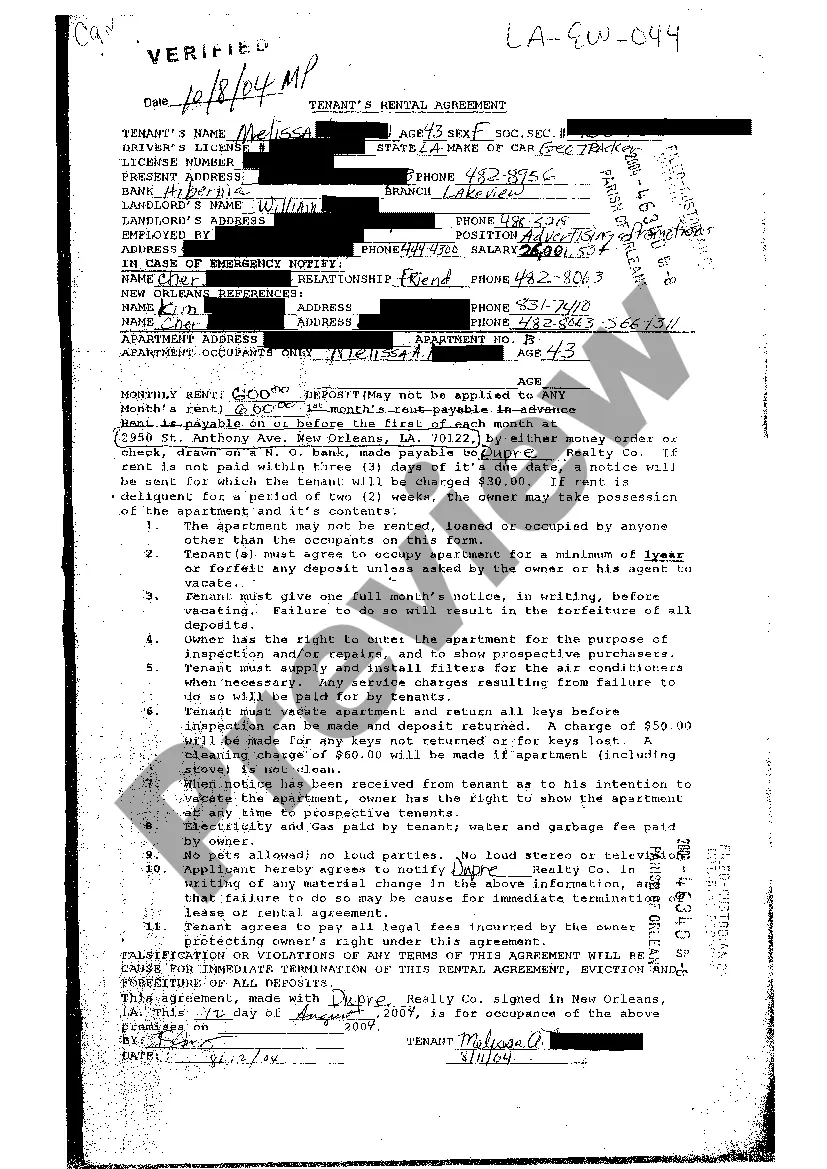

Nevada Liquidation of Partnership with Authority, Rights and Obligations during Liquidation In Nevada, when a partnership decides to dissolve, it goes through a process known as liquidation. This is where all assets and liabilities of the partnership are settled, and the remaining proceeds are distributed among the partners. Understanding the authority, rights, and obligations during liquidation is crucial for all parties involved. 1. Voluntary Liquidation: This type of liquidation occurs when the partners unanimously agree to dissolve the partnership voluntarily. It could be due to various reasons, such as retirement, disagreement among partners, or pursuing other business opportunities. Voluntary liquidation allows the partners to have some control over the process, as they can collectively determine the order of selling assets, paying creditors, and distributing remaining assets. 2. Involuntary Liquidation: Unlike voluntary liquidation, involuntary liquidation is initiated by external factors, such as bankruptcy or court order. This type of liquidation often occurs when the partnership fails to meet its financial obligations, and creditors take legal action to dissolve the partnership. Involuntary liquidation may involve the intervention of a court-appointed trustee or receiver to ensure a fair and equitable distribution of assets among the creditors. Authority during Liquidation: During the liquidation process, the partnership's authority structure may change to reflect the need for efficient asset distribution. Typically, the partnership agreement outlines the authority of partners during liquidation. In the absence of such an agreement, Nevada Revised Statutes (NRS) Chapter 87 governs partnership liquidation. Some key points of authority during liquidation include: 1. Decision-making Authority: Partners usually retain their decision-making authority unless stated otherwise in the partnership agreement. However, in certain situations like involuntary liquidation, a court-appointed trustee may have overriding decision-making powers to ensure fairness and protect the interests of creditors. 2. Limited Partnership Authority: Limited partners usually lack authority in the decision-making process, as their liability is limited to their capital contribution. However, they may have the right to be notified and participate in partnership meetings to address their concerns during liquidation. Rights and Obligations during Liquidation: Rights and obligations of partners during liquidation are influenced by the partnership agreement and Nevada state laws. Some key rights and obligations to be aware of during the liquidation process are: 1. Right to Participation: Partners have the right to participate in the liquidation process and contribute to decisions that affect the partnership's assets. This includes having access to financial records, attending meetings, and voicing their concerns. 2. Obligation to Settle Debts: Partners are obligated to ensure that all partnership debts, including outstanding loans, taxes, and invoices, are settled during the liquidation process. Partners may need to sell partnership assets to generate funds for debt clearance. 3. Right to Asset Distribution: Partners have the right to receive their respective share of the remaining assets after all partnership debts are settled. The distribution of assets must follow the agreed upon terms in the partnership agreement, or as per the guidance of Nevada state laws. 4. Obligation to Act in Good Faith: Throughout the liquidation process, partners have an obligation to act in good faith and with loyalty towards each other. This means partners should not engage in activities that may harm the partnership or prioritize their own interests over the shared assets. In conclusion, the process of Nevada liquidation of partnership involves authority, rights, and obligations that partners must adhere to ensure a fair and smooth dissolution. Whether through voluntary or involuntary liquidation, partners should have a clear understanding of their roles and responsibilities during this process to protect their interests and maintain a positive business reputation.

Nevada Liquidation of Partnership with Authority, Rights and Obligations during Liquidation

Description

How to fill out Nevada Liquidation Of Partnership With Authority, Rights And Obligations During Liquidation?

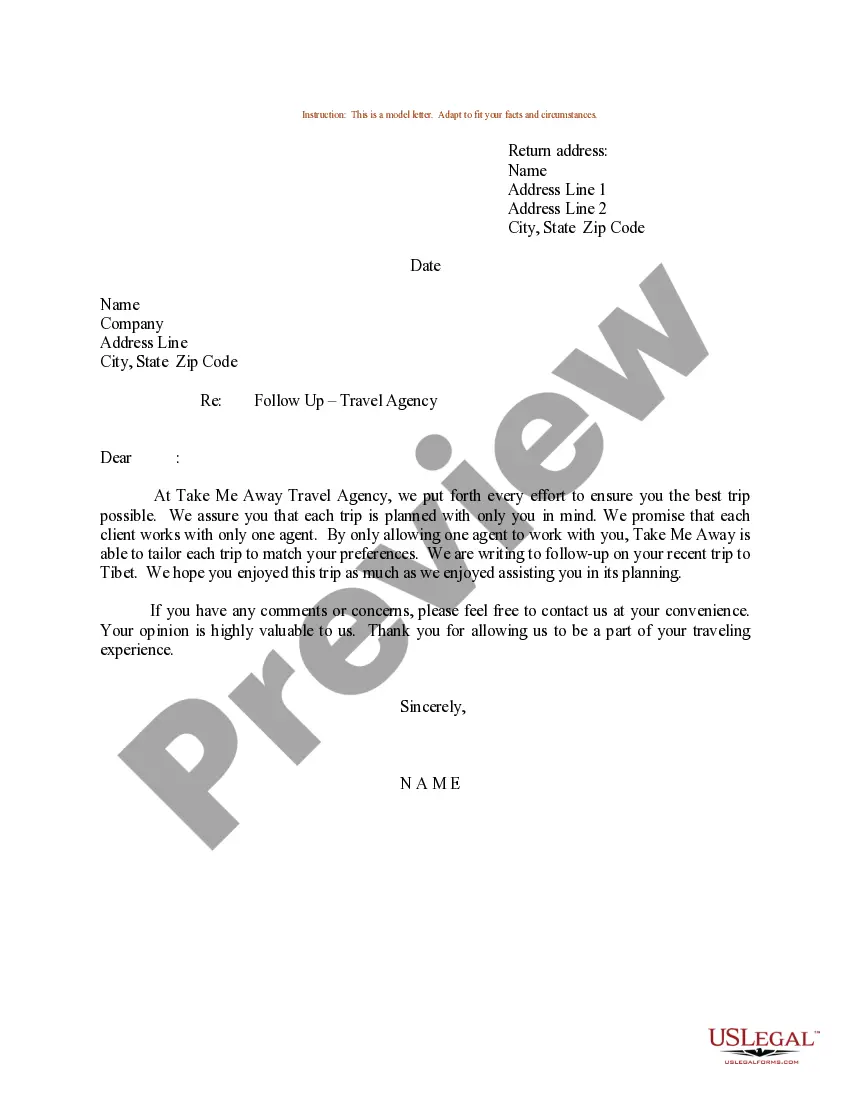

If you have to complete, download, or print out legitimate file templates, use US Legal Forms, the largest collection of legitimate varieties, that can be found on the web. Use the site`s simple and easy handy look for to get the files you want. Numerous templates for organization and person reasons are sorted by classes and says, or key phrases. Use US Legal Forms to get the Nevada Liquidation of Partnership with Authority, Rights and Obligations during Liquidation with a handful of clicks.

If you are already a US Legal Forms customer, log in for your profile and click on the Acquire key to have the Nevada Liquidation of Partnership with Authority, Rights and Obligations during Liquidation. Also you can gain access to varieties you earlier downloaded inside the My Forms tab of your profile.

If you work with US Legal Forms the first time, follow the instructions under:

- Step 1. Make sure you have chosen the shape to the right city/country.

- Step 2. Make use of the Review method to check out the form`s information. Never neglect to read the explanation.

- Step 3. If you are not satisfied together with the form, make use of the Search field near the top of the display screen to find other models of the legitimate form web template.

- Step 4. After you have found the shape you want, click the Get now key. Opt for the pricing strategy you prefer and put your qualifications to sign up for an profile.

- Step 5. Procedure the purchase. You can use your credit card or PayPal profile to perform the purchase.

- Step 6. Pick the file format of the legitimate form and download it on the system.

- Step 7. Total, revise and print out or signal the Nevada Liquidation of Partnership with Authority, Rights and Obligations during Liquidation.

Every single legitimate file web template you acquire is your own permanently. You might have acces to every form you downloaded inside your acccount. Select the My Forms area and pick a form to print out or download once more.

Remain competitive and download, and print out the Nevada Liquidation of Partnership with Authority, Rights and Obligations during Liquidation with US Legal Forms. There are thousands of specialist and status-distinct varieties you may use for your organization or person demands.

Form popularity

FAQ

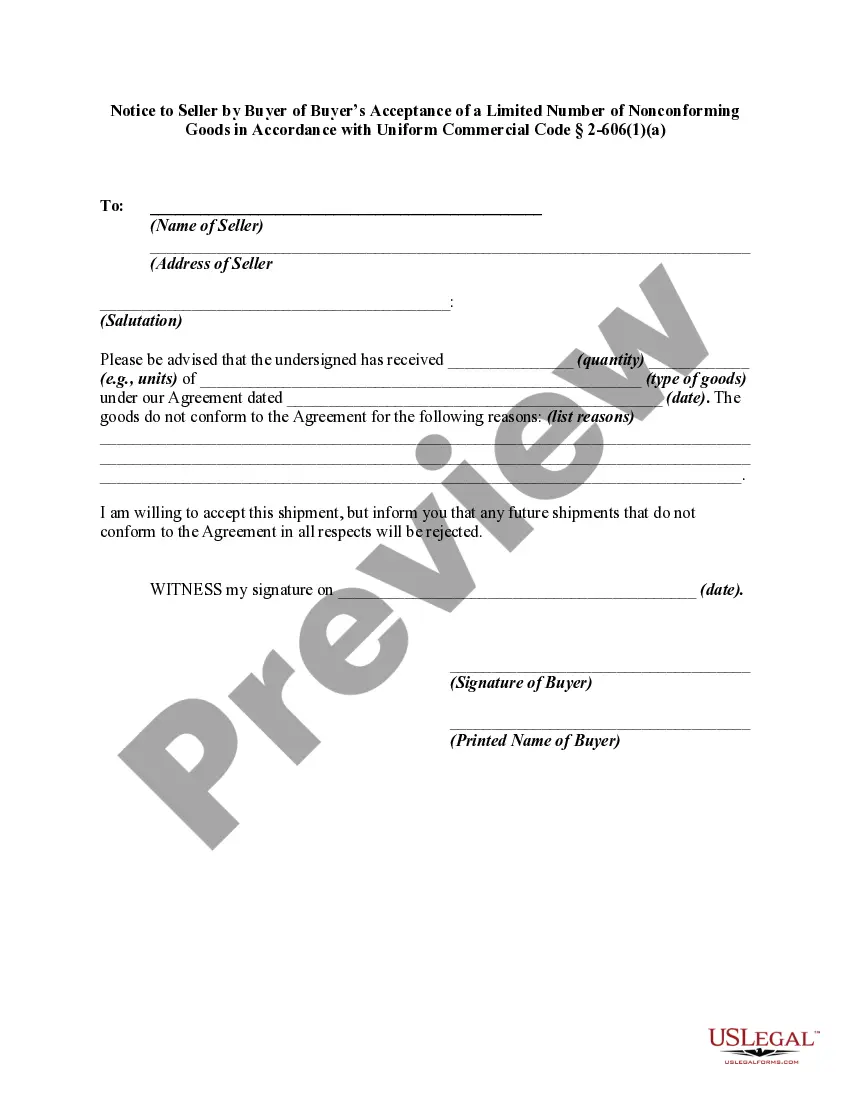

The dissociated partner generally remains liable for obligations incurred by the partnership before the partner's dissociation, and also after the dissociation if the other party to the transaction: (i) reasonably believed when entering the transaction that the dissociated partner was still a partner, and (ii) did not

In a general partnership, each partner has unlimited personal liability. Partnership rules usually dictate that whatever debts are incurred by the business, it is the legal responsibility of all partners to pay them off.

Another difference between the two Chapters would be that Chapter 88 requires a dissolution date for your LP, while 87A allows for your limited partnership to exist forever. Regardless of the type of limited partnership, the partnership must register as such with the Nevada Secretary of State.

Liability for General and Limited Partners Limited partners cannot incur obligations on behalf of the partnership, participate in daily operations, or manage the operation. Because limited partners do not manage the business, they are not personally liable for the partnership's debts.

A general partnership is an unincorporated business with two or more owners who share business responsibilities. Each general partner has unlimited personal liability for the debts and obligations of the business. Each partner reports their share of business profits and losses on their personal tax return.

All partners will share profits and losses equally, unless otherwise agreed. one partner cannot be expelled by the other partners unless otherwise agreed. a partner is only responsible for partnership debts and liabilities that arise after the person becomes a partner.

Rights and Duties of Partners Inter Se under Indian Partnership Act, 1932Duty to act in good faith.Duty to Render true accounts.Duty to Indemnify for fraud.Duty not to compete.Duty to be Diligent.Duty to properly use the property of the firm.Duty to account for personal profits.

In a partnership, each partner has a legal duty to act in the partnership's best interests, as well as the best interest of the other partners. There's also the legal duty of individual personal liability for partnership obligations. General partners are liable for all contracts entered into by other partners.

A partnership is a for-profit business organization comprised of two or more persons. State laws govern partnerships. Under various state laws, "persons" can include individuals, groups of individuals, companies, and corporations. As such, partnerships vary in complexity.

Specifically, a sole proprietor will be responsible for business debts, as will most partners in a partnership. By contrast, the purpose of a corporate structure is to shield those with an ownership interest (such as a stockholder) from personal liability.