Nevada Checklist for Corporate Minutes

Description

How to fill out Checklist For Corporate Minutes?

You might spend numerous hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms provides thousands of legal documents that are reviewed by experts.

It is easy to obtain or print the Nevada Checklist for Corporate Minutes from my service.

If available, utilize the Preview button to browse the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can fill out, modify, print, or sign the Nevada Checklist for Corporate Minutes.

- Each legal document template you purchase is yours forever.

- To get another copy of any purchased template, visit the My documents tab and click the appropriate button.

- If you're using the US Legal Forms site for the first time, follow these simple guidelines below.

- First, make sure that you have selected the correct document template for the region/city of your choice.

- Review the document description to confirm you have chosen the correct form.

Form popularity

FAQ

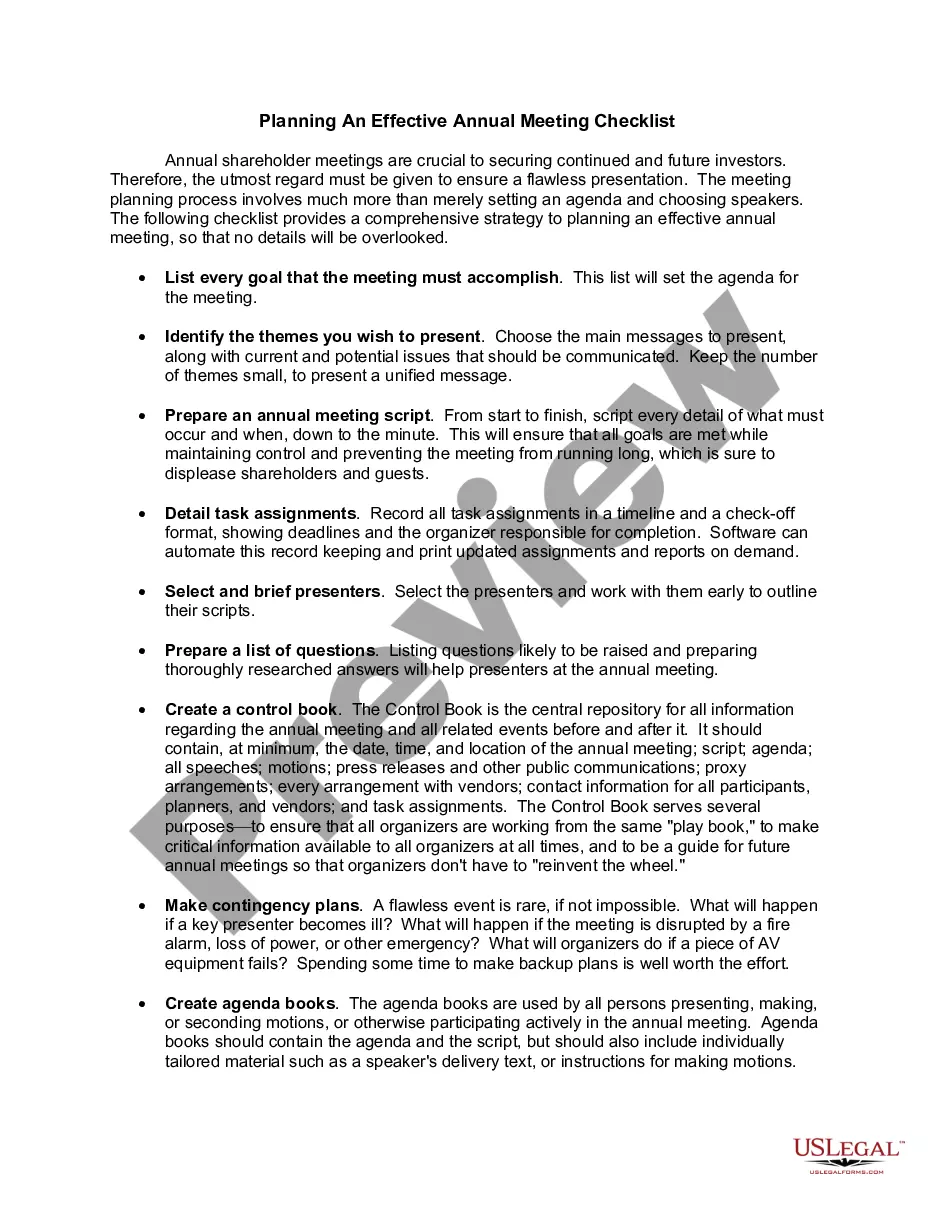

The main purpose of annual meetings is to allow shareholders to elect the directors who are responsible for the oversight of the company and its strategic direction. In addition, shareholders may be asked to vote on matters proposed by management or by other shareholders.

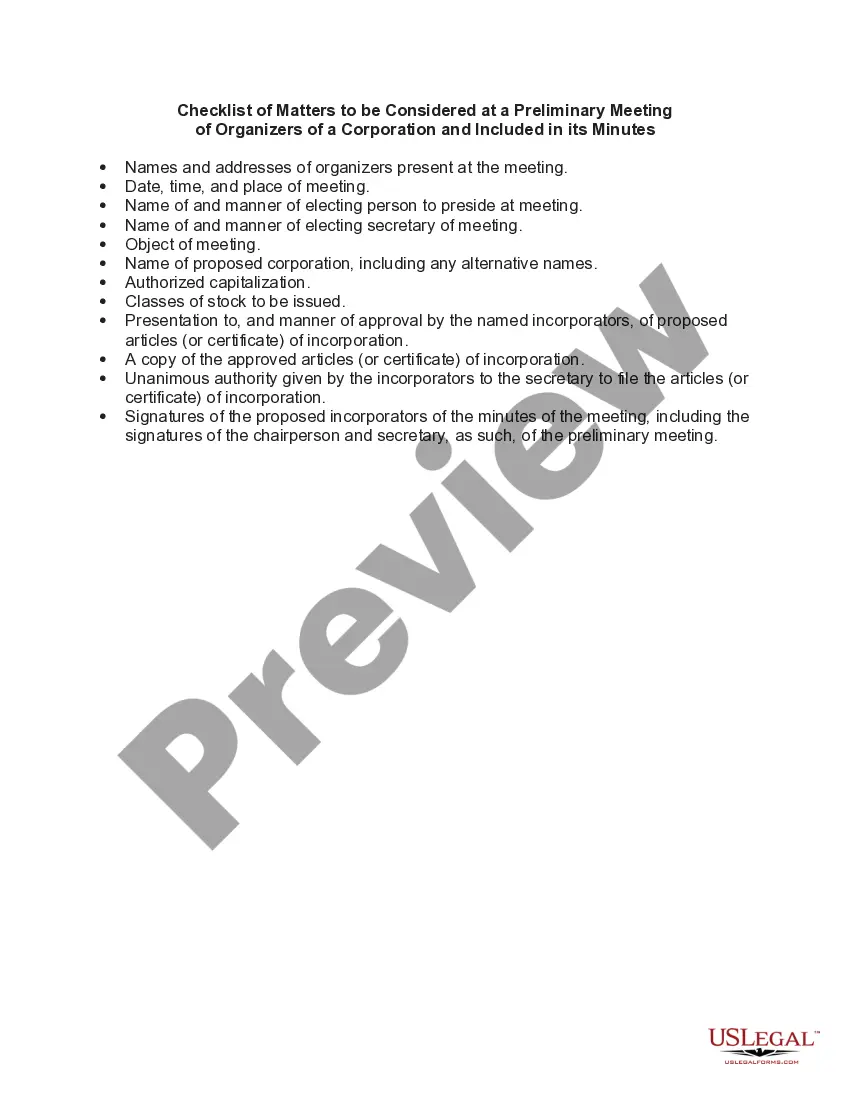

The minutes should include the title of the group that is meeting; the date, time, and venue; the names of those in attendance (including staff) and the person recording the minutes; and the agenda.

Depending on the item for which the record pertains, the IRS recommends keeping the records for 2 - 7 years.

Information captured in an LLC's annual meeting minutes usually includes:The meeting's date, time, and location.Who wrote the minutes.The names of the members in attendance.Brief description of the meeting agenda.Details about what the members discussed.Decisions made or voting actions taken.More items...?

Failure to Keep Meeting Minutes The most severe consequence is the loss of liability protection. If this happens, shareholders' personal assets may be exposed to liability for the corporation's debts.

Annual meeting minutes for corporations are one of the important business compliance requirements that keep a company's corporate veil (legal and financial separation of a business and its owners) intact.

Annual Meeting TopicsAdministrative Tasks. Any changes to your company's bylaws should be presented, discussed, and voted on at the annual meeting.Board of Directors.Values and Purpose.Goals and Strategy.Sales and Results.

Are Minutes Required For A Corporation? In most states, keeping corporate meeting minutes is a requirement for all official meetings at S corporations and C corporations. This includes the board of directors' meetings, too.

A corporation must file an annual return with the Registrar of Corporations each year, and must record proper minutes of annual shareholders and directors meetings.

While the federal government has no requirement regarding the keeping of meeting minutes if the IRS is planning an audit of your company they may ask to examine your company's meeting minutes.