Nevada Compensation Administration Checklist

Description

How to fill out Compensation Administration Checklist?

If you need to fill out, obtain, or print authorized documents templates, utilize US Legal Forms, the largest selection of legal forms, which are available online.

Take advantage of the site`s straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours indefinitely. You have access to every form you saved within your account. Click on the My documents section and select a form to print or download again.

Complete and obtain, and print the Nevada Compensation Administration Checklist with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to locate the Nevada Compensation Administration Checklist in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Nevada Compensation Administration Checklist.

- You can also access forms previously saved in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

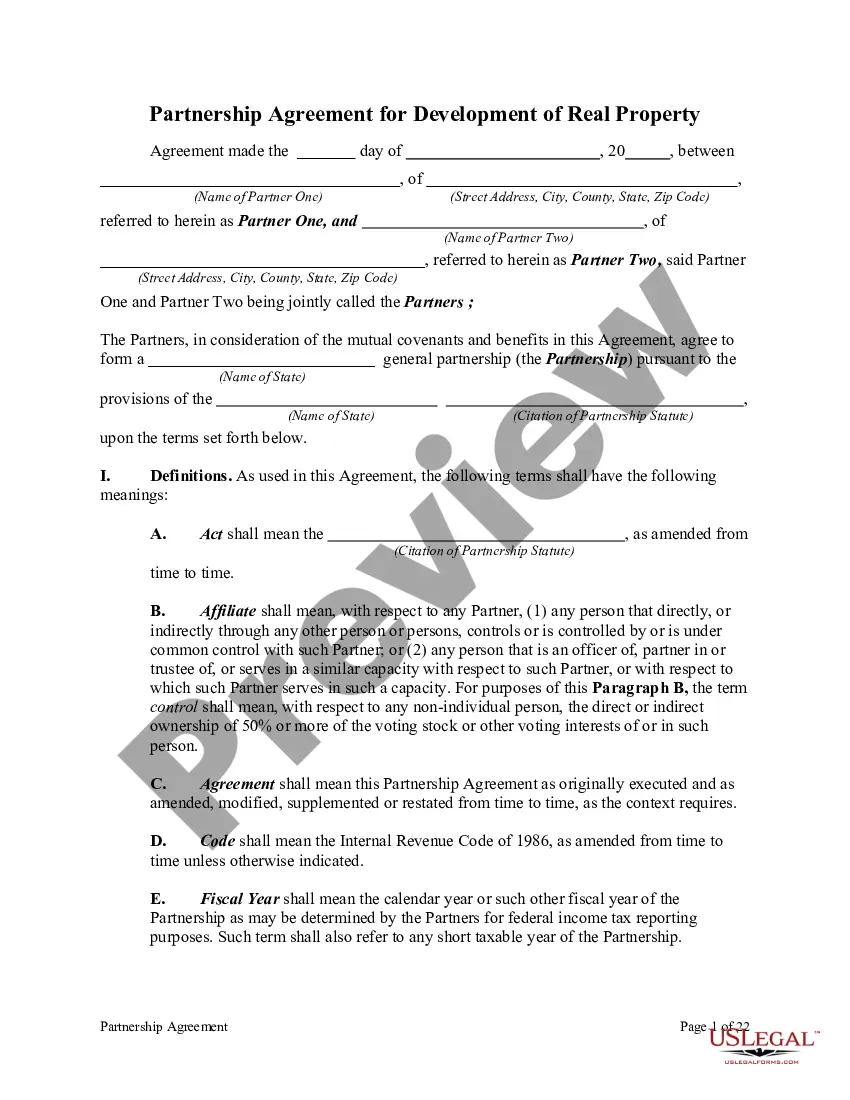

- Step 2. Use the Preview function to review the form`s content. Don’t forget to check the details.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the page to find other variations of the legal form template.

- Step 4. Once you have found the form you need, select the Buy now button. Choose the pricing plan you prefer and enter your details to create an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Nevada Compensation Administration Checklist.

Form popularity

FAQ

Workers' compensation, a no-fault insurance plan, provides guaranteed financial payments for work related injuries and illnesses. Financial compensation includes lost wages (i.e. temporary disability payments), medical bills, and lump sum permanent disability payments.

Following the Workers' Comp Claim Process Request an "Employee's Claim for Workers' Compensation Benefits" form from your supervisor (it's also known as a DWC 1 form). Your employer must give or mail you a claim form within one working day after learning about your injury or illness.

Maximum disability compensation in Nevada is 66-2/3 percent of the Average Monthly Wage (NRS 616A. 065 and 616C. 475). If the earned wage on the dateof injury was less than $6,096.60 per month, compensation is 66-2/3 percent of the actual earned wage.

DWC-7 Notice to Employees-Injuries Caused by Work (English and Spanish). This form provides your employees with information regarding workers' compensation benefits and the Medical Provider Network (MPN) in California.

Filing a claim for workers' compensation benefits in Nevada is a two-step process:Within seven days of the injury, the injured workers should notify the employer and submit an Incident Report.If the injured worker requires medical treatment or misses work, he or she should fill out an Employee's Claim for Compensation.

Filling out a DWC-1 form is actually pretty straightforward....On the form, you will need to only fill out the Employee section, which asks for basic information:Name, date, and address.Date and location of injury.Brief description of injury.List of injured body parts.Social Security Number.

Typically, there are four basic eligibility requirements for workers' comp benefits:You must be an employee.Your employer must carry workers' comp insurance.You must have a work-related injury or illness.You must meet your state's deadlines for reporting the injury and filing a workers' comp claim.

There is no waiting period for workers' compensation coverage. Once you are hired, you are covered by your employer's workers' compensation policy. See Nevada Administrative Code 616 or 617 for more details.

DWC-1 Workers Compensation Claim Form. This is the form you will complete and send to EMPLOYERS to initiate the claim process for your employee. This form must be completed and provided to EMPLOYERS within one working day from you becoming aware of a work-related injury or occupational disease.